Summary:

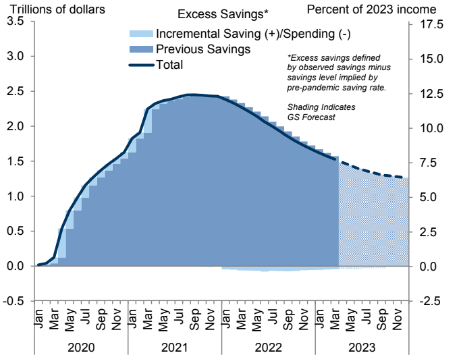

- The retail industry has struggled in the last two-plus years as excess savings declined post-COVID.

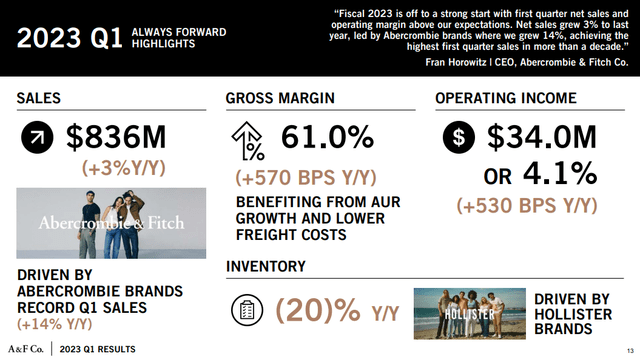

- Abercrombie & Fitch reported a much better than expected Q1 as margin improvement vs. the previous outlook assuaged fears.

- A dividend reinstatement could be in the cards with a few more solid quarterly results.

Justin Sullivan

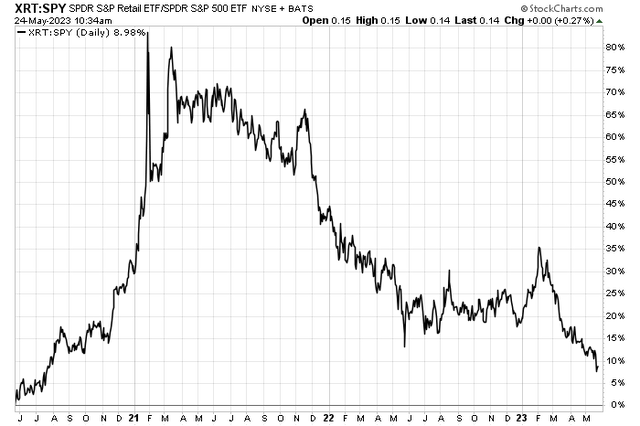

Retail stocks have suffered in the last few months as the consumer shows signs of increasing stress. Excess savings continue to dwindle while uncertainty climbs in the employment market. With still high inflation, folks are being more cautious about spending. But Abercrombie & Fitch (NYSE:ANF) reported a solid Q1, and shares soared on Wednesday. Intraday, ANF was higher by more than 20%, making it the top-performing NYSE stock.

With an improved earnings outlook and better technical trends, I have a hold on the stock due to the valuation and trading range.

Retail’s Rowdy Ride Since Early 2021: Major Relative Weakness

StockCharts.com

Excess Savings Declining Post-Pandemic

Goldman Sachs Investment Research

According to CFRA Research, ANF is a global specialty retailer offering a wide assortment of apparel and accessories under the Hollister, Abercrombie & Fitch, and Abercrombie kids brands. The company operates through two segments – Hollister and Abercrombie. It sells products through its stores, various wholesale, franchise, and licensing arrangements, and e-commerce platforms.

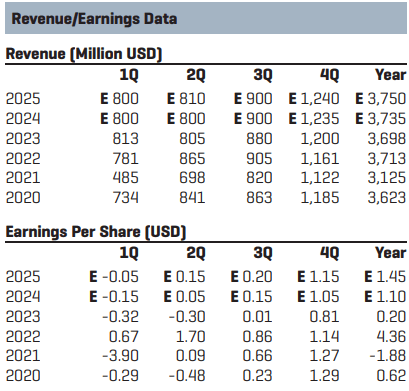

The Ohio-based $1.2 billion market cap Apparel Retail industry company within the Consumer Discretionary sector trades at a high trailing 12-month GAAP price-to-earnings ratio given just $0.06 of as-reported EPS in the last year and the company does not pay a dividend, according to The Wall Street Journal.

On Wednesday, ANF reported first quarter operating earnings per share of $0.39, topping the consensus forecast of just $0.02. Revenues rose 2.8% from a year ago to $836 million, another beat. While those numbers were solid, albeit after lowered expectations, what drove the stock higher mid-week was increased guidance, the management team now anticipates net sales growth of 2%-4% vs. the previous range of 1%-3% for FY2023.

Color on Quarter

ANF

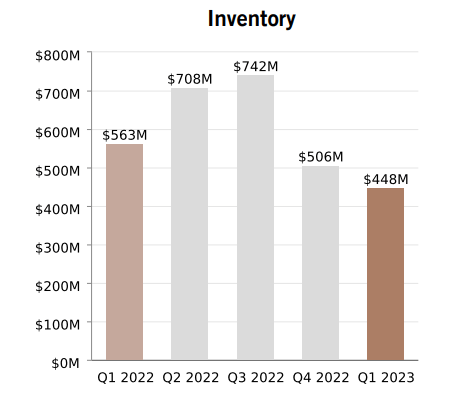

Margins are a key issue this earnings season, and ANF now sees operating margins to be in the 5%-6% range compared to 4%-5% in the prior outlook. Margins had been a particular risk – back in April, Argus slashed its rating to Hold for, in part, that very reason, so the Q1 report assuaged those fears. Also bullish was that inventory ended the quarter 20% lower while its cash buffer was ample at nearly $450 million.

ANF Inventory Reduction

ANF

Earnings are seen as normalizing above $1 per share in the coming quarters after a volatile stretch since 2020. Top-line growth is modest, though. With share buybacks summing to $126 million in the previous year, ANF holders have benefited. And if we continue to see a return to profitability over the coming quarters, I would not be surprised to see the dividend get reinstated. Argus also noted that potential if their bearish case does not pan out.

ANF: Improving Earnings Outlook, Q1 EPS Blows Past CFRA’s Q1 -$0.15 Estimate

CFRA Research

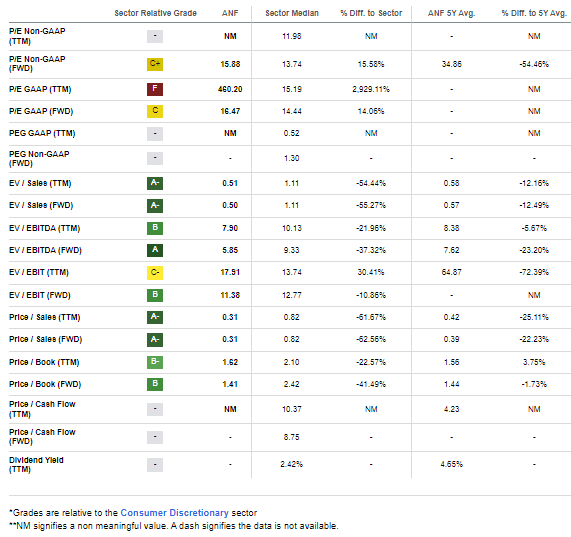

With an improving growth outlook, the stock trades cheaply across several sales metrics. Its forward price-to-sales ratio is just 0.31 – a 22% discount to the firm’s five-year average and steeply under the sector median. If we assume $1.70 of NTM operating earnings (given the solid beat reported this morning), and a 16x multiple (below the sector average), then I place the fair value near $26. So, I have a hold rating based on valuation after the major stock price climb post-earnings.

ANF: Attractive Valuation Across Sales Metrics

Seeking Alpha

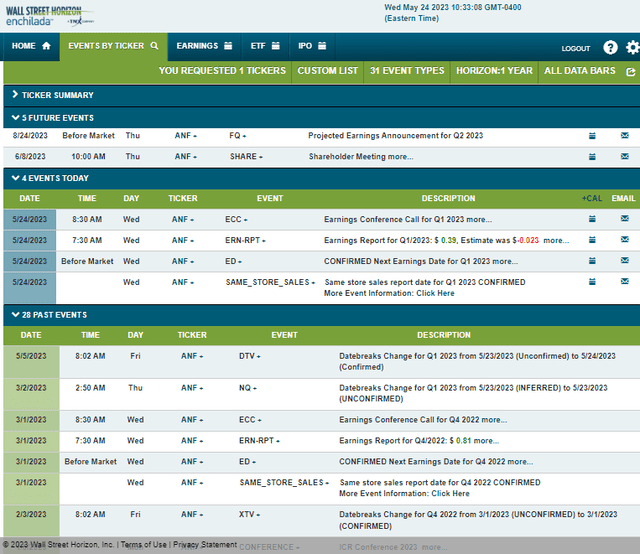

The firm hosts its annual shareholders’ meeting on Thursday, June 8, where some volatility could be seen in ANF shares.

Corporate Event Risk Calendar

Wall Street Horizon

The Options Angle

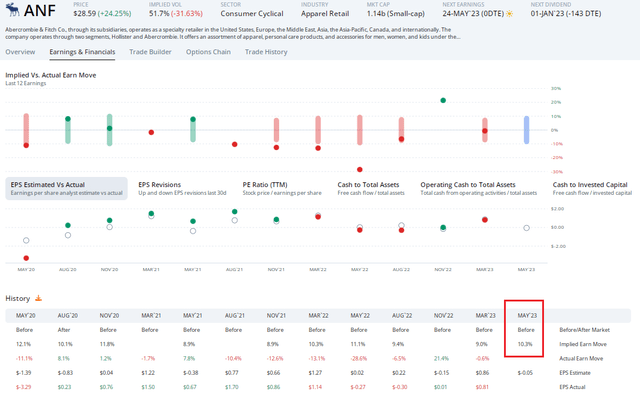

After the major rally, I wanted to see what options traders were expecting heading into the Q1 report. According to Option Research & Technology Services (ORATS), the at-the-money straddle was priced at just 10.5%. But ANF had a history of posting outsized earnings-related moves. Five of the last seven reactions were in the double-digit percentage range. The stock fell by a comparable amount a year ago. But don’t expect similar changes in the days ahead – by midday Wednesday, implied volatility was down to 51% (implying a 3% to 4% daily swing).

ANF: Lower Implied Volatility Post-Earnings, Staddle Paying Off

ORATS

The Technical Take

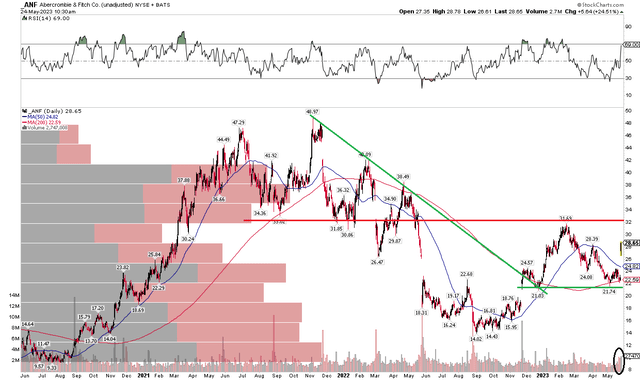

With the shares slightly overvalued, the chart suggests a holding pattern. Notice in the graph below that a range may be developing between $21 and $31. ANF is moving toward the upper end of that zone now after holding key support. The stock broke its downtrend that began with a bearish double-top pattern in 2021. After plunging from near $50 to $14, shares more than doubled to a 2023 high near $32, but then retreated 50% to touch the 200-day moving average.

I like that 200-DMA is now upward-sloping after the break of the downtrend. Thus, a rally above $32 would signify a continuation of a reversal pattern. With volume increasing lately, shares could be getting ready to break out, but we need to wait for confirmation in price.

Overall, there are certainly optimistic clues here, but $31 to $32 remains resistance.

ANF: Shares Hold Critical Support After Bucking The 2021-22 Downtrend

StockCharts.com

The Bottom Line

I’m a hold on ANF. Shares appear near fair value after the Q1 report while the chart is much improved over the past several quarters.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.