Summary:

- Accenture reported its fiscal Q1 earnings with EPS beating expectations.

- The company is seeing strong client demand for projects to implement new AI tools.

- We like the stock with an expectation for firming margins and climbing earnings as a tailwind into 2024.

courtneyk

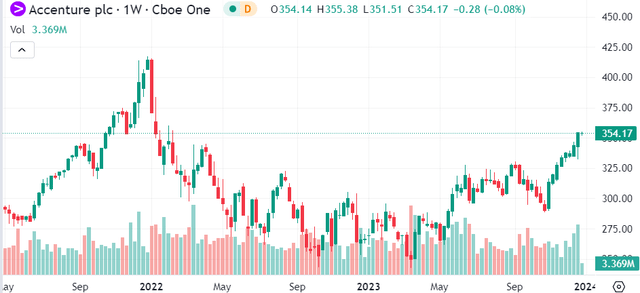

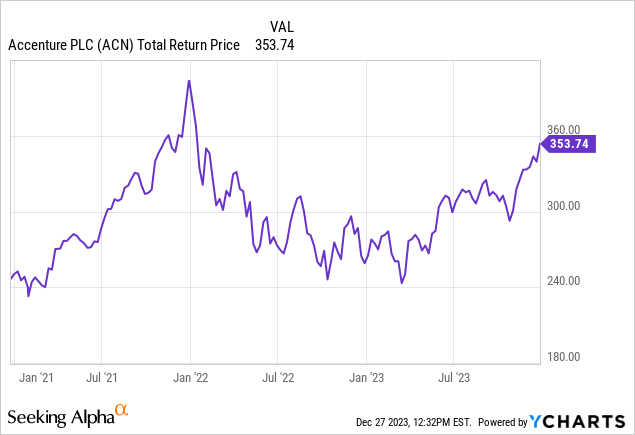

Accenture PLC (NYSE:ACN) emerged as an impressive turnaround story this year with shares climbing more than 30%, reversing the bulk of its 2022 selloff. The consultancy giant has benefited from resilient macro conditions while driving earnings growth through solid financial execution.

Notably, Accenture has embraced artificial intelligence as a new growth driver supporting client demand in various sectors. Indeed, the company reported its latest quarterly results with EPS beating expectations, sending shares to a near 2-year high. We believe an ongoing shift towards these areas of value-added technologies can lift shares higher into 2024.

ACN Q4 Earnings Recap

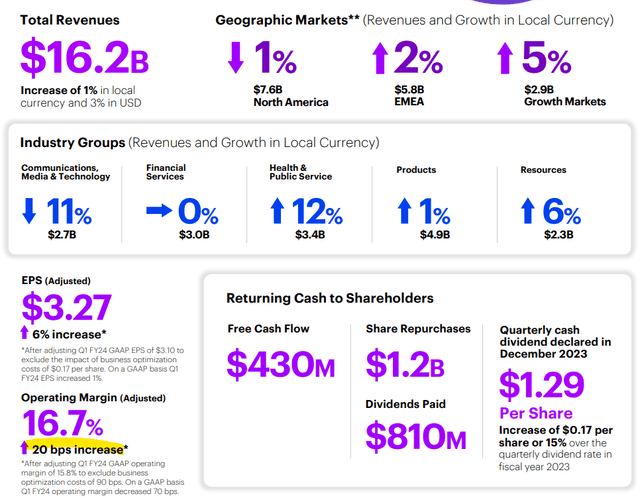

ACN reported fiscal Q4 EPS of $3.27, up 6% year-over-year, and also $0.14 ahead of consensus. Revenue of $16.2 billion climbed by 2.9% y/y, with the context being mixed trends from various segments.

While sales were down -1% in the North American region, that was balanced by a 2% growth from EMEA and a 5% increase from growth markets. Within those figures, the “Health & Public Service” industry was a strong point with 12% revenue growth, while the core “products” side delivered a 1% increase.

We mentioned generative AI as a big theme for the company. Management explained that demand for “GenAI” sales has accelerated, even since the prior quarter, with a good response to the launch of Accenture’s specialized service. This includes adding headcount in key roles to enhance the firm-wide expertise expected to add operating momentum over the decade. From the earnings conference call:

We continue to take an early leadership position in GenAI, which will be an important part of the reinvention of our clients in the next decade. Last quarter, we shared that we had sold approximately 300 projects with $300 million in sales in all of FY ’23. Demand continued to accelerate in Q1 with over $450 million in GenAI sales.

As you know, we are investing $3 billion in AI over three years. For many of our clients, 2023 was a year of generative AI experimentation. We are now focusing on helping our clients in 2024 realize value at scale.

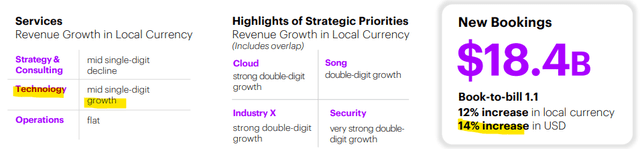

Beyond the Q1 headline revenue and EPS numbers, the impact of this push towards AI is already evident. New bookings at $18.4 billion this quarter are up 14% y/y, with recent client wins including a major engagement with McDonald’s Corp (MCD) to incorporate AI at restaurant locations.

That shift towards “technology” outpacing legacy strategy and consultancy is also translating into higher margins. The operating margin at 16.7% is up 20bps from Q1 fiscal 2023. Free cash flow this quarter at $430 million has also increased from $397 million in the period last year.

What’s Next For ACN?

What we like about Accenture is the sense that the company is uniquely positioned to capitalize on what remains the early innings of the transformative opportunities in AI.

Simply put, large enterprises and small businesses, along with public sector agencies, that often lack technical proficiency can look to Accenture as the starting point to begin implementing AI tools. The idea with generative AI is that all types of business processes can be improved through automation, adding operational and financial efficiencies while enhancing the customer experience.

The company highlights how clients in 2023 just began to acknowledge this newfound urgency to scale AI, and the expectation is that more projects will be greenlit into 2024 and beyond.

By this measure, the bullish case for ACN is that the growth over the next several years can exceed current expectations as a catalyst for the stock to climb higher.

According to consensus, Accenture is expected to see 3% revenue and 5% EPS growth this year, which is in line with the latest management guidance. That pace should pick up toward the double-digit range by fiscal 2026. We believe these forecasts may prove to be conservative, particularly on the earnings side, if Accenture can drive margins higher as it scales the AI projects.

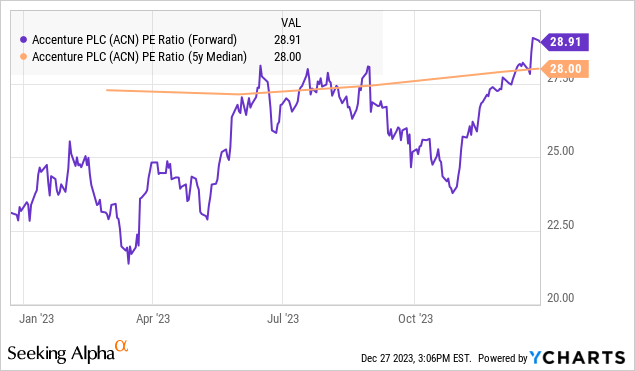

In terms of valuation, ACN trading at a 29x forward P/E is slightly above the 5-year average for the multiple closer to 28x. At the same time, we believe this spread and higher premium are justified considering the expected earnings momentum and leadership within “AI consulting”.

Keep in mind that the stock has overall solid fundamentals, including a balance sheet position with more than $4 billion in net cash. The company has also been generous with shareholder payouts, including buying back more than $1.2 billion in shares during Q1 and distributing $800 million in dividends. On this point, the quarterly dividend of $1.29 was increased by 15% from the prior amount and yields 1.5% on a forward basis.

ACN Stock Price Forecast

We rate ACN as a buy with a price target for the year ahead at $400, representing a 30x multiple on the current consensus fiscal 2025 EPS of $13.39. The way we see it playing out is that through the calendar year 2024, there is some room for ACN to grow into its valuation.

The modest 13% upside from the current level recognizes what has already been a breathtaking rally from under $300 just a few months ago while looking ahead to results over the next few quarters. It will be important for the company to confirm the AI momentum is translating into stronger earnings with the operating margin being a key monitoring point.

On the downside, the main risk to consider would be a deterioration of the economic environment as undermining the sales outlook. Weaker-than-expected results would open the door for shares to reset lower.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click for a two-week free trial.