Summary:

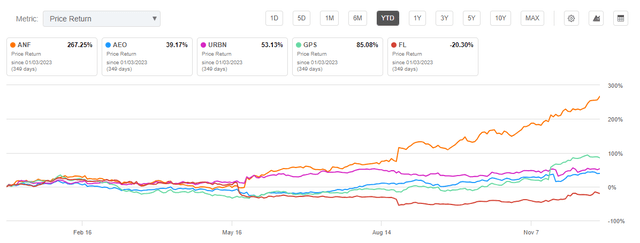

- Omnichannel retailer Abercrombie & Fitch has been one of the top performing retailers in calendar 2023.

- Shares in the stock are up over 250% YTD, including a 70% run since my last update on the stock.

- The gains have come as ANF continues to report stellar results in its namesake unit, as well as building momentum in the Hollister brand.

- Recent retail trends provide confidence that the strength can continue into the holiday quarter.

- While I remain bullish on ANF stock, I would view any pause in the forward momentum as prudent and appropriate.

Justin Sullivan

Omnichannel apparel and accessories retailer, Abercrombie & Fitch (NYSE:ANF), has risen 70% since my last update on the stock.

At the time, shares had just reached a new 52-week high after flying by their Q2 earnings expectations. While I viewed investor interest in the stock as warranted, I admittedly was not expecting another significant increase to new 52-week highs, let alone a 70% increase.

Today, ANF is again trading near new highs and has logged YTD returns of more than 250%.

Seeking Alpha – YTD Share Price Return Of ANF Stock

ANF carries double-digit short interest and has been the topic of bearish commentary in recent articles. Insiders have also offloaded positioning over the last month.

While these may be cautionary signs, ANF still commands high scoring on Seeking Alpha’s (“SA”) quant rating system. And more fundamentally, ANF trades at a surprising earnings multiple of just over 14.5x, comparable to their peer set and discounted to the broader markets.

In my view, a pause in the bullish momentum would be prudent. But a positive outlook and market-beating operating strength warrant a continued watch and potential add on any notable share price dips.

ANF Stock Key Metrics

Among mall-based retailers, ANF has been a distinguished winner this year. While several other similar-sized peers have also gained over the same period, ANF’s over 250% YTD returns are unmatched.

Seeking Alpha – YTD Share Price Return of ANF Stock Compared To Peers

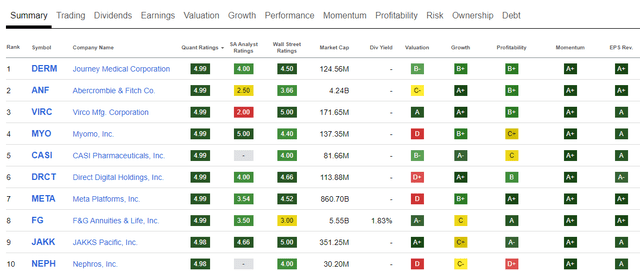

Despite the dizzying performance thus far, ANF scores a number two ranking on the SA quant rating system. No other comparable retailer ranks among the top ten.

Seeking Alpha – Top Ranked Stocks By SA Quant Score

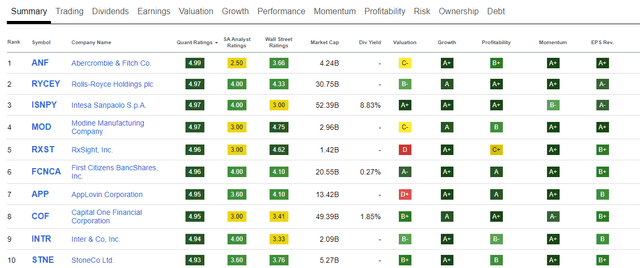

ANF is also ranked as the top growth stock among companies with a +$1.0B or more market cap.

Seeking Alpha – Top Ranked Growth Stocks By SA Quant Score

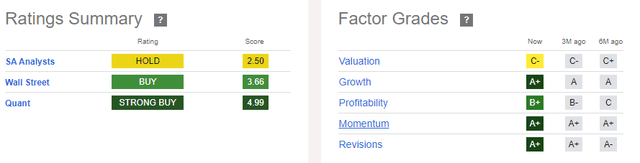

Among the factors driving ANF’s “strong buy” quant score is their growth metrics, which includes a 3-year EBITDA compound growth rate of 30%. In addition, ANF scores favorably on its recent momentum and positive Wall Street analyst revisions in recent months.

Seeking Alpha – Ratings Summary Of ANF Stock

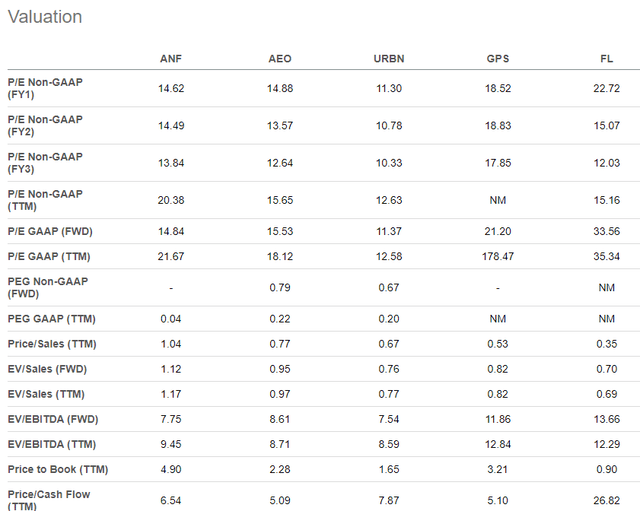

The quants rate ANF less favorably on valuation, but I would place less weight on this particular score. At present, ANF commands a forward earnings multiple of 14.6x. That’s not wildly out of line by any means. The broader S&P, in contrast, is currently near the 20x range. ANF’s competitors such as American Eagle (AEO) even trade at or above where ANF currently sits.

Seeking Alpha – Valuation Metrics Of ANF Stock Compared To Peers

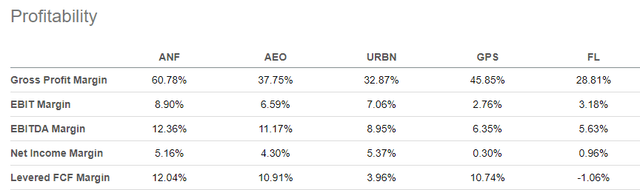

In my view, the medium to long-term growth rates and ANF’s profitability strength justify their current trading valuation. Currently ANF is operating on gross margins in the 60% range. This compares to less than 40% elsewhere. ANF is also guiding for operating margins at the 10% mark. That is also at or above nearby competitors.

Seeking Alpha – Profitability Metrics Of ANF Stock Compared To Peers

ANF Recent Financial Results

Momentum in sales continued in Q3. Total revenues grew 20%, beating estimates by nearly +$80M. The sales growth included a YOY increase in comparable sales of 16%, with positive contributions from both the physical and digital footprints.

The highlight continued to be ANF’s namesake brand, which delivered growth of 30% during the quarter, including 26% growth on a comparable basis. The sales growth marked the brand’s 11th consecutive.

While ANF’s Hollister brands can’t boast the same streak of growth, its reinvigoration this fiscal year is notable. In Q3, the brand delivered 11% topline growth or 7% on a comparable basis, its second consecutive quarter of positive contribution.

The overall sales strength between the two brands continued to be realized equitably across demographic and operating region. ANF reported double-digit increases in each of their operating regions, including 32% growth in Asia Pacific. And while the namesake was more consistent across genders, the Hollister brand saw greater interest among the female demographic.

Though the positive results at the topline are notable, ANF has really showed its shine at the bottom line. For the quarter, ANF reported a 13.1% operating margin, representing a 1,100-basis point (“bps”) improvement over the same period last year. The operating expansion was due in part to an increase of 570bps in gross profit margins.

The gross profit rate for the quarter was up to an impressive 64.9%, driven in part by a more favorable mix to their higher-margin namesake brand, as well as lower promotional activity elsewhere due to a more conservative inventory profile. Like others in the retail space, ANF also benefitted from a more favorable freight backdrop.

Outlook For Abercrombie & Fitch

Looking ahead, ANF guided for fourth quarter net sales to be up in the low double-digits compared to the same period last year. Based on the holiday trends thus far and the generally more robust retail environment, I don’t expect ANF to have issues in hitting this target. In fact, they may once again exceed expectations with a healthy beat.

More to the bottom line, ANF expects operating margins to land at a midpoint of 13% in Q4. That would compare nicely to the 7.7% reported last year. It would also be in-line with what ANF realized in Q3. As one would expect, the margin expansion is expected to be driven by a higher gross profit rate, as well as a more accommodative freight environment.

Based on the YTD results through Q3, the management team had enough confidence to revise their outlook for topline sales growth to a range of between 12% to 14%, up from their prior estimate of approximately 10%. On a similar note, full-year operating margins are seen at about 10%, up from their previous estimate of 8% to 9%.

ANF Insider Activity

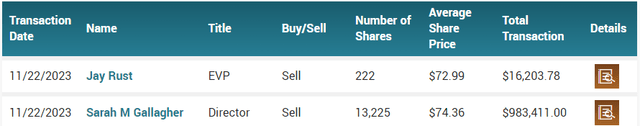

Following market-beating gains through the calendar year, several key executives in recent months have notably offloaded some of their holdings.

In a November SEC filing, ANF Director Sarah Gallagher and EVP Jay Rust disclosed the sale of a combined 13,447 shares of ANF stock. This amounted to a total value of approximately +$1M.

Benzinga – Insider Trading Summary Of ANF Stock

In addition, Chief Digital & Tech Officer, Samir Desai, disclosed the sale of around 9,700 units for a total sales price of approximately $714K.

Granted, the total value isn’t overly significant, but it is noteworthy, given the stock’s run to new all-time highs. This could perhaps be taken as one sign the stock has reached its perfect trading value. But in my view, I wouldn’t put too much weight into that thought.

While the insider activity attracts attention, the volume sold is just a fraction of the total activity and total shares outstanding.

Is ANF Stock A Buy, Sell, Or Hold?

In the last completed quarter, ANF reported double-digit sales growth across brand and geographic operating region. And they generated gross margins in the mid-60% range and operating margins in the mid-teens percentage range, each of which represented material expansion over the prior year. Operational enhancements have also facilitated operating efficiency, leading to better-than-expected expense control.

While ANF’s past results can’t necessarily dictate what they will put forth in Q4, I expect another strong output for the holiday quarter. Overall November retail sales grew 0.3% during the month, a significant beat on expectations of a 0.1% decline. A pullback in gasoline prices and a generally more affordable holiday season also provide the consumer greater penchant to spend.

With this in mind, I expect ANF to again deliver positive sales growth in Q4, with their namesake leading the way to its 12th consecutive quarter of growth. This should result in full fiscal year sales growth of approximately 15% over fiscal 2022 levels. At that mark, shares would trade at a multiple of sales of approximately 1.10x at current trading values.

While that would represent a premium to other mall-based retailers, such as AEO, who currently commands a mark of 0.77x, the premium is reasonable given ANF’s profitability strength. I expect ANF to operate on operating margins of 10% and a gross in the mid-60s. This could help support ANF’s current forward earnings multiple of 14.6x.

Though I would disagree with bearish sentiment on ANF following its skyscraper-like gains thus far, I do believe a pause in bullishness is warranted. A modest correction in forward momentum could even benefit ANF over the longer-term horizon. And specifically, a healthy pullback in the 10%-15% range could warrant further consideration on the dip. Until then, a “hold” at current trading levels seems most appropriate.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.