Summary:

- Abercrombie & Fitch has seen a strong rally in 2024, consolidating gains recently, but I believe it has further upside into 2025, rating it a Strong Buy.

- The stock shows a bullish long-term setup, with a key support level at $130-$135; seasonality in January also supports potential upside.

- Margins have driven recent earnings growth, with significant improvements in gross and operating margins; revenue growth remains crucial for sustaining this trend.

- The company’s valuation is attractive, with a forward P/E of 13X, suggesting potential for multiple expansion if growth expectations are met or exceeded.

jetcityimage

Mid-cap apparel retailer Abercrombie & Fitch (NYSE:ANF) has seen an epic rally in 2024. The stock has exploded to the upside, but in recent months, has consolidated gains. It is my belief that Abercrombie has further upside continuation as we head into 2025, and I’m sticking a Strong Buy rating on shares today.

A bullish long-term setup

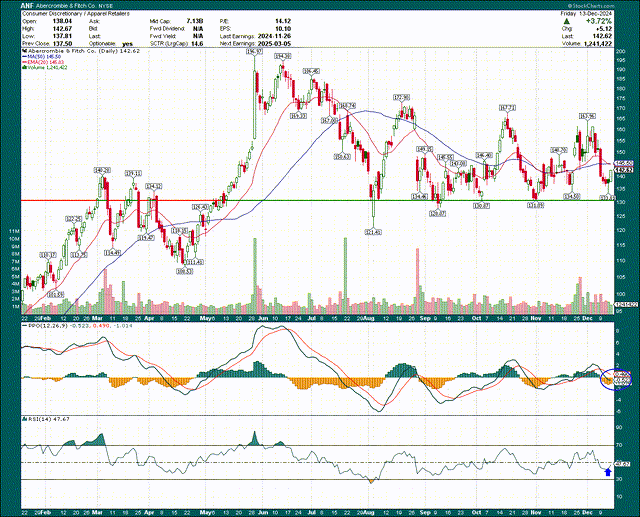

The charts look great for Abercrombie for the longer-term, but note that the near-term is somewhat murkier. Let’s begin with the latter.

We can see after the stock exploded to almost $200 in May, it has spent months consolidating. There has been drawn a very clear line in the sand at $130 to $135, a level which has been successfully tested numerous times. So long as the stock is ahead of this level, I remain bullish. If this level breaks, the thesis changes for me, so this is something to keep an eye on if you get long.

The PPO and RSI are both bouncing right where you’d expect them to – the centerline on the former and the 40 level on the latter – so all looks okay from a momentum perspective.

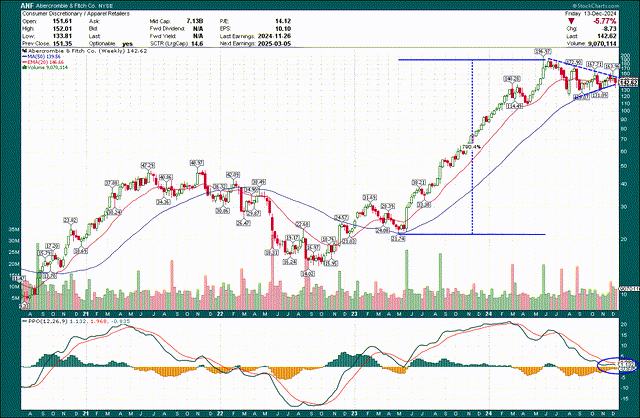

If we turn our attention to the weekly chart, things get really interesting.

The long-term chart of Abercrombie shows a bullish flag, with the “pole” being the 800% rally from early-2023 to early-2024. The “flag” is the consolidation that has occurred in the past several months, which is reaching its terminus. It is my view this flag will result in an upside break, but we must also acknowledge the downside risk potential. I’ll reiterate the $130/$135 level from the daily chart; if that level breaks, we have to reevaluate. But unless that happens, this chart looks extremely bullish.

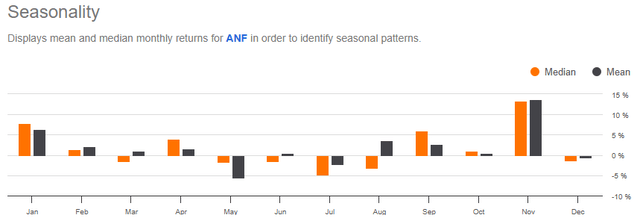

Aiding my bullish argument is that seasonality is outstanding in January.

It’s the second-best month of the year for Abercrombie behind November, so if we’re to see an upside break from the flag, history would suggest that time is near. Seasonality is a secondary indicator, but it’s lining up quite well with the current setup.

Margins drive earnings upside

Of course, if we’re to see a sustainable rally off of current levels, we’ll need the fundamentals to drive it. Let’s start with a baseline of where we are today with earnings and revenue.

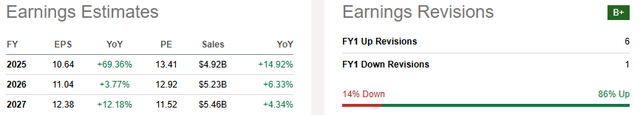

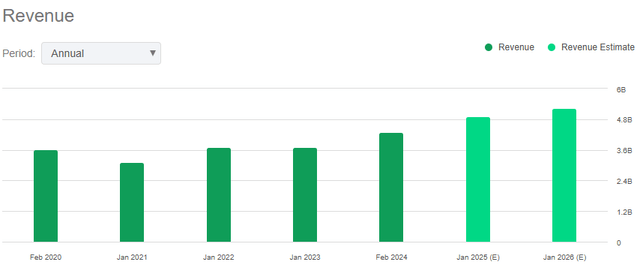

The company is expected to produce mid-single digit revenue growth in the coming years, and slightly better earnings growth. There are three ways that any company can boost (or reduce) EPS, with those being revenue, margins, and the share count.

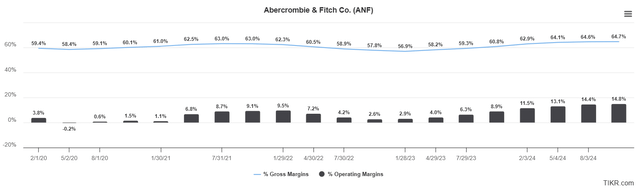

We’ll start with margins, with the below showing trailing-twelve-months gross and operating margins.

This is where the overwhelming majority of Abercrombie’s recent earnings growth has come from. The bottom in margins came late in 2022, with gross margins at 57.8% of revenue, and operating margins at just 2.6%. The most recent 12 months showed 64.7% and 14.8% respectively. Those are increases of 6.9% and 12.2% respectively, showing how operating leverage can see a company produce explosive earnings growth. Higher gross margins are always key in producing earnings growth, but there is another factor for Abercrombie investors must keep an eye on.

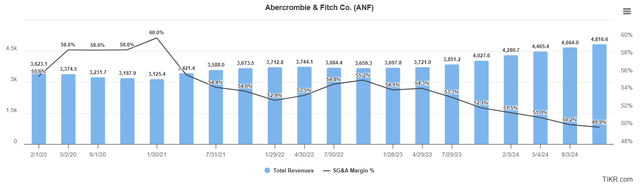

This chart shows trailing-twelve-months revenue and S&GA costs, and we can see that as revenue has risen, SG&A costs have declined considerably. The top in SG&A costs corresponds with the bottom in operating margins, with about 600 basis points in margin expansion owed to SG&A cost savings.

Looking forward, so long as Abercrombie can see revenue grow, SG&A costs should continue to be leveraged down, which in turn drives operating profits higher.

Revenue is set to grow nicely this year and the next, and should we see that, SG&A costs are likely to continue to drive EPS. The other thing that higher revenue drives is the ability to mark down less inventory, which means gross margins remain supported. Thus, the bull case here is heavily predicated upon revenue growth.

Six of the past seven updates in estimates from analysts have been higher, so the outlook remains strong. From a risk perspective, it is sales that is driving the margin case, which in turn drives the EPS growth case.

The float is the final piece of the puzzle, as we’ve already seen the margin and revenue components. Abercrombie has bought back significant amounts of stock in the past, but isn’t doing so currently. If that changes, it will factor into the equation but for now, the share count is essentially a non-factor.

Other considerations

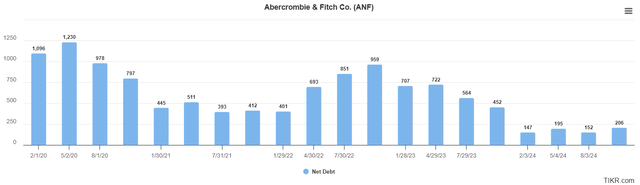

Let’s quickly look at the company’s balance sheet, which is in great shape.

Net debt stands about $200 million, so it’s quite manageable. The company has plenty of liquidity and ability to further borrow if the need arises. For now, the balance sheet looks good and I have no concerns.

The balance sheet, then, is not presenting a risk. However, I’ll reiterate once more before we wrap up that Abercrombie’s bull case is fully predicated upon sales rising. If estimates begin to fall, the margin story will almost certainly deteriorate, and the share price is likely to follow. Sales growth is the principal risk here, and it’s something investors must keep a keen eye on.

Wrapping up

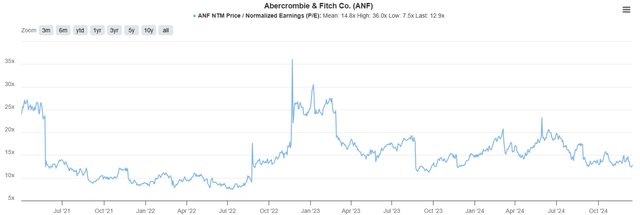

The final puzzle piece here is the valuation, and I have to say it adds to the bullish case for me.

The forward earnings multiple is about 13X, which is below average, and very near the bottom of the range for the past year or so. Given the rising estimates from analysts and strong outlook generally, I don’t think Abercrombie deserves a below-average multiple. Therefore, I see upside here as well, as earnings are valued more highly, driving further gains in the share price.

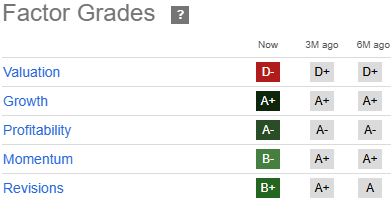

The Quant Rating is at Hold right now, with the factors below.

Seeking Alpha

I actually disagree on the Valuation rating of D-; I think Abercrombie is in much better shape than that, and would put it closer to B+ or something of the sort. The forward P/E is quite low and pricing in little growth. If Abercrombie can deliver even slightly better than expected growth, it is my view the multiple will be bid up to reflect that.

At any rate, with growth, profitability, and revisions all looking quite good in conjunction with a low valuation, I have Abercrombie at a Strong Buy. I mentioned levels to watch on the chart and those must be respected. But assuming they are, the risk/reward of buying Abercrombie here is outstanding.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ANF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.