Summary:

- Abercrombie & Fitch has engineered a successful turnaround, rewarding its investors.

- ANF investors have jumped onto the bandwagon, powering the stock to a 1Y total return of over 320%.

- The company’s solid execution of its turnaround strategy justifies the market’s optimism.

- Questions about whether significant optimism has already been reflected are justified. I highlight what you must consider.

- Notwithstanding the recent bear market, I argue why this retail rocket ship can continue to defy gravity. Read on.

anouchka/iStock Unreleased via Getty Images

Abercrombie: Defying Gravity With Its Turnaround

Abercrombie & Fitch Co. (NYSE:ANF) is a leading retail lifestyle company that has transformed its playbook from primarily focusing on teens to Millennials. ANF has also expanded from its mainly male customer audience to becoming the go-to brand for female customers, as the Fran Horowitz-led company is inching closer to its $5B long-term sales target.

Abercrombie investors have also experienced a breathtaking rally over the past year, as ANF delivered a 1Y total return exceeding 320%. As a result, it also outperformed its retail peers listed in this comparison set, rewarding investors who picked its lows. Given Abercrombie’s incredible results amid a relatively challenging consumer spending environment, I assess the market’s optimism is justified.

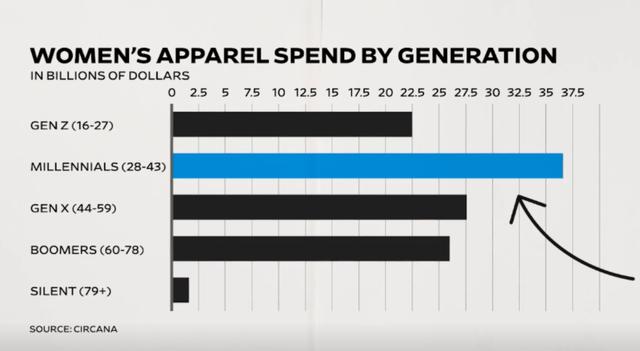

Women’s apparel spend by generation (WSJ, Circana)

Abercrombie’s transformation to target female Millennials consumers is astute. Millennials offer significant potential for retailers in the women’s apparel category if they can execute well, as seen above. Therefore, the company has correctly identified its target market in its transformation.

However, it still requires immaculate execution, given that ex-CEO Mike Jeffries led ANF into malaise. The company was mainly focused on “using sex appeal as a central theme in marketing, with little restraint.” The brand’s focus on exclusivity and prestige worked for a while, but ultimately led to its undoing. The “rise of the body positivity movement” also contributed to the decline of the ANF brand, as management didn’t pivot quickly and effectively to new consumer trends.

Abercrombie’s Solid Execution Justifies Market Optimism

Abercrombie brands (Abercrombie filings)

In contrast, the current ANF has transitioned quickly into four distinct segments within two brands. Led by the flagship Abercrombie & Fitch brand, it has successfully expanded into Millennials. Accordingly, it delivered an impressive 31% YoY increase in revenue in Q1. The teen-focused Hollister brand has also performed admirably, although growth was markedly slower at 12% YoY. Despite that, on a comps basis, “Abercrombie grew 29%, and Hollister grew 13%,” reflecting solid performance across its key segments.

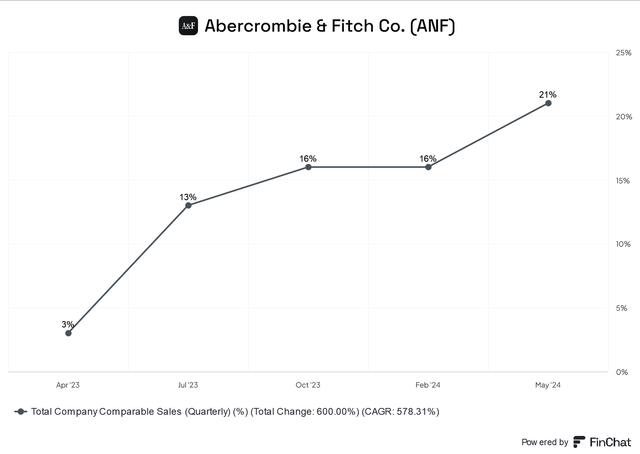

Abercrombie comps sales change % (FinChat)

As a result, it bolstered ANF’s comps sales on average with a 21% increase in Q1. Notably, the company observed “double-digit growth in both stores and digital,” underscoring the effectiveness of its channel strategy. It’s important to acknowledge that the brand has restructured its retail and digital strategy per consumer preferences.

The Abercrombie flagship brand focuses more on digital engagement and conversion. However, its Hollister brand converts primarily in its physical store, emphasizing the criticality of maintaining an effective omnichannel retail strategy.

Therefore, I assess that ANF management has delivered an impressive turnaround, although bearish investors will likely argue Abercrombie’s success has been reflected in its valuation. Has it?

ANF: Valuation Expensive? Think Again

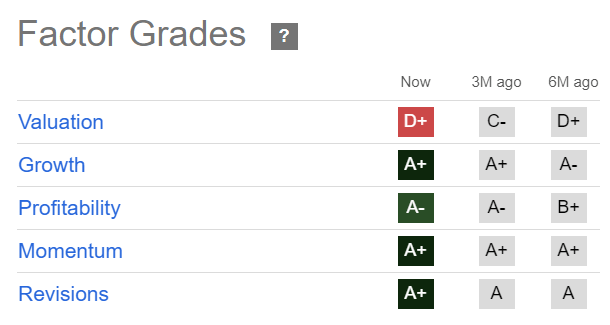

ANF Quant Grades (Seeking Alpha)

Betting against an “A+” momentum stock requires a high level of conviction. ANF is assigned four “A” range grades out of five crucial factor ratings, underscoring the robustness of the stock’s bullish thesis.

Despite that, its “D+” valuation grade might ruffle some feathers, suggesting the market could have captured most of its potential upside. However, a closer inspection suggests ANF was also rated with a “D+” grade six months ago before going on a 50% rally. Hence, I urge investors to scrutinize the key metrics underpinning the stock’s forward valuation before concluding its directional bias.

ANF’s forward-adjusted P/E multiple of 16.7x is about 10% higher than its consumer discretionary sector median of 15.2x. On a forward-adjusted EBITDA basis, it’s valued at 10x, just under 3% higher than its sector median. Are there significant signs of substantial overvaluation? I have not assessed the possibility from the stock’s current forward valuation metrics.

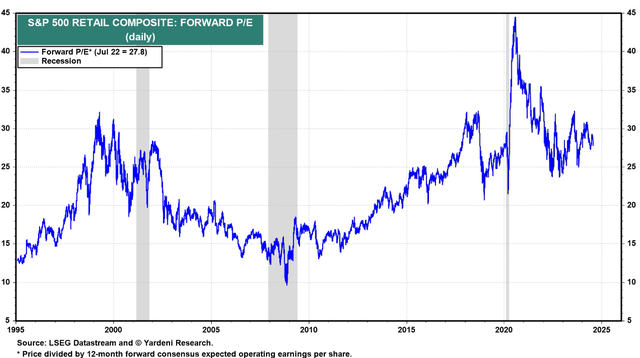

S&P 500 Retail composite forward P/E (Yardeni Research)

Relative to ANF’s retail composite peers, its valuation isn’t excessive. The retail composite is valued at a forward P/E of almost 28x, well above ANF stock’s 16.7x metric. The composite’s forward adjusted earnings growth rate of 19.3% is well below Abercrombie’s “A+” rated growth profile. Hence, I also didn’t assess substantial risks on the stock’s bullish thesis suggesting a steep bear market seems imminent.

Is ANF Stock A Buy, Sell, Or Hold?

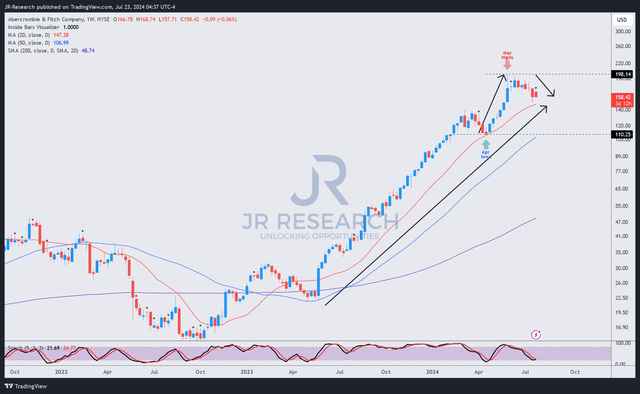

ANF price chart (weekly, medium-term) (TradingView)

ANF has gone on a rampaging run, with no signs of a bull trap or red flags indicating that a sustained decline could follow. The stock’s meteoric rise faced two hurdles in April and May 2024. The stock found its bottom in April at the $110 level before powering into another rally just under the $200 zone.

However, it has since come under pressure from sellers, falling almost 25% through last week’s lows. In other words, ANF has already declined into a bear market, which should attract dip buyers if the rally still has more momentum moving ahead.

While I’ve not assessed signs of a bullish reversal, I’m confident that the market has not gone into FOMO mode with ANF’s valuation. Questions about Abercrombie’s ability to sustain its retail comps store growth are justified. However, ANF’s valuation isn’t excessive and is still valued at a marked discount relative to its retail composite peers.

However, investors considering investing in ANF’s remarkable turnaround growth story must be conscious of the risks of investing in retailers. The highly competitive nature of the fashion industry requires constant innovation to keep up with prevailing consumer trends. A failure to leverage these changes effectively could lead to substantial brand and concomitant sales erosion, as past ANF investors would likely attest.

In addition, investors must also be careful when assessing the macroeconomic climate, as the business performance of retailers like ANF is closely linked to the health of consumer spending. While the company has demonstrated its ability to execute impressively amid uncertain macro conditions, it should never be taken for granted.

Also, inventory challenges are consistent headwinds that even top retailers like Abercrombie & Fitch need to circumvent. Management highlighted that the company entered FY2024 with a “clean inventory position,” mitigating supply chain risks. It has also allowed the company to pursue less aggressive promotional campaigns, improving its profitability.

The company adopts “agile chase capabilities” to improve its speed and capabilities to “respond to positive sales trends by replenishing inventory promptly.” However, excellent execution is required to lower the risks of missed sales opportunities that even a big retailer like Lululemon (LULU) deals with. Therefore, the ability to strike a delicate balance in ANF’s inventory position is crucial to executing its strategy and mitigating the impact of unanticipated discounting.

Rating: Initiate Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ANF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!