Summary:

- The recent market rotation has triggered ANF’s drastically cheaper valuations at FWD PEG non-GAAP ratio of 0.62x, prompting our upgraded Buy rating.

- If anything, the impressive H1’24 performance with net sales growth of +21.4% YoY and operating margins of 14.1% suggests a potential for beat and raise performance ahead.

- This is despite ANF’s recently raised FY2024 guidance, with it sustaining the stock’s high growth/ profitable investment thesis.

- Even so, while we are optimistic about its long-term prospects, readers must note that its near-term performance may underwhelm due to the elevated short interest and macroeconomic uncertainties.

- This is especially since the Americas region comprises the lion’s share of its revenues while being responsible for most of the YoY sales growth.

Nuthawut Somsuk

ANF’s High Growth Investment Thesis Is Finally Cheap After The Deep Pullback

We previously covered Abercrombie & Fitch (NYSE:ANF) in July 2024, discussing why we had continued to rate the stock as a Sell then, attributed to the stock’s still expensive valuations/ prices then and the potential impact of the elevated freight rates on its bottom-lines.

Combined with the pulled forward upside potential, the elevated VIX index, and the minimal margin of safety, we believed that there might be more pain in the near-term.

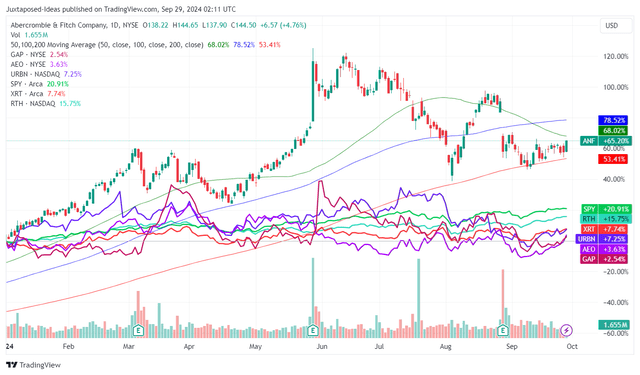

ANF YTD Stock Price

Since then, ANF has further pulled back by -14.8% at its worst, effectively losing much of its recent Q3’24 gains, thanks to the July/ August 2024 market rotation.

Perhaps part of the headwinds is attributed to the pessimistic market sentiments surrounding consumer retail stocks, as observed in their underperformance on a YTD basis compared to the wider market, aside from ANF.

This development may be attributed to the rising non-housing debt levels of $4.9T by Q2’24 (+0.6% QoQ/ +4% YoY/ +20.9% from Q2’19 levels) and the elevated average credit card delinquency rate of 3% by August 2024 (+0.02 points MoM/ +0.26 YoY/ +0.33 from August 2019).

With the Consumer Confidence Index still pessimistic at 98.7x by September 2024 (-6.9 MoM and extremely low compared to the ~120x observed in 2018 and 2019), it is unsurprising that the wider retail market has been impacted by the mixed consumer spending outlook, despite the Fed’s recent pivot.

This is also why we believe that investors may want to pay attention to ANF’s near-term performance.

This is especially since the Americas region comprises 79.4% of its sales in FQ2’24 (+1.3 points YoY) while being responsible for most of the sales growth by +23.2% YoY (compared to the EMEA at +16.1% YoY and APAC at +3.4% YoY).

On the other hand, ANF has continued to double beat the consensus estimates over the past six consecutive quarters, despite the consistently raised estimates – thanks to the growing Average Unit Retail pricing and sales volume.

This is on top of the management’s recently raised FY2024 net sales growth guidance of +12.5% YoY and adj operating margin of +14.5% (+3.1 points YoY) at the midpoint, compared to the original guidance of +5% YoY and +12% (+0.6 points YoY) offered in the FQ4’23 earnings call, respectively.

These numbers do not appear to be overly aggressive for now, based on ANF’s H1’24 net sales growth at +21.4% YoY and operating margins of 14.1% (+7.2 points YoY), implying the latter’s ability to potentially report beat and raise performances over the next two quarters despite our original bottom-line concerns.

Much of its tailwinds are attributed to the highly strategic and successful regional/ localized approach along with targeted seasonal offerings across customer groups, key partnerships (including Collegiate/ NFL), and digital marketing/ sales.

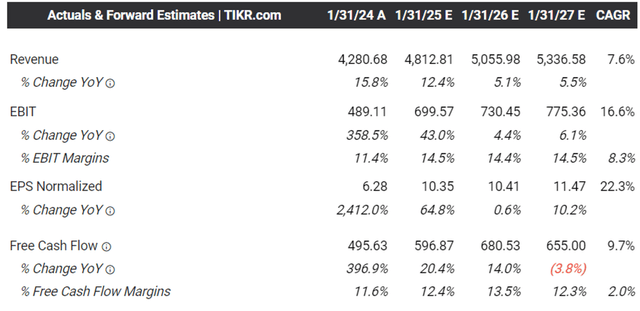

The Consensus Forward Estimates

And it is for this reason that we believe that the above consensus forward estimates appear to be on the low side, especially given the impressive H1’24 adj EPS growth by +224.4% YoY and the relatively tight float at 53.27M (+1.74M YoY).

While FY2025 may bring forth a tougher YoY comparison, we believe that ANF’s highly profitable investment thesis remains compelling especially after the recent correction.

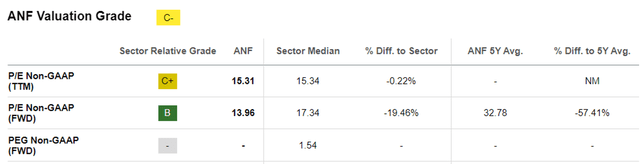

ANF Valuations

This is also why we believe ANF is finally trading reasonably at FWD P/E non GAAP valuations of 13.96x, compared to its 10Y mean of 20.70x, the sector median of 17.34x, and the recent heights of 23.22x in May 2024.

This is attributed to its relatively cheap FWD PEG non-GAAP ratio of 0.62x, attributed to the projected expansion in its adj EPS at a CAGR of +22.3% through FY2026.

This is compared to the original estimates of +10.8%, while building upon the historical growth at a CAGR of +45.9% between FY2017 and FY2023.

At the same time, ANF has put much of its increasingly rich LTM Free Cash Flow generation of $547M (+96.7% sequentially) and margins of 11.7% (+4.5 points sequentially) to great use, as observed in the healthier balance sheet at a net cash position of $738M (+13.3% QoQ/ +130.6% YoY) and effectively zero debts.

While the stock does not pay out dividends, the management has also been repurchasing shares to cancel part of its elevated stock-based compensations and ongoing insider selling, with $202M remaining in its existing authorization.

Impressive indeed.

So, Is ANF Stock A Buy, Sell, or Hold?

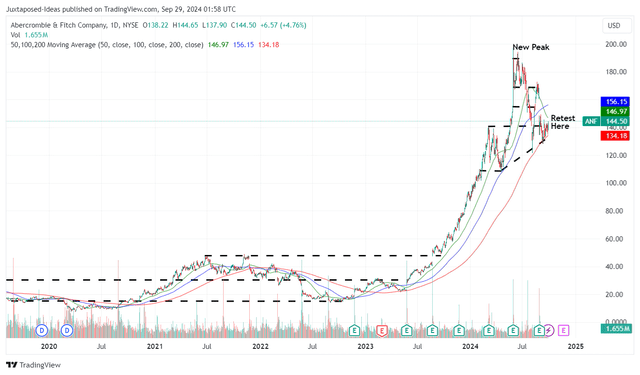

ANF 5Y Stock Price

For now, ANF has already returned most of its YTD gains with the stock seemingly well supported at $140s while nearing the 200 day moving averages.

For context, we had offered a fair value estimate of $124.50 in our last article, based on the LTM adj EPS of $8.04 ending FQ1’24 (+783.5% sequentially) and the 1Y P/E mean of 15.49x.

Based on the LTM adj EPS of $9.44 ending FQ2’24 (+248% sequentially) and the same P/E mean, it appears that ANF is finally trading near to our updated fair value estimates of $146.20.

Based on the consensus raised FY2026 adj EPS estimates from $10.49 to $11.47, there is an expanded upside potential of +22.9% to our updated long-term price target from $162.50 to $177.70 as well.

As a result of the much improved risk/ reward ratio as discussed in the above section and the stock’s uptrend support from the April 2024 bottom, we are cautiously upgrading the ANF stock as a Buy here.

Even so, readers must note that short interest remains elevated at 7.9% at the time of writing, albeit moderated from the start of the year at 13.4% and a year ago at 15.1%.

Combined with the stock market’s overly greedy sentiments, we believe that ANF’s near-term stock performance may underwhelm prior to the normalization in sentiments and macroeconomics outlook.

As a result, we believe that the stock is only suitable for those with a long-term investing trajectory, since its recover is unlikely to occur in the near-term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.