Summary:

- Absci Corporation uses IDCP technology to quickly produce high-quality drug candidates in as little as six weeks, reducing costs and improving research success rates.

- The company has promising candidates in inflammatory bowel disease, dermatology, and immuno-oncology, attracting major partnerships with over $900 million in deal value and royalties.

- ABSI focuses on three therapeutic areas: inflammatory bowel disease, dermatology, and immuno-oncology.

- Investors should be aware of the high risks due to the speculative nature of AI-driven drug discovery and potential funding needs.

- Still, ABSI trades at a reasonable valuation, making it a sound speculative “buy” for investors aware of biotech’s inherent risks.

iLexx

Absci Corporation (NASDAQ:ABSI) is a biotech stock that uses its IDCP technology, combining extensive datasets, advanced AI algorithms, and wet lab validation. This produces high-quality drug candidates quickly, in as little as six weeks. ABSI’s streamlined process reduces costs and should improve its research progress success rate. Additionally, the company’s innovative approach has attracted major partnerships that yielded over $900 million in deal value and royalties in 2H2023 and has promising candidates in inflammatory bowel disease, dermatology, and immuno-oncology. I believe ABSI is a unique biotech that also leverages AI, trading at a reasonable valuation multiple. Hence, I deem ABSI a sound speculative “buy” for investors aware of the inherent risks.

Biotech AI: Business Overview

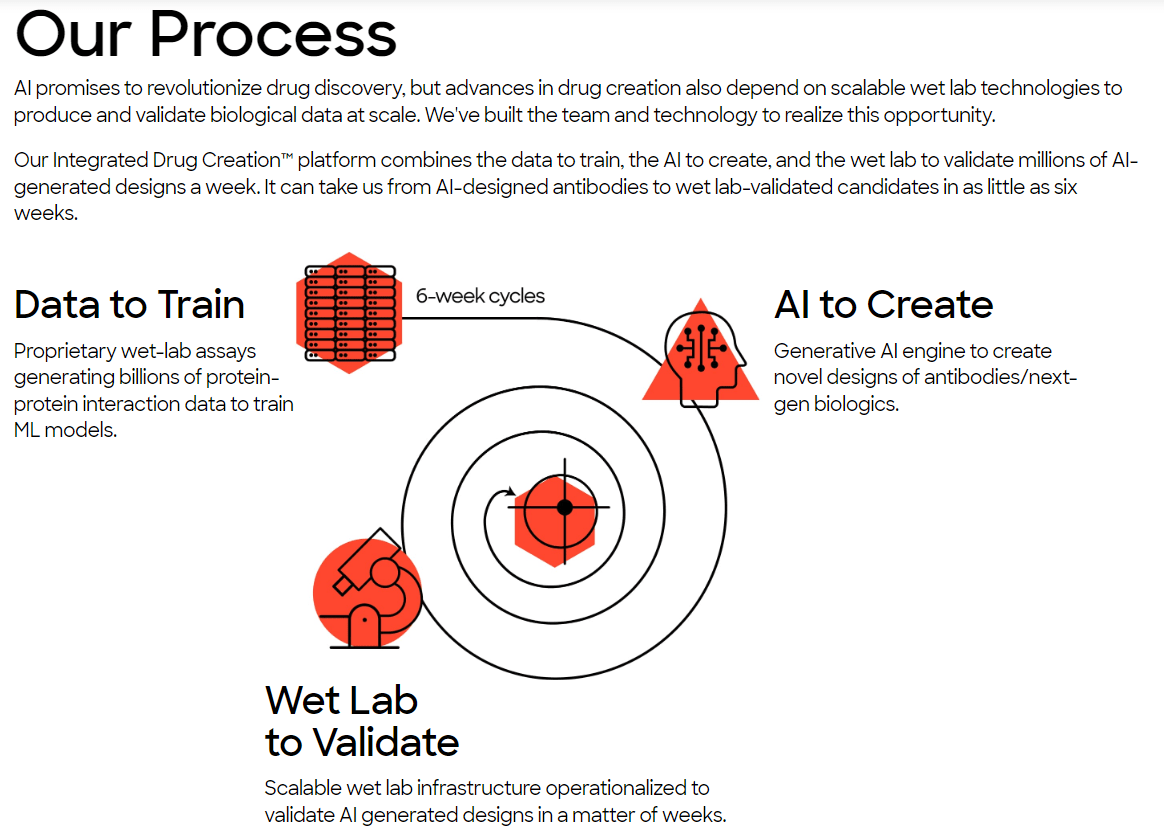

Absci Corporation is a biotechnology company that uses generative AI for drug discovery. Its platform and wet lab technologies then create and validate biologics rapidly. ABSI was founded in 2011 and is headquartered in Vancouver, Washington, with additional offices in New York City and Zug, Switzerland. The company’s Integrated Drug Creation Platform [IDCP] is its main value driver for generating new medications. It combines three components: 1) extensive datasets with genetic, biochemical, and pharmacological data that train AI algorithms for discovering drug candidates. Also, 2) AI algorithms design drugs based on patterns extracted during the training Phase. Lastly, ABSI’s 3) wet lab technologies validate AI-designed drug candidates, optimizing for specific characteristics and safety.

Source: Company’s website.

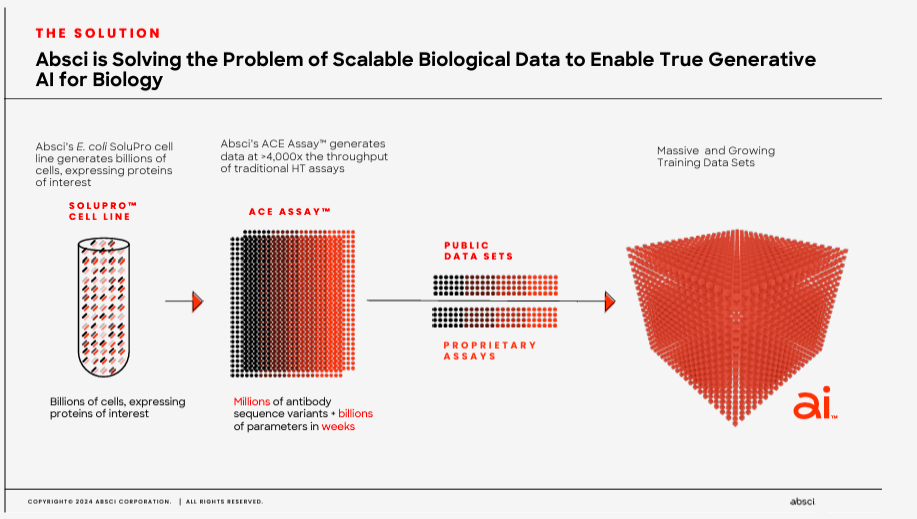

Currently, ABSI claims that it can generate validated drug candidates in as little as six weeks, reducing the costs and timelines to produce new drug candidates. The underlying approach uses ABSI’s IDCP and inputs millions of possible candidates, optimizing different drug versions. Then ABSI uses its proprietary SoluPro cell line to create billions of cells with proteins of interest that are further analyzed and tested. Its Activity-specific Cell Enrichment [ACE] assay technology then evaluates millions of antibody sequences and billions of parameters in weeks, allowing for rapid drug candidate screening.

Moreover, the generated SoluPro cell line and ACE assay data are combined with public datasets to produce vast training data. These datasets are then fed into AI algorithms. The AI’s output is antibodies and biologics produced by generative AI models. The final step uses ABSI’s validation lab, which receives AI-generated biologics and evaluates binding affinity and target specificity. Every six weeks, the company then uses wet lab data as feedback for the AI algorithms, which creates a constantly improving feedback loop for the AI models.

Source: Corporate Presentation. Spring 2024.

Theoretically, ABSI’s approach is an improvement over traditional biotech methods that typically take two years from drug discovery to the IND stage. Typical techniques have less than a 5% success rate and cost between $14 million and $16 million per R&D project. In contrast, ABSI’s AI platform significantly reduces the time needed to progress to the IND Phase and increases the success rate.

For example, ABSI generated ABS101 reached Phase 1 in just 14 months, spending less than $5 million. So, the potential improvements from shorter drug development timelines translate into considerable cost savings and should lead to much faster clinical development. Also, from a narrative perspective, it provides ABSI with a unique investment profile in biotech. It addresses challenging approval processes through AI that could yield new and unusual action mechanisms across different indications.

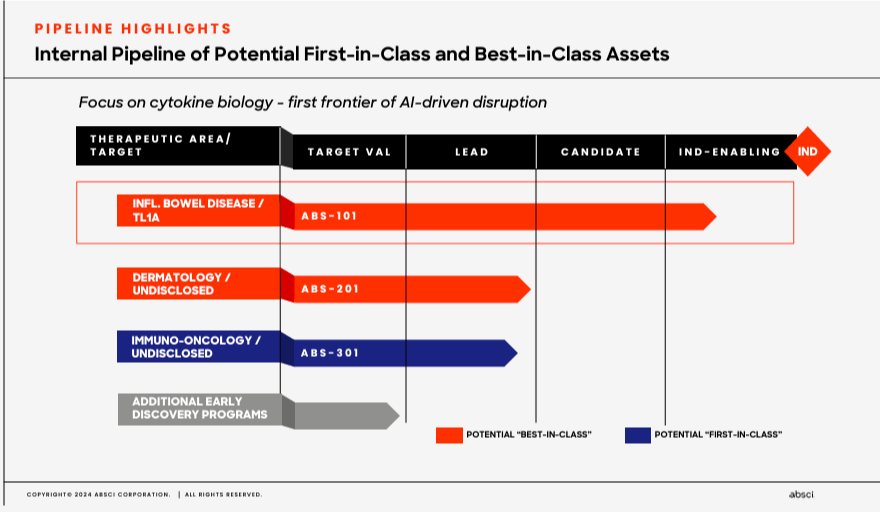

AI-Generated: Product Pipeline

The company’s pipeline focuses on three therapeutic areas. First, ABSI’s inflammatory bowel disease area targets TL1A, a cytokine related to inflammation. Here, ABS-101 is in the IND-enabling stage as a potential “best-in-class” drug. ABS-101 research started in January 2024, demonstrating high target affinity and effectiveness at low concentrations, with a long half-life and cost-effective manufacturability. Then ABS-101’s IND-enabling research began in February 2024, and Phase 1 trials are planned for 1H2025. The company’s 2) dermatology area has an undisclosed target with ABS-201, which is in the lead stage before IND. This candidate is also named as a potential “best-in-class” drug. Lastly, ABSI’s 3) immuno-oncology has an undisclosed target linked to cancer treatment through activating the immune system. Here, ABS-301 is touted as a potential “first-in-class” drug. So clearly, ABSI’s approach is quickly generating multiple unique drug candidates that, over time, could progress faster through the FDA’s regulatory approval processes.

Source: Corporate Presentation. Spring 2024.

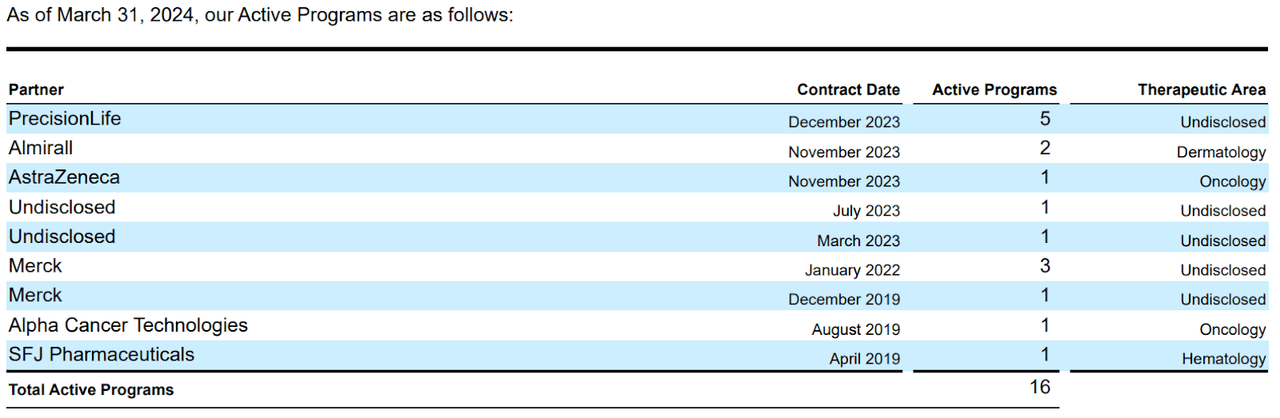

It’s worth highlighting that ABSI’s IDCP platform was also the foundation for collaborations with a deal value of roughly $900 million, plus royalties in 2H2023. The company’s partnerships included AstraZeneca (AZN), Merck (MRK), EQRx (EQRX), PrecisionLife, and Almirall (ALMRY) (OTCPK:LBTSF). In my view, AI-designed drugs should become the future of biotech over time. According to a peer-reviewed Drug Discovery Today journal article, AI-discovery molecules have an 80% to 90% success rate in Phase 1 clinical studies due to precision algorithms and validated targets that reduce toxicity risk.

Source: AlphaFold’s website.

Initially, Google’s AlphaFold was a major AI-biotech breakthrough. Since safety is one of the two key parameters the FDA considers before approving a drug (the other being its efficacy), ABSI could build on this progress. Thus, the paper’s results based on data from 100 AI-focused biotechs could explain the recent surge in AI-led drug discovery that has grown over 60% during the last ten years.

Moreover, success rates through Phase 3 improved to around 9% to 18%, from 5% to 10%. If ABSI’s platform delivers similar improvements, it could double R&D its productivity relative to peers, giving it a vital edge in the long term. Note that the paper’s data was compiled from 2015. This means generative AI contributions were likely minimal in the paper’s analysis but will probably become enormous in the future. In July 2024, Morgan Stanley initiated coverage on ABSI with an “overweight” rating, mainly noting its potential for outperformance due to AI drug design processes. This, coupled with recent collaborations with pharma giants like AstraZeneca and Almirall, paints an encouraging future for ABSI in biotech AI.

Reasonable Price: Valuation Analysis

ABSI trades at a $506.6 million market cap from a valuation perspective, making it a biotech microcap. Its balance sheet holds $58.8 million in cash and equivalents plus $102.7 million in short-term investments. This amounts to $161.5 million in available short-term liquidity against $7.1 million in financial debt. ABSI has $274.9 million in total assets and only $34.8 million in total liabilities. Its book value is $240.1 million, implying a 2.1 P/B multiple. This reasonable valuation seems cheap relative to its sector’s median P/B ratio of 2.5.

I estimate its latest quarterly cash burn was $17.8 million by adding its CFOs and Net CAPEX. This would suggest an annual cash burn rate of about $71.2 million, indicating a cash runway of 2.3 years. In my view, this gives ABSI some flexibility for the foreseeable future. Still, since its most advanced drug candidate is only in the IND stage, it will likely require additional funding for Phase 2 and 3 trials that typically require larger patient populations and more rigorous testing.

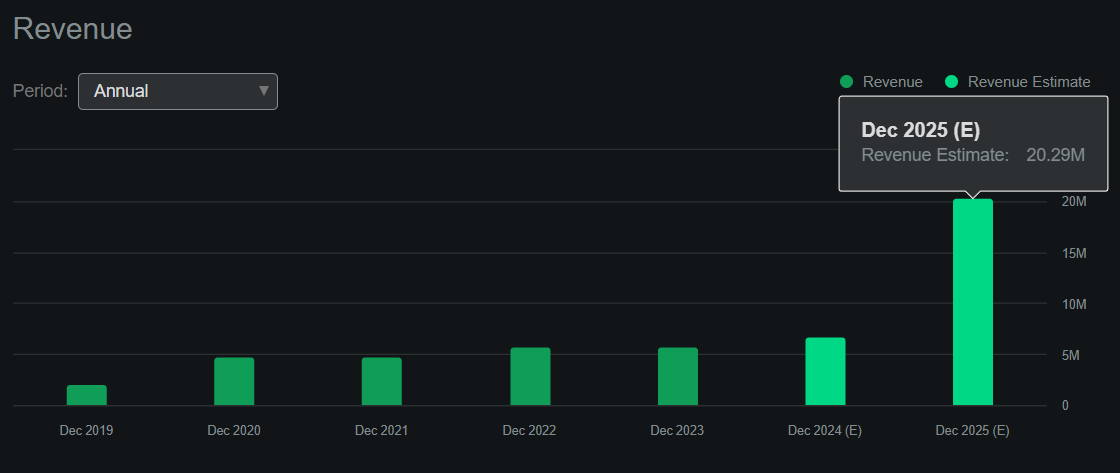

Source: Seeking Alpha.

However, future collaborations might yield more revenue than anticipated, particularly if ABSI’s internal research shows promising results. After all, the company has several partnerships, which, in my experience, is rare for a biotech of its size, suggesting its technology is unusually valuable. Naturally, I don’t think the company’s current revenue potential is its main value driver. Instead, investors are betting on the company’s potential across several possible indications, likely through its partnerships. Also, ABSI’s internally generated IP could tap into multiple sizeable TAMs over time, but it’s mostly speculative at this juncture.

Source. ABSI’s latest 10-Q report.

Therefore, I believe that ABSI’s valuation makes sense for now, and its AI approach could surprise investors’ expectations. Given that ABSI trades at a reasonable valuation with a unique AI-driven biotech approach, I think it’s worth being bullish on it. Hence, I rate the stock as a speculative “buy” for AI and biotech investors.

Investment Caveats: Risk Analysis

Naturally, this investment is not without its risks. Investors need to realize that ABSI remains a highly speculative company despite its promising approach to biotech through AI. I think its cash runway will be enough to get ABS-101 into Phase 1 and maybe Phase 2 if it’s surprisingly efficient. However, there’s a high probability that the company will require additional funding at some point, which will likely involve some stockholder dilution. By then, the stock may be considerably higher, which would mitigate dilution prospects. However, this scenario is not guaranteed, and if its research disappoints the market, dilution could be considerable if done at a low stock price. Moreover, ABSI is inherently a long-term investment, as its true potential will only shine if it delivers a fully AI-generated FDA-approved drug, which will take several years.

Source: TradingView.

Lastly, ABSI’s value largely hinges on its platform’s attractiveness to other pharma players. However, these companies could theoretically develop their internal AI drug generation platforms, detracting from ABSI’s value proposition. The stock faces competitive risks until ABSI builds a substantial proprietary dataset and AI models. Nevertheless, I think that as it stands, ABSI is a reasonably priced bet on AI in biotech, which holds exciting potential.

Speculative Buy: Conclusion

Overall, I lean bullish on ABSI due to its promising potential through AI for biotech, which could disrupt the industry long-term. However, ABSI is highly speculative at this juncture because its technology remains mostly unproven, with no FDA-approved products to date. I reckon its early progress with ABS-101 is proof of concept for AI-generated drugs, but until the company develops a fully FDA-approved medication, it’ll remain inherently risky. Nevertheless, I think ABSI’s current valuation provides investors a compelling entry point for AI and biotech. Thus, I rate ABSI a speculative “buy” as long as investors understand the risks and uncertainties embedded in ABSI.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.