Summary:

- Acadia’s Q1 2023 financials demonstrate marginal improvement when compared to the same period in 2022, with a slight increase in net product sales and notable cost reduction.

- Liquidity position appears stable, but ongoing losses may eventually pressure it. The company heavily relies on stock-based compensation, which could potentially dilute existing shareholders’ equity.

- Nuplazid sales are stagnant, and this trend is expected to continue until its key patents expire this decade, which may be further compounded by the potential entry of generic alternatives.

- The launch of Daybue, with a list price of $375,000, may not significantly boost profitability due to high pricing, potential side effects, and modest benefits over a brief duration.

- Acadia’s Q1 ’23 earnings report, which highlights its strong liquidity position, may be perceived positively by investors. However, this does not alter my original investment recommendation of “Sell.”

Juanmonino/E+ via Getty Images

Introduction

Acadia Pharmaceuticals (NASDAQ:ACAD) is a commercial-stage biotechnology company that specializes in developing treatments for central nervous system disorders. Among its FDA-approved products is Nuplazid (pimavanserin), which is used to manage hallucinations and delusions associated with Parkinson’s disease psychosis (PDP). Another product in Acadia’s portfolio is Daybue (trofinetide), a synthetic analog of glycine-proline-glutamate that was FDA-approved for treating Rett Syndrome on March 10.

In my previous assessment, I detailed a number of challenges confronting Acadia, such as the failure to broaden Nuplazid’s application to Alzheimer’s, plateauing sales, and an impending patent expiration. I also conjectured that even though trofinetide was projected to enter the US market, it might not considerably boost Acadia’s total worth due to the large milestone payments that would be due to Neuren once the FDA gave its approval. This could potentially necessitate further financing. I also pointed out the potential scenario where profits from trofinetide might not be fully realized until after Nuplazid had begun facing competition from generic alternatives. As a result, I advised to “Sell”.

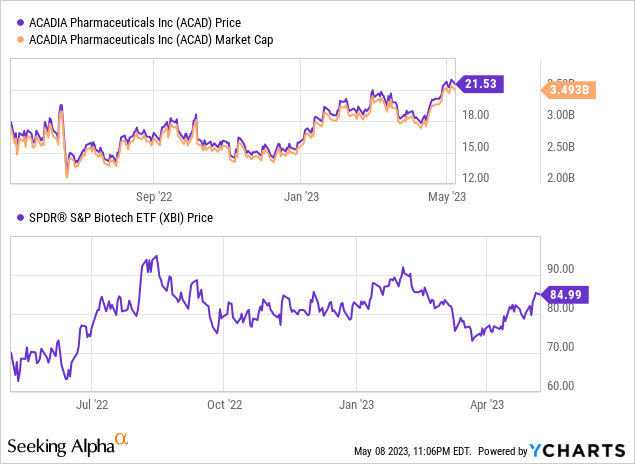

Since my February review, there have been several key changes, including a 14% surge in Acadia’s stock, FDA’s green light for trofinetide, and the unveiling of the company’s financial report for Q1 ’23.

This article will delve into the analysis of Acadia’s Q1 ’23 financial performance.

Acadia’s Financials

In Q1 2023, Acadia reported that Nuplazid’s net sales increased by 3% to $118.5 million compared to Q1 2022, mainly due to increased patient enrollments. However, the sell-in volume decreased by 2% due to reduced in-channel inventory. The company’s R&D expenses decreased significantly from $128.9 million in Q1 2022 to $69.1 million in Q1 2023, primarily due to a $60 million upfront payment to Stoke Therapeutics in 2022. SG&A expenses for Q1 2023 were almost the same as Q1 2022, with lower spending in the Nuplazid commercial franchise offset by Daybue launch investments, totaling $101.2 million and $96.7 million, respectively.

Despite the slight improvement in revenue and cost reduction, Acadia still reported a net loss of $43.0 million, or $0.27 per share, for Q1 2023, an improvement from Q1 2022’s net loss of $113.1 million, or $0.70 per share. The net loss in both periods included non-cash stock-based compensation expenses of around $15 million.

As of March 2023, Acadia had $402.9 million in cash and equivalents, which is slightly lower than the $416.8 million reported at the end of 2022. Additionally, the company reiterated its financial guidance from February 2023, which forecasted Nuplazid net sales between $520 and $550 million, R&D expenses between $235 and $255 million (including $20 million in stock-based compensation), and SG&A expenses between $360 and $380 million (including $45 million in stock-based compensation).

Acadia’s Q1 ’23 Analysis: Marginal Improvement Offset by Persistent Losses

Upon closer scrutiny, Acadia’s financial situation demonstrates marginal improvement when comparing Q1 2023 to the same period in 2022. Here are a few points to consider:

- Moderate revenue growth: Acadia’s net product sales saw a slight increase from $115.5 million in Q1 2022 to $118.5 million in Q1 2023. While this growth is modest, it does indicate some level of revenue expansion, possibly driven by increased patient enrollments.

- Net loss remains, albeit decreased: Acadia’s net loss was reduced from $113.1 million in Q1 2022 to $43.0 million in Q1 2023. While this is a substantial reduction, it’s crucial to note that the company is still operating at a loss. The reduction is mainly due to the $60 million upfront payment to Stoke Therapeutics in Q1 2022, which wasn’t a recurring cost.

- Liquidity appears stable, but net loss continues: Despite the net loss, Acadia’s liquidity position seems stable. As of March 31, 2023, the company had $402.9 million in cash, cash equivalents, and investment securities, down slightly from $416.8 million at the end of 2022. However, the ongoing losses could eventually pressure this liquidity.

- Relying heavily on stock-based compensation: Acadia seems to depend significantly on stock-based compensation, especially within its SG&A expenses. While this strategy might help retain talent and align employee interests with shareholders, it could also dilute existing shareholders’ equity.

Static Nuplazid Sales, Rising SG&A Expenses, and the Launch of High-Priced Daybue

Regrettably, Acadia’s Q1 report didn’t significantly change my viewpoint on the company. The sales of Nuplazid remain largely static compared to the previous year, and there is no forecast of this trend altering before key patents expire later this decade. While Acadia is anticipating Nuplazid data related to negative symptoms of schizophrenia this year, achieving such an indication is known to be particularly challenging.

The company’s SG&A expenses, already exceeding $100 million every quarter, are projected to rise with the ongoing launch of Daybue. Acadia’s list price for Daybue, at approximately $375,000, greatly surpasses my conservative calculation, yet aligns with the pricing of treatments for rare diseases. If we suppose that 20% of the 6,000-9,000 US Rett patients take Daybue at a cost of $375,000 annually, the estimated peak sales would range between $450 million and $675 million.

UpToDate, a prominent resource amongst clinicians, recommends that treatment decisions for Daybue should be personalized and involve collaboration between the treating clinician, family, and caregivers. This advice is founded on the results of the LAVENDER study, which UpToDate reports showed modest benefits over a brief duration and a significant incidence of side effects, particularly diarrhea. Furthermore, in my view, the high cost of the medication may present financial barriers for Rett patients. As a result, the estimates of $450 million and $675 million for Daybue are likely optimistic projections.

My Analysis & Recommendation

In conclusion, Acadia Pharmaceuticals’ outlook remains uncertain despite marginal financial improvements, including a slight increase in net product sales and notable cost reduction between Q1 2022 and Q1 2023. While the company still reports net losses, the magnitude has decreased. Although the liquidity position appears stable, ongoing losses may impact the company’s financial position in the long run. Nonetheless, investors can take encouragement from Acadia’s solid cash position, which provides the company with both opportunity and time.

Acadia’s flagship product, Nuplazid, has reached a sales plateau near $500 million, which is likely to persist until the key patents expire later this decade, indicating limited growth potential in the near term. With possible entry of generics into the market within a few years, Nuplazid’s sales could potentially take a significant hit in the coming years.

Meanwhile, Acadia’s new product, Daybue, has potential for peak annual sales of $500 million but may not significantly boost profitability due to its high pricing, potential side effects, and modest benefits over a brief duration. The profitability of Daybue may be further hampered by milestone payments and royalties due to Neuren.

Although Acadia’s enterprise value of around $3 billion does not indicate overt overvaluation, the company’s prospects remain uncertain due to the challenges surrounding Nuplazid, impending patent expirations, and the uncertain prospects for Daybue. Therefore, my investment recommendation for Acadia remains “Sell.”

Investors should monitor the company’s ongoing research and development efforts, potential changes in its strategic direction, and market acceptance of Daybue to gain more clarity on whether Acadia can overcome its current challenges and deliver long-term growth and value for its shareholders.

Risks to Thesis

When the facts change, I change my mind.

Although I hold a negative assessment of Acadia Pharmaceuticals at present, there exist several potential factors that could challenge this outlook:

- Stronger-than-expected sales for Nuplazid: While I believe its revenue may have peaked around $500 million per year, Nuplazid could exceed expectations due to increased prescriber acceptance or more eligible patients.

- Strengthened intellectual property: Acadia may enhance Nuplazid’s intellectual property or extend its patents, deterring generic competition.

- Successful expansion of Nuplazid’s application: If approved for use in other central nervous system disorders, Nuplazid could significantly increase revenue and growth potential.

- Positive results for Daybue in additional studies: If more studies demonstrate significant efficacy and fewer side effects, Daybue could see higher adoption and revenue for Acadia.

- Stronger-than-expected sales for Daybue: Despite my belief that $500 million in peak annual revenue is optimistic, Daybue could exceed those expectations, boosting Acadia’s profitability prospects.

- New product development: If Acadia develops a new product with strong potential for central nervous system disorders, it could lead to significant revenue and growth potential.

- Mergers and acquisitions: A larger pharmaceutical company that aims to expand its neurologic portfolio could acquire Acadia for a premium price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content only and should not be construed as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. Any predictions made in this article regarding clinical, regulatory, and market outcomes are the author's opinions and are based on probabilities, not certainties. While the information provided aims to be factual, errors may occur, and readers should verify the information for themselves. Investing in biotech is highly volatile, risky, and speculative, so readers should conduct their own research and consider their financial situation before making any investment decisions. The author cannot be held responsible for any financial losses resulting from reliance on the information presented in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.