Summary:

- Abercrombie & Fitch’s Q2 earnings release led to a steep selloff as investors digested its tepid Q3 outlook.

- However, investors must note that management upgraded its full-year guidance, suggesting the pessimism is likely overstated.

- There are near-term profitability challenges to navigate, but they aren’t expected to be structural.

- ANF isn’t assessed to be significantly overvalued while still boasting sector-leading growth metrics.

- I explain why the market is too myopic as it focuses on its tepid Q3 outlook, presenting a solid buying opportunity for long-term investors.

jetcityimage

Abercrombie’s Moment Of Reckoning

Abercrombie & Fitch Co. (NYSE:ANF) investors received a moment of reckoning yesterday (August 28) as the leading retailer reported earnings. Abercrombie’s Q2 earnings release indicated a mixed scorecard. Although comps sales growth was robust, its gross margins failed to meet Wall Street’s estimates. As a result, it led to a battering in ANF stock yesterday as the market reassessed its growth algorithm. After ANF’s significant market outperformance over the past year, its less-than-stellar release likely spurred profit-taking in early investors as they looked to protect their prized gains.

I urged Abercrombie investors to remain vested in the retail rocketship as management has executed a successful turnaround. However, the sizzle was dismantled by the selling intensity this week, as investors ask questions about ANF’s ability to maintain its buying optimism.

Abercrombie’s management didn’t shy away from the company’s near-term profitability growth challenges. Accordingly, ANF guided for Q3 revenue growth in the low double digits while anticipating adjusted operating margins of between 13% and 14%. However, that’s a marked step-down from Q2’s adjusted operating margin of 15.5%, based on a topline growth metric of 21.2%. Consequently, the tepid Q3 outlook suggests Abercrombie & Fitch isn’t immune to the consumer spending slowdown headwinds that also impacted other retail peers. Since ANF is still priced for growth (“A+” growth grade), the market’s caution against its Q3 guidance is justified.

Abercrombie Needs To Deliver A Solid Q4

Notwithstanding its near-term caution, I’ve assessed that Abercrombie’s FY2024 outlook is still relatively optimistic. Accordingly, management raised its full-year net sales outlook to between 12% and 13%, up from its previous 10% outlook. It also upgraded its adjusted operating margin to between 14% and 15%, suggesting a Q4 growth inflection is in the works. Hence, I assess that investors have likely determined potentially higher execution risks as the company’s outlook has placed more emphasis on a higher-performing Q4 to meet its full-year guidance.

The company highlighted underlying cost pressures that affected its gross margin accretion in Q2. Higher freight costs mitigated the improved pricing strategies that drove higher average unit retail. However, I assess that the company’s omnichannel marketing approach to driving growth should alleviate the underlying cost pressures over time.

Furthermore, the company’s full-year outlook should assure investors that the cost pressures are likely limited to Q2 and Q3 before a more robust improvement in Q4. However, bearish ANF investors could highlight management’s cautious commentary on assessing uncertainties relating to holiday spending and macroeconomic factors. Hence, ANF is likely heading into the final calendar quarter of the year with more questions about demand sustainability than before. Consequently, investors who sold yesterday likely adopted the “sell first and ask questions later” approach as they digest potentially higher execution risks.

While pessimism about ANF’s profitability growth challenges to justify its high-growth grade is warranted, investors should remain focused on its execution through the end of the year. Management has demonstrated its ability to engineer a successful turnaround. Therefore, the market is expected to remain optimistic about a Q4 growth ramp, notwithstanding the near-term caution.

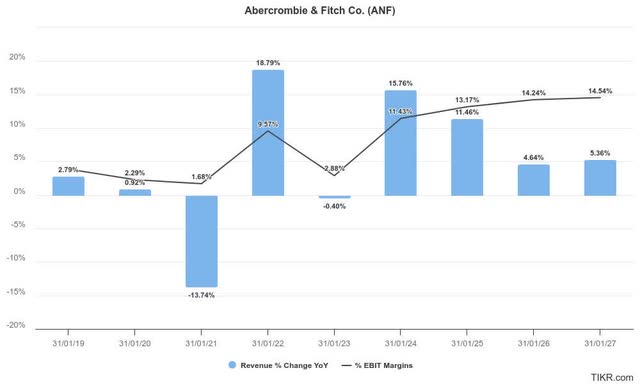

As seen above, ANF’s topline growth is expected to slow further. Management previously telegraphed a long-term $5B sales target. Hence, unless the company upgrades its long-term outlook markedly, I believe the market has already reflected caution on its possible growth normalization phase.

Notwithstanding the topline growth slowdown estimates, its adjusted operating margin is still expected to remain robust, underscoring its effective execution. Wall Street’s estimates on ANF have also been upgraded, suggesting optimism on the stock isn’t misplaced. The question is whether the market has already priced in these challenges, even as the retailer works to reignite its profitability growth in Q4.

ANF Stock: Not Assessed To Be Significantly Overvalued

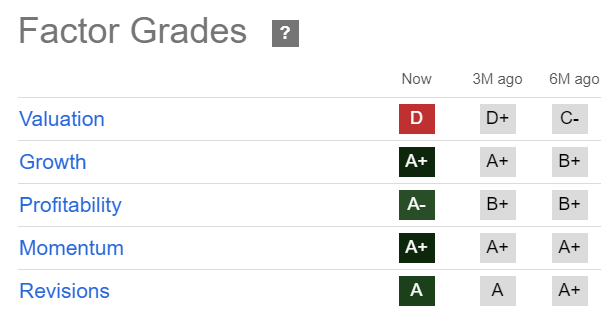

ANF Quant Grades (Seeking Alpha)

ANF’s “D” valuation grade suggests the stock is still priced for growth. In other words, the market will likely scrutinize its execution in the second half, even as investors digested its tepid Q2 earning scorecard and outlook.

As a result, investors must brace for more pain if ANF’s subsequent earnings updates over the next two quarters underperform. While the stock’s “A+” momentum bolsters its robust buying resilience, it could quickly reverse if its growth faltered.

However, ANF’s forward adjusted earnings multiple of 17x is less than 10% over its sector median while boasting sector-leading growth metrics. As a result, investors shouldn’t be unduly concerned about potential overvaluation risks, as the market seems to have priced in the headwinds accordingly.

Risks To ANF’s Thesis

Abercrombie faces near-term profitability growth headwinds that dissolved much of the recovery from its recent August lows. While I anticipate dip-buying sentiments to remain robust, the stock isn’t assessed to be undervalued. Therefore, worse-than-anticipated consumer spending headwinds could hinder the company’s execution of a Q4 turnaround. Investors must consider these challenges and developments carefully, considering the cooling labor market.

ANF operates in a cyclical retail industry. While it has delivered breakneck profitability growth over the past year, it doesn’t seem reasonable to expect the momentum to continue indefinitely. Retail trends also move quickly, requiring ANF to rapidly adapt its go-to-market and distribution strategies to meet customer demand. Since ANF is priced for growth, the market expects management to execute robustly, suggesting poor execution could lead to further valuation de-rating.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ANF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!