Summary:

- Accenture plc has a solid financial foundation, minimal debt, and a commitment to returning capital to shareholders through dividends and buybacks.

- Accenture presents an attractive investment opportunity, trading at a reasonable valuation of around 21 times next year’s projected free cash flow.

- While revenue growth rates have moderated to single-digit figures, the company’s robust profitability, and commitment to returning capital to shareholders, bolster its investment appeal.

VioletaStoimenova

Investment Thesis

Accenture plc (NYSE:ACN) is a large professional services company known for helping leading businesses and governments build their digital operations. Their operations are roughly split between consulting and managed services.

The business’ strongest growth days are now in the rearview mirror. That’s the negative aspect facing this business. But on a positive note, the business is clearly highly free cash flow-yielding.

Furthermore, not only is its balance sheet rock-solid, but also, its valuation at 21x next year’s free cash flows is far from exuberantly priced. Altogether, there are many positives here.

Accenture’s Near-Term Prospects

Accenture is a large global professional services company that specializes in helping businesses, governments, and organizations navigate the digital landscape. You can think of them as a very broad consulting firm.

Accenture bases its value proposition on its ability to help customers build their digital core, streamline processes, and improve citizen services. Accenture operates across a vast geographic expansion with a presence in 120 countries.

They seek to provide tangible value for clients and their stakeholders, through their ecosystem relationships, and innovation hubs.

Accenture operates by managing various business processes on behalf of clients, specializing in enterprise functions such as finance, procurement, and supply chain. They facilitate organizational reinvention through their cloud platform, SynOps, which employs human and machine-based capabilities.

Recently, Accenture has made significant investments in AI. More specifically, Accenture has made a $3 billion investment in AI, which will see them doubling their data and AI workforce and expanding their Center for Advanced AI. Next, putting its narrative aside, its growth prospects don’t exude quite the same level of sparkle, which we’ll discuss next.

Revenue Growth Rates Leave Much to be Desired

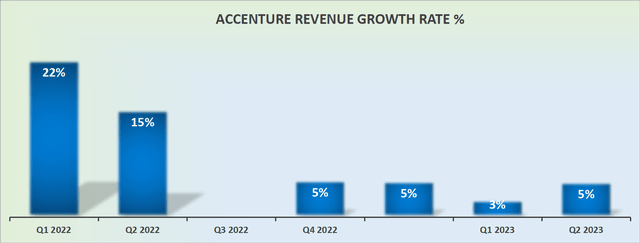

ACC revenue growth rates, GAAP figures, not currency-adjusted

As you can see above, Accenture’s growth rates are now pointing to around single-digit CAGR.

However, we slice and dice its near-term prospects, investors will no doubt look back longingly to the start of Accenture’s fiscal 2023 guidance when Accenture’s growth rates were expected to come in at around 10% to 11% this fiscal year (fx-adjusted).

A few quarterly results later and now we can see that its full-year guidance is expected to be slightly lower at 8% to 9% (fx-adjusted). In other words, it’s not only the impact of currency plaguing its results, it’s also the fact that growing at more than $16 billion in revenues per year is a tough feat.

And yet, as its growth rates mature, investors will need to refocus their lens on its underlying profitability, because that’s attractive.

Profitability Profile is the Crown Jewel Here

Here are two positives. The positives undoubtedly include the fact that Accenture’s balance sheet is squeaky clean. The business carries an immaterial amount of debt and close to $8 billion of cash. This means that even if there are problems with the business’ growth prospects, the business is on a very strong financial footing.

The other noteworthy positive consideration is that Accenture reaffirms its commitment to returning cash to shareholders as part of its financial objectives. Approximately half the capital return comes via dividends and the other half via buybacks.

However, to be frank, this is not a high dividend-yielding stock, as its dividend yield stands at 1% yield. On the other hand, its dividend did increase by 15% y/y, which further reflects management’s determination to return capital to shareholders.

What’s more, Accenture notes that it still has $3.5 billion worth of share repurchases authorized, which again echoes my overall contention, that there are capital returns coming back to investors.

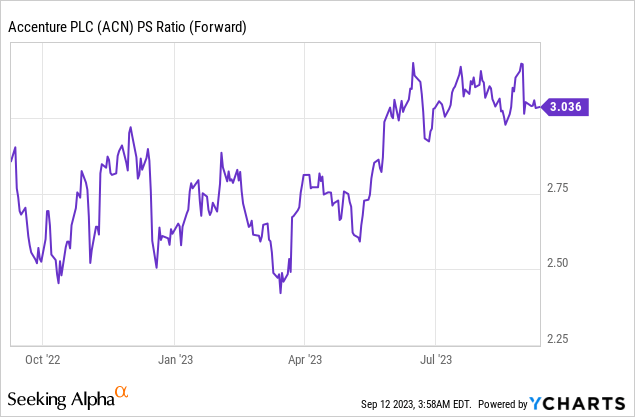

If I were to highlight one pesky detraction from the bull case, it would be reflected below.

What you see above, the multiple that investors are paying for Accenture has recently expanded. That being said, according to my estimates, the stock is priced at roughly 21x next year’s free cash flow. I don’t believe that’s a stretched valuation for a high-quality business.

The Bottom Line

Accenture maintains a robust balance sheet, ensuring financial stability even amidst growth challenges. Furthermore, Accenture is committed to returning capital to shareholders through a balanced approach of dividends and buybacks, with $3.5 billion in authorized share repurchases. Despite a modest dividend yield of 1%, this reflects management’s dedication to shareholder returns.

Meanwhile, although the stock’s valuation multiple has expanded, it currently trades at approximately 21 times next year’s projected free cash flow, which is a fair and reasonable multiple for a high-quality business. Despite some growth rate challenges, Accenture’s strong profitability, global reach, and strategic investments position it favorably for continued success. I’m bullish on Accenture plc stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.