Summary:

- AbbVie’s acquisition of Cerevel Therapeutics enhances its neuroscience pipeline with promising candidates Emraclidine and Tavapadon, expected to significantly boost revenues post-approval.

- Emraclidine and Tavapadon show strong clinical trial results, positioning them as potential best-in-class treatments for Schizophrenia and Parkinson’s Disease, respectively.

- AbbVie demonstrates financial strength with rising revenues from Skyrizi and Rinvoq, supporting a bullish long-term investment thesis despite Humira’s decline.

- Considering AbbVie’s robust pipeline and financial performance, I rate ABBV as a “Buy” for long-term investors, with a strategy of gradual position increases.

fatido/E+ via Getty Images

Thesis

AbbVie, Inc. (NYSE:ABBV) announced the acquisition of Cerevel Therapeutics in December 2023. The deal strengthened AbbVie’s neuroscience pipeline, which now includes promising product candidates such as Emraclidine and Tavapadon. The transaction, with a cost of $8.7 billion, was completed last August, and it is expected to have a diluting impact of $0.19/share in the FY2024 EPS.

Taking into account the late stage of development of Emraclidine and Tavapadon, and their positive results in clinical trials to date, which position both product candidates as potential best-in-class drugs for the treatment of Schizophrenia and Parkinson’s disease. I believe, once they get approved, Emraclidine and Tavapadon are likely to significantly boost AbbVie’s Neuroscience-driven revenues, which in my opinion has not been factored in ABBV’s current share price.

Thus, in this article, I will be describing the latest developments associated with Emraclidine and Tavapadon including their mechanism of action, clinical trial results and value to investors. Moreover, I will provide a summary of ABBV’s financial status and my valuation of the company, which overall supports my “Buy” rate for the stock for long-term value investors.

Overview

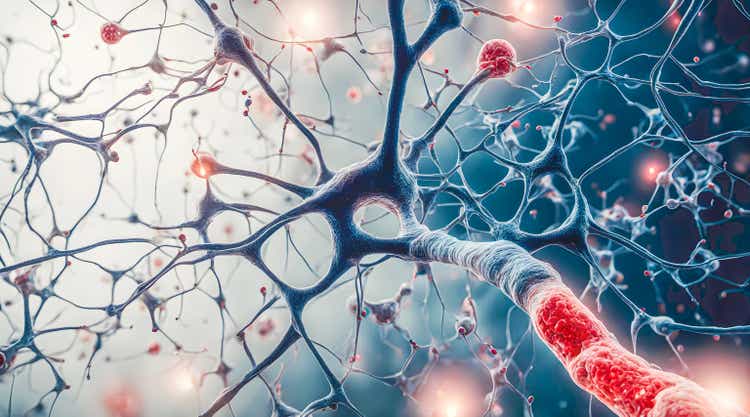

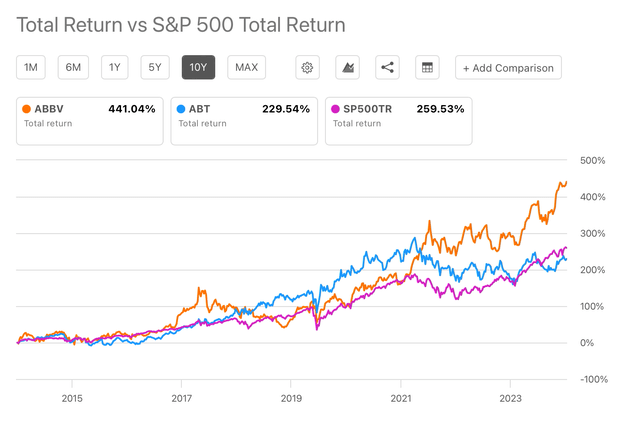

AbbVie completed its separation from Abbott (ABT), its parent company, in January 2013. Since then, AbbVie has become a powerhouse in the biopharmaceutical business. From the investor’s point of view, I believe long-term holders have reasons to be delighted with their investment. Indeed, a hypothetical investment of $10,000 in ABBV at the moment of the IPO would be worth $92,126 if reinvesting dividends, accounting for a 20.8% CAGR. Thus outperforming the returns from similar hypothetical investments on ABT or the SP500 (see image below).

Backrest portfolio showing investment performance of ABBV vs ABT vs SP500 from ABBV’s inception (Value investing.io)

From inception until 2022, the company has reported revenues growing year-over-year. However, FY2023 revenues were 6.43% lower than in FY2022, mainly due to Humira’s loss of exclusivity (LOE). Following the handbook of most pharmaceutical companies, ABBV has been reducing the impact of Humira’s LOE by investing in the development and/or acquisition of products and product candidates with growth potential that may replace or exceed the revenue decline from Humira.

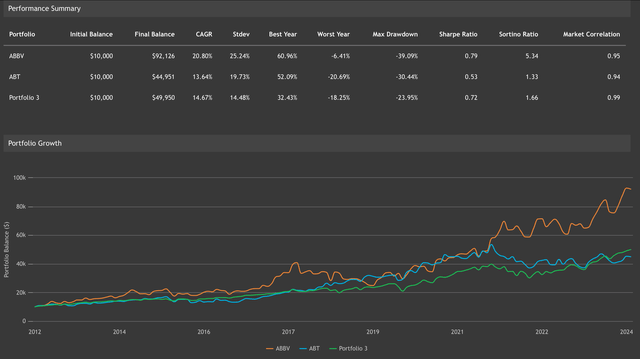

In this sense, I believe that Cervel’s strategic acquisition is likely to contribute to the growth of AbbVie’s Neuroscience drug portfolio (see image below). Likewise, Cobenfy, whose revenue potential and implications for Bristol-Myers Squibb (BMY) investors I covered here, Emraclidine is, in my opinion, the most attractive asset acquired from the Cerevel deal.

Cerevel’s pipeline (Cerevel acquisition presentation Dec 2023)

Emraclidine is a positive allosteric modulator (PAM) of the muscarinic M4 receptor. PAM are molecules able to facilitate the activation of their targeted receptor, in this case the M4 receptor. The M4 receptor is known to be involved in the regulation of dopaminergic neurons, which are key for the treatment of psychosis related to Schizophrenia, Alzheimer’s disease, and other neurological conditions. Thus becoming a potential future competitor for the recently approved Cobenfy. AbbVie is expected to share top-line results from the EMPOWER-1 and EMPOWER-2 clinical trials evaluating the safety and efficacy of Emraclidine as monotherapy for the treatment of Schizophrenia before year-end.

In addition to Emraclidine, AbbVie also acquired Tavapadon from Cerevel, which is a partial agonist of the dopamine D1/D5 receptors. In other words, Tavapadon is a molecule that mimics the role of the native molecules that bind to the D1/D5 receptors.

Tavapadon is aimed at the treatment of early symptoms of Parkinson’s Disease. Last week, Abbvie announced the top-line results of the TEMPO-1 Phase III clinical trial, in which patients treated with Tavapadon showed a significant reduction in the Movement Disorder Society-Unified Parkinson’s Disease Rating Scale (MDS-UPDRS) when compared against patients treated with placebo for 26 weeks, demonstrating the drug’s capacity to not only stop the progress of Parkinson but also reverse it. Hence, placing Tavapadon as the best-in-class product candidate for the treatment of Parkinson’s disease.

Furthermore, the company is expected to share top-line results from the TEMPO-2 Phase III clinical trial evaluating a flexible dosing of Tavapadon in Q4 2024. In this sense, if TEMPO-2 yields positive results, I believe that the findings from both studies are likely to support the Tavapadon BLA as monotherapy for the treatment of the early symptoms of Parkinson’s Disease in 2025.

Combined, Schizophrenia, and Parkinson’s disease affect over 32 million people worldwide, highlighting the large number of people affected by those debilitating neurological conditions. However, if I consider the potential indication of Emraclidine on Alzheimer’s disease, which has been estimated to affect over 7.2 million people in 2019, the total number of patients who may be able to benefit from drugs such as Emraclidine and Tapovon is approximately 39 million people. Therefore, in order to better understand the revenue potential of those drugs, in the next sections, I will provide a summary of the most recent news and results associated with Emraclidine and Tavapadon.

Emraclidine

Mechanism of Action

Emraclidine is a M4 PAM with the capacity to cross the blood-brain barrier, which means it is a molecule able to reach the brain cells (neurons), and enhance the sensitivity and response of the M4 muscarinic receptors when it binds to its agonists or native activator molecules.

In this sense, a video released by Cerevel highlighted how targeting the M4 receptor activation would help to balance the impaired signals from the dopaminergic and cholinergic receptors, resulting in a reduction of Schizophrenia symptoms such as psychosis, agitation and confusion while sparing patients from the negative effects of dopamine D2 receptor blockage (classic Schizophrenia treatment approach), which cause negative effects such as movement disorders, sedation, apathy, increased risk of diabetes and cardiovascular disease, among others. Particularly, the activation of M4 receptors inhibits the release of dopamine on D1 dopamine receptor neurons, which then results in antipsychotic effects, while M4 targeting also promotes positive cognitive effects by reducing glutamatergic receptor hyperactivity in the cortex neurons.

As mentioned in my previous analysis focused on KarXT/Cobenfy, since last week, when BMY obtained the FDA approval for Cobenfy, Schizophrenia patients have the option of being treated with a drug targeting the muscarinic receptors instead of the dopamine receptors. In contrast with Emraclidine, Cobenfy is a combined treatment of xanomeline and trospium, where the first one is aimed at M1/M4 agonist, while the second one is aimed at peripheral antagonist of muscarinic receptors, thus reducing the potential negative effects of muscarinic receptor activation, such as constipation, vomits, increased production of saliva, sweat, and tears, among others.

Interestingly, a series of preclinical studies revealed the role of M4 selective PAM molecules in the treatment of positive Schizophrenia symptoms such as psychosis, hallucinations, disorganised speech and dilutions to the same extent as M1/M4 agonists, while also holding promise for improving cognitive deficiencies associated with Schizophrenia. Moreover, the M4-selective PAMs have been linked with reduced peripheral side effects.

Given the similarities and differences between Emraclidine and Cobenfy, I consider it relevant to take a look into Emraclidine’s clinical trial results in order to have a better understanding of its therapeutic effects as well as its safety and tolerability profile.

Performance in Clinical trials

Emraclidine’s Phase II clinical trials are expected to yield top-line results before year-end. However, the results from the two-part Phase Ib trial are available here.

In summary, the first part of the study was a multiple-ascending-dose study, which aimed to assess the safety and tolerability of 5 doses of Emraclidine. The study enrolled 49 participants with stable Schizophrenia, of whom 5 withdrew consent prior to the study’s end and 44 concluded the study. 36 participants were randomly assigned to different doses of Emraclidine, and 8 participants received placebo. The participants were divided into 5 cohorts receiving the following doses of placebo or Emraclidine: a) 5 mg once daily for 14 days; b) 10 mg once daily for 14 days; c) 20 mg once daily; d) 30 mg once daily; and e) 5 mg twice daily for 3 days; 10 mg twice daily for 4 days; and 20 mg twice daily for 21 days, for a total of 28 days of study.

From the multiple-ascending-dose study, no serious adverse events were observed, with 41% of participants receiving at least one dose of Emraclidine reporting the occurrence of mild to moderate adverse effects. Headache (10%), dizziness (5%), insomnia (5%), and increased weight (5%) were the most commonly reported adverse effects. Given the safe profile of the drug, the investigators chose the two highest doses (30 mg once daily and 20 mg twice daily) to be further investigated in the second part of the clinical trial.

The second part of the study enrolled 81 participants with acutely exacerbated Schizophrenia, of whom 27 were randomly assigned to the placebo group, 27 were treated with 30 mg of Emraclidine once daily, and 27 received 20 mg of Emraclidine twice daily. The investigators observed 6 discontinuations in each cohort, for a total of 18 discontinuations. In the 30 mg daily group, 2 discontinuations were associated with the occurrence of adverse events, while only one discontinuation related to adverse events was reported in the 20 mg twice daily group.

Building on this, the occurrence of adverse events was similar in all cohorts, with the 30 mg once daily group presenting the lowest percentage of study drug-related adverse events reported (26%), which was even lower than the placebo group (37%). The most common adverse effects reported were headache (26% placebo, 30% 30 mg once daily, and 26% 20 mg twice daily), dry mouth, which was observed in 11% of the participants treated with 30 mg once daily, and nausea (4% in the placebo and 7% in the other two cohorts). Across the study, 3 serious adverse events were reported, two of them in the 30 mg once daily group and 1 in the 20 mg twice daily group. However, none of the adverse events (COVID, cocaine overdose and exacerbation of Schizophrenia) were considered by the investigators to be related to Emraclidine.

Once established the safety and tolerability of Emraclidine, it is time to dig into its therapeutic effects on Schizophrenia. In this sense, by day 21, the treatment with 30 mg once daily reduced -14.2 points of the Positive and Negative Scale for Schizophrenia (PANSS) score from the baseline, while the 20 mg twice daily induced a reduction of -9.22 points in the PANSS score, and the placebo reported a reduction of -5.6 in the PANSS score. Moreover, when comparing the PANSS scores against the placebo, the 30 mg once daily group significantly reduced the score by -8.61 points at 21 days of treatment. Importantly, when observing the results of the total length of the study (6 weeks), the placebo group induced a -6.77 reduction in the PANSS score from the baseline, while the 30 mg once daily dose reduced the PANSS score by -19.5 points and the 20 mg twice daily reduced the PANSS score by -17.9 points.

Therefore, the 30 mg once daily dose reduced the PANSS score by -12.7 points when compared against placebo, while the 20 mg twice a day dose resulted in a mean reduction of -11.1 points when compared against the placebo, after six weeks of treatment.

In order to put those numbers into perspective, Cobenfy’s EMERGENT-1 results reported a -17.4 points reduction in the PANSS score, which was 11.5 points lower than the results observed in the placebo group after five weeks of treatment. The EMERGENT-2 study reported that Cobenfy was able to reduce the PANSS score by -9.6, and the EMERGENT-3 study reported -8.4 points reduction in the PANSS score when compared against placebo.

Thus, Emraclidine’s Phase 1b results outperformed Cobenfy’s clinical trial results. However, I have to highlight that in order to have a better idea of Emraclidine’s clinical performance it will be important to assess the results of the Phase II study, from which AbbVie is expected to share top-line results before the year-end.

Value to Investors

Schizophrenia affects approximately 24 million people globally, accounting for a global market size estimated at $7.84 billion in 2023, and projected to grow at 5.49% CAGR from 2024-2032.

Bristol-Myers Squibb estimates that in the U.S. alone, there are more than 2.8 million people suffering with Schizophrenia, from which 60-70% of patients are not responding well to the classic dopamine receptor blockage treatments. In this sense, analysts at William Blair have projected that Bristol’s newly approved Schizophrenia treatment is likely to reach peak sales at $2 billion annual revenue by 2030, and $3-5 billion annual sales if it obtains FDA approval in Alzheimer’s disease.

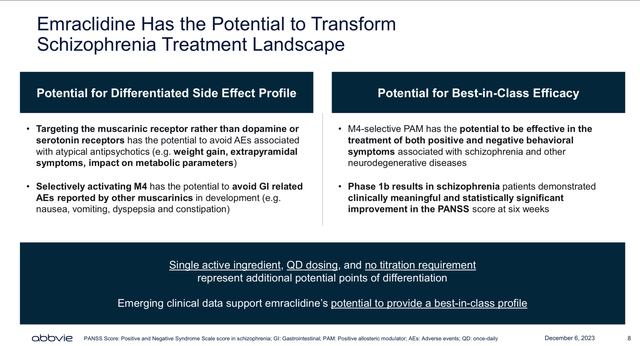

Although Cobenfy has the first-mover advantage, I believe Emraclidine’s positive clinical results and high efficiency on the reduction of Schizophrenia’s symptoms (achieving a larger reduction of the PANSS score than Cobenfy), and reduced side effect profile, might support Emraclidine’s claim to be best in-class (see image below) muscarinic treatment against Schizophrenia. Thus, allowing AbbVie’s product candidate to capture a significant portion of the Schizophrenia global addressable market once it obtains regulatory approval. Therefore, significantly boosting AbbVie’s neuroscience revenue.

Emraclidine’s potential (Cerevel’s acquisition presentation Dec 2023)

Tavapadon

Mechanism of Action

Cerevel’s website has an illustrative video describing Tavapadon’s mechanism of action and advantage when compared against Levodopa (the gold standard treatment for Parkinson’s disease).

In summary, Tavapadon is a partial selective agonist of dopamine receptors D1/D5 with little to no activity on other dopamine receptors such as D2, D3 and D4. Given its partial agonism capacity, Tavapadon is able to reduce the risk of dopamine receptor desensitisation, which is often associated with full agonists. From the motor control point of view, Tavapadon, in preclinical trials performed in non-human primates, improved the motor control of the subjects for twice as long as Levodopa, demonstrating its sustained therapeutic effects. Moreover, Tavapadon D1/D5 selective activity supports a lower risk of impulse control disorders and a lower risk of inducing drug addiction than therapies targeting dopamine D2/D3 receptors.

Performance in Clinical trials

Tavapadon’s Phase I clinical trial recruited 18 participants in the single ascending dose (SAD) study, of whom only one discontinued the treatment before the study ended. While the multiple ascending dose (MAD) recruited 50 participants, no voluntary discontinuations were reported, but 5 participants did not meet the criteria to enroll in the second period of the MAD study.

In general the participants in both the SAD and the MAD studies reported good tolerability of the drug, and no treatment-associated discontinuations or casualties were reported. Among the common adverse events was a mild increase in the QT interval (a heart rhythm disorder causing fast and chaotic heartbeats), which was only observed in the SAD study. According to the MAD study, the most common adverse events reported were headaches, nausea, unusual dreams, dizziness and vomiting. Out of a total of 172 adverse events (AES) reported during the MAD study, only 6 were considered severe. All the AEs were observed between days 3 and 24, and they were related to the pace and increment of the dose rather than reaching a maximum dose.

In terms of therapeutic effects, the SAD study demonstrated that, when compared against the placebo, 9 mg Tavapadon induced significant decreases from baseline in the total motor score from day 1. Moreover, the results from the MAD study revealed that the treatment with 15 mg once daily and 25 mg once daily induced the MDS-UPDRS-III scores to decrease -20 points below baseline when measured at 12 hours post-treatment on day 22. Similarly, the 25 mg once daily dose induced a significant decrease in the MDS-UPDRS-III score of -9.33 points from the baseline. Thus, the results from the Phase I clinical trials supported Tavapadon’s progress into Phase II clinical trials.

Tavapadon’s Phase II clinical trial recruited 57 treatment-naive participants with early Parkinson’s disease. From which, 29 were treated with Tavapadon and 28 were treated with placebo for 9-week dose optimization and 6-week dose maintenance. Tavapadon was associated with a mean reduction in the MDS-UPDRS score of -9, which was a significantly higher reduction than the one observed in the placebo (-4.3). More importantly, those effects were observed from week three of treatment and sustained until the study ended.

The most common AEs reported were nausea (31%), headache (24%), dry mouth (17%), somnolence (14%), and tremors (14%). Two discontinuations were reported in the Tavapadon cohort, while 4 participants from the placebo group withdrew from the study. Tavapadon was also linked to mild decreases in blood pressure and mild heart rate increases.

Last week, AbbVie announced the top-line results of Tavapadon’s Phase III clinical trial. The results demonstrated that 5 mg and 15 mg of Tavapadon once daily induced a statistically significant improvement on the MDS-UPDRS Part II and III scales of -9.7 and -10.2 points, respectively. In contrast, to the placebo group, which worsened the symptoms of the condition (MDS-UPDRS +1.8) by week 26. Furthermore, the company is expected to share top-line results from the flexible dose Phase III clinical trial TEMPO-2 by Q4 2024.Taken together I would expect AbbVie to submit Tavapadon BLA as monotherapy by H1 2025, supported by the TEMPO-1 and TEMPO-2 clinical trials.

Value to Investors

Parkinson’s Disease projected market size in 2024 is projected to be $4.3 billion, and it is expected to reach $6.7 billion by 2034, accounting for a 5.1% CAGR over the period of time. In the U.S. alone, the annual direct and indirect cost of Parkinson’s is estimated to be $51.9 billion. Moreover, it is projected that the annual economic burden of Parkinson’s in the U.S. alone will increase up to $79 billion by 2037, of which approximately 49.9% is associated with direct medical costs.

Thus, given that Tavapadon has demonstrated to induce mild AEs while also reducing the symptoms of Parkinson’s disease without causing overtime receptor desensitisation, I believe this product candidate is likely to become the new standard of care for people with early Parkinson’s once it gets regulatory approval. Thus, significantly boosting AbbVie’s neuroscience revenues.

AbbVie’s Financial Highlights

AbbVie’s Q3 2024 earnings call is scheduled for October 30th. So, in this section, I will summarise the company’s performance in H1 2024.

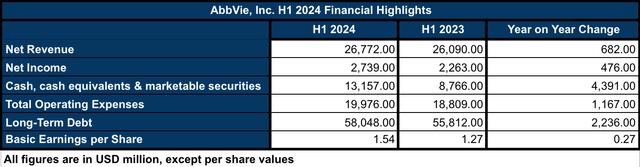

In this sense, Q2 2024 financial results, although still impacted by Humira’s 30% sales decline, also shed some light on AbbVie’s future. Particularly, the rise of Skyrizi and Rinvoq, which combined accounted for 58% of AbbVie’s immunology revenues in H1 2024, observing a 46% and 57% total revenue increase when compared against H1 2023, respectively. Thus, it gives many analysts and investors confidence in the future of the company post-Humira. Neuroscience is AbbVie’s second-largest revenue driver, accounting for $4.127 billion in sales revenue in H1 2024 and observing a 15.3% increase when compared against H1 2023. Altogether, net revenues in H1 2024 were $26.772 billion, accounting for a modest 2.6% increase against the same 2023 period (see image below).

AbbVie’s H1 2024 Financial Highlights (Data collected by the author from Q2 2024 10Q report)

Building on this, the net income in H1 2024 increased by 21% when compared against H1 2023, which was also associated with a 21% increase in the EPS when comparing the same periods of time. Thus, in my opinion, the company is showing signs of recovery. In terms of operating expenses and long-term debt, the figures are showing a 6.2% and 4% increase, respectively. Although, in my opinion, those increases are not a reason to be concerned about given the strong cash & equivalents position that the company is currently holding ($13.157 billion), which has increased by 199% when compared against H1 2023, and AbbVie’s enterprise value ($405.72 billion), which is seven times higher than the $58 billion in long-term debt.

So, overall, I believe AbbVie is showing signs of financial strength, particularly with the rise of Skyrizi and Rinvoq. Moreover, looking into the future, Emraclidine and Tavapadon are likely to become blockbuster assets in AbbVie’s Neuroscience business sector. Thus, it provides further growth that, in my opinion, hasn’t been priced in the company’s valuation yet.

Valuation

Currently, ABBV’s shares are trading at $196.82, a $347.90 billion market cap, a P/E of 65.85, and a 3.15% dividend yield. So, at a first glance, it is not looking like a bargain anymore. Indeed, since the latest low reached at the end of May, the stock has observed a 27% share price increase, while the 1-year share price has increased by 33%. In terms of historical performance, AbbVie’s 10-year total returns outperform the total returns of both the SP500 and ABT (see image below). Although the excellent performance is largely due to Humira’s success, as commented in the previous section, I believe the company is showing signs of a bright future post-Humira that are likely to support further growth.

ABBV vs ABT vs SP500 10-y Total Returns (Seeking Alpha)

In terms of investor returns, the company has been increasing its dividend continuously since inception, accounting for an 8% 5-year growth rate and a safe 57% payout ratio. Moreover, AbbVie’s dividend is more than twice the Sector’s median, which is only 1.45%. Thus showing the company’s compromise with its investors.

Looking into the company’s metrics, Seeking Alpha estimates an 18.10 P/E in 2024, which is expected to be reduced to 16.28, 14.60 and 13.28 by 2025, 2026 and 2027, respectively. While the EPS is also projected to grow at 11% in 2025 and 2026 and 9% in 2027, AbbVie’s 2024 P/E is 5% lower than the Sector’s median, which stands at 19.39. Likewise, ABBV’s EV/EBIT forward is standing at 16.33, 2.89% lower than the sector’s median value. On the other hand, given the impact of Humira, the EV/sales TTM and FWD are nearly twice the sector median figures.

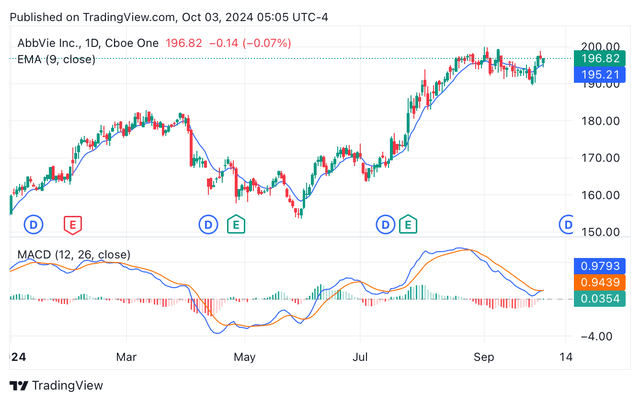

Regarding momentum and technical analysis, ABBV’s shares are observing an optimistic market, with bullish investors pushing the share price up as a consequence of the good performance of the immunology growth portfolio (see image below). Indeed, the exponential moving average and the moving average convergence/divergence are both signalling for “buy” ratings. Thus, it matches Wall Street’s and Seeking Alpha’s analysts, who rate the stock as a buy. In contrast, Seeking Alpha’s Quant is rating the shares as a Hold. Taking in consideration all analysts and Quant ratings, my blended score is 7, which translates into a “strong buy” blended rating. More on how I calculate the blended rating in here.

Year-to-date ABBV’s candle price chart depicting EMA and MACD (Seeking Alpha/TradingView)

In summary, I believe ABBV has shown good signs of recovery despite Humira’s impact. Although the current share price seems to account for the good performance of AbbVie’s immunology business sector, I believe it is not accounting for the midterm effects of the potential regulatory approvals of Emraclidine and Tavapadon in Schizophrenia, Alzheimer’s, and Parkinson’s disease. Hence, I rate ABBV as a “Buy” for long-term value investors. Should investors open or increase their positions on this stock, I would recommend doing so slowly, buying small positions and adding more when/if the share price falls, or following a DCA investment strategy. I would also recommend that potential investors keep an eye on Emraclidine’s and Tavapadon’s top-line results, which are expected before the year-end, in order to further assess the progress of the product candidates and gain a better understanding of their revenue potential.

Risks

My investment thesis is based on the speculative assumption of Emraclidine’s and Tavapadon’s potential regulatory approvals and good revenue performance if/when they hit the market. Although that thesis is based on clinical data released to date, it also has the risk of failing if the upcoming clinical trials show poor performance in either therapeutic efficacy or safety of the drugs.

Moreover, even if Tavapadon and Emraclidine eventually obtain regulatory approvals in the U.S. and elsewhere, both product candidates are still 1-3 years away from hitting the market (assuming positive clinical trial results in Q4 2024). In this sense, neither of the product candidates will have the advantage of being first-in-class in their targeted indications. However, if the drugs maintain their clinical performance, both drugs could be considered best-in-class for their indications, potentially supporting AbbVie’s commercial success once the drugs become commercially available. In the meantime, I believe AbbVie’s dividend, together with Skyrizi’s and Rinvoq’s revenue performance, which the company expects to reach $27 billion in annual revenue by 2027, support a sleep-well bullish investment thesis on ABBV.

Conclusions

In my opinion, AbbVie, Inc. immunology sector recovery and pipeline including midterm blockbuster potential drugs such as Tavapadon and Emraclidine support a long-term bullish investment thesis. Moreover, I believe the market has not factored in ABBV’s share price, a potential neuroscience revenue boost coming from the potential regulatory approvals of Tavapadon and Emraclidine.

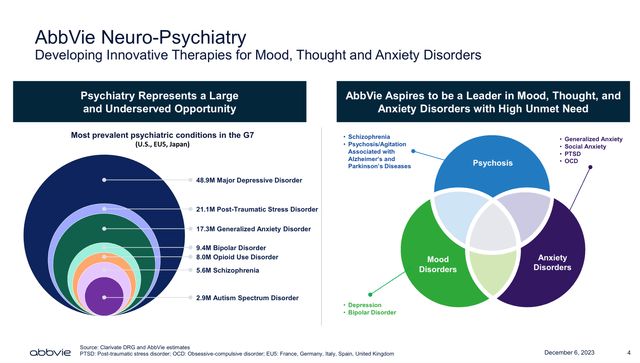

AbbVie’s neuroscience business sector, as reported in the Q2 2024 10Q, is already its second-largest revenue sector. However, most analysts and investors overlook the neuroscience business. In this sense, as shown in the Cerevel acquisition presentation, AbbVie is aiming to be a leader in mood, thought and anxiety disorders with large unmet clinical needs (see image below). So, promising product candidates such as Emraclidine and Tavapadon are likely to position AbbVie towards achieving their goal in neuroscience.

AbbVie’s goal in Neuroscience (Cerevel’s acquisition presentation Dec 2023)

Therefore, I consider AbbVie’s pipeline and sales performance to support a “Buy” rating for long-term investors. Should investors consider increasing or starting positions on ABBV, my recommendation is to do so slowly, with small positions and following a “buy the deep” or a DCA investment strategy that may allow them to reduce their average and increase their overall returns while also benefiting from the dividend growth in the meantime.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 14. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ABBV over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.