Summary:

- At least from my personal use, I can say that ChatGPT has partially replaced Google for me.

- Google is launching its own system. But in the past, the company has had problems converting users into paying subscribers.

- YouTube still has a lot of potential, but success is not guaranteed. I suspect that total watch time is already dropping.

- I believe it can be very positive for the company in the long term if they lose some market share to competition in the next few years. For far too long, they have had an unchallenged market position and rested on it.

supersizer/E+ via Getty Images

Investment Thesis

Alphabet/Google (NASDAQ:GOOG) (NASDAQ:GOOGL) is facing a challenge with the rise of OpenAI’s ChatGPT, which has quickly gained millions of users and partially replaced Google search for some. With Microsoft (MSFT) planning to integrate GPT into Bing, Google is under pressure to launch a competitive product. However, monetizing a chatbot would be a challenge for Google, which would need to integrate advertising or offer a paid subscription like OpenAI. In addition, the growth of Google’s primary source of revenue, Google Search, is also slowing and could be further impacted by the rise of ChatGPT. This article tries to shed light on the big picture for Google stock.

Google’s answer to ChatGPT

ChatGPT has caused a lot of excitement at Google, and the company has even issued a “code red.” In my opinion, rightly so, because it really is a threat to Google’s primary source of revenue, the display of advertising in search results. As I wrote in a previous article, I believe that Google search is outdated. It is not user-friendly when you are looking for information, and the entire page you see is advertising.

After several months of use, I would say that in some areas, Google is faster and preferable, and in other areas, ChatGPT is better. Furthermore, the chatbot has incredible usability that Google can’t do (write me 50 keywords for xyz). So, at least in my personal use, ChatGPT has partially replaced Google. Given that ChatGPT is one of the fastest-growing applications of all time and now has a hundred million monthly users, I’d like to speculate that GPT is already taking market share from Google.

Add to that the fact that Microsoft will be integrating these features into its search, and it becomes even more worrying for Google. It is, therefore, only a matter of time before Google launches a similar product. Indeed, there is now news that Google is already letting its employees use the chatbot internally and asking for feedback. The system will be published under the name Bard and will be available to everyone in the next few months. Under the link to this quote, there is also a short video of how the whole thing looks integrated into the search.

We’re releasing it initially with our lightweight model version of LaMDA. This much smaller model requires significantly less computing power, enabling us to scale to more users, allowing for more feedback. We’ll combine external feedback with our own internal testing to make sure Bard’s responses meet a high bar for quality, safety and groundedness in real-world information. We’re excited for this phase of testing to help us continue to learn and improve Bard’s quality and speed.

Google already has the necessary technology and the large language models with LaMDA. I have also read reports that Google has had the possibility to offer a chatbot for a long time but has deliberately held back to protect its business model.

The problem of monetization

The question of how OpenAI plans to monetize its chatbot was common at the beginning. The answer came quickly: simply through a paid subscription ($20 per month). This is not surprising as ChatGPT offers an obvious added value; therefore, many people will be willing to pay. Moreover, this type of monetization improves the user experience by avoiding advertising.

Can Google do the same? Possibly. However, Google will probably have a harder time explaining to its existing users that they should now pay a monthly fee to extend their search. It’s a psychological effect of a habit. If something has been free for a long time and suddenly no longer is, we feel ripped off. But if something is new, we are more likely to accept the price.

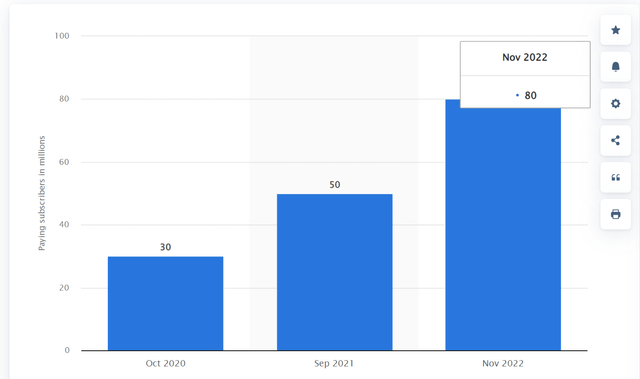

We see this effect with YouTube, for example. It has a harder time converting its users into paying users than other apps because YouTube has been free for so long. Netflix or Spotify have a much higher percentage of paying subscribers than YouTube, which currently has about 80 million premium users with about 2 billion monthly active users. However, in my opinion, YouTube offers a great overall package because you get ad-free YouTube and many other features, such as the ability to download and a Spotify alternative with YouTube Music as a bonus on top.

Google might be forced to disrupt itself

Many assumptions are still uncertain, but I actually believe that ChatGPT has already taken market share from Google. With the release of Bard, Google faces a dilemma: can they integrate advertising into the chatbot? That would be the closest to Google’s search revenue stream, but I can’t see how it would work. And there is no advertising under the short animated video on Google’s blog either. Or do they go the way of OpenAI and release a paid version? We will know more details as time goes on. But certainly, ChatGPT is the biggest and most qualitative challenge Google Search has ever faced.

What are the future growth drivers?

For years, Google has had three main sources of revenue: Google Search, YouTube, and the cloud. At least there are three now, so they are better diversified than they used to be, but still, more than 50% of the total revenue comes from Google Search alone. A few months ago, I wrote an article looking at Google’s market share; here is a quote from the conclusion:

Overall, I think the time of fast-growing user numbers and revenues is over. Google’s market share is already so high that it can hardly be higher. Future growth will come from the increasing world population and possibly higher costs for advertisers in developing countries. Certainly, YouTube also has a lot of room to increase costs for advertisers in developing countries. The single country with the most users is India. At the same time, the price of a premium account here is the lowest in the world.

The most significant risk for Google is if their primary source of revenue, Google search, loses market share. But this will probably not be a quick process, but it will take years. Shareholders should therefore have more than enough time to react to such developments. However, it could also be that we are already at the beginning of this development and just do not understand it yet.

Article: Has Google Reached Its Peak? Analysis Of The Market Share

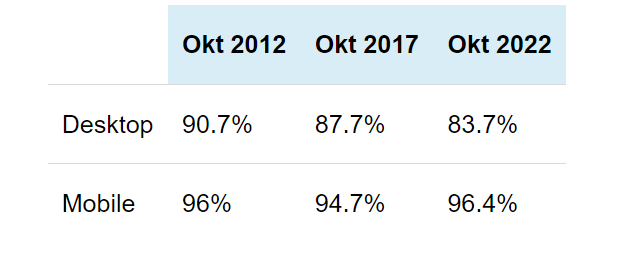

The article was written before ChatGPT. The last sentence refers to the fact that Google has been losing market share for years, especially on desktop, but remains high on mobile. This is because more similarly attractive search engines have emerged over time: DuckDuckGo, Ecosia, Neeva, and many more. Russia and China also have their own systems. ChatGPT now comes on top as an additional threat. The trend of losing market share in percentage terms was already there before. However, it is essential to understand that in absolute terms, users have increased because more and more people have gained internet access, and the world population has increased. These trends are still there now but at a much slower pace.

statcounter.com

YouTube

YouTube already has so many users that it can hardly grow anymore because almost the whole world is now connected to the internet. The world population is still growing but at a slower pace. I still think that YouTube has a lot of growth potential on the revenue side in the future because advertising costs in many countries are still much lower than in Western countries, and YouTube has, as I said, about 80 million subscribers with more than 2 billion monthly active users. However, the actual number of active users is probably much lower, as is the case with all apps that use the monthly active user metric. Even if you only use YouTube once a month, you are still included in this statistic. Of course, a premium subscription is only interesting for frequent users. However, overall, the premium potential is still much larger than 80M, and there is still a lot of potential for price increases in emerging markets. The previous chart earlier in the article shows that YouTube Premium is growing very fast, from 30M to 80M in just two years.

However, I think the company is doing a poor job of selling the benefits to potential customers. Users get a lot of advantages on YouTube and an equivalent Spotify (SPOT) replacement on top of it. But at least in my circle, almost nobody knows about it and therefore doesn’t consider it an alternative to Spotify. The recently discontinued Stadia service was also an excellent offer that could save people money by eliminating the need for a graphic card. But apart from frequent gamers, casual gamers didn’t know about it. I don’t understand why the company doesn’t use its networks on Google and YouTube more to promote its services.

Other bets

The other bets still generate very little revenue and burn money, but this story is still intact because the potential remains. I have written articles about two other bets, which explore the potential business models and opportunities in more detail, so I would instead direct interested readers to the articles on DeepMind and Waymo.

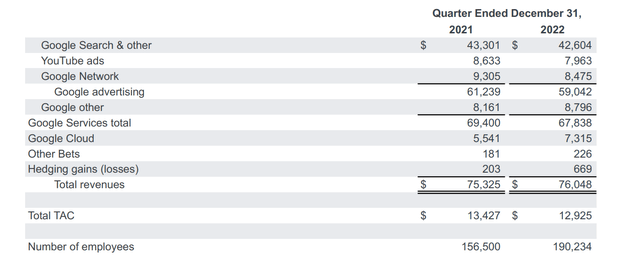

The quarterly results

Much has been written and interpreted about the results in other articles here on Seeking Alpha. So I would like to highlight a few interesting points from my point of view. First, of course, we know that the decline in Google and YouTube revenues is mainly due to recession fears and reduced advertising spending by other companies. But I’m very surprised that Google is down only slightly, but YouTube is down 10%. What is the company saying about the reasons? The answer is nothing, at least not in the press release, which is only nine pages long.

Above, I was optimistic about the future potential of YouTube, and now I want to talk about the downside. One reason could be that YouTube has lost more market share than many believe. As already mentioned, the indicator of monthly active users is rather uninformative and says nothing about the watch time. YouTube is getting more and more competition from apps like TikTok and alternatives like Rumble (RUM) and Odysee. This competition needed to emerge, as many users were unhappy with YouTube’s policy of simply deleting unpopular topics and channels.

Everyone has only a limited amount of time to spend on the internet, and countless excellent services are now vying for this time. YouTube cannot afford to disappoint its users, especially now that the alternative Odysee offers content creators to clone their entire YouTube channel and upload it one-to-one to Odysee. What keeps YouTube alive are the many excellent channels. For all these reasons, we will have to keep a close eye on how YouTube develops. I suspect that the watch time is already decreasing. However, I can’t prove this, unfortunately. But the decreasing revenue indicates this – especially because the premium subscribers are increasing very quickly, and the advertising is constantly increasing as well. So how can revenue decrease? That is only possible with falling total watch time by its users.

Valuation

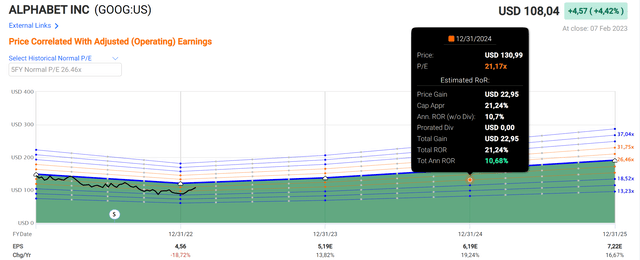

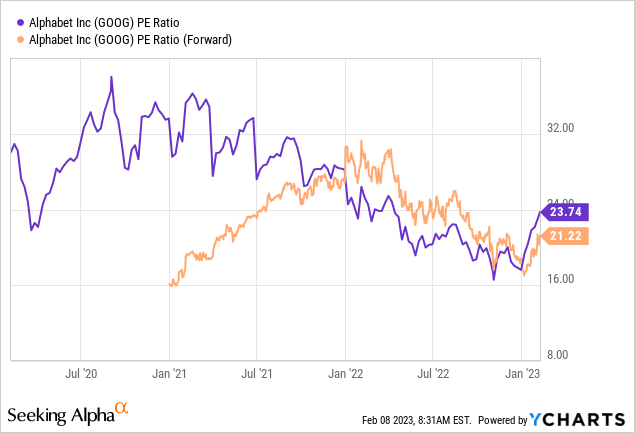

From the very attractive valuation a short time ago at a P/E ratio of below 20, the company has deviated again. It stands at around 24, based on the last 12 months. If the analysts’ estimates are correct, the forward P/E ratio would be 21.

According to fastgraphs, the company’s long-term average is a P/E ratio of 26. However, this is of little significance because interest rates were different in the past, the economy was different, and the company’s growth figures were higher. Higher interest rates mean that many companies that use Google to advertise have to cut back significantly on their spending or at least become more cautious. According to fastgraphs, the potential return is just about 10% p.a. if analysts’ estimates are correct, and the company is then trading at a P/E of 21.

Conclusion

The company has many challenges. They have built trust with billions of users through excellent products over the years. But all businesses are now challenged like never before, especially the two revenue streams, Google search and YouTube. I didn’t talk about the cloud, which is growing fast but is still a loss-making business, and there is strong competition too.

I believe it can be very positive for the company in the long term if they lose some market share to competition in the next few years. They have had an unchallenged market position for far too long and rested on it. However, losing some market share will be a wake-up call for the company, and if they make the right decisions, the company will emerge more vital than ever. The company is still in an excellent position with a world-renowned brand, billions of users, extremely high cash flow, heaps of brainpower, and the other bets as aces in the hole.

But given the challenges for the company’s cash cows, I am changing my rating to hold. This does not necessarily mean that I am pessimistic about the stock or I believe it is now permanently on the decline. It means that, from my point of view, there are other companies where I see better opportunities. Or in other words, where I am more certain about the prospects. One reason for my hold rating is also the valuation, which is too high in my view. I am currently only invested here through ETFs, where the company has one of the top positions, so I’m fine with this. As an individual stock, I’m not entirely convinced after the recent rally. I want to see how YouTube develops and the company’s decisions regarding its chatbot, especially monetization. Because I believe that such systems will conquer more and more market share in the future, and at some point, the Google search of today will be outdated in my opinion.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.