Summary:

- Shares of Acadia Pharmaceuticals Inc. are stuck in the 20s despite the company’s progress in the past year.

- Concerns about the growth trajectory of Daybue may be impacting investor sentiment, and, perhaps, some risk aversion ahead of Nuplazid’s phase 3 results in schizophrenia patients.

- Acadia expects to generate revenues between $930 million and $1.01 billion in 2024, and I continue to like the long-term risk-reward at current levels.

mesh cube/iStock via Getty Images

ACADIA Pharmaceuticals overview

Shares of ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD) are still in the 20s, and this is quite surprising considering the progress the company made in the last 12 months. This includes the successful launch of Daybue last spring to the successful defense of Nuplazid patents in court in the fourth quarter to the expansion of the pipeline that includes the next-generation Nuplazid and the phase 3 asset ACP-101 for the treatment of Prader-Willy syndrome.

The strong Q4 2023 results and the good guidance for 2024 did little to change the share price direction, and the stock is down today and down 15% since my December 2023 article where I covered the removal of the IP overhang on Nuplazid and highlighted Daybue’s progress.

The only reasons I see for the lack of progress of the stock is the continued concern about the growth trajectory of Daybue, and, perhaps, the reluctance of investors and traders to own the stock ahead of the most important pipeline readout of the year – the phase 3 results of Nuplazid (pimavanserin) as an adjunctive treatment of negative symptoms of schizophrenia. I continue to see the stock as well positioned to deliver long-term value even if Nuplazid fails in the phase 3 trial, and the Daybue launch still looks good to me.

Daybue growth concerns

Daybue significantly outperformed early launch expectations in 2023, and some investors are still not happy. There was even a short report this month by Culper Research focused on Daybue and how it will supposedly fail to live up to Street expectations. I do share some of the concerns from that report, primarily the retention of patients due to Daybue’s poor gastrointestinal tolerability profile, but so far, the numbers are proving the skeptics wrong.

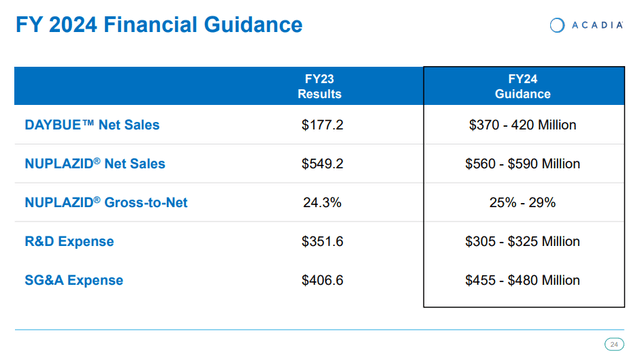

Daybue generated $87.1 million in net sales in the fourth quarter and $177.2 million in 2023, having been launched in the second quarter. And Acadia provided the annual sales guidance for Daybue for the first time this week. The company expects to generate between $370 million and $420 million in Daybue sales this year.

However, I believe the stock declined today because the company guided Q1 2024 net sales of Daybue in the $76-82 million range. Combined with the short report above and the concerns ever since the product was launched, it seems natural that the stock would react negatively, at least in the near term.

The numbers are a bit deceiving, and Q1 is also usually the seasonally worst quarter of the year for drug sales due to the start-of-the-year dynamics that include insurance resets and coverage problems that negatively impact compliance at the start of the year, as well as lower patient volumes at treatment centers after the holidays. All of this impacted Daybue numbers in January, and the company said Rett syndrome clinic visits were much lower than anticipated.

Management also said that new patient starts are back to normal in February and that the Q4 trends as well as the return to those trends in the last few weeks provide confidence in the full-year guidance range for Daybue. They also said that a good number of refills was pulled from January to December and that this also resulted in unfavorable sequential comparisons.

While these trends are still important to track, I do not see real reasons for concern. I expect Daybue sales to recover in the second quarter and grow sequentially in the second half of the year.

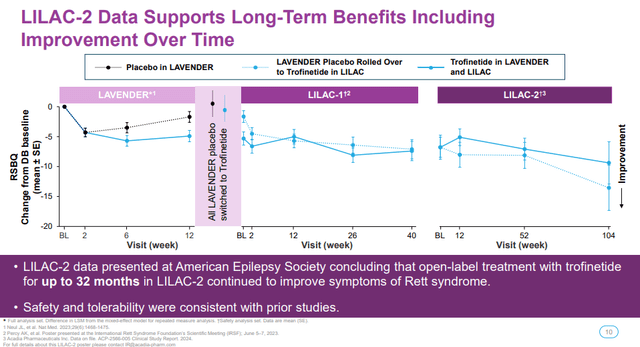

I also want to add that long-term compliance in the open-label extension trial and the continued improvements in Rett symptoms look very encouraging.

Acadia Pharmaceuticals investor presentation

2024 guidance looks good

Acadia expects to generate revenues between $930 million and $1.01 billion in 2024. The mid-point of the range is $970 million and was slightly ahead of the $966 million consensus.

Acadia Pharmaceuticals investor presentation

Nuplazid in Parkinson’s disease psychosis remains a low-growth cash cow with greater than $300 million in annual cash flows, and the company expects to end the year with a cash balance between $585 million and $655 million, up nearly $150 million at the low end and nearly $220 million at the high end of the range, from December 2023 levels.

Total revenue growth of 34% at the mid-point of the guidance range will exceed the guided 19% increase in total expense growth (also at the mid-point of the range), and we should see improved operating leverage throughout the year.

The improving financial position puts Acadia in a great position to continue to expand the pipeline through business development efforts.

Key pipeline catalyst expected in the next few weeks – phase 3 results of Nuplazid as an adjunct treatment of negative symptoms of schizophrenia

The other reason some investors are potentially shy about holding the stock is the phase 3 readout of Nuplazid as an adjunct treatment of negative symptoms of schizophrenia.

Adjunctive treatment of schizophrenia could be a more valuable indication than the current indication (Parkinson’s disease psychosis) but I also wonder what the access strategy will be given Nuplazid’s very high price tag for this population. I think it could be sold as a different brand and at a lower price.

My current assumption is that this indication could lead to Nuplazid sales doubling or more than doubling by the end of the decade, even if the price is lowered to facilitate proper payer coverage. Acadia estimates the U.S. population at approximately 700,000, and based on the current price of Nuplazid, each percentage point of the addressable population is worth more than $200 million a year. In other words, 5% market penetration would result in greater than $1 billion in annual net sales. But, as I said, I anticipate the price for this population will be lower.

The first study was successful, but the benefit was not exactly robust and I would not say the probability of success is high. The primary endpoint was barely met with a p-value of 0.043 for all doses combined, but the 34mg dose that the company took forward did demonstrate better efficacy and an effect size of 0.34 versus 0.21 (higher is better) for the combined population on the primary endpoint – the Negative Symptom Assessment score, or NSA-16. The key secondary endpoint – change in Personal and Social Performance (“PSP”) score was not met with no difference between Nuplazid and placebo.

These results do not exactly inspire confidence, but this does not mean the study is likely to fail. Based on the available data – the positive but barely statistically significant treatment effect on the primary endpoint – my probability of success estimate (which is only a subjective assessment) is slightly better than a coin toss at 55%.

The good news is that the current valuation does not assign a lot of value to this indication. I would even say no value at all, but we rarely see a stock trade flat or higher after a failed study, and I would expect a negative near-term reaction if the study fails. My best estimate for the near-term downside reaction is the stock falling to the high teens.

Risks

The key near-term risks are the commercial performance of Daybue and the outcome of the phase 3 trial of Nuplazid in schizophrenia patients. I do believe that these risks are more than priced-in at current levels and that Acadia could deliver shareholder value even if Daybue comes short of long-term expectations and if Nuplazid fails in the mentioned phase 3 trial. However, if Daybue underperforms sales expectations and if Nuplazid fails in the phase 3 trial in schizophrenia patients could negatively impact investor sentiment and the combination of these two risks materializing could probably drive the share price to as low as mid-teens.

Longer-term risks include ACP-204, the next-generation Nuplazid failing to show a treatment effect in the phase 2/3 trial in patients with Alzheimer’s disease psychosis, and other pipeline assets failing in mid/late-stage clinical trials. Increased competition in Acadia’s areas of commercial and clinical interest is also a long-term risk.

Conclusion

Concerns about Daybue’s growth trajectory and the upcoming high-risk readout of Nuplazid in schizophrenia patients may be weighing on Acadia Pharmaceuticals Inc. in the near term, but I continue to see a very good risk-reward setup at current levels for long-term investors. If we just look at Acadia’s commercial business, Daybue and Nuplazid should generate close to $1 billion in revenue in 2024 and up to $220 million in cash flow with continued upside in the following years, and this is despite the company intending to spend more than $300 million on research and development this year.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ACAD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article reflects the author's opinion and should not be regarded as a buy or sell recommendation or investment advice in any way.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.