Summary:

- AbSci has filed to raise $200 million in a U.S. IPO.

- The firm is commercializing a biologic development platform.

- ABSI has promise but is still at a very early stage of commercialization and further development of its technologies and business model, so I’ll watch the IPO from the sidelines.

Quick Take

AbSci (NASDAQ:ABSI) has filed to raise $200 million in an IPO of its common stock, according to an S-1/A registration statement.

The firm provides a fully integrated biologics drug creation platform for researchers.

ABSI commercialization efforts are at an early stage and management is seeking a very high price at IPO, so I’m in a ‘show me’ mode.

Company & Technology

Vancouver, Washington-based AbSci was founded to develop its ‘AI-powered Drug Creation Platform’ to combine biologic drug discovery and cell line development into a single, simultaneous process.

Management is headed by founder and CEO Sean McClain, who currently serves on the board of the Oregon Bioscience Association and other organizations.

Below is a brief overview video of an interview of AbSci founder and CEO Sean McClain:

(Source)

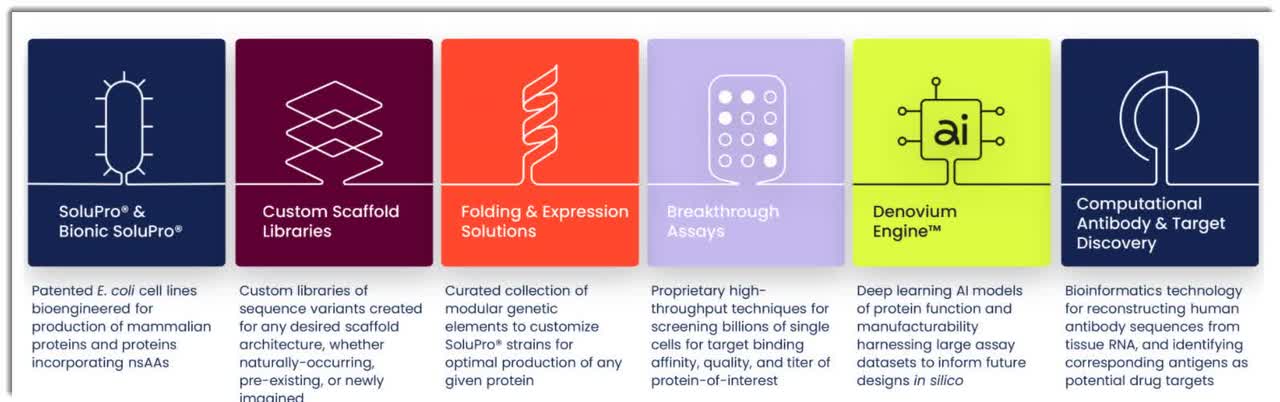

The company’s primary offerings include:

-

SoluPro & Bionic SoluPro

-

Custom Scaffold Libraries

-

Folding & Expression Solutions

-

Breakthrough Assays

-

Denovium Engine

-

Computational Antibody & Target Discovery

Below is a chart showing these offerings along with a brief explanation of each:

AbSci has received at least $161 million in equity investment from investors including Phoenix Venture Partners, Casdin Capital, Redmile Group, Mark Valasek and Souther Investment affiliates.

Customer Acquisition

The firm seeks development partners focused on developing production cell lines for drug candidates.

ABSI had nine Active Programs as of March 31, 2021, with companies including Merck, Xyphos Biotechnology, Alpha Cancer Technologies and others.

Selling, G&A expenses as a percentage of total revenue have varied significantly as revenues have increased, as the figures below indicate:

|

Selling, G&A |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Three Mos. Ended March 31, 2021 |

440.7% |

|

2020 |

115.1% |

|

2019 |

171.0% |

(Source)

The Selling, G&A efficiency rate, defined as how many dollars of additional new revenue are generated by each dollar of Selling, G&A spend, dropped to 0.1x in the most recent reporting period, as shown in the table below:

|

Selling, G&A |

Efficiency Rate |

|

Period |

Multiple |

|

Three Mos. Ended March 31, 2021 |

0.1 |

|

2020 |

0.5 |

(Source)

Market & Competition

According to a 2020 market research report by Mordor Intelligence, the global market for biologic drug discovery was an estimated $303 billion in 2020 and is forecast to reach $509 billion by 2026.

This represents a forecast CAGR of 9.06% from 2021 to 2026.

The main drivers for this expected growth are a growing investment from major market participants and loss of patent exclusivity for leading biologic drugs, pushing pharmaceuticals to invest in next generation treatments.

Also, the COVID-19 pandemic will likely drive demand for biologic study.

Major competitive or other industry participants include:

-

Insitro

-

TScan Therapeutics

-

3T Biosciences

-

Generate Biomedicines

-

Schrodinger

-

Recursion Pharmaceuticals

-

Relay Therapeutics

-

Atomwise

-

Valo Health

-

Escientia

-

AbCellera Biologics

-

Adimab

-

Berkeley Lights

-

Others

Financial Performance

AbSci’s recent financial results can be summarized as follows:

-

Uneven topline revenue

-

Sharply increased operating losses

-

Increasing cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Three Mos. Ended March 31, 2021 |

$ 1,063,000 |

85.8% |

|

2020 |

$ 4,780,000 |

132.0% |

|

2019 |

$ 2,060,000 |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Three Mos. Ended March 31, 2021 |

$ (11,148,000) |

-1048.7% |

|

2020 |

$ (13,301,000) |

-278.3% |

|

2019 |

$ (6,265,000) |

-304.1% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

|

|

Three Mos. Ended March 31, 2021 |

$ (11,957,000) |

|

|

2020 |

$ (49,469,000) |

|

|

2019 |

$ (23,870,000) |

|

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Three Mos. Ended March 31, 2021 |

$ (7,285,000) |

|

|

2020 |

$ (10,970,000) |

|

|

2019 |

$ (6,032,000) |

|

(Source)

As of March 31, 2021, AbSci had $181 million in cash and $160 million in total liabilities.

Free cash flow during the twelve months ended March 31, 2021, was ($24.2 million).

IPO Details

AbSci intends to raise $200 million in gross proceeds from an IPO of its common stock, offering 12.5 million shares at a proposed midpoint price of $16.00 per share.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $1.1billion, excluding the effects of underwriter over-allotment options.

Excluding effects of underwriter options and private placement shares or restricted stock, if any, the float to outstanding shares ratio will be approximately 13.83%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Management says it will use the net proceeds from the IPO as follows:

As of June 30, 2021, we had cash and cash equivalents of $99.5 million. We currently expect to use our net proceeds from this offering, together with our existing cash and cash equivalents, to further our investment in expanding our Integrated Drug Creation Platform’s capabilities, continued growth of our business development organization and activities, and for general corporate purposes, including working capital, capital expenditures, and operating expenses. We may also use a portion of the remaining net proceeds, if any, to acquire complementary businesses, products, services or technologies, including scientific expertise, although we have no binding agreements or commitments to do so at this time.

Based on our current plans, we believe that the net proceeds from this offering, together with our existing cash and cash equivalents, will be sufficient to fund our operating expenses and capital expenditure requirements at least through 2023.

(Source)

Management’s presentation of the company roadshow is available here.

Listed bookrunners of the IPO are J.P. Morgan, Credit Suisse, BofA Securities, Cowen and Stifel.

Valuation Metrics

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$1,446,000,352 |

|

Enterprise Value |

$1,131,513,352 |

|

Price / Sales |

274.33 |

|

EV / Revenue |

214.67 |

|

EV / EBITDA |

-51.53 |

|

Earnings Per Share |

-$0.52 |

|

Float To Outstanding Shares Ratio |

13.83% |

|

Proposed IPO Midpoint Price per Share |

$16.00 |

|

Net Free Cash Flow |

-$24,172,000 |

|

Free Cash Flow Yield Per Share |

-1.67% |

|

Revenue Growth Rate |

85.84% |

(Source)

Commentary

AbSci is seeking public capital market funding to advance its general corporate expansion plans, which are unspecified.

The firm’s financials show a small amount of topline revenue and growing operating losses and operating cash burn.

Free cash flow for the twelve months ended March 31, 2021, was ($24.2 million).

Selling, G&A expenses as a percentage of total revenue have fluctuated wildly as revenue has varied; its Selling, G&A efficiency rate dropped to 0.1x in the first quarter of 2021.

The market opportunity for selling an integrated platform for biologic development is large and expected to grow at a marked rate of growth over the coming years.

J.P. Morgan is the lead left underwriter and IPOs led by the firm over the last 12-month period have generated an average return of 19.9% since their IPO. This is a mid-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is that so far it doesn’t have any partners that have ‘entered into a license for clinical or commercial use of any intellectual property rights related to biologic drug candidates or cell lines generated utilizing our platform.’

As for valuation, management is asking IPO investors to pay an EV/Revenue multiple of over 214x.

Given the ultra early stage of the firm’s commercialization efforts and the extremely high multiple it is seeking at IPO, I’m in a wait and see mode.

Expected IPO Pricing Date: July 21, 2021

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investing in IPOs is an inherently volatile and opaque endeavor. My research is focused on identifying quality IPO companies at a reasonable price, but I’m wrong sometimes. I analyze fundamental company performance and my conclusions may not be relevant for first-day or early IPO trading activity, which can be highly volatile and unrelated to company fundamentals. This report is intended for educational purposes only and is not financial, legal or investment advice.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!