Summary:

- Abercrombie is heading into its Q4 earnings release with shares up 140% in the last six months and 350% in the last year.

- Double-digit sales growth and material expansion in margins lend support to the continued outperformance.

- The continuing operating strength is matched with high expectations heading into the print.

- I’ve maintained a neutral stance on ANF stock in prior coverage. And I continue to do so today despite my ill-timed neutrality in past months.

Michael M. Santiago/Getty Images News

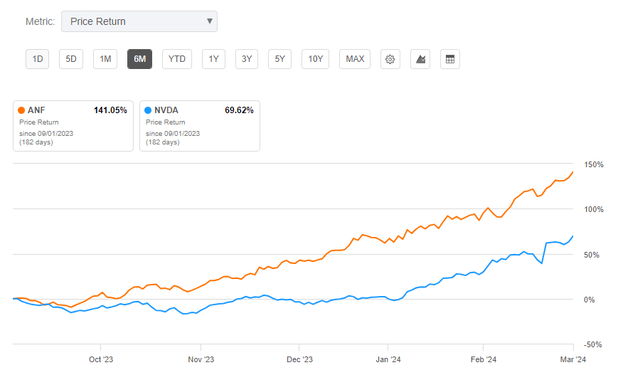

When it comes to meteoric stock gains, Abercrombie & Fitch (NYSE:ANF) is likely not the first name that would come to mind; many more would likely think about an AI-themed stock, such as Nvidia (NVDA) before even considering the unconventional prospects of an apparel retailer.

As it would happen, momentum in ANF stock appears unstoppable. It is up over 140% in the last six months, double that of market favorite NVDA.

Seeking Alpha – 6M Share Price Performance Of ANF Compared To NVDA

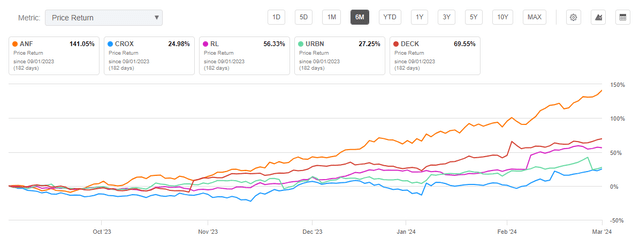

Granted, ANF isn’t the only apparel retailer to post a strong share price output over the last six months. Crocs, Inc. (CROX) is up 25%, while HOKA owner, Deckers (DECK) is up about 70%. Still, these returns pale in comparison to ANF.

Seeking Alpha – 6M Share Price Performance Of ANF Compared To Retail Peers

I first initiated coverage on ANF after it hit its first 52-week high of $50/share, a pricing milestone it reached for the first time since 2011. In that article, I viewed shares as best left on hold due primarily to valuation metrics. The stock went on to gain 160% since that update.

I again covered the stock in late December and stated that shares were worth continued attention. However, I refrained from expressing overly bullish sentiment on further momentum. The call again proved ill-timed as investors saw another 50% gain since that update.

With Q4 results on deck to be released on Wednesday, I maintain that shares are best left on hold for existing shareholders. I would also view it as prudent for new investors to avoid new positioning in the stock at current trading levels. Here’s what else to know before ANF reports results.

Why Are ANF Shares Continuing To Outperform?

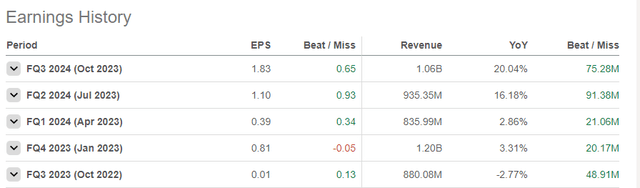

ANF’s outperformance hasn’t been without merit. The retailer has topped revenue expectations for five straight quarters. It has also beat on earnings in four of the last five quarters.

Seeking Alpha – Earnings/Revenue History Of ANF By Quarter

Most recently, the company reported 20% YOY consolidated sales growth with an operating margin rate of 13.1%, a whopping 1,100 basis point improvement over the same period in 2022. Driving the bottom-line margins was a 570 basis point expansion in gross profit margins.

Supporting sales is ANF’s namesake unit, which delivered their 11th consecutive quarter of sales growth in Q3. Additionally, the unit’s sales grew 30% in Q3 as the company saw consensus strength across genders and in channel mix. The Abercrombie brands were also supported by growth in reinvigorated Hollister, which grew 11% during the quarter.

Can Abercrombie & Fitch’s Outperformance Continue?

Investors are clearly cheering the robust sales growth, as well as operating efficiency, which has led to a significant expansion in ANF’s margin profile.

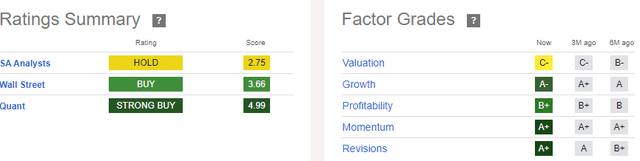

Analysts appear convinced that the good times can continue. In the last three months, consensus EPS estimates have been raised nine times. This has contributed to a near-perfect score from Seeking Alpha’s (“SA”) quant system. The stock also grades favorably elsewhere. This has kept shares in “strong buy” territory from the quant ratings.

Seeking Alpha – Ratings Summary Of ANF

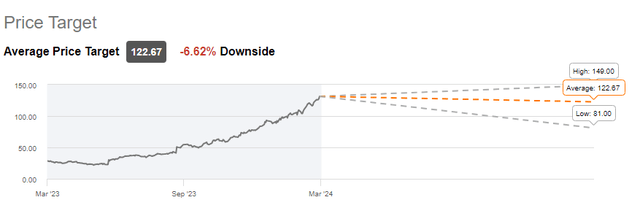

Wall Street is similarly bullish on an overall basis. However, most analysts view shares as fairly valued in the $120/share price range, suggesting mid-single-digit percentage downside risk.

Seeking Alpha – Average Wall Street Price Target Of ANF

The overall SA community, too, is more neutral. Recent commentary also negatively opines on the stock’s current share price.

Abercrombie & Fitch Q4 Guidance And Outlook

Whether ANF can continue to shine will depend on how it meets its increasingly high expectations. In Q3, better-than-expected results enabled the management team to raise their sales and operating margin expectations for 2023.

Expectations for the final quarter of the year were also propped up by the strong start seen on the date of the Q3 results. With most of the volume from the holiday season yet to have come, management appeared increasingly optimistic that ANF would turn in a strong finish to 2023.

Overall, net Q4 sales are expected to increase in the low-double-digit range. And operating margins are expected to land at a midpoint of 13%. That would be compared to margins of 7.7% in the same period last year.

The lofty expectations may come as a surprise, given current discretionary spending patterns. But ANF’s YTD sales performance suggests ANF has clearly identified a way to connect with their target population. Even if ANF were to miss its expectations, results would still likely land well above last year’s benchmark.

Is ANF Stock A Buy, Sell, Or Hold?

ANF’s share price performance has continued to defy my prior expectations. While the operating results do support the outperformance, I believe a pause in further share price appreciation is likely sooner rather than later.

At present, shares are commanding valuation metrics that are well above historical averages. ANF is currently trading at 1.75x price/sales. That compares to an average of 0.40x in the last five years. Similarly, it trades at an EV/EBIT multiple of 20x. A 12x valuation would be more appropriate based on its historical record.

Can the stock maintain a higher multiple based on its current and future expected performance? Perhaps. But in my view, the new fiscal year will bring forth a much more difficult comparable environment at the topline after ANF’s banner 2023. Additionally, margins have significantly expanded due in part to freight tailwinds that will likely reverse course in the coming months.

Declining inflation and the possibility of lower interest rates could further support revenue growth. And this could provide the momentum for continued outperformance. But I would be hesitant to initiate bullish coverage on a stock that has gained 350% in the last year.

For investors seeking positioning, I maintain the view that a “hold” position remains most prudent in advance of ANF’s earnings release this week, a release where expectations will likely be running higher than in past reports.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.