Summary:

- Absci Corporation’s stock has rebounded due to new collaborations, but skepticism about AI’s impact on drug discovery keeps it heavily underwater from its IPO price.

- Absci uses AI and wet lab technologies to speed up drug discovery, aiming to reduce preclinical periods to under two years.

- Despite partnerships with Merck, AstraZeneca, and others, Absci’s revenue remains minimal, and it has no advanced pipeline assets yet.

- With a market cap just over $300 million and cash runway into 1H27, Absci is a speculative play in the AI drug discovery space.

- An analysis around Absci Corporation follows in the paragraphs below.

J Studios

Shares of AI-assisted drug creation concern Absci Corporation (NASDAQ:ABSI) have rebounded nicely in the past year as four more signed collaborations have boosted confidence in its approach. That rally has faded recently. Despite the rise of its 52-week lows, the stock is still heavily underwater from its IPO pricing as the market questions whether AI will actually speed up time to the clinic or approval rates. With a differentiated approach to drug creation versus its AI competition but no clinical data to substantiate its validity, this name merited a deeper dive. An analysis follows in the paragraphs below.

Company Overview:

Absci Corporation is a Vancouver, Washington-based drug discovery concern focused on the development of biologics leveraging artificial intelligence and scalable wet lab technologies. The company is engaged in 22 active drug candidate discovery programs with a plethora of partners, as well as three internal creation programs. Absci was formed in 2011, began commercial operations in 2018, and went public in 2021, raising net proceeds of $210.1 million at $16 per share. Its stock currently trades around $2.75 a share, translating to a market cap of just over $300 million.

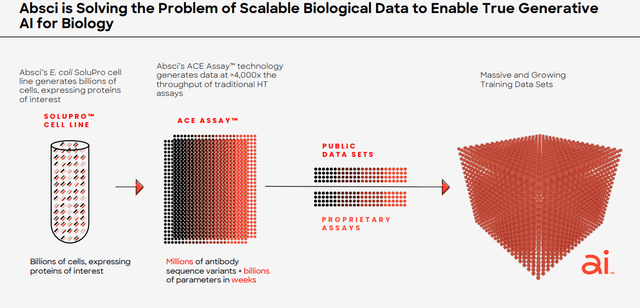

Third Quarter Company Presentation

Approach

The company is attempting to upend the current drug discovery model, harnessing AI to create therapies through a disease-agnostic paradigm. By doing so, it expects to greatly speed up the long iterative discovery and preclinical journey that (if successful) takes five and half years on average to achieve IND acceptance from the FDA. Using Absci’s own terminology, it leverages its “lab-in-a-loop”, which employs “the data to train, the AI to create, and the wet lab to validate” its discovery candidates in rapid six-week cycles that could reduce the preclinical period to less than two years.

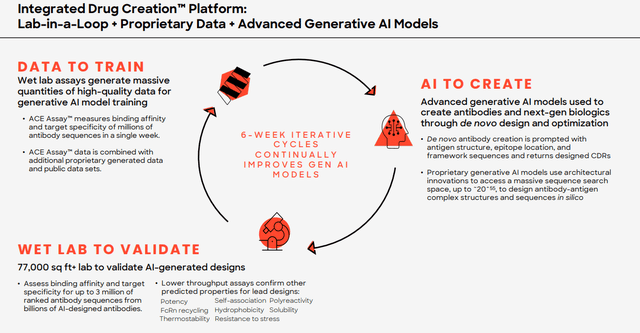

Third Quarter Company Presentation

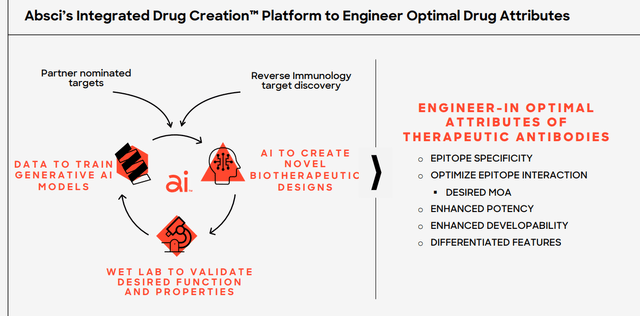

As for the specifics: after leveraging reverse immunology tools for target identification, the company uses its proprietary E. coli SoluPro cell line to generate billions of cells that express proteins of interest. Those cells are run through Absci’s ACE assays to measure the binding affinity and target specificity of millions of antibody sequence variants every week. Those findings are combined with publicly available data, which are processed by AI models to create de novo (from scratch) antibody-antigen complex structures and sequences in silico (in the computer). The highest-ranked antibody sequences from the dry lab are entered into the wet lab (analyzed and tested using liquids) to validate their characteristics. This six-week cycle is continuously repeated to arrive at optimal therapeutic candidates for the clinic. The more data generated from this approach, the more its AI models learn, allowing them to create new and better engineered biologic constructs faster. Absci believes this strategy will result in shorter times to human trials with success (FDA approval) rates above the standard 10%-20% probability once in the clinic.

Third Quarter Company Presentation

One example of how these AI procedures can speed up drug development and reduce discovery costs would be the ability to predict whether a newly discovered compound could induce adverse events before testing it on animals or later in the clinic on humans. A foreknown negative safety profile can save a biopharmaceutical concern years of needless preclinical testing and millions of dollars – not to mention a few animals.

Partnerships

From this approach, Absci has procured nine drug development partnerships encompassing 22 active programs. That said, they have not garnered much revenue to date. A three-program deal with Merck (MRK) in 2022 was advertised as bringing in upfront and potential milestones of $610 million plus tiered royalties after the duo teamed up for a single undisclosed program in 2019. In 4Q23, the company signed a two-program dermatology collaboration with Spanish biopharma Almirall (OTCPK:LBTSF) potentially worth $664 million in upfront fees and milestones. That was followed in the same stanza by news of a one-compound partnership with AstraZeneca (AZN) that provides an undisclosed “upfront commitment”, as well as milestones and royalties. That said, the upfront considerations from these deals are clearly not significant, as Absci has generated total revenue of $5.7 million in both FY22 and FY23.

The company also inked a five-program deal with computational biology concern PrecisionLife in December 2023, as well as a six-program co-development oncology collaboration with Memorial Sloan Kettering in mid-2024. However, neither of these partnerships will result in any upfront fees or potential future milestones, only the hope of developing clinical worthy compounds. Many of the specifics surrounding these partnerships are shrouded in secrecy with regards to disease category or target for competitive reasons.

Management anticipates signing three additional deals before YE24.

Wholly Owned Programs

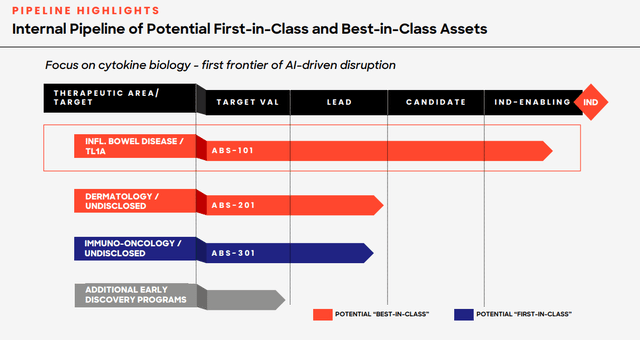

Absci also has directed some of its technology inwards, with three discovery programs of its own. Its lead program (ABS-101) is in IND-enabling studies targeting TL1A for the treatment of inflammatory bowel disease, a malady with a prevalence of approximately five million worldwide. That said, Merck, Roche (OTCQX:RHHBY), and Sanofi (SNY) all have TL1A antibodies in the clinic, the data from which are being leveraged to develop and improve ABS-101, with some measurable success: it has demonstrated two to three times the half-life in the preclinic versus the competition. The company expects to file an IND in 1Q25 with an eye on initiating its first clinical trial in 1H25. Absci’s other two programs, ABS-201 (dermatology) and ABS-301 (immuno-oncology) are still in the discovery phase with preclinical data anticipated in late-2024/early 2025. For the avoidance of doubt, management expects to out-license these programs if they demonstrate potential in Phase 1 trials.

Third Quarter Company Presentation

AI Development Marketplace

Although AI sounds sexy and new, the space for leveraging the technology in the field of biopharmaceuticals is already very crowded, with Generate Biomedicines, Exscientia (EXAI), Phenomic AI, BioMap, Quris, Valo Health, BenevolentAI (OTC:BAIVF), Recursion Pharmaceuticals (RXRX), Relay Therapeutics (RLAY), and Isomorphic Labs all offering AI-linked design and development capabilities. Absci’s differentiating feature is its use of the wet lab to gain a better understanding of its designs vis-à-vis the strictly dry lab approach of its competitors.

Balance Sheet & Analyst Commentary:

To help advance its partnered and wholly owned programs while it awaits potential milestone revenue, Absci raised net proceeds of $80.8 million at $4.50 per share in a secondary offering conducted in February/March 2024. In total, the company held cash and investments of $127.1 million on September 30, 2024, providing it an operating runway into 1H27, assuming no funding from existing or future collaborations.

Despite having nothing in the clinic, either on its own or through a partnership, Absci receives mostly constructive support from the Street. Since the company’s third quarter results were posted on November 12th, TD Cowen, H.C. Wainwright ($7 price target) and Scotiabank ($13 price target) have all reissued Buy ratings on the stock. Stifel Nicolaus maintained its Hold rating and six bucks a share price target on the stock.

Verdict:

After nearly doubling two weeks after its IPO in 2021, the ‘irony’ of a company pushing a quicker to clinic discovery platform with no clinical assets weighed heavily on shares of ABSI, which were down 96% from their all-time high (and 93% from their IPO pricing) at $1.11 in October 2023. Since then, Absci’s stock has caught a bid, more than doubling in the past year, in part because it was trading at cash (or a slight discount to) at its lows with upside potential from its Merck collaboration. Beyond a cheap valuation, confidence in its approach – boosted by partnerships signed with AstraZeneca, Almirall, PrecisionLife, and Memorial Sloan Kettering – has provided share price appreciation. Also, its wet-lab process holds the possibility of separating from its competition.

However, it remains to be seen whether AI is actually going to speed up preclinical evaluation or increase success rates in the clinic. With its approach valued at just under $200 million net of cash, the skepticism discount no longer exists. As such, the recommendation is to stay to the sidelines unless one is a very aggressive investor looking to increase exposure to the emerging AI drug discovery space.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Live Chat on The Biotech Forum has been dominated by discussion of lucrative buy-write or covered call opportunities on selected biotech stocks over the past several months. To see what I and the other season biotech investors are targeting as trading ideas real-time, just join our community at The Biotech Forum by clicking HERE.