Summary:

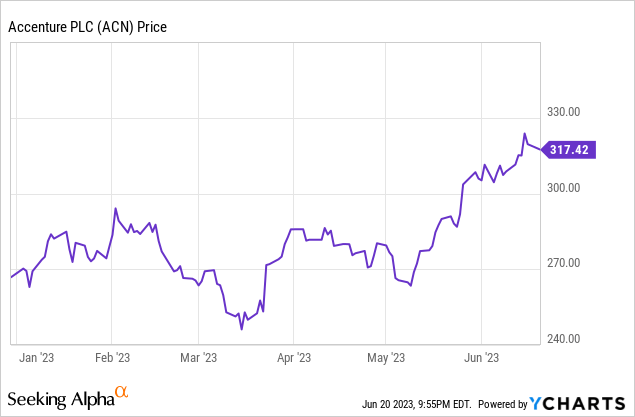

- Since my last coverage in February, Accenture has quietly rallied nearly 20% and is now trading near its 52-week highs.

- The AI industry has been progressing rapidly and the company is well-positioned to benefit from the exponential market expansion.

- The company is the leader in AI services and it has been expanding its presence through ongoing M&A and investments.

- The technology-neutral nature of the services segment makes the company a much safer AI bet compared to technology providers, in my view.

sanjeri/E+ via Getty Images

Investment Thesis

Accenture (NYSE:ACN) has risen nearly 20% since my previous coverage in February. While most investors have been focusing on tech companies like Microsoft (MSFT), Nvidia (NVDA), and Palantir (PLTR), I believe Accenture is also a major beneficiary of AI (artificial intelligence), which explains the recent rally.

The AI industry has been progressing quickly and its market size is poised to expand exponentially moving forward. Accenture plays an important role in the AI value chain and should be well-positioned to benefit from ongoing market expansion. It is also the leader in AI services with best-in-class capabilities, which creates a strong moat and competitive advantage.

AI And Accenture’s Market Fit

AI is no doubt the hottest trend in the market right now. Since the launch of OpenAI’s GPT-4 earlier this year, the AI industry has been moving rapidly. Different tech giants such as Google (GOOGL) (GOOG), Adobe (ADBE), and Salesforce (CRM) each released their respective generative AI technology while a lot of smaller companies also got into the mix. Unlike other recent trends including blockchain and the metaverse, the adoption of AI has been much faster and broader, as it is already demonstrating strong and clear value propositions.

For instance, GitHub’s Copilot (which leverages OpenAI’s Codex) has quickly become an essential tool for coding, while ChatGPT became the fastest application to reach 100 million monthly active users. According to Accenture’s report, 90% of business leaders are now leveraging AI technologies and 73% of them are prioritizing it over other digital investments.

Thanks to rising adoption and increasing use cases, the AI market is set to expand exponentially. According to Grand View Research, the global market size of AI is forecasted to grow from $136.6 billion in 2022 to $1.81 trillion in 2030, representing a CAGR (compounded annual growth rate) of 37.3%.

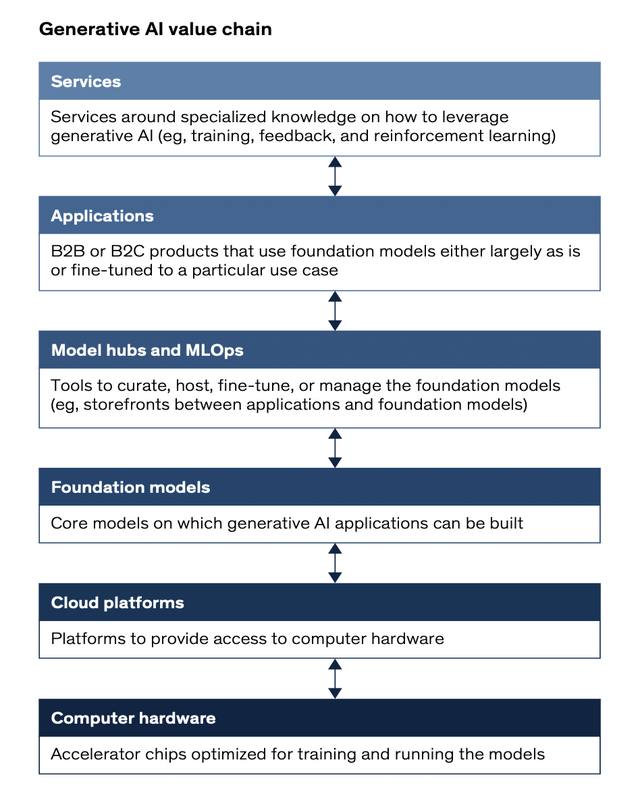

So where does Accenture fit into all of this? As shown in the illustration below by McKinsey, the current generative AI value chain can be categorized into computer hardware, cloud platforms, foundation models, model hubs & machine learning operations (MLOps), applications, and services.

Accenture specializes in the services segment, which is extremely important but often overlooked. While the other segments together create the AI technology, it is often too complex for businesses to implement the technology themselves. Accenture is essentially the bridge between them that helps with consulting, onboarding, optimizing, etc. As more companies adopt the latest AI technology, the demand for AI services should also grow accordingly.

The Leader In AI Services

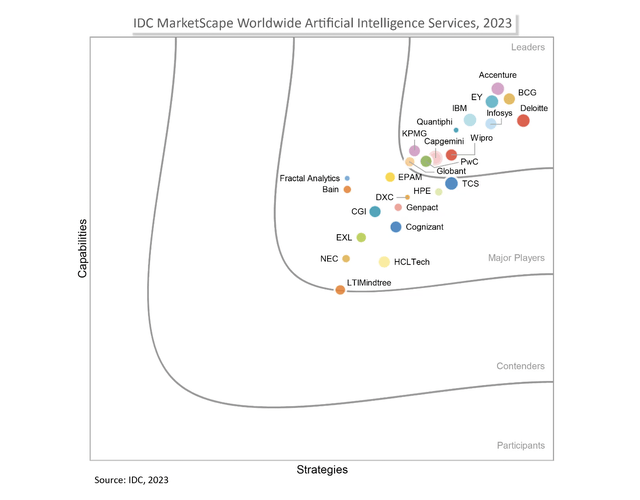

Accenture has been involved in AI services for a long period of time, which gives them a strong head start and competitive advantage. For instance, the company already owns more than 1,450 patents and pending patents around AI-related applications and solutions. As shown in the chart below by IDC, the company is currently the leader in AI services with best-in-class capabilities.

The company has also been expanding the segment through ongoing M&A (mergers and acquisitions). Over the past few years, it had completed around 10 AI-related acquisitions. In March, the company acquired Flutura, an Indian industrial AI company that specializes in plants, refineries, and supply chain operations. These acquisitions continue to advance the company’s technological capability and help meet different customers’ needs.

Earlier this month, Accenture announced its huge $3 billion investment in AI (across the next 3 years). The company is planning to launch AI Navigator, a generative AI platform that helps enterprises with AI strategy, use cases, decision-making, etc. It is also aiming to double its AI-related headcount to 80,000 and will continue to pursue acquisition and partnership opportunities. The ongoing M&A and investments should help the company better address rising demand and further strengthen its leading position.

Julie Sweet, CEO, on the recent AI investment:

Companies that build a strong foundation of AI by adopting and scaling it now, where the technology is mature and delivers clear value, will be better positioned to reinvent, compete and achieve new levels of performance. Our clients have complex environments, and at a time when technology is changing rapidly, our deep understanding of ecosystem solutions allows us to help them navigate quickly and cost-effectively to make smart decisions.

Investor Takeaway

Accenture is a great pick-and-shovel play for AI. I generally prefer companies operating in the services segment as their technology-neutral nature makes them much less risky compared to technology providers. It is way too hard and early to tell which provider will end up having the best AI technology, especially with competition increasing rapidly. Accenture is a much safer bet as it can benefit from market expansion regardless of who ends up winning.

I am bullish on the company’s long-term growth prospects, but investors should also be prudent about the near-term outlook, as macro uncertainty is still a risk at the moment. While the AI momentum will likely continue, companies are going to become more nimble and conservative in spending if the economy were to slow meaningfully, let alone a recession. The company’s valuation is also less compelling after the meaningful rally. I reiterate my buy rating on Accenture amid the strong prospects, but I believe investors can be patient and wait for a more favorable price point before jumping in.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.