Summary:

- Abercrombie & Fitch reported strong revenue growth and higher profit margins in Q1 FY24, leading to increased guidance for FY24.

- However, earnings growth is expected to peak in Q2, with a competitive landscape and uncertain macroeconomic environment potentially impacting future growth.

- Based on valuation analysis, Abercrombie & Fitch stock is considered a “hold” with no margin of safety left for investors to initiate or add to positions.

Robert Way

Introduction & Investment Thesis

Abercrombie & Fitch (NYSE:ANF) is a lifestyle retailer for men, women, and kids that has hugely outperformed the S&P 500 and Nasdaq 100 since 2023. The company reported its Q1 FY24 earnings, where its revenue and operating profit grew 22% and 282% YoY, respectively, beating estimates. Since 2023, the company has made tremendous progress in redefining its brand messaging, resulting in accelerating revenue growth as it successfully managed to attract men, women, and teens across its brand families and geographic regions through its omnichannel marketing activities while simultaneously optimizing inventory and operating expenses.

Although the stock has returned over 300% in gains over the last year, outperforming the index by 12x, I believe that most of the gains are likely over. The management has raised their revenue and earnings guidance for the full year FY24; however, based on consensus estimates, revenue and earnings growth are likely to slow next year, as the company will face tougher comps, along with a highly competitive environment. Therefore, after assessing both the “good” and the “bad,” I believe that there is practically no margin of safety left that justifies initiating or adding to an existing position, making it a “hold.”

The good: Strong Revenue growth, Higher Profit Margins and Increased Guidance for FY24

Abercrombie & Fitch reported their Q1 FY24 earnings, where it saw revenue grow 22% YoY to $1.02B, with strength particularly in its Americas region, which contributed more than 80% to Total Revenue, growing 23% YoY to $820M. At the same time, the company also benefited from AUR (Average Unit Retail) improvements as it optimized its category and style mix across both men and women, leading to fewer promotions.

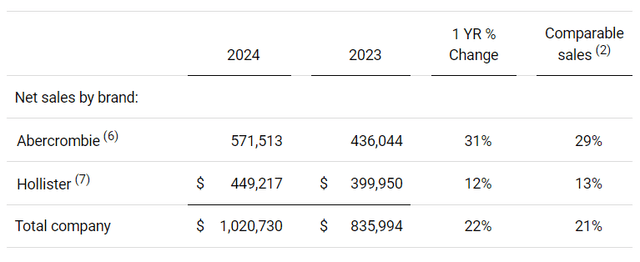

Since 2023, the company has made tremendous progress in defining what each of their brands stands for and capitalizes on with relevant assortments and a compelling brand voice by leveraging strong inventory discipline and strengthening their operations across digital, technology, stores, and data analytics. I believe this has enabled the company to grow its sales in its Abercrombie brands by 31% YoY, contributing 56% of Total Revenue, while its Hollister brands have returned to growth at a 12% YoY rate after a challenging teen apparel environment, as the company continues to expand their customer base through increased localization of product assortment, driving compelling brand awareness programs, and improving the omnichannel customer experience both digitally and in-store. Plus, during the earnings call, the management also pointed out that they have room for further runway in EMEA and APAC, with particular focus in the UK, Germany, and China as they are opening new stores.

Q1 FY24 Earnings report: Revenue growth rate across its brand families

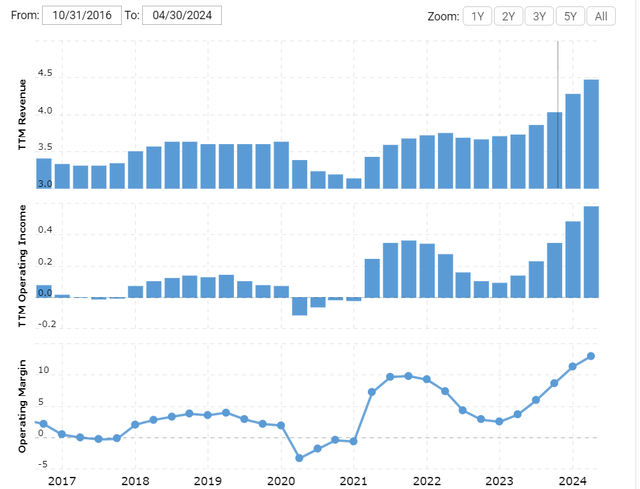

Shifting gears to profitability, the company generated a gross profit of $677M at a margin of 66.4%, which improved 540 basis points as the company benefited from lower cotton and freight costs, along with lower promotions from optimal inventory management. Meanwhile, its operating income grew 282% YoY to close to $130M, on a GAAP basis, where the expansion in margin of 860 basis points was made possible by streamlining operating expenses as a percentage of sales while driving higher AUR from an improved category and style mix amidst targeted investment in marketing efforts to better target and retain its customers.

Macrotrends: Growth of revenue and profitability since 2016

In terms of guidance, the company has increased their expectations for revenue to grow 10% for the full year FY24 after outperforming in their Q1 earnings. This is a huge upward revision from their previous guidance of a 4-6% YoY sales growth expectation. At the same time, the management has also raised their guidance on operating margin from 12% to 14% in FY24 as they expect tailwinds from lower cotton costs and AUR expansion on lower promotions, which will help unlock operating leverage. Meanwhile, the company is also set to join the S&P Midcap 400 by replacing Equitrans Midstream (ETRN), and most recently, J.P. Morgan upgraded the stock to an overweight rating with a December 2025 price target of$194,4 with analyst Matthew Boss outlining that the company has been successfully expanding its reach to the 18–40 year demographic with its marketing and merchandising improvements, along with a higher mix of full prices, helping it unlock operating leverage. Finally, Matthew Boss also highlighted that its Hollister brand may be at a point of inflection, along with a $400M revenue recapture opportunity internationally as it gains momentum.

The bad: Earnings growth will likely peak next quarter, along with a highly competitive landscape and somewhat uncertain macroeconomic environment

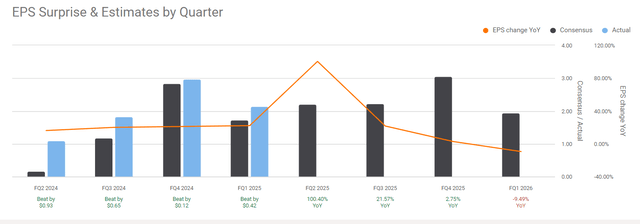

However, I would like to point out that its earnings growth is likely to peak out in Q2, where its earnings per share is expected to grow 100% YoY to $2.2, as can be seen in the chart below, followed by a deceleration in the pace of growth. Plus, as per consensus estimates, revenue growth is expected to grow in the mid-single digits from FY25 onwards, as the company faces more challenging comps along with operating in a highly competitive environment with players such as Gap (NYSE:GPS), American Eagle Outfitters (NYSE:AEO), Urban Outfitters (NASDAQ:URBN), and more that could possibly take market share away from Abercrombie in the coming years. Although its peers are growing at a relatively slower revenue rate, with Gap and American Eagle Outfitters growing in the low single-digit range, Abercrombie is trading at a premium to its peers, with a forward price-to-earnings ratio of close to 17. While the higher valuation multiple is justified given its superior growth rate, any slowdown in demand will inevitably suppress investor sentiment. What I am saying is that in order for investors to continue rewarding the stock, it needs to see continued momentum in its Americas and international markets from its customer acquisition efforts. Although retail sales in the US are still resilient, with clothing and accessories categories outpacing the broad retail numbers for the second straight month, a further weakening in the labor market may cause some pain for its growth prospects in the short term.

Seeking Alpha: EPS estimates in the coming quarters

Revisiting my valuation: Abercrombie is a “hold”

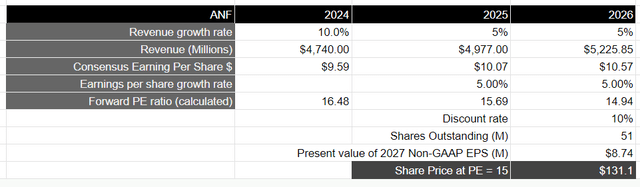

Assuming that Abercrombie & Fitch meets their FY24 revenue target, followed by growth in the mid-single digits after that until FY26, as it drives AUR growth across both its brand families in the Americas region and internationally through competitive product assortment and creating compelling brand moments to attract and retain customers, it should generate $5.2B in revenue. From a profitability standpoint, taking the consensus estimates for non-GAAP EPS of $9.59 in FY24 and assuming that it grows in line with revenue growth until FY27, it should generate $10.57 in non-GAAP EPS, which will be equivalent to a present value of $8.74 when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15–18, I believe it will likely trade at the lower bound of the multiple range, given the growth rate of its earnings during this period of time. This will translate to a P/E ratio of 15, or a price target of $131, which represents a downside of 17%.

My final verdict and conclusions: There is no margin of safety

There is no doubt that the company had a phenomenal run-up in its stock price over the last year, as it repositioned its brand with compelling messaging and marketing activities, along with disciplined inventory optimization efforts and operational streamlining that resulted in renewed growth of its Abercrombie and Hollister brands. While I think there is still whitespace in its international markets where it can gain market share, I believe that most of the upside in the stock has already been realized. Assuming that revenue and earnings growth will likely slow down from its current levels because of tougher comps, we also have to be cognizant that it operates in a highly competitive landscape, and short-term macroeconomic headwinds may develop if the labor market weakens from its current levels. Therefore, even though there may be some short-term upside left depending on momentum to a possible price target of $194, as per J.P. Morgan’s target, I don’t think there is any margin of safety left, as my assumptions point to a 17% downside. Assessing both the “good” and the “bad,” I believe that it doesn’t make sense to initiate or add an incremental position in the stock given the risk-reward price. As a result, I will remain on the sidelines and rate the stock a “hold” in the meantime.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.