Summary:

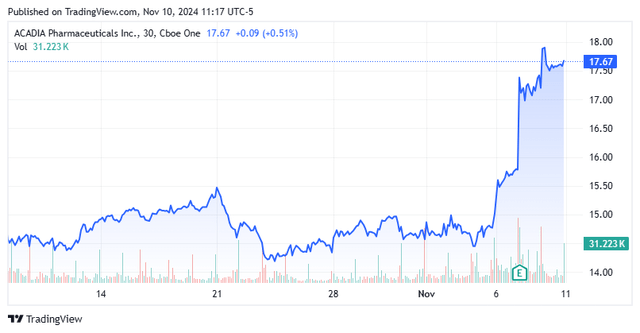

- Today, we are revisiting with mid-cap biopharma Acadia Pharmaceuticals Inc., whose stock surged some 20% last week following Q3 results.

- The company beat both top and bottom-line expectations and also posted updated FY2024 guidance.

- Acadia Pharmaceuticals is becoming profitable, has a pristine balance sheet, and is seeing solid growth.

- An updated analysis around ACAD stock follows in the paragraphs below.

Bill Oxford

Today, we are circling back to ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD). I called this mid-cap biopharma back in the “buy zone” when I posted an article on this name in June, and the sentiment on the shares were too bearish when the equity trading just above the $15.00 level. The equity staged a better than 20% last week after posting Q3 results that appear to prove the naysayers wrong. Let’s go to the tape and look at the company’s more than solid quarter. An update analysis follows below.

As a reminder, Acadia Pharmaceuticals has two primary products on the market. The first is Nuplazid, which was approved in 2016 and remains the only approved treatment for hallucinations and delusions associated with Parkinson’s Disease. Daybue came to market in the first half of 2023 and is the first-ever treatment approved for Rett Syndrome for patients two and older. The stock currently trades just under $18.00 a share and sports an approximate market capitalization of $2.95 billion.

Third Quarter Results:

November 2024 Company Presentation

ACADIA Pharmaceuticals posted its Q3 numbers on November 6th. They were more than solid. The company delivered 20 cents a share in GAAP earnings, six cents a share above the analyst firm consensus. The company lost 40 cents a share in Q3 2023, it should be noted.

November 2024 Company Presentation

Revenues rose just over 18% on a year-over-year basis to $250.4 million, meaning the company is now on an over $1 billion annual sales run rate. Sales were slightly above expectations for the quarter. Nuplazid continued to deliver consistent growth, with revenues increasing 10% from the same period a year ago to $159.6 million. Daybue revenues rose 36% to $91.2 million.

November 2024 Company Presentation

Leadership updated its FY2024 guidance. As you can see below, the midpoint for Daybue sales went down slightly, while the midpoint for Nuplazid revenues went up a tad. In addition, the midpoint for the range around its yearend cash balance went up noticeably.

November 2024 Company Presentation

There are a couple of interesting candidates within the company pipeline. The first is a compound called ACP-101 is targeting the hyperphagia commonly found in the rare disease Prader-Willi Syndrome. The company is currently enrolling patients in a global and pivotal Phase 3 study. More defined timelines will be given in early 2025, probably with fourth quarter results or soon thereafter.

November 2024 Company Presentation

In addition, the ACADIA Pharmaceuticals is currently enrolling a Phase 2 trial for its compound ACP-2024, which looks to build on the success of Nuplazid (pimavanserin). Timing around this study should come out at/around the same time as news around the ACP-101 study.

November 2024 Company Presentation

Acadia Pharmaceuticals does have a couple of other compounds in development, but they are too early stage to be germane to this analysis.

November 2024 Company Presentation

Analyst Commentary & Balance Sheet:

The analyst community is largely supportive of the stock. Since third quarter results hit the wires, nine analyst firms, including Needham, J.P. Morgan and RBC Capital have reissued Buy ratings on the stock. Price targets proffered range from $26 to $35 a share. Oppenheimer ($17 price target), Morgan Stanley ($20 price target) and Stifel Nicolaus ($18 price target) have chosen to maintain Hold ratings against the equity.

Approximately five percent of the outstanding float in the shares is currently held short. The company ended the quarter with approximately $565 million worth of cash and marketable securities on its balance sheet, and listed no long-term debt on the 10-Q that was filed for Q3. The company’s cash balance has risen just over $125 million in the first nine months of 2024 it should be noted.

Conclusion:

ACADIA lost 37 cents a share in FY2023 on just over $726 million in revenues. The current analyst firm consensus is for the company to deliver 61 cents a share in earnings in FY2024 as revenues increase to on $973 million in sales. They project earnings of 82 cents a share in FY2025 on eight percent earnings growth. Given Q3 results, earnings estimates will probably get taken up a tad in the coming weeks.

Even with last week’s approximately 20% rally, the stock is trading for approximately 2.5 times forward sales after subtracting the company’s net cash from its market cap. Given sales growth and a couple of intriguing pipeline assets being advanced, Acadia Pharmaceuticals Inc. stock still looks attractive at these levels and is throwing off increasing cash flow. The stock has been a successful covered call trade for my portfolio over the past couple of years, and that is the way I plan to continue to profit from this solid biopharma concern.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ACAD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Live Chat on The Biotech Forum has been dominated by discussion of lucrative buy-write or covered call opportunities on selected biotech stocks over the past several months. To see what I and the other season biotech investors are targeting as trading ideas real-time, just join our community at The Biotech Forum by clicking HERE.