Summary:

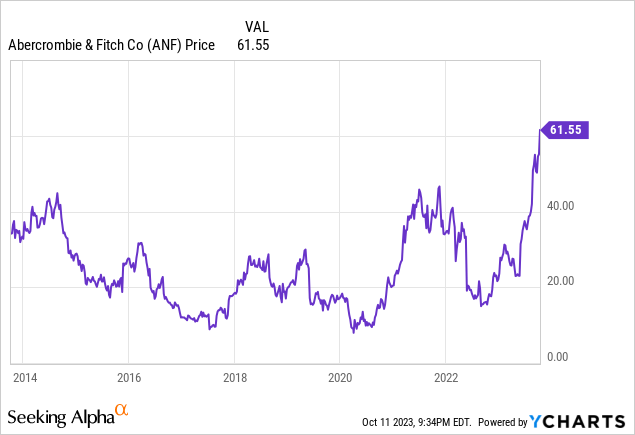

- Abercrombie & Fitch stock has risen more than 160% YTD thanks to an exceptional business performance.

- However, after such an increase in the stock price, the question arises: is it too late to buy the stock?

- Through our DCF model, we find that the stock is overvalued and could experience a pull back in the short term.

- However, in the long term, the company still has a huge opportunity it can capitalize on while returning money to shareholders.

Robert Way

Investment Thesis

Abercrombie & Fitch (NYSE:ANF) operates as a specialty retailer that offers an assortment of apparel, personal care products, and accessories for men, women, and kids under the Abercrombie & Fitch, Hollister, Gilly Hicks, Social Tourist, and Abercrombie & Fitch Kids brands.

To the surprise of many, the stock has risen more than 160% YTD, thanks to strong financial results and momentum. However, after such an increase in price, an obvious question arises: Can it go higher? We believe that although shares are not significantly overvalued, a pullback in the near term is more than necessary for the stock. However, if the company continues to execute well and buy back shares, we see no reason why the stock couldn’t continue to ascend, although not at the rate it has been for the past year.

Financial Results

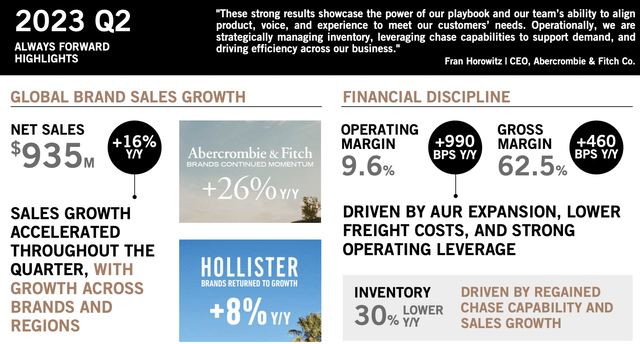

ANF reported its Q2 2023 financial results on August 28, but in this analysis, we are going to focus on the H1 2023 figures. Revenue was $1.77 billion, marking a 9.48% year-over-year increase despite the prevailing consumer weakness. Historically, Hollister has targeted the teenage demographic, while Abercrombie & Fitch has focused on millennials. However, the company is now reaching a broader customer base as it shifts towards more comfortable and casual apparel, aligning with companies like Lululemon and Alo. The efforts seem to be paying off, as the management continues to expect growth in both brands.

The company hasn’t only managed to increase revenue but also increase margins and profitability. In the first half of the year, the gross margin was 62.5%, a 460bps increase year over year, and the operating margin was 9.6%, a 990bps increase year over year. The jump in margins was driven by AUR expansion, lower freight costs, and strong operating leverage. Moreover, ANF generated $126 million in free cash flow in H1 2023, which hasn’t been used yet.

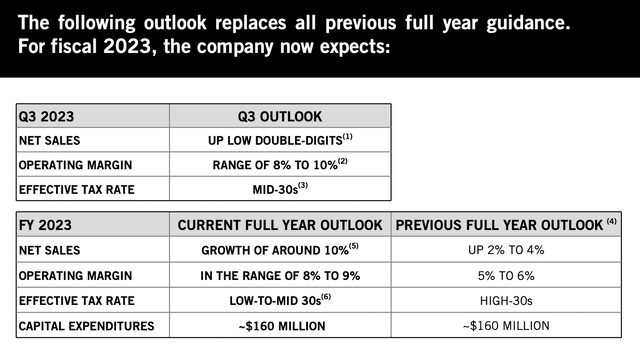

But the real reason why the stock jumped more than 20% after they reported Q2 financial results is that they significantly raised their guidance for the remainder of the year. They now expect revenue to grow around 10%, have an operating margin in the range of 8% to 9%, and a tax rate in the low-to-mid 30s.

Longer term, the company keeps on track to achieve their “Always Forward Plan”. In 2025, they expect to achieve sales between $4.1-$4.3 billion and +8% operating margin. However, at this rate, we could see the company reaching its goals in 2024.

Valuation

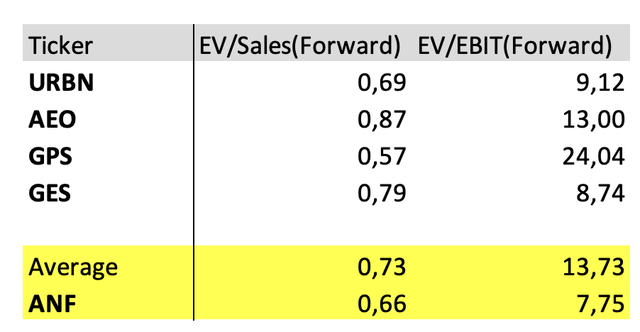

ANF has a market cap of $3 billion. If we sum the debt($297 million) and subtract cash and equivalents($617 million), we arrive at an enterprise value of $2.68 billion. The company holds an impressive cash position, which increased 67% YoY thanks to a reduction in inventory levels and generation of free cash flow.

However, when compared to its closest peers, ANF seems to trade at a discount. Assuming the company grows revenue 10% YoY in F2024 and operating margins reach 8.5%(guidance midpoint), the stock is trading at 0.66x EV/Sales and 7.75x EV/EBIT. The later ratio is much lower than the average of its peers.

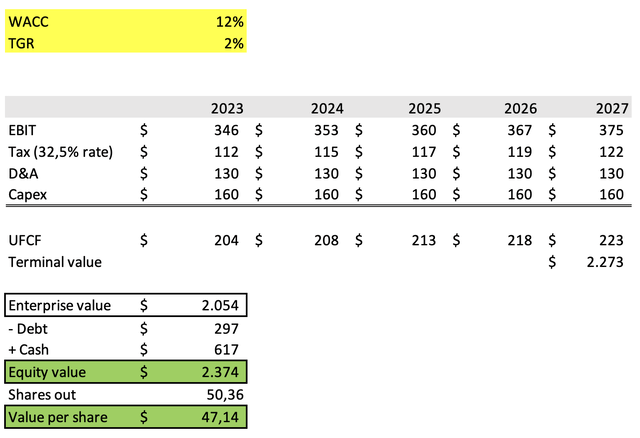

We also decided to do a DCF model. We assumed that revenue will grow at a constant rate of 2% going forward, the tax rate will be 32.5%, depreciation will be the same as last year, and capex levels will remain the same as this year’s expectations. We also assumed a WACC of 12%.

With these assumptions, we calculate an implied value per share of $47.14, which represents a 22% drop from current levels. By this measure, it seems like the stock is slightly overextended and could experience a pullback.

However, considering the amount of cash they have, any pullback appears to be a great opportunity for the company to buy back shares. In 2021 and 2022, they bought back $503 million worth of shares, while this year they didn’t buy back a single share. This could also suggest that the management believes the stock is overvalued and are waiting for a lower price.

Risks

In order for ANF to maintain its valuation, it is crucial to sustain this level of margins and performance during the next year. Management feels very positive about the growth opportunities, especially with Hollister, where they are still experimenting with store formats and pursuing growth opportunities.

Regarding the stock, ANF is on the list of the most crowded long stocks going into earnings, so a slight miss in estimates can lead to a short-term stock crash. Moreover, the stock has an extremely overbought RSI, which signals that a short-term pullback is imminent.

Lastly, a recession could hit ANF hard. During a recession, the apparel industry typically experiences significant impacts as consumers prioritize essential goods over discretionary items like clothing. As a result, apparel stocks often face declining sales and reduced profit margins.

Takeaway

Overall, the performance of the stock is justified by the improvement in the fundamentals of the company. If the company can continue to grow revenue in the single digits and maintain these levels of margins, the free cash flow generation should be strong enough to buy back shares or pay a dividend, propelling the stock higher. However, if the company hits a rough patch, the stock could drop as quickly as it rose. In the short term, the most probable thing is that the stock pullbacks 10%-20%, so I would wait a little if you want to get in.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.