Summary:

- Abercrombie & Fitch has driven an impressive brand turnaround, fueled by changing fashion trends making Abercrombie brands more attractive to young people.

- Investors should still note the risk of ever-changing fashion trends that could deteriorate the current financial trajectory of incredible margins and growth.

- While the stock could continue to rise as earnings climb, the valuation is starting to extrapolate too high-growth expectations and forgets the major risk from changing fashion trends.

E_Y_E/iStock Unreleased via Getty Images

Abercrombie & Fitch Co. (NYSE:ANF), the clothing manufacturer and retailer with the Abercrombie & Fitch and Hollister brands, has been the apparel sector’s undeniable star in the past couple of years. The company has been able to revitalize its brands successfully and has been able to grow demand and push through better pricing as a result, pushing aggressively higher revenues.

The stock has now returned 384% in the past year after a decade of otherwise mediocre returns from the stock, as the company’s brand turnaround has been able to drive dramatically improved earnings. The valuation is increasingly getting tight, though, as industry-leading financials are trajected to persist as the stock continues to climb higher.

1Y Stock Chart (Seeking Alpha)

The Abercrombie Brand Turnaround Has Been Impressive

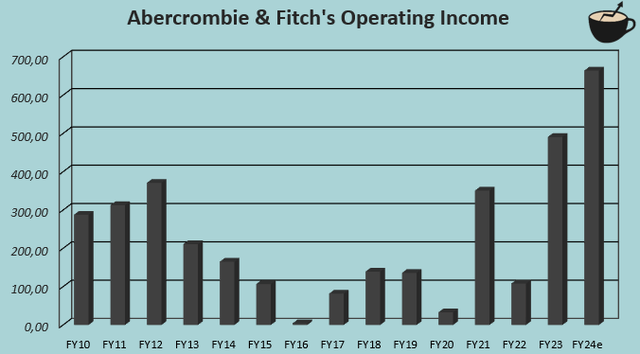

Abercrombie & Fitch has achieved an incredible turnaround of the company’s brands – sales have turned from very mediocre growth of a -0.7% CAGR from FY2014 to FY2019 prior to the pandemic into 15.8% in FY2023, and the company has been able to push through increased pricing, raising the operating margin from 3.8% in FY2019 into a trailing 13.1%. The incredible financial performance has continued as the company raised its guidance for FY2024 with the Q1 report.

Author’s Calculation Using TIKR Data

Behind the financial trends, Abercrombie & Fitch’s Abercrombie brands have had an impressive turnaround as the designs have resonated with younger people in an increasing manner. Abercrombie brands have been picked up by customers in an increasing manner with sales increasing from $1.46 billion in FY2019 to $2.20 billion in FY2023 compared to Hollister’s $2.16 billion to $2.06 billion in the same period.

The company seems to have shifted favorably in fashion trends in Abercrombie brands, boosted by the rising “old money” – fashion trend among younger people in recent years, which Abercrombie has adapted well to. The brand’s usually simple color schemes and quite ageless designs cater to the changing trend, driving the incredible rise in demand.

On the other hand, the Hollister brand seems to be performing worse, but still quite healthily with 12% in growth in Q1 compared to Abercrombie brands’ 31%.

The Fashion Risk: Dr. Martens’ Example

In the fashion industry, companies are constantly posed with the risk of constantly changing fashion trends – Abercrombie & Fitch’s hot financial run could be a temporary turn in fashion trends, and if trends change to no longer support Abercrombie’s offered style, the trend could reverse.

Dr. Martens (OTCPK:DRMTY), a footwear company based in the U.K., works as an example of what shifts in fashion trends can do to a company’s earnings – while the company’s revenues and operating income grew from £489.1 million and £61.0 million respectively in FY2018 into £1193.2 million and £297.5 million respectively in FY2022, the operating income is now only guided to be a fraction of the peak level in FY2025 despite the brand still showing healthy demand. I previously wrote an article on Dr. Martens, highlighting the notable weakness despite a remaining healthy-looking brand.

I don’t believe that investors of Abercrombie & Fitch should expect such a dramatic downturn as a base scenario, but the fashion risk is still something to consider. The Abercrombie brand’s offering seems to revolve mainly around simple colors and ageless fashion, making the risk at least more moderate in my opinion.

Abercrombie & Fitch’s FY2025 target, set in the Always Forward Plan in 2022, seems to guide for such a risk to start realizing in FY2025 with a sales target of $4.1-4.3 billion with an operating margin of 8%+, down from around $4.7 billion and 14% being guided respectively for FY2024. The long-term revenue target is $5 billion with a 10% operating margin. The market doesn’t seem to take the targets seriously when it comes to the valuation, though, and the company has already demonstrated a better performance than the plan set to achieve – I would guess that the targets are updated higher at some point.

Yet, as the targets have already been exceeded by such a wide margin, the incredibly hot fashion trends that could easily change can be seen to have surprised Abercrombie & Fitch itself, and investors should be cautious of the risk.

The Valuation Is Too Tight

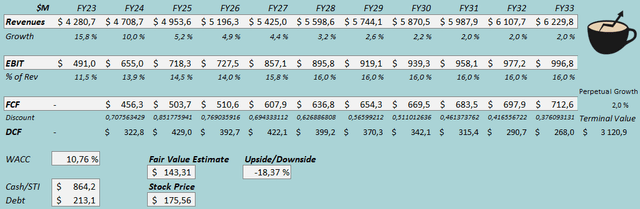

Abercrombie & Fitch’s valuation is starting to get too tight – to demonstrate the valuation, I constructed a discounted cash flow (DCF) model.

In the model, I estimate continued growth with 10% in FY2024 and a slowing growth afterward into 2% perpetual growth, representing a CAGR of 3.8% from FY2023 to FY2033 in revenues. For the EBIT margin, I estimate further leverage into 16.0% through operating leverage and good continued pricing. Abercrombie & Fitch has quite moderate capex and working capital needs, making for a good cash flow conversion.

DCF Model (Author’s Calculation)

The estimates put Abercrombie & Fitch’s fair value estimate at $143.31, 18% below the stock price at the time of writing. Considering the estimates’ expected continued strength and the potential of turning fashion trends deteriorating earnings in the mid- to long-term, I believe that the valuation is highly unappealing – while continued strength could still well continue the stock rally, I don’t believe that the risk-to-reward is worthwhile anymore.

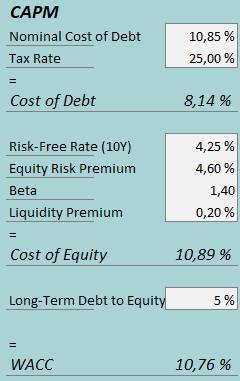

A weighted average cost of capital of 10.76% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q1, Abercrombie & Fitch had $5.8 million in interest expenses, making the company’s interest rate 10.85% with the current amount of interest-bearing debt. I estimate a low long-term debt-to-equity ratio of 5%. To estimate the cost of equity, I use the United States’ 10-year bond yield of 4.25% as the risk-free rate. The equity risk premium of 4.60% is Professor Aswath Damodaran’s latest estimate for the United States, updated on the 5th of January. Seeking Alpha estimates Abercrombie & Fitch’s beta at 1.40. Finally, I add a liquidity premium of 0.2%, creating a cost of equity of 10.89% and a WACC of 10.76%.

The Upside Risk

While the valuation currently seems tight, it has seemed so for a while now. The stock has still only continued to climb higher – Abercrombie & Fitch consistently raises the bar with earnings beat after earnings beat and a climbing financial guidance. In the past year, earnings have had to be revised to the upside multiple times by Wall Street analysts, and only reflecting the valuation to current expectations could still turn out to be too pessimistic.

Earnings History (Seeking Alpha)

Yet, I believe that some caution is needed in the estimates. Extrapolating the recent turnaround into too much long-term growth could easily turn out to be wrong as fashion companies have historically shown. Abercrombie & Fitch already achieves higher margins than nearly any non-designer brand in the industry does.

Takeaway

Abercrombie & Fitch’s brand turnaround, especially in Abercrombie brands, has been impressive, driving continued revenue growth, margin leverage, and ultimately share appreciation as the brand has adapted to changing fashion trends. Still, the long-term trend shouldn’t be extrapolated into the mid- to long-term without caution – fashion trends are in constant change, and Dr. Martens’ earnings history shows an example of what trend changes can do to earnings. While the constant earnings beats and leveraged earnings could drive a continued share rally, I believe that the valuation is now getting too tight as great growth is too boldly extrapolated. As such, I initiate Abercrombie & Fitch at Sell.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.