Summary:

- ANF has experienced impressive growth in its top/ bottom-lines since FY2019, with demand remaining robust and the management offering optimistic FQ1’24/ FY2024 guidance.

- The rise in popularity is not by mistake as well, with the management laser-focused on the rebranding of its offerings away from the scandals and lawsuits that plagued it previously.

- However, ANF’s valuations are expensive compared to its peers, with the stock prices also pulling forward most of its long-term upside potential.

- The Americans already record higher credit card balances as more borrowers fall behind on their payments in Q1’24, with a slowdown in consumer spending very likely amongst Millennials.

- Combined with the elevated short interests, we believe that it may more prudent to follow the massive insider selling thus far. Sell at this peak.

Bet_Noire

ANF’s Investment Thesis Is Overvalued Here – No Margin Of Safety

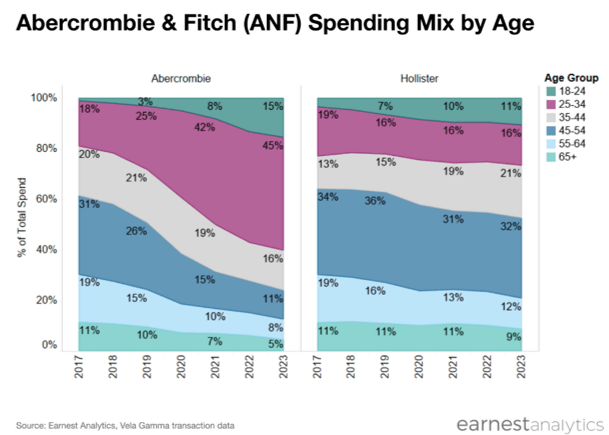

Abercrombie & Fitch Target Demographics

Earnest Analytics

Abercrombie & Fitch (NYSE:ANF) is a clothing company that requires little introduction, with the Abercrombie brand being highly popular amongst American millennials and the Hollister brand amongst teen consumers in a survey completed in 2023.

The rise in popularity is not by mistake as well, with the management laser-focused on the rebranding of its offerings away from the scandals and lawsuits that plagued it prior to the pandemic, as it increasingly portrays itself as a “diverse, inclusive, and friendly brand.”

It is apparent that the management’s efforts have not been in vain, with ANF already recording an impressive growth in its top-line at a CAGR of +4.3% and bottom-lines at +71.3% between FY2019 and FY2023, compared to the +0.7% and +0.9% reported between FY2016 and FY2019, respectively.

Its growth is not slowing down as well, as observed in ANF’s increased net sales of $4.28B (+15.9% YoY), expanding gross margins of 62.9% (+6 points YoY/ +3.5 from FY2019 levels of 59.4%), and moderating inventories of $469.46M (-7.1% YoY) in FY2023.

Most of the tailwinds are attributed to accelerating sales in the Americas at $3.45B (+18.1% YoY), particularly in the Abercrombie brand at $2.2B (+27.1% YoY).

Combined with ANF’s prudent operating expenses of $2.21B (+10.5% YoY) in FY2023, it is unsurprising that it reports a drastic jump in operating margins to 11.3% (+8.8 points YoY/ +9.4 from FY2019 levels of 1.9%).

Readers must also not discount the management’s constant share repurchases at $518M over the past four years, effectively retiring 13.05M or the equivalent 19.8% of its float since FY2019.

These developments have naturally triggered the tremendous jump in ANF’s FY2023 adj EPS to $6.28 (+2,412% YoY) and Free Cash Flow generation to $495.63M (+396.9% YoY).

With cash/ equivalents of $900.88M (+74% YoY) and long-term debt of $223.21M (inline YoY) maturing over the next three years, the retailer appears to be more than well capitalized as well.

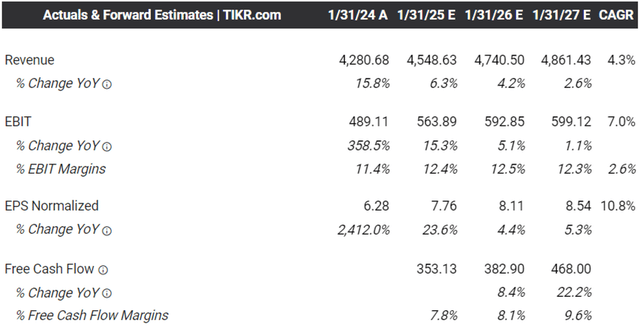

The Consensus Forward Estimates

Tikr Terminal

For now, ANF has guided FQ1’24 revenues growth of “low double-digits” YoY and operating margins of 9% at the midpoint (-6.3 points QoQ/ +4.4 YoY). This is on top of the FY2024 revenue guidance of $4.51B (+5% YoY at the midpoint) and operating margins of 12% (+0.6 points YoY).

Perhaps this is why the consensus have also raised their forward estimates, with ANF expected to generate an accelerated top/ bottom line growth at a CAGR of +4.3%/ +10.8% through FY2026. This is compared to the previous estimates of -0.3%/ -1.6%, respectively.

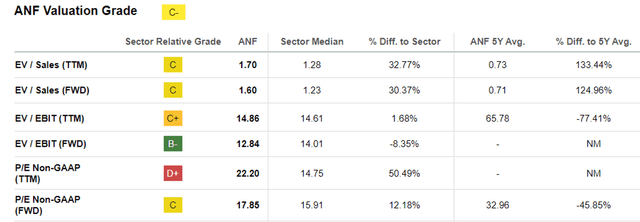

ANF Valuations

Seeking Alpha

It is understandable then, why the market has awarded ANF with the premium FWD EV/ EBIT valuations of 12.84x and FWD P/E valuations of 17.85x, higher compared to the 1Y mean of 11.10x/ 15.49x while nearing the pre-pandemic mean of 16.83x/ 17.38x, respectively.

However, if we are to compare ANF’s valuations compared to its US-based Consumer Apparel Retail peers, such as The Gap (GPS) at 15.81x/ 14.99x, American Eagle Outfitters (AEO) at 11.71x/ 13.56x, and Urban Outfitters (URBN) at 9.52x/ 11.48x, it is apparent that the former is on the expensive side here.

This is especially when comparing ANF’s top/ bottom line growth projections to GPS at +0.8%/ +11.9%, AEO at +4.1%/ +13%, and URBN at +4.5%/ +7.3% over the same time period, respectively.

So, Is ANF Stock A Buy, Sell, or Hold?

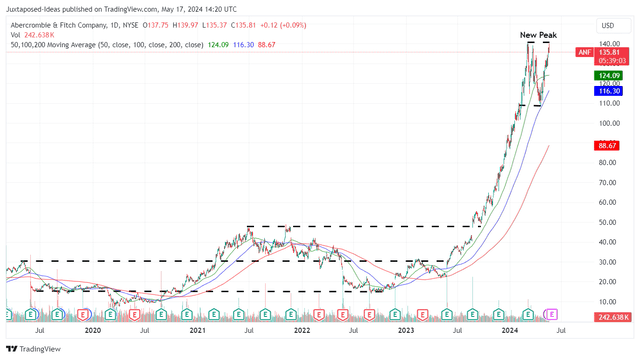

ANF 5Y Stock Price

Trading View

The same exuberance is also observed in ANF’s stock prices, with it charting an impressive 1Y return of +491% and YTD return of +54%, well outperforming the wider market at +29% and +11%, respectively.

This is especially since it is trading way above our fair value estimates of $97.20, based on the FY2023 adj EPS of $6.28 and the 1Y P/E mean of 15.49x (nearer to its peers).

Based on the consensus FY2026 adj EPS estimates of $8.54, the stock has also pulled forward much of its upside potential to our long-term price target of $132.20, offering interested investors with a minimal margin of safety.

At the same time, with the Big Tech Q1’24 earnings over and more retailers expected to report over the second half of May 2024, ANF included on May 29, 2024, we expect more volatility in the near-term as the stock market also turns increasingly Greedy.

While the April 2024 CPI has already moderated, the market has priced in higher interest rates for longer with the Fed expected to pivot only by the September 2024 FOMC meeting.

While the US labor market remains robust thus far, readers must also note that the Americans record higher credit card balances as more borrowers fall behind on their payments in Q1’24, with the “rising rents, ballooning student loan balances, and larger auto loan payments particularly affecting young adults.”

With rising delinquency rates, even beauty retailers such as Ulta Beauty, Inc. (ULTA) has highlighted “a slowdown in demand across beauty categories,” with a similar slowdown in consumer spending very likely amongst Millennials – the target demographic for the Abercrombie brand.

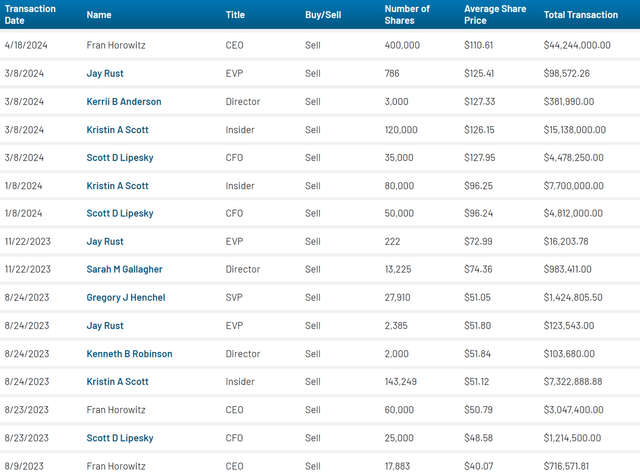

ANF’s Insider Selling

Market Beat

Combined with ANF’s massive insider selling over the past few months and the elevated short interest of +9.2% at the time of writing, we believe that it may be more prudent to unlock gains at this peak.

Interested traders may consider adding again after a deep pullback, preferably between our fair value estimates of $97s and its previous support level of $109s for an improved spread.

For now, we are initiating a Sell rating for the ANF stock here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.