Summary:

- Absci’s differentiated drug discovery platform could create significant shareholder value long term.

- The company has a long and expensive path to traverse before it can prove the merits of its approach though.

- While cash burn is currently limited, Absci’s operations are ramping, meaning increased costs could begin to pressure the share price in the future.

- Absci has largely avoided the growing pessimism towards AI-enabled drug discovery companies and is beginning to look expensive relative to peers as a result.

luismmolina/E+ via Getty Images

Absci’s (NASDAQ:ABSI) share price has held up well in recent months, despite AI-enabled drug discovery peers generally falling further out of favor with investors. Much of this could be the result of Absci announcing positive preclinical data related to its ABS-101 program. The company’s association with Nvidia (NVDA) and limited cash burn are also likely viewed favorably.

I previously suggested that Absci had a differentiated approach to antibody drug development that could yield advantages relative to existing methods. While I continue to believe that this is the case, I don’t think that this makes the company immune to broader developments in the space. For example, Recursion’s (RXRX) disappointing phase II data has further dampened investor sentiment towards AI-enabled drug discovery. I don’t believe this trial is particularly important longer-term, but it highlights the fact that the benefit of AI is likely to be incremental in nature. Exscientia’s decision to merge with Recursion and AbCellera’s (ABCL) slow progress also highlight the difficulty of maintaining early hype around the technology as the business matures and cash burn begins to increase. At the end of the day, all of these companies need to be able to succeed in clinical trials, and this is a long and expensive process.

Technology

Absci combines generative AI with scalable wet lab technologies to improve antibody discovery, with the eventual goal of enabling in-silico drug design. Data is currently the limiting factor on this approach, a problem that is addressed by Absci’s E. coli strain, which is capable of cost-effectively producing diverse human antibodies at scale. Assays are then performed to identify high potential antibodies and validate Absci’s algorithms.

Absci’s background is in cell line development and over the course of a decade, the company developed SoluPro, an E. coli platform that enables the production of antibodies at scale (billions of cells, which express proteins of interest). This is difficult because antibodies are complex proteins that require special cellular machinery to ensure they are correctly assembled and folded, and E. coli normally lacks the post-translational apparatus to produce functional antibodies. Absci’s E. coli cell lines are bioengineered for production of mammalian proteins and site-specific incorporation of non-standard amino acids.

High-throughput single-cell assays are used to evaluate fully constructed protein scaffolds for target binding affinity, protein quality, and production level. Absci’s ACE assay evaluates and sorts cells to find those with the most potential and provides 4,000x the throughput of traditional high-throughput assays. This data is used to train AI models.

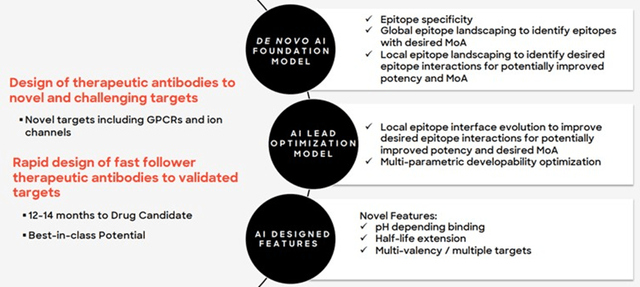

Other aspects of Absci’s platform that are potentially important include:

- The ability to optimize multiple drug characteristics simultaneously

- The ability to generate antibodies with epitope specificity

Figure 1: Benefits of Absci’s Platform (source: Absci)

Absci also has the ability to use human immune responses to identify novel antibodies and their therapeutic targets. This business is supported by a network of health care institutions which provide access to patient data. Absci wants to improve the scalability of this part of the business by using AI to predict the target rather than performing screening to determine what the antibody is binding to.

Absci has stated that it can generate a differentiated antibody candidate and complete IND-enabling studies for around 15 million USD, within a 12-14 month timeframe. For example, ABS-101 was created and advanced to IND-enabling studies in 14 months for a cost of less than 5 million USD. Recursion has put its cost to generate a candidate and complete IND-enabling studies at closer to 5 million USD, with a 2-year timeline, compared to an estimated industry average of approximately 20 million USD.

Programs

Absci has previously focused on partner programs, which limited the company’s ability to communicate with investors. The company more recently pivoted to a hybrid model, allowing the company to provide more details on internal programs. While internal programs increase the cash needs of the business, it creates more upside for investors.

Absci is advancing three programs toward clinical trials, with an initial focus on cytokine biology. The company expects to initiate a phase I study for ABS-101 in patients with IBD in early 2025, with interim data expect later in 2025. Inflammatory Bowel Disease is currently a 20 billion USD market that is expected to offer single digit growth going forward.

Absci has demonstrated ABS-101’s ability to bind both the TL1A monomer and trimer, which could lead to differentiated clinical efficacy. The company also believes that it addresses all known monomer isoforms. Non-human primate studies showed 2-3x longer half-life compared to competitor molecules (Roivant RVT-3101 and Merck MK-7240) in clinical development. The candidate also has increased biodistribution, which could lead to a therapeutic benefit and potentially obviate the need for a loading dose. Studies also show that ABS-101 can be formulated a high concentration (200 mg/ml), supporting further development of a subcutaneous formulation. GLP toxicology studies are currently ongoing. While non-human primate data appears promising, it is not guaranteed that results will translate in human trials. Despite physiological and genetic similarity, factors such as differences in metabolism, immune responses, and disease progression can affect outcomes.

ABS-201 is targeting an undisclosed dermatological indication. Absci expects to select a development candidate for this program later this year.

ABS-301 could be a first-in-class antibody for an undisclosed immuno-oncology target, which was discovered using Absci’s reverse immunology platform. ABS-301 is a fully human antibody designed to inhibit an immunosuppressive cytokine and stimulate an innate immune response. It is currently being evaluated for a variety of oncology indications. Mode of action validation studies are expected to be completed in the second half of 2024.

Absci expects to share preclinical data for ABS-201 and ABS-301 either later this year or early next year. Absci also expects to advance at least one additional internal program to a lead stage in 2024.

Partnerships

Absci recently entered into a collaboration with Memorial Sloan Kettering Cancer Center to jointly develop up to six therapeutic programs. The organizations will share costs, which will help Absci to advance its pipeline while controlling costs.

Absci’s other partners include Merck, AstraZeneca and Almirall. The company is targeting an additional three drug creation partnerships in 2024. While Absci reportedly has a robust pipeline of potential partners, time is running out to announce the three additional partnerships.

Financial Analysis

Absci generated 900,000 USD revenue in the first quarter of 2024 and 1.3 million USD in Q2. R&D expenses totaled 15.3 million USD in Q2, up around 25% sequentially, driven by increased lab operations. SG&A expenses have been sitting at around 9 million USD per quarter.

Gross cash burn is expected to total around 80 million USD in 2024, including the costs of completing IND-enabling studies for ABS-101 with a third-party CRO. This is important as Absci’s cash balance is fairly modest (145.2 million USD at the end of Q2, down from 161.5 million USD in Q1).

Absci performed an underwritten public offering of common stock earlier in the year, which provided gross proceeds of around 86 million USD and will likely need to do so again in the near future. The company’s current liquidity is expected to be sufficient to fund operations into the first half of 2027. This implies cash burn of around 15 million USD per quarter, which appears optimistic given that operations are likely to scale significantly over this time frame. The company may be looking for more positive data to drive its share price higher before further diluting investors.

Conclusion

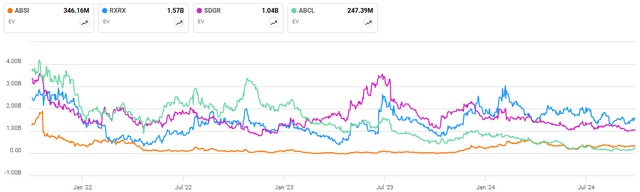

Absci has a differentiated technology platform, which has significant potential, but the stock is beginning to look expensive relative to more mature peers. While Schrodinger (SDGR) and Recursion have much larger enterprise values, Schrodinger also has a software business that probably should be worth upwards of 1 billion USD. Recursion/Exscientia has a pipeline of approximately 10 clinical readouts over the next 18 months. Most of these programs, if successful, could have annual peak sales opportunities in excess of 1 billion USD. In comparison to Absci, AbCellera has a much stronger balance sheet, and while its internal pipeline is still nascent, it has around 13 molecules in the clinic through partner programs. This makes Absci look quite attractive relative to peers, even if the company’s valuation is reasonable on an absolute basis.

Figure 2: Absci Enterprise Value (source: Seeking Alpha)

Absci is potentially benefitting from operating in a hot area (generative AI, data play, relationship with Nvidia) and the fact that its cash burn is currently moderate. The company also doesn’t appear to have been hit by the negative sentiment that Recursion’s poor clinical trial data has created toward other AI-enabled drug discovery companies.

Absci continues to land new partnerships, which is difficult to do in the current environment. Companies like AbCellera have struggled to attract partners in recent years, accelerating a transition toward internal programs. While I believe this shift was inevitable, and is a positive longer term, it has raised cash burn concerns in a tight financing environment. Absci could find itself in a similar position in the next few years, particularly given its small cash position, as it increases the number of internal programs.

Even if Absci lives up to its potential, it will take time and capital to really accelerate the company’s data flywheel, which will require raising capital on favorable terms. Given this situation, I think it is likely that Absci’s share price will come under pressure when the reality of the company’s near-term future sets in.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SDGR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.