Summary:

- Abercrombie & Fitch’s has reported strong sales growth in its core Abercrombie business.

- This sales growth seems set to continue in contrast to its peers who have reported declining sales.

- Abercrombie’s valuation is slightly elevated historically but not overvalued.

eclipse_images

Abercrombie & Fitch’s (NYSE:ANF) stock has performed exceptionally well in recent months increasing by around 65% year-to-date. This is particularly impressive considering the relatively poor performance of other stocks in the consumer discretionary sector which has been plagued with concerns over declining sales in several core customer segments. The company has largely bucked this trend and reported strong sales growth in its core Abercrombie business, notwithstanding a sales decline in its Hollister’s business.

As Abercrombie approaches its second-quarter earnings report, the spotlight will be on its ability to sustain its sales growth trajectory. While recent economic improvements are promising, cautious consumer behavior remains a factor to watch. Amidst the uncertainty, Abercrombie’s standout management and solid fundamentals suggest a favorable long term investment opportunity.

The retail market and Abercrombie & Fitch’s sales

The rise of inflation has had a negative impact on US retail sales with people spending less on non-essential clothes and being more careful with their money. This is hitting mid-priced stores the hardest, as more shoppers are going to cheaper stores for clothes. These factors have contributed substantially to the decline in sales witnessed at many of Abercrombie’s competitors in recent months. However, as Seeking Alpha analyst LEL Investment LLC notes:

Contrary to reports of consumer weakness from other retailers, ANF anticipated an acceleration in sales for the second quarter. Management expected the growth trend of Abercrombie to continue, while Hollister is projected to demonstrate sequential progress.

In the first quarter of 2023, the company reported its highest Q1 sales level for the Abercrombie brand in a decade. In my view, this served as an important signal that the company has exited the transformation phase of its turnaround strategy and is now firmly focused on growth under its “Always Forward” plan. Management is currently targeting sales between $4.1 billion and $4.3 billion by 2025. This is up between $400 million and $600 million from their current sales levels.

Analysts have also expressed confidence in Abercrombie’s management and their ability to execute on the Always Forward plan. Analysts from Global Data recently noted that:

The question as to why Abercrombie & Fitch has performed where others have not is an important one. And, at a high level, the answer can be found in the skills and attitude of management. Executives are very focused on the consumer and are ever keen to understand what they want. Once they have discerned this, they know how to go about delivering this in an efficient and effective way….Management’s skills are one of the reasons why, over the longer term, Abercrombie has been a retail turnaround success story.

I agree with these sentiments particularly in relation to management’s key-focus on understanding the consumer. A core part of the “Always Forward” plan is indeed the “know them better” initiative through which Abercrombie seeks to obtain an ever-improving understanding of its customers and their needs. This also involves continued investment in customer analytics systems.

Abercrombie’s strong fundamentals

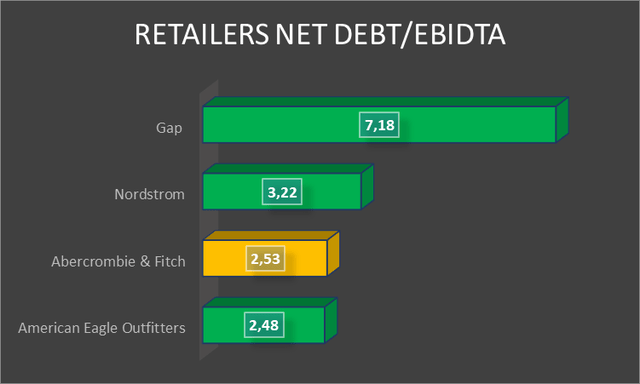

In addition to a more positive sales outlook than many of its peers, Abercrombie has also maintained a strong balance sheet with low leverage levels. In early 2022 Moody’s commented on Abercrombie’s strong balance sheet by noting its “solid credit metrics compared to retail peers, low levels of funded debt relative to cash balances, and very good liquidity.” The company has maintained this strong credit profile with a net debt to earnings before interest, taxation, depreciation and amortization (EBIDTA) ratio of around 2.53 which is the second lowest of the retailers considered in the peer comp charts below.

Retailers Net Debt/EBIDTA (Author created based on data from EquityRT)

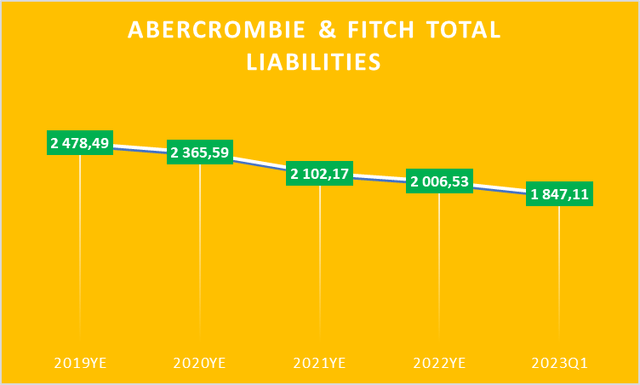

Furthermore, Abercrombie has seen a consistent decline in its total liabilities in recent years. This trend also continued in the first quarter of 2023 when its total liabilities declined by more than $150 million quarter-over-quarter or by around 7.9% Q-o-Q. This together with its low levels of short-term financial debt further demonstrates the company’s strong balance sheet.

Author created based on company fillings and data from EquityRT

Abercrombie currently has short term financial debt totaling just below $190 million which is well below the company’s total cash on hand which exceeds $400 million. In its most recent earnings call management has also indicated that:

As we look to the second quarter and the rest of 2023, we expect to continue to manage a strong liquidity position as we work through this period of macro uncertainty to help ensure we can invest for the long-term through any cycle.

Therefore, it seems like management will continue to take a cautious approach to further expenditure and new debt despite its current growth focus. In my view, this is a prudent approach given the current uncertainty over the risk of a recession and stubborn inflation levels.

What to look out for in upcoming earnings?

Abercrombie will report second-quarter earnings later this month. Investors will likely be interested in the extent to which management has achieved the sales growth forecasted earlier this year. The recent rise in consumer spending and early indications of easing inflation may bode well for these projections and broader sales growth prospects throughout the year.

The slight increase in consumer spending has not, however, equally translated into an increase in consumer discretionary spending such as on clothing. Analysts have indicated that the lowered levels of inflation were expected to drive an increase in consumer discretionary spending. However, consumers have remained cautious, and this uptick has not materialized. I am of the view that the recent trend of lowering inflation is unlikely to meaningfully benefit Abercrombie at this stage. I will be closely monitoring managements statements on sales growth when its 2nd quarter earnings call is released. A miss on sales growth estimates would pose a material risk to the investment thesis in Abercrombie in the short term.

Valuation

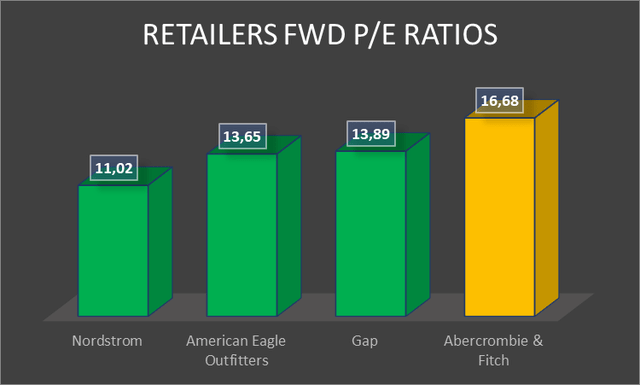

Abercrombie is currently trading at a forward price-to-earnings ratio of around 16.68 which is the highest of the retailers considered in the peer comp charts below. This higher-than-peers forward P/E ratio can partially be justified by its superior growth outlook in the near term.

Retailers FWD P/E Ratios (Author created based on data from EquityRT)

This somewhat elevated forward P/E ratio is not substantially higher than its historical averages. Abercrombie’ 5-year average forward P/E ratio is around 15.8 which means that its current forward P/E ratio is less than 7% higher than its 5-year average. This is particularly noteworthy if one considers that throughout much of the previous few years the company was going through a transition which is only now starting to bear fruit.

These considerations lead me to believe that the stock is not overvalued despite its strong performance this year. Nevertheless, given the uncertain macro environment I would only consider entering a small position at present levels and then buy any dips should they present themselves.

Conclusion

Abercrombie’s skilled management and proactive consumer insights sets it apart from its competitors. The company’s solid financials, including a strong balance sheet and declining liabilities, further strengthen the case for investing in Abercrombie. Nevertheless, as the company prepares to report its second-quarter earnings, the focus will be on whether it can deliver on its projected sales growth. While recent improvements in consumer spending and inflation may provide a favorable backdrop, cautious consumer behavior in the discretionary spending segment could pose challenges. Close attention should be paid to management’s statements regarding sales growth in the upcoming earnings call, as any deviation from expectations could impact the short-term investment thesis.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.