Summary:

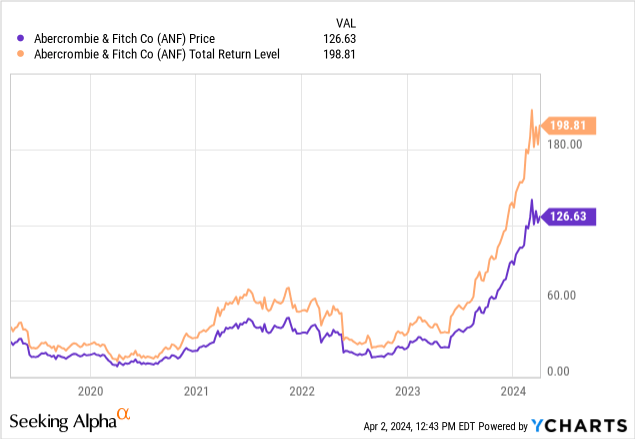

- Abercrombie & Fitch has successfully turned around its brand, with a 404% increase in total returns over the past 5 years.

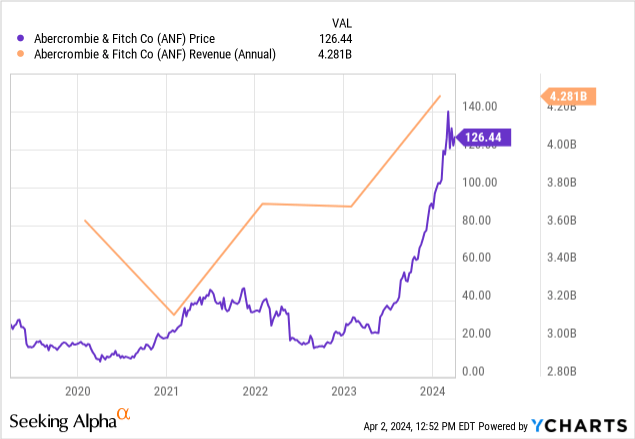

- The company’s recent earnings report showed strong growth, with net sales up 21% in the fourth quarter and 16% for the full year.

- Abercrombie & Fitch has significant room for growth overseas and a strong balance sheet, making it an undervalued stock.

Tim Boyle

Reinventing brands is hard. Once consumers and market views of companies crystallize, management teams usually find the task of changing those perceptions difficult if not impossible. Brand equity is everything in the retail business, and when the appeal of a label diminishes, that usually marks the beginning of the end for most companies.

Abercrombie & Fitch (NYSE:ANF) is one of the best turnaround stories the market has seen in some time. This company was voted the most hated retailer as recently as 2016, and management did not start to try to reinvent the brand until 2019. Today the company is on a completely different track, and the turnaround story has been a clear success. The retailer currently gets 52% of the company’s revenues from the Abercrombie & Fitch brand, and 48% of revenues come from the Hollister brand.

Abercrombie & Fitch is up 404% over the last 5 years as measured by total returns, while the S&P 500 has offered investors total returns of nearly 98% during this same time period.

Today I am rating Abercrombie & Fitch a buy. The company’s successful management team has turned around the core business, and this retailer should have stronger additional growth head. Abercrombie & Fitch also has a very strong balance sheet and the company continues to generate impressive cash flow as well, management is likely to be able to return significant cash to shareholders in the coming years. The stock also looks undervalued using several metrics as well.

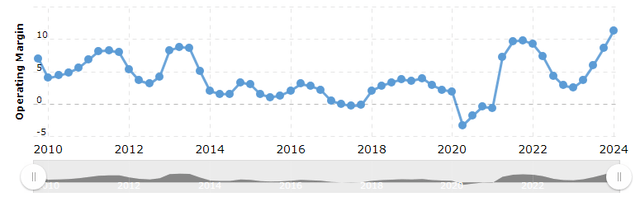

The company’s recent fourth-quarter earnings report highlighted how strong the retailer’s turnaround story is. The retailer beat on the top and bottom line, with Abercrombie & Fitch stating that fourth-quarter net sales were up 21%, and full-year net sales were up 16%. Management stated there was a 35% growth in Abercrombie brands. The company reported GAAP earnings of $2.97 a share, beating expectations of $2.88 a share. Revenues came in at $1.45 billion, beating expectations of $1.24 billion. The retailer also reported strong margin expansion up 880 basis points from the previous year, with operating margins coming in at 11.3%, the highest the company has seen in 15 years. Management also issued bullish guidance for this year as well, stating the company now expects double-digit sales growth this quarter and the current margin levels to be sustainable.

Analysts have consistently and significantly underestimated ANF over the last 3 years.

ANF has grown revenues by 35% in just the last 3 years, and the company has also grown earnings per share from $1.08 in 2019 to $4.20 in 2022. Analysts expect the company to make $7.67 over the next year going into 2025. This retailer has also been able to build out margins during the turnaround as well, and management is confident that the company can sustain 12% margins moving forward.

A chart of ANF’s net margins (macrotrends)

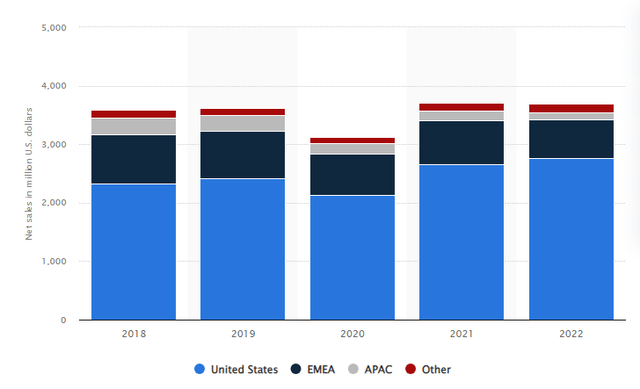

Abercrombie & Fitch also has significant room to grow overseas. The company gets just over a third of the corporation’s revenues from outside of the US, and less than 5% of the retailer’s revenues come from the fast growing Asia-Pacific region.

A chart of ANF’s revenues (Statista)

The retailer also continue to generate strong cash flow, and the company’s balance sheet is very strong. ANF has total debt of $1.05 billion, and the company has total cash of nearly $901 million. The retailer has operating free cash flow of $653 million and levered free cash flow of $462 million. Management has reduced long-term debt significantly since 2020, from $1.48 billion to current levels of $868 million. The company has just $180 million in short-term debt.

This is why Abercrombie & Fitch also looks undervalued at 16.84x expected forward GAAP earnings. The retailer’s current market cap is just $6.66, and the company has nearly $1 billion in cash with minimal short-term debt. ANF is also generating significant cash flow, and analysts have consistently and significantly undervalued the company’s impressive turnaround story. Management is likely to initiate a share buyback plan in the near-term, and current analyst estimates expecting mid-single-digit revenue growth over the next three years are likely too low since the company’s earnings growth and margin expansion have been consistently underestimated by the analyst community.

The retailer’s average 5-year valuation is also at 33x predicted forward earnings estimates. ANF should be able to continue to grow at a high mid-single digit rate over the next several years, and a company with a strong balance sheet and cash flow with this kind of earnings potential should see multiple expansion to around 20x more reasonably forecasted forward earnings estimates, which would put this retailer’s stock at $165 a share.

Abercrombie & Fitch has successfully revamped the core brand of the company by focusing on older consumers and more middle-income buyers. The company’s turnaround story should continue, and the retailer also has significant room for growth overseas as well. While the stock isn’t likely to rise as quickly moving forward as was seen in the last several years, this company still looks undervalued.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.