Summary:

- Abercrombie & Fitch Co. recently reported Q3 earnings that exceeded cellar-dwelling expectations on both the top and bottom lines.

- However, the company saw many key metrics fall significantly from last year and still forecasts a drop in revenue to come.

- While ANF exceeded the low bar set in front of them in Q3, significant structural challenges remain – I rate this stock a “Hold” with a $21 price target.

jetcityimage

Introduction & Purpose

Abercrombie & Fitch Co. (NYSE:ANF) recently reported Q3 earnings that beat low expectations and shocked the market, sending the stock up ~20% on the release day. The company’s revenue declined materially from the prior year, but ANF improved its guidance for the remainder of 2022, from a mid-single digit decline forecast in Q2 to only a 2-4% decline estimate in the recent release. My recent article on ANF showcased a bear view, and even with the stock jumping, these results reinforced my opinion. With a macro environment likely to remain challenged as rates rise, and ongoing turmoil as the company loses money, ANF isn’t well-positioned to outperform. I reiterate my “Hold” rating with a $21 price target over an 18-month timeline.

ANF Q3 Review

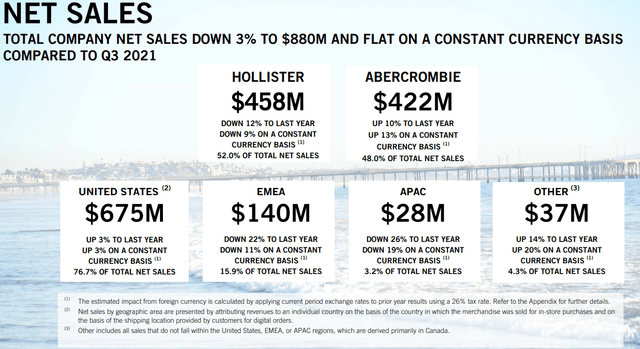

ANF announced Q3 earnings on November 22, 2022 that shocked the market, sending the stock up significantly in the following days. Total revenues fell to $880MM, down 3% year over year. The company also reported another quarter of margin deterioration from the previous year, as gross margin fell from 63.7% to 59.2%. ANF saw jumps in stores and distribution expenses, and ended the quarter with a net loss of ($2.2MM), down significantly from last year’s net income mark of $47MM, but above Q2’s loss of ($16.8MM). Hollister, the largest brand by revenue in the portfolio, saw sales fall 12% year over year. However, there was some promise from the Abercrombie brand, which saw a 10% revenue jump, given its strength in the return to school demographic and special occasion fashion, as noted by executives on the earnings call. The parent brand is now closing in on Hollister as the leading revenue generator, and it spells an important shift in the sales mix. Global sales fell significantly, highlighted by a 23% weighted drop in the European, Middle East and Asia-Pacific region. The company was fortunately able to reverse the trend of slowing domestic sales, which grew 3% after falling 4% in Q2, and was one of the key reasons for optimism. While the results were decent, the bar had been set so low from previous quarterly results that I’m not sure these earnings are a catalyst for the stock to have a prolonged rally. Management has not been able to adapt quickly enough, unlike their peers, and this quarter proved that ANF remains a laggard.

ANF ended the quarter with just $257MM in cash, well below the previous year, in which the company had close to $1B on hand, and even last quarters $370MM total. The company also burned $301MM from operations, up another $41MM from last quarter. Inventory of $742MM, up 36% year over year, is not too concerning given that the company has cycled through a lot of discounted inventory and because 92% of that inventory is landed and is in season. Fran Horowitz, CEO, noted on the conference call that they are “determined to improve Hollister’s performance in the quarters to come“, though there have been ongoing inventory issues for over a year. CAPEX is expected to hit $170MM by the end of the year, as the company hones in on growth in the Abercrombie brand. There were some intangible positives in the quarter – ANF was listed on the “144 Brands That Matter” list for 2022, and seem to have achieved real traction with the Abercrombie brand. The company is also redesigning the displays of Hollister stores and adding an app for customers, and have seen higher sales per customer than average since its launch. Overall, it was a mixed quarter, with some positive undertones, but still with struggles on the top and bottom lines.

The company also announced that Terry Burman, Chair of ANF, would step down from his perch. Terry had been with ANF since 2014 and did a decent job – though scandals and a stagnant share price since he became Chair in 2018 will likely headline his bio. Former Dunkin Donuts executive and existing board member Nigel Travis will take over as Chair, which signals that the strategy for the firm is unlikely to shift significantly.

Model Shows Limited Upside

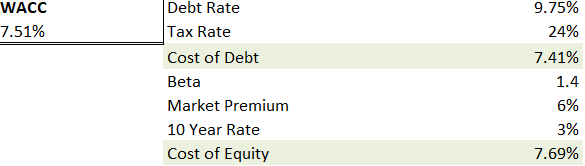

A senior note at 8.75% stings in hindsight given the net loss, and the company’s net cash position dropped dramatically once again. While they did buy back $8MM of their outstanding debt, given their weak performance, I anticipate the cost of capital remaining elevated at 7.5%.

Author WACC

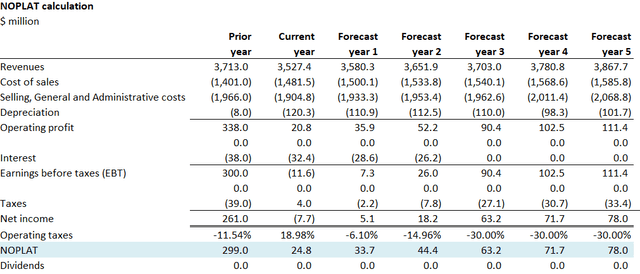

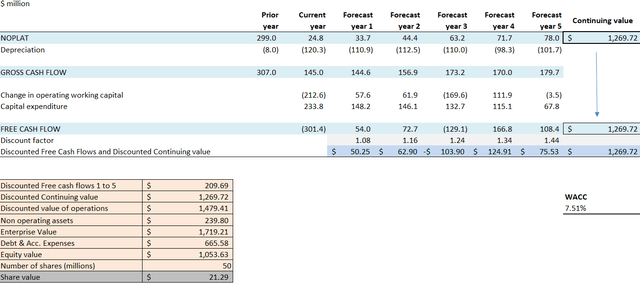

I forecast a continuing value of about $1.3B, given a -5% revenue decrease this year and blended revenue gains of ~1.75% for five years, as supply chain woes and inflation continue. I hold the majority of other cost ratios equal as a percentage of revenue from the previous model, with a slight uptick in future revenue. I also forecast that the company will hold most of their debt to maturity without refinancing, which explains the low cash flow in 2025. A $21 share price (see below) can be supported with fundamentals of a 11.7x 2023 EV-EBITDA.

Author NOPLAT Forecast Author EV Forecast

Conclusion

ANF stemmed the bleeding this quarter, but revenue declines and operational challenges still continue to plague the company. I believe that ANF will remain an underperformer, or at best middle of the pack. Significant challenges lie ahead with its Hollister brand and ANF still has a significant cost base with too much square footage. It’s wise to hold the stock if you have had it for some time, and wait for a pull back and/or another catalyst to buy. I project an $21 price target with a “Hold” rating over an 18-month timeline.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.