Summary:

- Acadia Pharmaceuticals’ stock rose 20% after expanding rights to Rett syndrome drug Daybue, with projected increased sales for Q2 and Q3 2023.

- Despite a net loss of $43.0 million in Q1 2023, Acadia showed a 3% increase in Nuplazid’s net sales and significantly cut R&D expenses.

- The company’s expansion of Daybue rights and promising early performance have led to an adjustment of the investment recommendation from “Sell” to “Hold”.

Klaus Vedfelt/DigitalVision via Getty Images

Introduction

Acadia Pharmaceuticals (NASDAQ:ACAD) is a neuroscience-focused company with a 30-year history in the healthcare sector. It has made significant contributions to the field, notably in developing the first approved therapies for hallucinations and delusions associated with Parkinson’s disease psychosis, as well as a treatment for Rett syndrome. Currently, Acadia’s clinical research focuses on several areas, including the negative symptoms of schizophrenia, psychosis related to Alzheimer’s disease, and neuropsychiatric symptoms in central nervous system disorders.

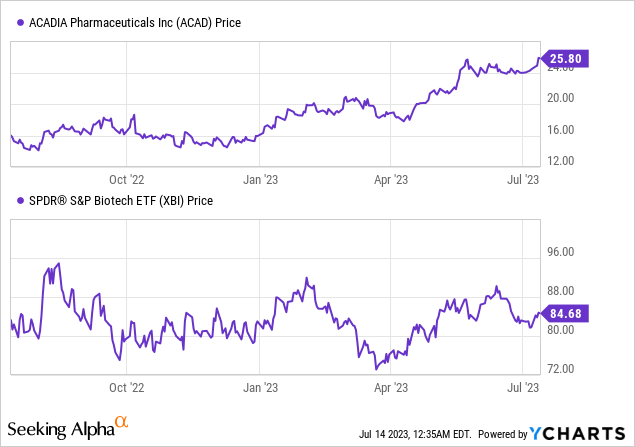

In my previous analysis, I noted that Acadia Pharmaceuticals, despite marginal financial progress between Q1 2022 and Q1 2023, faced an uncertain future due to continued net losses. Although Acadia had a robust cash position, the company’s primary product, Nuplazid, seemed to have reached a sales plateau, with potential risks from generic market entries looming. The newly introduced product, Daybue, while showing sales potential, may not significantly boost profitability due to high pricing, potential side effects, and impending payments to Neuren. Despite the company’s $3 billion enterprise value not indicating clear overvaluation, uncertainty over Nuplazid’s future, impending patent expirations, and Daybue’s unproven prospects led me to maintain a “Sell” recommendation. I suggested that investors closely monitor Acadia’s ongoing R&D, strategic shifts, and Daybue’s market acceptance to ascertain Acadia’s ability to overcome its current challenges. Since my “Sell” recommendation, shares of Acadia trade 19% higher.

Recent developments: Yesterday, Acadia Pharmaceuticals’ stock rose 20% in after-hour trading after acquiring expanded rights to the Rett syndrome drug Daybue, projecting increased sales for Q2 and Q3.

The following article revisits my thesis in light of these recent developments.

Q1 2023 Earnings

Before we begin, let’s review the firm’s most recent earnings report. In Q1 2023, Acadia Pharmaceuticals reported a slight 3% increase in Nuplazid’s net sales to $118.5 million, attributed to higher patient enrollments despite a 2% decrease in sell-in volume. The company significantly cut R&D expenses from $128.9 million in Q1 2022 to $69.1 million in Q1 2023, largely due to a prior payment to Stoke Therapeutics. SG&A expenses remained steady at around $100 million. Despite these improvements, Acadia still reported a net loss of $43.0 million, though this was an improvement from the $113.1 million loss in Q1 2022. As of March 2023, Acadia held $402.9 million in cash and equivalents, slightly lower than the year-end 2022 figure. The company reiterated its previous financial forecast, including Nuplazid net sales of $520-$550 million, R&D expenses of $235-$255 million, and SG&A expenses of $360-$380 million.

ACAD Stock Assessment

Per Seeking Alpha data, Acadia Pharmaceuticals has displayed notable stock momentum, outpacing the S&P 500 over the last year with a gain of 66.52%. Analysts forecast a shift towards profitability, with EPS expected to grow from -$0.53 in 2023 to $1.09 in 2025. This aligns with the steady revenue growth projections, from $557.90M in 2023 to $861.59M in 2025. However, Acadia’s high valuation metrics, such as the price/book ratio of 11.22 and EV/Sales of 7.43, suggest potential overvaluation at the current price. Despite the improving Gross Profit Margin at 29.08%, negative EBIT and Net Income Margins indicate ongoing profitability challenges. Acadia maintains a healthy balance sheet, with modest total debt and substantial cash reserves, offering operational flexibility.

Acadia Expands Licensing Agreement, Bolstering Global Leadership in Rett Syndrome Treatment

In a recent press release, Acadia Pharmaceuticals announced the expansion of its existing licensing agreement with Neuren Pharmaceuticals. This move extends Acadia’s rights to distribute the drug Daybue beyond North America, and grants them worldwide rights to Neuren’s drug candidate NNZ-2591, targeted at treating Rett syndrome and Fragile X syndrome. Furthermore, Acadia plans to file a New Drug Submission for trofinetide in Canada within the next 18 months. As part of the agreement, Neuren will receive an upfront payment of $100 million from Acadia, along with potential milestone and royalty payments.

Regarding sales projections, Acadia estimates Daybue’s net sales for the second quarter of 2023 to fall between $21-$23 million, and between $45-$55 million for the third quarter. Nuplazid, another Acadia product, is expected to generate net sales of $140-$144 million in the second quarter of 2023.

Upon reconsidering my preliminary analysis of Daybue’s market potential, I realize I may have been overly conservative. Initially, concerns about the drug’s high list price and potential side effects influenced my cautious outlook. However, the strong early market performance of Daybue suggests that the urgent need for a dedicated Rett syndrome treatment could override these concerns.

We must keep in mind that Daybue is in the initial stages of commercialization. While the early market response is positive, its long-term success is contingent on factors such as enduring market acceptance, long-term safety and effectiveness, and effective competition management.

An evident testament to Acadia’s confidence in Daybue is their recent acquisition of global rights to the drug. This strategic decision underlines their aim to serve a wider global patient population and indicates optimism about Daybue’s future market performance.

In light of these developments, it could be wise to adjust my initial sales forecasts upwards. Provided Daybue maintains its current market trajectory, the drug could meet, or possibly even exceed, the upper limit of my initial $675 million estimate. Despite this, it remains essential to maintain a cautious approach, with continuous tracking of Daybue’s market performance being key to making accurate future predictions.

My Analysis & Recommendation

The recent developments surrounding Acadia Pharmaceuticals, particularly its expansion of Daybue rights and promising early performance of Daybue, call for a reassessment of the company’s investment potential. The 20% after-hours stock appreciation underlines the market’s positive reaction to Acadia’s strategic moves and revised revenue projections. Despite previously holding a “Sell” recommendation due to uncertainties, it appears Acadia is taking steps to address its challenges, and the market response suggests confidence in its potential for long-term growth.

That said, it is essential to remain cautiously optimistic. Daybue is still in the early stages of its commercialization journey, and its long-term success will hinge on factors such as sustained market acceptance, safety profile, and competition. It will also be critical to monitor the progress of Acadia’s planned New Drug Submission for trofinetide in Canada and potential expansions into other markets.

Considering the company’s current market cap, its strong momentum, and promising sales projections, I believe that the recent stock appreciation is warranted. Therefore, based on these factors and in light of the recent positive developments, I am adjusting my recommendation from “Sell” to “Hold”. Investors should closely monitor Acadia’s performance and strategic moves in the coming months for further investment decisions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content only and should not be construed as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. Any predictions made in this article regarding clinical, regulatory, and market outcomes are the author's opinions and are based on probabilities, not certainties. While the information provided aims to be factual, errors may occur, and readers should verify the information for themselves. Investing in biotech is highly volatile, risky, and speculative, so readers should conduct their own research and consider their financial situation before making any investment decisions. The author cannot be held responsible for any financial losses resulting from reliance on the information presented in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.