Summary:

- Abercrombie & Fitch’s Q3 results exceeded expectations with 14.4% YoY revenue growth and a 6.4% EPS beat, leading to raised full-year guidance.

- ANF’s strong financials, strategic focus on digital innovation, omnichannel strategies, and localized marketing have driven broad-based growth across brands and regions, displaying its quality playbook.

- Risks include cautious consumer confidence, cyclical headwinds, and uncertainties from tariff policies.

- Given ANF’s undervaluation, strong customer base, recovering consumer confidence, and good timing before Q4’s holiday season, I recommend a buy rating with a 24% upside until Q2 25.

Robert Way

Introduction

The past few weeks have been hectic. The S&P 500 (SP500) surged post-election, making the best weekly gain this year of over 5% after the Republican’s White House, Senate, and House victories. Trump’s anticipated tax cuts, higher tariffs and a more “American-first” agenda, coupled with the Fed’s recent 25 bps cut to 4.50%-4.75% just after its previous 50 bps cut will catalyze US equity growth in the short to medium term with room for further boosts depending on whether and when Trump enacts his promised policies. Stock averages finished higher on Tuesday as a show of US exceptionalism. In addition, jobless claims decreased, and housing demand was receptive to lowered interest rates. On top of this, Goldman Sachs sentiment indicators present 8/10 of one standard deviation, presenting the potential for investors to increase their exposure to the markets too.

While this paints a rosy picture of the economic outlook to come, some areas remain concerning. US bond markets faced a minor breakdown, placing upward pressure on mortgages and other household borrowing costs, which potentially affects housing affordability and the cost of living. In addition, the Federal Reserve, chaired by Jerome Powell, is trying to bring the US economy towards a soft landing amidst worries of unemployment and inflation flaring up in future months. In November results, the PCE indicator shows stalling inflation and unrevised GDP growth of 2.8%. In terms of consumer spending, the US Consumer Confidence Index (CCI) shows that consumers’ confidence has recovered even post-election (currently 111.7 in November compared to 109.6 in October). However, we have yet to see the longer-term impact of the US election and Trump’s presidency, which involves a series of economic proposals and tariffs that may affect US import prices and thus worsen inflation and growth. In my view, even if inflation approaches recovery, consumer psyche around inflation dynamics benefits the overall economy more than apparel related stocks because of the seasonality element involved in such discretionary spending.

With the upcoming cyclical headwinds and tailwinds in the US, and insular forces of digitalization for clothing platforms, one would expect a recently well-performing company such as Abercrombie & Fitch Co. (NYSE:ANF) to see room for stable growth in the Consumer Discretionary space. But considering so many varying forces, it is uncertain whether and how long these forces will benefit consumer cyclical core stocks like ANF.

In my opinion, ANF is a unique stock for several reasons:

-

Financials show all the right signs in terms of improving revenue, margins, cash flows and more, yet investors still react negatively to earnings releases that beat estimates.

-

ANF has seen exceptional recovery and growth with solid sales, margins, forward EPS, and share price of 68.40% to date growth that far exceeds its key competitors; Gap Inc., American Eagle Outfitters, and Urban Outfitters.

-

Its strong performance YTD has allowed it to gain positive momentum and optimistic earning revisions that have been met in prior quarters, but seasonal fashion on top of recovering economic factors like US Consumer Confidence entail greater volatility that ANF is susceptible towards.

Overall, I believe that ANF is relatively well-positioned to both tide against headwinds if economic indicators have yet to show signs of reaching a soft landing, and ride current tailwinds that affect the industry.

Company Overview

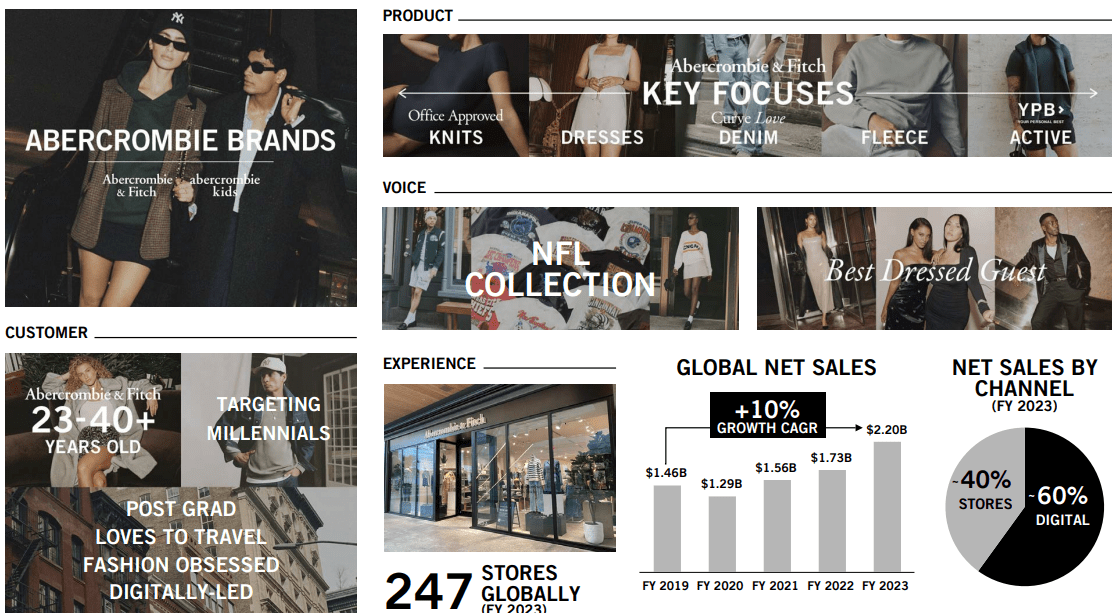

Abercrombie & Fitch is an international retailer driven by digital innovation and omnichannel strategies, offering apparel and accessories designed to meet the lifestyle preferences of children, teens, and young adults. It consists of its Abercrombie brands (Abercrombie & Fitch, Abercrombie Kids) and Hollister brands (Hollister, Gilly Hicks Active).

Abercrombie Brand (Q3 Investor Presentation)

The Abercrombie Brand markets a preppy, aspirational lifestyle with a focus on high-quality clothing and accessories for a slightly older, more affluent millennial audience.

Hollister Brand (Q3 Investor Presentation)

Hollister offers more affordable, casual apparel designed for a youthful (13–21 years old), laid-back lifestyle. Its designs emphasize a carefree beach aesthetic, catering to high school students and early college-age consumers.

Investment Thesis

ANF has immense long-term growth potential with its financials and strong playbook. It is still undervalued like most of its consumer cyclical counterparts, but shareholder/investor sentiment must be accounted for as well, looking at reactions to prior earnings. Considering a recovering economy, strong Q3 results, raised 2024 guidance and optimism for Q4 by ANF, I give ANF a “Buy” rating to time secular tailwinds that its dominance in apparel retail enhances.

Data shows that ANF is still undervalued, which is still surprising with its previous price surge earlier this year. Looking at analyst consensus, I give ANF a 24% upside to a price target of $186 by Q2 25.

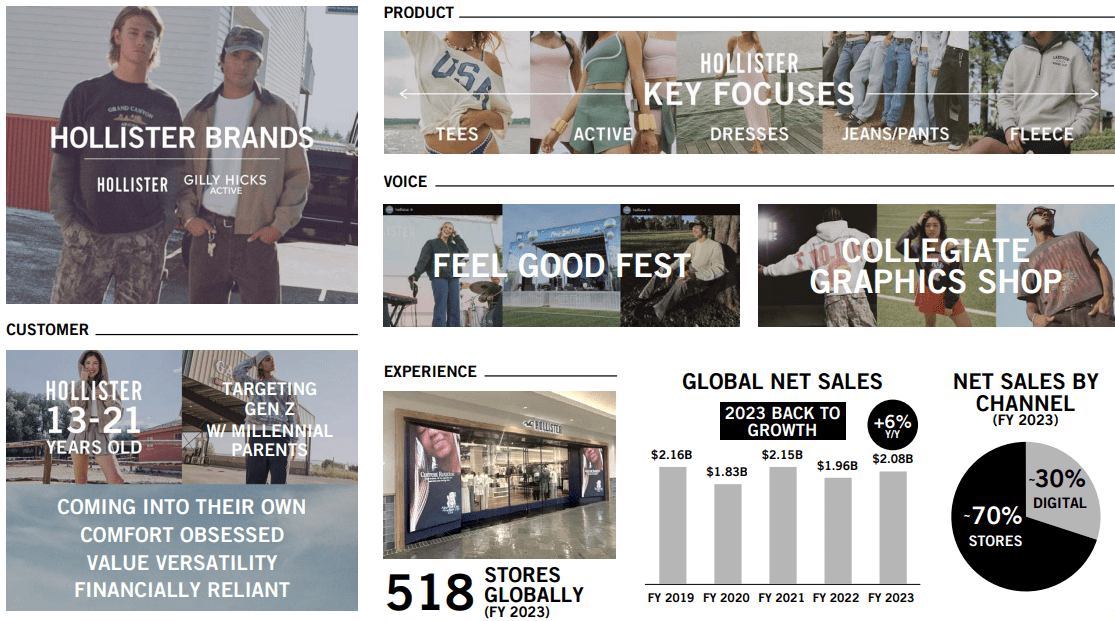

A Look into ANF’s Historical Prices

ANF faced a great rally in price after its Q1 24 results on 29th May, maintaining mostly above $170 for the month of June and then a steady decline going into July. Since then, ANF saw stellar Q2 24 results on Aug 28th, showcasing strong growth in net sales and robust operating margins as well as being placed in a healthy financial position to follow up on its strategic “Always Forward Plan” on top of its stand out performance in comparable sales versus its competitors. Yet, its share price did not increase greatly after the earnings, with prices falling from highs of $192 to the $130-$150 range that has persisted for the past 3 months. This was attributed to the cautious outlook for the rest of the year and 2025, especially Q4 with lower projected sales of 6.5-7.5%, lower than Q3 albeit Q4 being the best quarter of the year seasonally. Shareholders were sensitive to uncertainty in Q4, causing a price drop of almost 20% after Q2 earnings. ANF’s performance is not ideal in the short term, albeit being driven by a solid core proposition and secular tailwinds in the longer term. Even after Trump’s election victory, share prices rose only 4.0% in the week after 5th November, nearly the same as SP500’s 3.5% increase in the same period.

ANF’s Historical Price (TradingView)

Q3 2024 Results

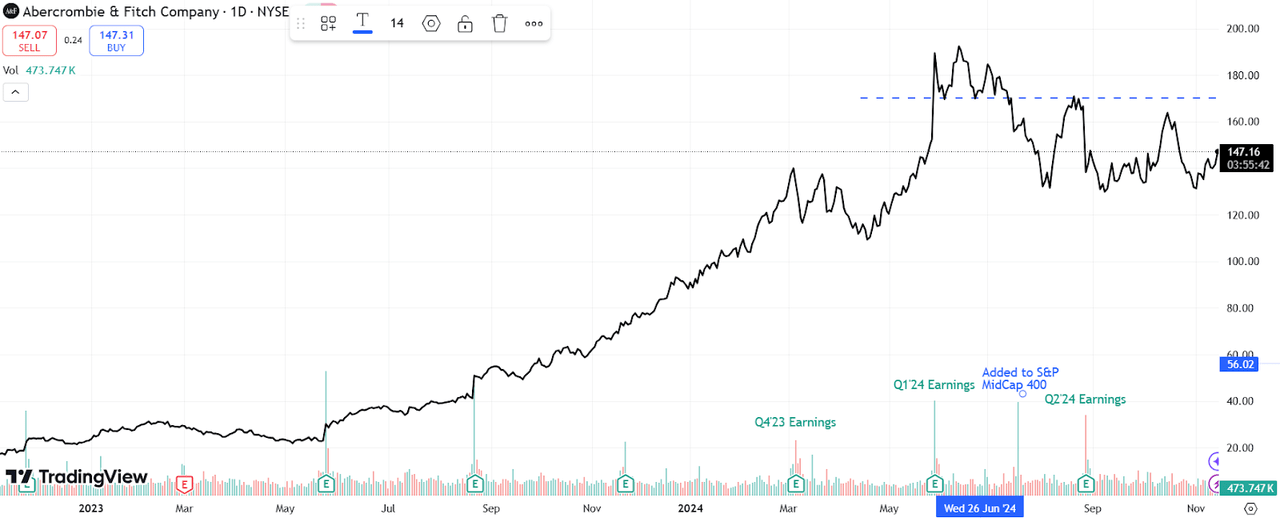

Q3 Update Slide (Q3 Investor Presentation)

However, this pessimistic sentiment may take a turn for the better after Q3’s results, which have exceeded expectations once again.

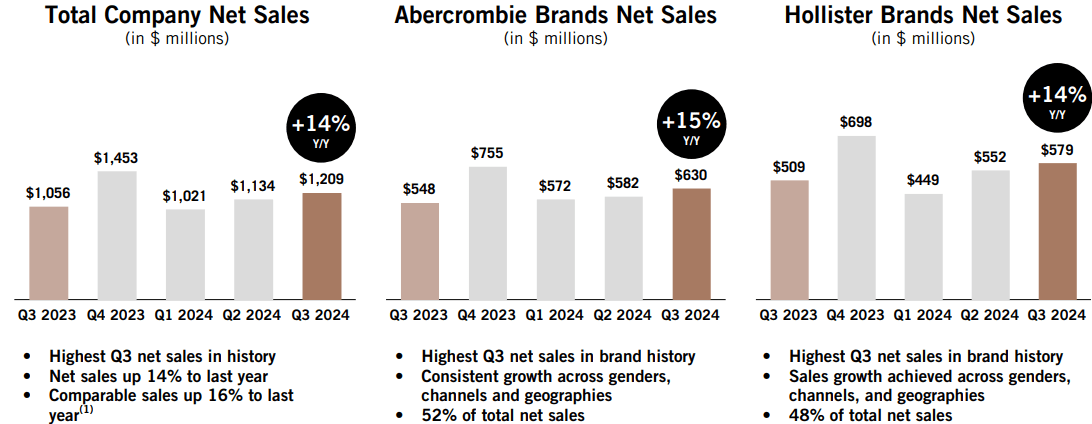

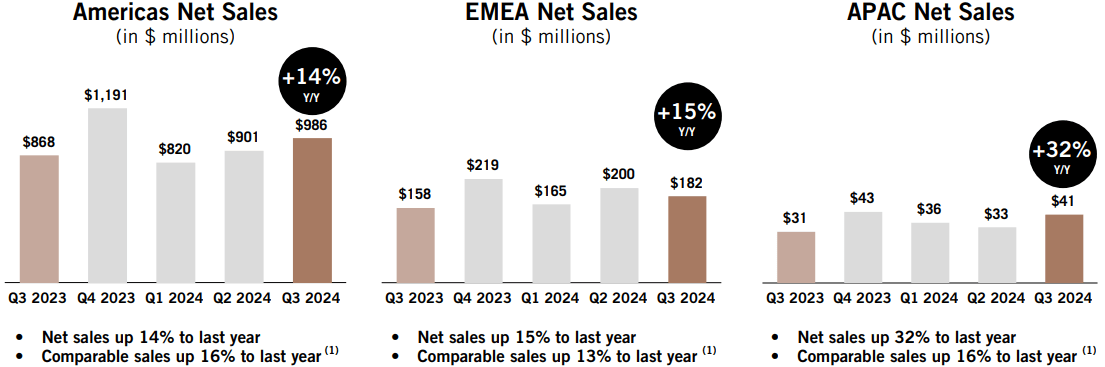

Revenue grew 14.4% YoY to $1.21B and a 2.7% beat. Every region and brand grew double digits, and comparable sales grew 18% YoY, beating estimates. Adjusted EPS increased to $2.50 vs analyst estimates of $2.35, a 6.4% beat. Operating margins were 14.8%, up from 13.1% in Q3 23.

In addition to this, ANF has raised its full-year guidance after seeing a good start in November, preparing itself to achieve the higher end of its previous margin targets. Broad-based growth across ANF’s brands, regions, channels, and genders continues to prove the quality of its playbook.

Having said that, the management is focused on driving growth by localizing their playbook across regions. During the Q2 earnings call, CEO Fran Horowitz pointed out that customers in the UK and Germany are responding positively to the localized assortments as they increase their marketing and brand presence in these locations. Meanwhile, in the APAC region, the company is focused on its China and Japan markets to engage with customers in new and different ways to boost relevance and growth. The Q3 results thus show their ability to achieve targets and should instill confidence in shareholders.

In the Q3 earnings call, management mentioned several goals: to bring as much as possible to customers for Q4, to reach the adjusted 2024 outlook numbers and to improve inventory in 2025, which will “signal more growth into the business” as mentioned by COO Scott Lipesky. With their consistent track record and good November results thus far, I believe that Q4 will be a solid quarter as well.

The Good

Valuations

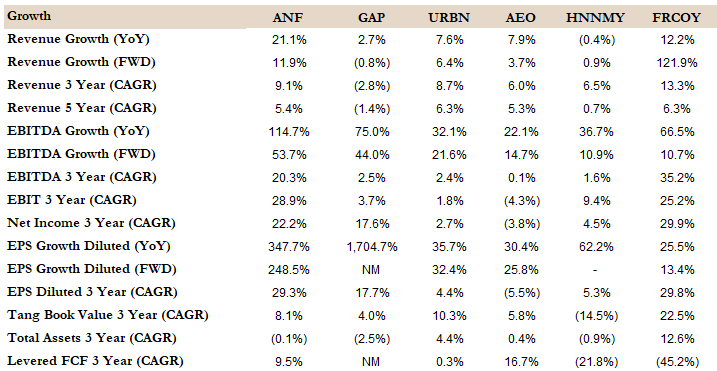

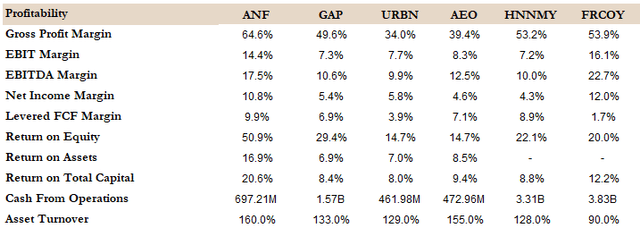

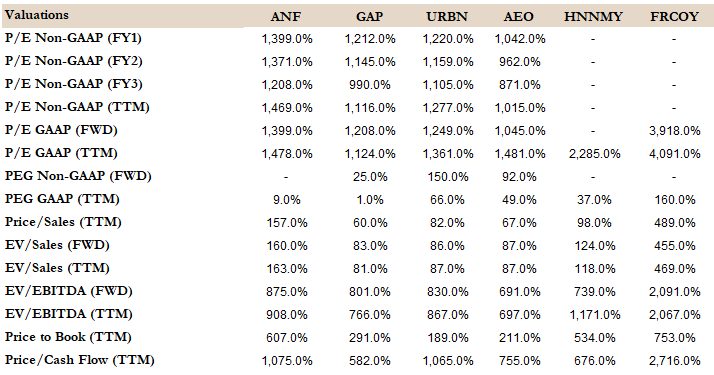

Growth Metrics of Comps (Seeking Alpha)

Compared to its comps, ANF’s much stronger YTD performance has been backed up by its strong key metrics. It is 1st in YoY revenue growth, YoY EBITDA growth, and FWD EBITDA growth. It comes 2nd in FWD revenue growth, net income growth, and diluted YoY EPS growth. It is also 1st in nearly every profitability metric, less EBIT margin, EBITDA margin, and net income margins (2nd to FRCOY, which owns Uniqlo).

Profitability Metrics of Comps (Seeking Alpha)

P/E (FWD) indicates that ANF is relatively higher valued than its competitors, while EV/EBITDA (FWD) indicates the same less FRCOY. Average analyst estimates give ANF an average target price of $186, a 24% upside to the current price of $150.

Valuation Metrics of Comps (Seeking Alpha)

Financial Health

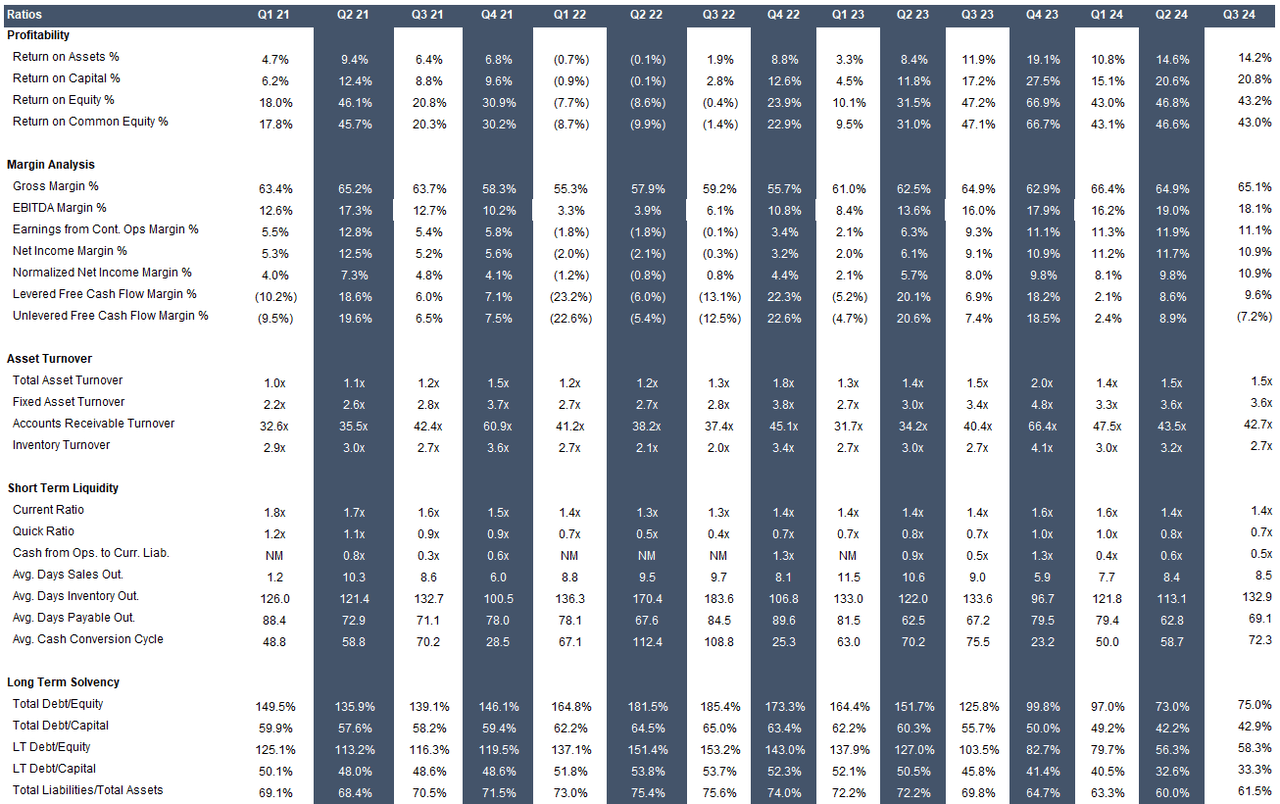

We talked about how ANF’s YoY revenues, EBITDA, net income, EPS, and free cash flow growth are healthier in general compared to its competition. But for an apparel company, other important metrics beyond sales, margins, and cash flows include inventory health, liquidity, and popularity of the brand. Inventory turnover and days outstanding inventory data both exemplify the seasonality of ANF. Both metrics are generally the highest in Q4 of every year, followed by Q2, Q1, and then Q3 (in FY23, turnover from Q1 to Q4 was 2.7x, 3.0x, 2.7x, and 4.1x respectively). From this perspective, the last 4 quarters (Q4 23 to Q3 24) recorded their highest turnovers, while inventory days outstanding numbers recorded their lowest numbers versus prior years. Liquidity ratios are consistent, holding stable quick and current ratios in quarters YoY. Inventories itself was up 16.4% YoY of $693m, with clean inventory positions across brands. Hence, ANF is managing its inventory adeptly in an industry where trends change rapidly and obsolescence is a concern.

ANF’s Ratio Performance (CapIQ)

Coming to long-term solvency, debt/equity, debt/capital, and total liabilities/total asset values have noticeably decreased from 139.1%, 58.2% and 70.5% in Q3 21 to 75.0%, 42.9% and 61.55% respectively in Q3 24. Return on assets improved from 12.4% in Q3 21 to 14.2% in Q3 24. There are no short or long-term borrowings outstanding under the senior secured credit facility or senior secured notes, respectively, compared to $300m of long-term borrowings outstanding last year. With the remaining 8.75% senior secured notes outstanding being redeemed in Q2 when they were due next year July, this means that ANF does not need to worry about devoting excessive amounts (if any) for subsequent quarter de-leverings, explaining why total liquidity increased over 5.2% to $1.1B in Q3 24. Altogether with their recent purchase of 100m shares, ANF is evidently in a healthy financial position to reinvest its cash flows, seeing that it is comfortably de-levering and has recovered quickly after the pandemic’s effects in FY20.

Brand Growth and Marketing

ANF manages to lead the industry through its customer-centric focus with partnerships, trendy collections and adding increasingly popular categories for its targeted, young audience. Fran Horowitz stated in the Q2 24 earnings call that promotions are done weekly “to see what’s working, what’s not working”, focusing on the business itself instead of its competition. Partnerships include Haddad to grow the Abercrombie Kids brand beyond North America for geographic synergies, and Zappos.com to become ANF’s E-commerce partner. Since then, A&F tapped into Zappos’s customer base, broadening its reach beyond typical e-commerce channels.

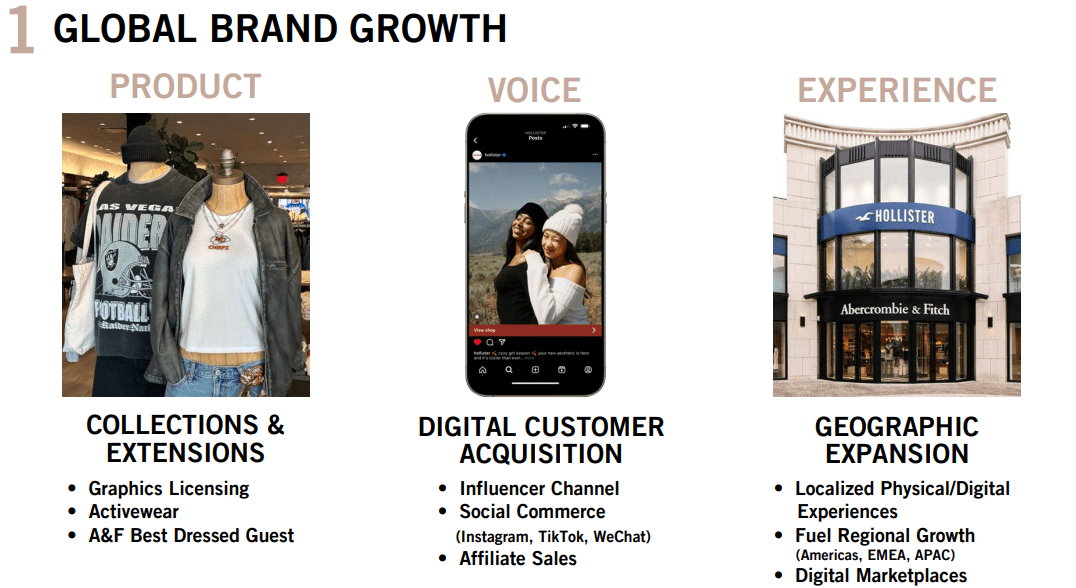

ANF’s Brand Growth Strategies (Q3 Investor Presentation)

The Abercrombie and Hollister brands have both gained momentum, showing broad-based sales, average unit retail and margins improvements across geographies, brands and genders through partnerships (e.g: ANF X McLaren Racing collaboration), trendy collections (e.g: official casual wear of all NFL teams for the 2024 season) and increasingly popular categories (e.g: the “Back-to-School” and “Hollister Collegiate Graphic Shop”) to appeal to its youthful demographic. Thus, experimenting with collaborations and reviewing customer receptiveness to them allows for efficient trialing to see what does and does not work, unlocking unexpected streams of revenue to catalyze sales. A case in point is the wedding shop beating expectations as they are all year round in 204 day occasions that expand across the seasons and the YPB sports brand in its 3rd year of growth due to the quality sportswear products.

Fran Horowitz shared that:

For the brands, each brand delivered record net sales for the third quarter. Abercrombie brands continued to deliver strong results, growing net sales by 15% over last year, while Hollister brands grew 14% as customers continue to respond to our product and marketing. Comparable sales grew 11% at Abercrombie and 21% at Hollister. The growth in both brands was driven by strong traffic in both the stores and digital channels.

All in all, these new features are effective ways to retain existing customers and give them something new to look forward to when they return to purchase more casual wear while drawing in new ones through enhanced marketing in digital and social channels has also been highly effective.

ANF’s Sales By Brand (Q3 Investor Presentation) ANF’s Sales By Region (Q3 Investor Presentation)

Regionally, sales were largely attributed to the EMEA and NA regions, with over double-digit growth in these geographies. However, each region grew greatly, especially APAC which was up 32% YoY. This was helped by localized marketing and digital campaigns – from partnering with local influencers to new store openings in popular areas such as Greater London and Berlin and conducting data analysis to create tailored shopping experiences and product recommendations based on local trends, seasonality, competitive landscape and price points in these areas. ANF’s omnichannel marketing strategy has helped to seamlessly integrate online and offline experiences, allowing them to more conveniently engage with the brand through various platforms, be it physical outlets, ANF’s digital store or social media platforms (through popular influencers).

With the holiday season just around the corner, and ANF feeling a confident Q4 based on strong Nov results, I believe there is room to run as teams tailor the holiday experience for all customers (new and existing) on all channels (digital and social). Fran Horowitz elaborated by saying:

For the upcoming holiday, our customers will see a lot of exciting newness in a variety of the gift giving and gift yourself ideas across categories. Coupled with compelling marketing campaigns in digital and social, our goal is to give the customer reasons to buy all season long.

While these efforts have led to operating expenses rising by 11.5% to $609m YoY, operating expenses as a % of sales decreased from 51.7% to 50.4% YoY, showing more efficient spending. This exemplifies improvements even though ANF already leads the industry in gross margins and returns on capital, so there should be no issue for them to continue attracting audiences to help them in customer acquisition, solidifying their presence in the industry and expanding beyond their originally famous “cool kids” brand for greater diversity and individuality.

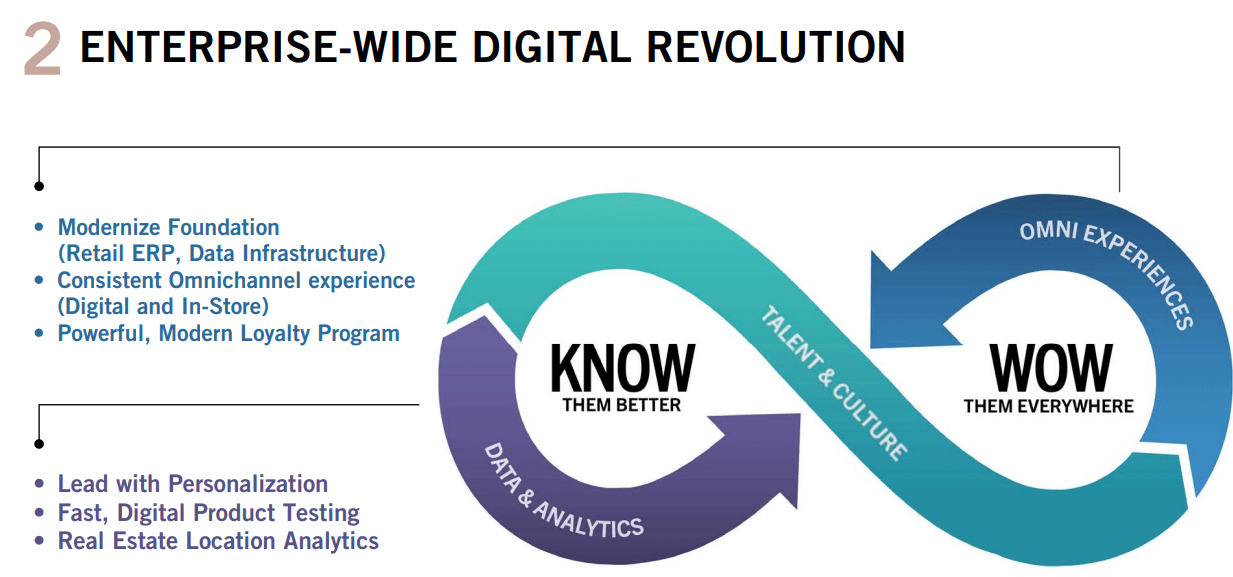

ANF’s Digital Innovation Strategies (Q3 Investor Presentation)

Fran Horowitz also highlights that there is “more runway ahead”, through revenue rather than pure margin expansion, as ANF is trying to improve its visibility and accessibility to other prime locations like Italy and France to tap into their audiences who are also inclined to wear quality apparel. This signals room for continued outperformance from the industry leader.

The Not So Good

Consumer Confidence

Albeit ANF’s performance, its cyclical nature makes it vulnerable to economic headwinds and uncertainty. A shaky economy from scenarios like inflation’s progress reversing, pessimistic sentiments from political uncertainty of tariffs or tensions from Donald Trump’s presidency to a volatile stock market would cause a cooldown in consumer spending, which would affect fashion apparel first since they are non-essential, evident in the high average levered beta (5 yr) of 1.46 in the comps. ANF has a beta of 1.51, making it more volatile to price changes.

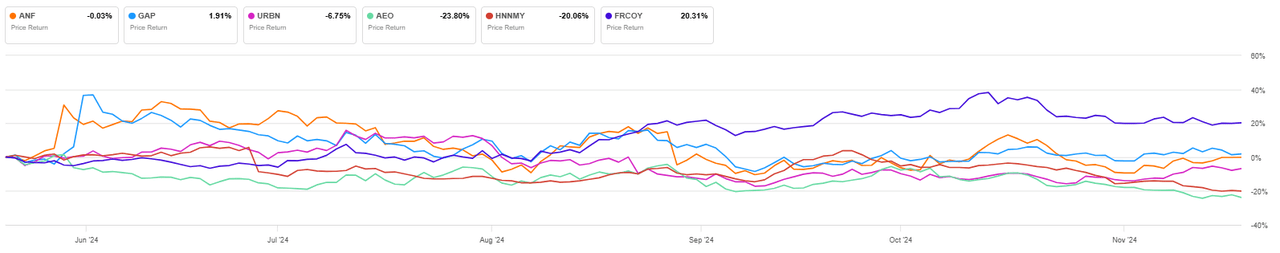

Revisiting CCI, it recorded the strongest monthly gain since March 2021, improving in all 5 components. However, it did not break free of the narrow range that prevailed over the past 2 years. People are still overwhelmed with high prices across demand inelastic staples like gas, food, and housing, directly impacting price-elastic goods and services like travel and fashion. Consumers are price sensitive from the recent period of high inflation, the acceleration of climate change, the continued reshuffling of global trade, and a rise in cheaper alternative clothing from dupes to thrift wear. This has led to sluggishness in the industry and explains why price returns have been poor for ANF and its competitors in the past 6 months.

Price Performance of ANF and Comps (Seeking Alpha)

Cyclicality

The VIX index indicated an uptick of 12% in the past 3 days from the reversal post-election, approaching 17.00. Whilst still within the healthy 15-20 range, the SP500, Nasdaq and Dow Jones index (DJIA) took hits from their pricey highs. This VIX index may continue to rise as Donald Trump enacts policies and measures drastically different from the previous cabinet, from harsh immigration restrictions, appointments of controversial figures for his new cabinet, to a series of economic proposals that may worsen inflation and growth.

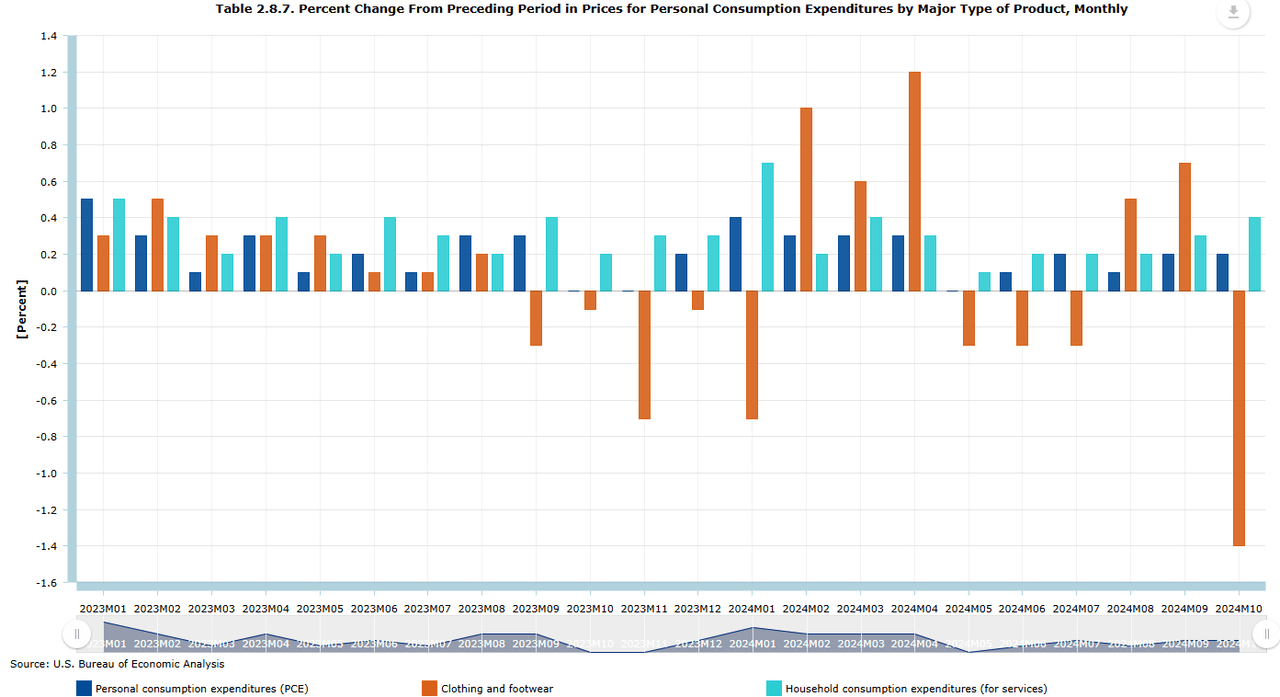

PCE Data from Preceding Periods (US Bureau of Economic Analysis)

Until key components of CPI and PCEPI cool to a stable level with fewer upticks (signaling the Economy’s approach to a soft landing), consumers will still feel apprehensive about spending on consumer cyclical items despite the relative undervaluation in the sector. This is especially so considering prices in the clothing and footwear segment saw a 1.4% decrease in October but came from a 0.7% increase in September.

Tariff Uncertainties

The modest forward 2025 targets with figures near 2023 levels reflect this weaker macroeconomic and industry backdrop, a common point noted by ANF and its competitors. Consumer confidence in October improved from 99.2 in September to 109.6 in October and 111.7 in November. This confidence needs to be maintained until the end of the year to optimize ANF’s momentum.

Finally, another concern would be Trump’s tariffs, such as his proposed additional 10% tariff on all China-sourced items. All in all, these tariffs could lead to consumers paying over $12.9 to 24.0b more for apparel. Scott Lipesky mentioned that:

today, into the U.S., we import about 5% to 6% of our receipts from China into the United States. So, a very small piece of our business, half of that 12% that you call out.

I know there were some discussions last night about tariffs also around Mexico and Canada. Just for us, we don’t have anything coming in from Canada. And Mexico was immaterial in the grand scheme for us coming into the U.S.

So right now, we’ll see what happens. We’re following the news, just like everybody else. We have an awesome sourcing team. We have great partners globally. And we’ll have a playbook if and when new tariffs come in play at some point in the future. We source out of 17 countries, diversified, agile supply chain. And we’re excited to continue to flex that muscle in the future.

While ANF seems diversified enough to bear the potential impact of tariffs on different country imports, if Trump’s tariffs affect imports in ANF’s main countries of sourcing (such as Vietnam), then margins may become a problem. Interestingly, out of its comps (including GAP, Urban Outfitters and American Eagle Outliers, ANF and Uniqlo (under FRCOY) are the only companies whose main import receipts do not come from China, but Vietnam. Considering that China will inevitably bear tariffs, the three with China as a main import source will bear greater losses, but that does not mean ANF can be complacent.

Smaller, More Flexible Competition

The McKinsey report on the state of fashion for 2025 highlights the need for supply chains to be more agile. Leaders who move quickly to identify the bright spots, whether they are geographic, demographic, or technological, will be primed for success, but only if they’re able to evolve.

ANF currently fits this framework. Its supply chain and inventory management efficiencies allow it to more quickly identify fashion trends and bright spots compared to its similarly sized competitors. Newer “challenger” brands may have the upper hand in this regard with their smaller scale and thus flexibility, but ANF also offers a focus on timeless, quality clothing that lasts for a long period of time, giving it a stable source of income beyond trends.

Conclusion

ANF has immense long-term growth potential with its financials and strong playbook, being ahead of its competition. Yet, the industry as a whole has yet to fully recover, and ANF is still undervalued like most of its consumer cyclical counterparts. Shareholder/investor sentiment must be accounted for as well, looking at reactions to prior earnings (notably Q4 23 and Q2 24).

Ultimately, as long as ANF continues to build on its loyal customer base, and ensures high retention rates and a healthy inflow of new customers, it will be able to sustain its strong financials into Q4 and beyond. This in turn propels it towards further collaborations and allows ANF to experiment with new collections that make it stand out more than the rest, refining its brand playbook and brand image along the way.

This compels me to give ANF a buy rating given that Q4’s forecast has been revised for the better, and seasonality favors ANF’s performance after Q3 and the existing momentum it has. In addition, with consumer confidence recovering to some extent, I believe that now is a good time to buy ANF and watch it grow as the economy approaches a soft landing, apparel prices cool down consistently and the outlook for consumer cyclicals improves.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ANF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.