Summary:

- Abercrombie & Fitch’s Q2 FY24 earnings beat estimates with 21% revenue growth and 95% operating income growth, driven by strong unit and AUR growth across brands and geographies.

- Despite raised FY24 guidance, a slowdown in revenue growth and margin contraction is expected due to tougher comps and constrained consumer spending.

- The stock remains a “hold” as it doesn’t offer an attractive risk-reward entry point, despite outperforming competitors and impressive brand and market strategy progress.

- Optimism remains for future growth drivers, including international markets, Hollister brand, and category expansion within Abercrombie, but current valuation lacks sufficient margin of safety.

Robert Way

Introduction & Investment Thesis

I last wrote about Abercrombie & Fitch (NYSE:ANF) on July 23, where I initiated a “hold” rating on the stock as I believed that the stock price did not offer sufficient margin of safety to initiate a position. Since then, the stock is down over 9%, underperforming the indices.

The company reported its Q2 FY24 earnings in late August, where revenue and operating income grew 21% and 95% YoY, respectively, beating estimates. This was driven by growth in both units and AUR (Average Unit Retail) across its brands as the company continued to innovate with its assortment with relevant messaging and brand moments on digital, social, and real-life, leading to lesser promotions. What is noteworthy is that its Hollister brand also saw a sequential acceleration in revenue growth rate, contributing over 48% to Total Revenue growth.

For the full year FY24, the management raised its revenue and earnings guidance, where it now expects revenue to grow between 12 and 13% with an operating margin of 14.5%. However, despite all the positives, I continue to maintain my “hold” rating on the stock.

This is because, even though the management raised full-year guidance, the overall pace of revenue points to a slowdown ahead with a slight contraction in margins, which is driven by tougher comps from the previous year along with a constrained consumer wallet. Although Abercrombie & Fitch continues to grow at a faster rate compared to its competitors that include Urban Outfitters (NASDAQ:URBN), Gap (NYSE:GAP), and American Eagle Outfitters (NYSE:AEO), I believe that the stock is not trading at a level that is attractive enough to initiate a position from a risk-reward perspective, making it a “hold.”

The good: Revenue and earnings beat Q2 expectations, Hollister sees acceleration in growth.

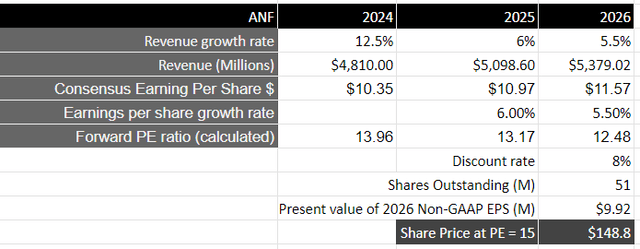

Abercrombie & Fitch reported their Q2 FY24 earnings, where revenue grew 21% YoY to $1.13B, with comparable sales growing 18% YoY, beating estimates. Similar to the previous quarter, its Americas market continued to grow faster than its EMEA and APAC markets at a 23% YoY growth rate to generate $901.2M in sales, contributing close to 80% to Total Revenue.

Having said that, the management is focused on driving growth by localizing their playbook across regions. During the earnings call, Fran Horowitz, CEO, pointed out that customers in the UK and Germany are responding positively to the localized assortments as they increase their marketing and brand presence in these locations. Meanwhile, in the APAC region, the company is focused on its China and Japan markets to engage with the customer in new and different ways to boost relevance and growth.

Q2 FY24 Earnings Slides: Distribution of revenue across geography

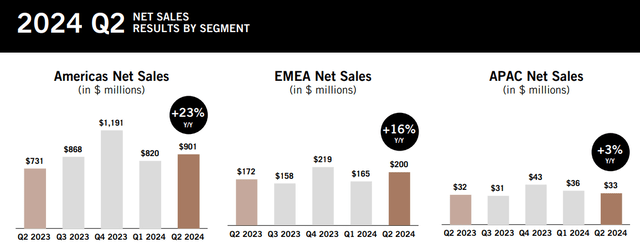

In terms of its brand-level performance, its Abercrombie brand continued to show strength, growing 26% YoY. What is also interesting is that its category expansion into The Wedding Shop continues to show promise to top line growth with the possibility for expansion into accessories, handbags, and footwear. I believe this is made possible as the company continues to make progress in its customer acquisition and engagement strategies by defining what their brand stands for with relevant assortments and compelling brand voice, particularly through digital marketing and social selling. At the same time, the company is investing in customer analytics to boost engagement and improve the end-to-end customer experience. All of this is done while maintaining an agile cost structure.

What is also noteworthy is that its Hollister brand is seeing an acceleration in its sequential growth rate from the prior quarter, growing its revenues at 17% YoY (vs. 12% YoY in the previous quarter) to $551.5M, with expansion in both unit sales and AUR for both men’s and women’s. As the momentum picks up, the company is now looking to amplify the brand with new store locations and refreshed experiences across digital and social channels. It is also focusing on authentic real-life experiences and activities to improve the customer journey in its target market of 13- to 21-year-olds and spearhead growth.

Q2 FY24 Earnings Slides: Distribution of revenue across its brands

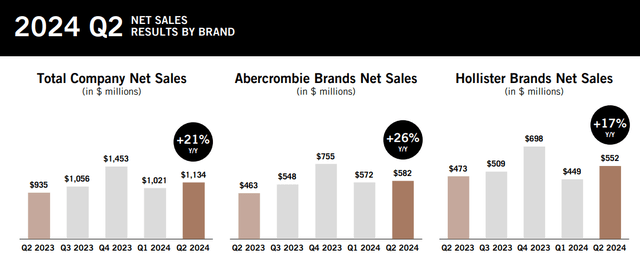

Shifting gears to profitability, Abercrombie & Fitch generated $736.2M in gross profit on a GAAP basis at a margin of 64.9%, which improved 240 basis points from the previous year, as they benefited from lower cotton costs, lesser promotions, and well-managed inventory levels entering the fall season. Meanwhile, its operating income grew 95% YoY to $175.6M with a margin of 15.5%, which saw an expansion of 590 basis points from the previous year as they continued to drive operating expense leverage with operating expenses as a percentage of sales at 49.4%, an improvement of 380 basis points compared to last year, while driving higher AUR from its relevant assortment mix across brands, regions, and channels.

Q2 FY24 Earnings Slides: Growing profitability

The bad: Management raised FY24 guidance, but it still points to a slowdown ahead.

Looking forward, the management has raised its FY24 revenue guidance from 10% to a range of 12-13%, which would approximately equate to a total revenue of $4.8B. In the meantime, they have also raised their projection of operating margin from 14% to 14.5% as they continue to operate with superior financial discipline.

However, despite the management raising guidance on both the top and the bottom lines, there is no denying that the numbers foretell that a slowdown is ahead of its current growth levels. We could already see that playing out in Q2, where its Abercrombie brand grew at a sequentially slower rate than in the previous quarter, while gross margins also contracted.

Similarly, even if we look at the company’s Q3 guidance, we can see that the management is projecting for net sales to grow in the low double digits, which would continue to mark a sequential slowdown, along with operating margin guidance between 13-14%, which also showcases a contraction from Q2 levels.

In my previous post, I had written that the company is likely to face tougher comps moving ahead, which is now indeed reflected in management’s forward guidance. Even though its international markets, Hollister brand, and category expansion in its Abercrombie brand can continue to act as growth levers, I believe that the management’s forward guidance is pointing to a somewhat constrained consumer, where the economy is showing signs of weakening, especially in the labor market.

Revisiting my valuation: It’s a “hold”.

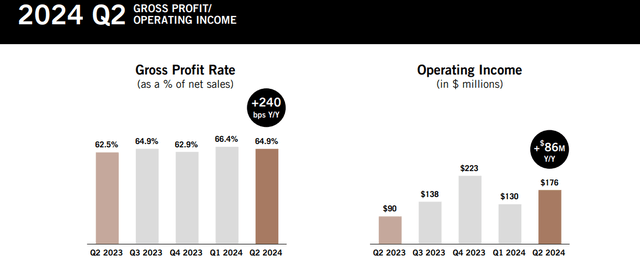

Taking the management’s FY24 guidance into account and assuming that Abercrombie & Fitch can continue to grow in the mid single digits in the following two years into FY26 as per consensus estimates, it should produce a total of $5.3B in revenue during this period of time. As I have written before, I believe that there is reason for optimism when it comes to its growth drivers that include its international markets, Hollister brands, and category expansion within its Abercrombie brand, where the company can drive targeted investments to unlock market share.

From a profitability standpoint, taking the consensus estimates for non-GAAP EPS of $10.35 in FY24 and assuming that it grows in line with revenue growth until FY26, it should generate $11.57 in non-GAAP EPS, which will be equivalent to a present value of $9.92 when discounted at 8%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15-18, I believe it will likely trade at the lower bound of the multiple range, given the growth rate of its earnings during this period of time. This will translate to a P/E ratio of 15, or a price target of $148, which represents an upside of just 3% from its current levels.

My final verdict and conclusions

In my previous post, I had initiated a “hold” rating on the stock as I believed that the stock price offered no margin of safety given the magnitude of its climb over the last year along with the risks of tougher comps ahead. Since then, the stock has declined over 9%, underperforming the index.

In this post, I will reiterate my “hold” rating once again as the Q2 earnings call confirmed that revenue growth is expected to continue to slow down from its current levels, along with a slight compression in operating margins. In the meantime, the stock, while down over 9% since the price of my previous publication, is not trading at an attractive level from a risk-reward perspective.

However, in all of this, I would like to emphasize that I continue to be impressed with the progress that the company has made up until now in redefining its brand messaging and go-to-market strategy that is translating into meaningful new customer acquisition and engagement across channels, geographies, and brands through targeted marketing moments, inventory optimization, and operational rigor. I am also optimistic about the company’s growth drivers moving forward when it comes to its international markets, Hollister brand, and category expansion in its Abercrombie brand.

While it is growing faster than a lot of the competitors in the space, I continue to maintain my stance that the stock does not provide yet an attractive entry point to initiate a net new position at the moment, making it a “hold”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I am Amrita and I write primarily about growth software stocks.

I recently joined The REIT Forum and if you are looking for more investment ideas like this one, get them exclusively at The REIT Forum with access to our subscriber only portfolios.