Summary:

- Most of the exuberance surrounding ANF’s double beat FQ1’24 earnings call and raised FY2024 guidance have been moderated, with more near-term uncertainty likely – arising from elevated freight rates.

- With container freight rates rising higher than expected, we believe that we may see the fashion retailer’s profit margins impacted, with it uncertain if the aggressive FY2024 margins still achievable.

- With ANF expected to record a tougher YoY comparison from FY2025 onwards, we believe that the market’s exuberance surrounding its future execution may further moderate.

- The stock has also pulled forward much of its upside potential, with current levels offering interested investors a minimal margin of safety.

- With the VIX index still rising, the market rotating from growth/ gen AI stocks, and we enter the Q2’24 earnings season, there may be more volatility indeed.

DNY59

ANF’s Investment Thesis Shows Great Promise, Thanks To The Robust Performance Metrics

We previously covered Abercrombie & Fitch (NYSE:NYSE:ANF) on May 20, 2024, discussing the impressive growth in its top/ bottom-lines since FY2019, with demand remaining robust and the management offering optimistic FQ1’24/ FY2024 guidance.

However, that also meant that the stock had been expensive when compared to its peers at that time, with the pulled forward upside potential offering interested readers with a minimal margin of safety, resulting in our Sell rating then.

Since then, ANF has reported a doubled beat FQ1’24 earnings call while raising their FY2024 guidance on May 29, 2024, resulting in us missing out on the near vertical +24% rally afterwards.

Even so, much of those gains have been lost over the past one and a half months as the market rotated from growth/ generative AI stocks, with it signaling (a hardly surprising) profit taking, as ANF well outperformed the wider market on a YTD basis.

With the fashion retailer set to announce their FQ2’24 financial results in August 2024 (estimated, as no official date has been announced), we shall also highlight a few metrics readers may want to look out for.

1. ANF’s Financial Performance Continues To Exceed Expectations

Despite the lofty consensus estimates for FQ1’24, ANF has beaten those numbers and by a wide margin for the adj EPS at that.

Most importantly, its comparable sales have risen drastically by +21% YoY in the latest quarter, accelerated compared to the +16% YoY reported in FQ4’23, +13% YoY in FY2023, and +3% YoY in FQ1’23.

The acceleration in ANF’s sales is impressive indeed, significantly aided by the softer YoY comparison. This is on top of the richer gross profit margins and operating margins, thanks to the leaner inventory levels and lower cotton COGS compared to hyper-pandemic heights.

As a result, we believe that the management’s raised FY2024 revenue guidance to +10% YoY growth is not overly aggressive indeed. This is up from the previous guidance of +5% YoY offered in the FQ4’23 earnings call, while building upon FY2023 levels of +16% YoY.

This is especially since ANF has guided higher selling prices from Q2’24 onwards, along with intensified customer acquisition across different targets and age groups.

At the same time, readers must note that Q3’24 will benefit from the seasonal back-to-school shopping, with ANF’s Hollister brand still commanding one of the leading mindshare for teens in the US.

This is thanks to the management’s strategic investments across marketing/ digital and technology capabilities, while building upon the launch of its ‘Feel Good Fest’ Music Program in numerous high schools between Spring and Fall 2024.

This concert series naturally allows ANF to partner with the musical artists to promote their fashion offerings, while growing their brand awareness amongst teenage customer group. A great idea indeed.

2. ANF May Miss The Aggressive Bottom-Line Guidance

Even so, while ANF already guides robust QoQ/ YoY sales growth and richer operating margins in FQ2’24, readers must note that the rising freight spot prices may trigger headwinds to its near-term performance.

For reference, the Drewry’s World Container Index [DWCI], which tracks the freight costs of 40-foot container via eight major routes, have risen drastically to $5.93K per TEU by July 18, 2024 (+16% MoM/ +300% YoY), up by +45.7% from ANF’s FQ1’24 earnings call – attributed to the ongoing Red Sea disruptions.

This is concerning indeed, since the ANF management expects the gross profit rate expansion to be the key driver to its operating margin expansion to 14% in FY2024 (+2.7 points YoY), up from the previous guidance of +12% (+0.7 points YoY) and FY2023 levels of 11.3%.

With the Gaza geopolitical events unlikely to end in the near-term, we may see the upcoming earnings call bring forth uncertainty in the fashion retailer’s profit margins, with it likely to trigger further stock correction.

As a result, readers may want to pay attention to the management’s commentary in the upcoming earnings call.

3. ANF Is Reasonably Valued, Assuming That The Management Delivers The Raised FY2024 Guidance

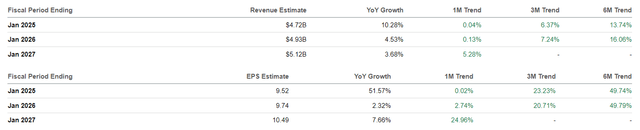

The Consensus Forward Estimates

Seeking Alpha

As a result of the raised FY2024 guidance, it is unsurprising that the consensus have already dramatically raised their forward estimates, with ANF expected to generate an accelerated top/ bottom-line growth at a CAGR of +6.1%/ +18.6% through FY2026.

This is compared to the previous estimates of +4.3%/ +10.8% and the historical growth at a CAGR of +3.4%/ +45.9% between FY2017 and FY2023, respectively.

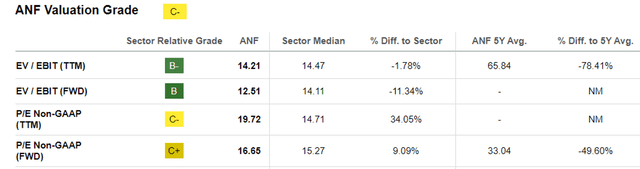

ANF Valuations

Seeking Alpha

And it is for this reason that ANF appears to be trading relatively reasonably at FWD P/E valuations of 16.65x, compared to the previous article at 17.85x, due to the accelerated growth prospects.

At the same time, if we are to compare ANF’s valuations compared to its US-based Consumer Apparel Retail peers, such as:

- The Gap (GPS) at FWD P/E valuations of 12.90x with the projected bottom-line growth at a CAGR of +17.1% through FY2026,

- American Eagle Outfitters (AEO) at 11.12x/ +11.6%, and

- Urban Outfitters (URBN) at 12.78x/ +8%,

it is apparent that the former is no longer expensive here.

So, Is ANF Stock A Buy, Sell, or Hold?

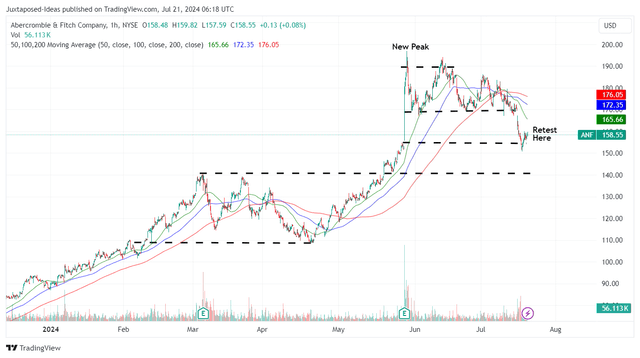

ANF YTD Stock Price

Trading View

For now, ANF has already returned most of its June 2024 gains and bounced off the $150s support levels, while trading below its 50/ 100/ 200 day moving averages.

For context, we had offered a fair value estimate of $97.20 in our last article, based on the FY2023 adj EPS of $6.28 and the 1Y P/E mean of 15.49x. This is on top of the long-term price target of $132.20, based on the consensus FY2026 adj EPS estimates of $8.54.

Despite the recent pullback, it is unfortunate that ANF is still trading above our updated fair value estimates of $124.50, based on the LTM adj EPS of $8.04 and the same P/E mean.

Based on the raised consensus FY2026 adj EPS estimates of $10.49 (+22.8%), there remains a minimal margin of safety to our updated long-term price target of $162.50 as well.

At the same time, with ANF expected to record a tougher YoY comparison from FY2025 onwards, we believe that the market’s exuberance surrounding its future execution may moderate from henceforth, as observed since early June 2024.

Lastly, readers must not forget that the stock remains shorted at 7.9% at the time of writing, albeit moderated from early 2024 levels of 13.4%.

With ANF already nearing its previous trading ranges prior to the FQ1’24 earnings call and the current risk/ reward ratio still unattractive, we prefer to prudently maintain our Sell rating here, despite the recent bounce from the $150s.

Interested investors may be better off observing from the sidelines, since we are likely to see further volatility in the near-term as we enter the Q2’24 earning season, attributed to the recent rotation from growth/ generative AI stocks and the rising CBOE Volatility Index.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.