Summary:

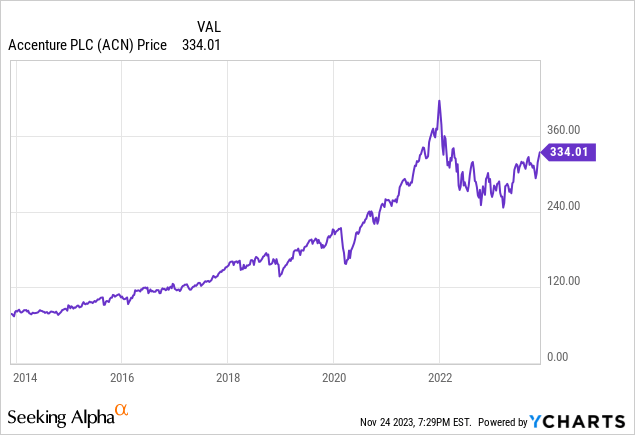

- Accenture’s valuation is starting to look expensive at a forward P/E of 27.5x, considering fiscal year 2024 guidance of only 3% to 6% EPS growth from management.

- Accenture’s latest fiscal year results showed only a 4% increase in revenues, down significantly from recent highs in 2021 and 2022.

- Accenture has a history of profitability and growth, with impressive ROE and ROIC, but the company is cyclical along with the global economy.

JHVEPhoto

Accenture (NYSE:ACN) is a great growth company with a growing track record and bench of consultants. At 31.0x TTM P/E the company is expensive given weak guidance for 2024 but shares are still 19.4% off all-time highs reached in December 2021.The company’s services are sticky, as not only does this consulting firm help some of the largest companies across the world become more efficient, but they also act as outsource partners who help achieve those efficiencies through ongoing offshoring of shared services. This article will explore Accenture’s recent results and historical profitability.

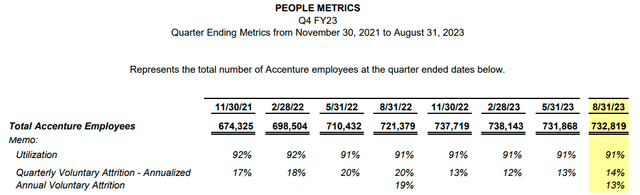

Now with a whopping 732,819 employees globally (down slightly from recent highs of 738,143 reached in February 2023), Accenture has a storied past and traces its roots back to the 1950’s as the business and technology consulting division of accounting firm Arthur Anderson. The separate consulting division later became a separate company which contractually paid 15% of operating profits back to Arthur Anderson. When the parent company accounting firm started competing with them on consulting services, the company took Arthur Anderson to arbitration with the International Chamber of Commerce in 2000 and as a result of the agreement broke all contractual ties with Arthur Anderson and changed its name to Accenture (derived from “Accent on the future”).

Accenture Employee Highlights (company Fiscal 2023 Infographic)

Accenture then had an IPO in July 2001 at a price of $14.50 to begin its life as a public company and has given investors a total return of 1,662% since that date for an annualized compounding return of approximately 13.7%. Arthur Anderson, however, later went out of business with its demise starting in 2002 following the Enron accounting scandal where the firm was charged for obstruction of justice from document shredding.

Latest Fiscal Year Results

Accenture last reported Q4 and full fiscal year earnings for the quarter August 31 on September 28, 2023 showing Q4 revenues of $16.0 billion which was an increase of 4% in both U.S. dollars and local currency. For the full fiscal year, revenues were $64.1 billion which was an increase of 4% in U.S. dollars and 8% in local currency. Driving the revenue gains in Q4 were the company’s Health & Public Services segment with revenues of $3.3 billion (+13%) and Resources segment revenue of $2.2 billion (+10%); partially offset by Communications, Media, & Technology revenues of $2.7 billion (-12%). Geographically, Europe with total revenues of $5.3 billion showed the largest revenue gains up 7%, with North American revenues of $7.6 billion increasing only 1%. The company’s other catch-all Growth Markets geography of $3.1 billon continued its strong growth being up 6%.

Revenue Highlights by Segment (company Fiscal 2023 Infographic )

Moving down the income statement, full year GAAP operating margin was 13.7%, showing a 150 basis point decrease compared to 15.2% in fiscal 2022. Adjusted operating margin expanded 20 bps to 15.4% with Q4 adjusted operating margin also expanding 20 bps to 14.9%. Q4 GAAP EPS was $2.15 (+21%) and management’s adjusted EPS was $2.71 (+4%). For the full fiscal year, GAAP EPS of $10.77 (+0.6%) was roughly flat with adjusted EPS of $11.67 showing strong gains up 9% YoY.

Given the annual growth, management increased the quarterly dividend 15% to $1.29 per share which now represents a forward dividend yield of 1.54% at the current $334.04 share price. Accenture’s shareholder returns don’t stop there though as the company repurchased $4.3 billion of its own shares in the past year ($2.8 billion net of share issuances). At today’s $209.8 billion market cap, the net share buybacks add another 1.33% to the cash being returned to shareholders. This looks set to continue as the board approved $4.0 billion of additional share repurchases in the latest quarter.

During 2023, Accenture invested approximately $2.5 billion across 25 acquisitions which management expects will drive inorganic growth of about 2% and help revenue growth to be in the range of 2% to 5% over fiscal ’23. Management expects adjusted EPS for next year to be in the range of $11.97 to $12.32 which represents a 3% to 6% growth rate over 2023 results. At today’s $334.04 share price this represents a forward P/E of 27.5x (earning yield of 3.6%) at the midpoint of $12.14.

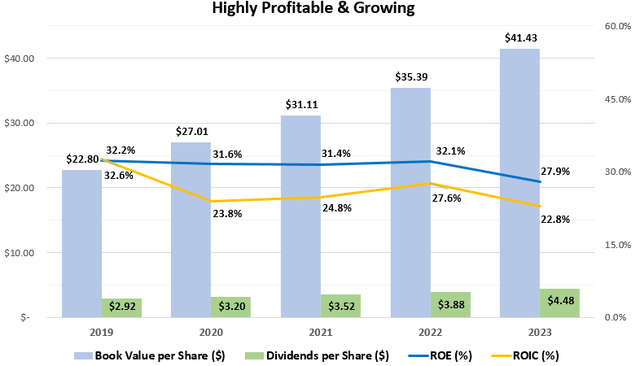

Highly Profitable & Growing Fast

Accenture’s, scale and expertise allow it to work with some of the largest corporations globally to share best practices and drive efficiencies in their operations. Since 2019, the company has earned impressive ROE and ROIC of 31.1% and 26.3%, respectively. Profitability levels have come down slightly in the latest 2023 fiscal year to 27.9% ROE and 22.8% ROIC, but this is more a factor of growing capital in the business rather than reduced profitability. Gross profit margins and net income margins remain strong at 32.3% and 10.7% compared to their 5-year average of 31.8% and 11.2%, respectively.

Profit & Growth Highlights (compiled by author from company financials)

In terms of growth, book value per share has grown from $22.80 in 2019 to $41.43 in the latest year. When combined with dividend paid out, this growth approximates 29.2% which further supports the ROE average. Over the period, revenues have grown from $43.2 billion to $64.1 billion for growth of 10.4% with the per share revenue growth of 10.9% being even better due to the share repurchases over the period. Notably, revenue growth is down sharply in recent years from highs of 14.0% in 2021 and 21.9% in 2022 to the 4% in the latest year discussed earlier. EPS and dividend growth have averaged 10.0% and 12.3%, respectively over the 5-year period. The 42% dividend payout ratio in the latest year leaves lots of room for potential growth.

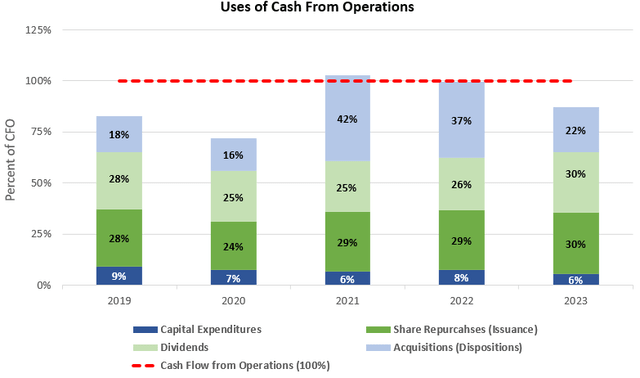

Great Cash Flows with Low CapEx Needs

Accenture’s service business is not very capital intensive and allows for great cash flows, even when considering acquisitions are a significant and regular part of the budget. As can be seen in the graph below, capital expenditures and acquisitions only used up on average 7% and 27%, respectively, of cash flow from operations since 2019. With average cash flow from operations of $9.4 billion over the past five fiscal years, this 34% would imply free cash flow to shareholders of $830 million for around a 2.7% free cash flow yield at the current $209.2 million market capitalization.

Cash Flow Analysis (compiled by author from company financials)

While this 2.7% FCF yield might not sound too impressive to value investors, adding the +10% historic growth discussed earlier starts to make the valuation look reasonable. I have confidence that this growth can continue as with only 7% being spent on regular capital expenditures, Accenture has plenty of room to pursue acquisitions to continue their great growth trajectory which is exactly what the company has been doing.

Comparison to Peers

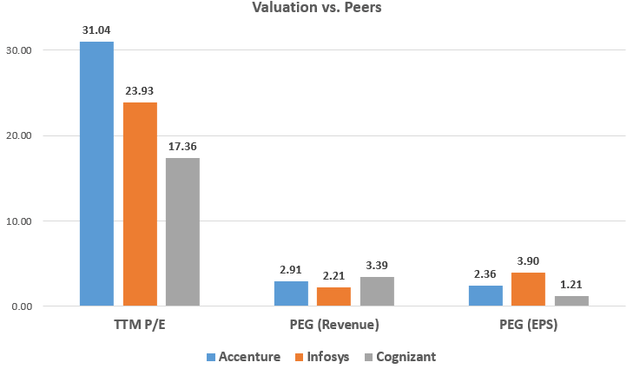

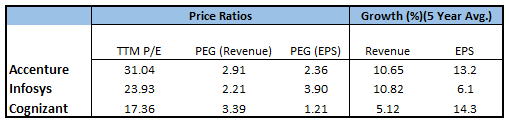

To get an idea of how Accenture’s valuation compares to other peers in the industry, I have highlighted a few main metrics below against Infosys (INFY) and Cognizant (CTSH). Accenture’s valuation is by far the most expensive at 31.0x TTM P/E which is over 78.8% higher than smaller rival Cognizant. Accenture’s growth rates start to explain some of the valuation discrepancy but the company still looks expensive on an absolute basis with PEG ratios above 2x. As mentioned earlier when discussing the latest quarterly results, management’s growth forecasts for next year are moderating with EPS growth expected to be only around 4.5%. Given the forward guidance I wouldn’t be surprised if Accenture’s multiple continues to contract in the short-term until the global economy improves and clients can loosen their purse strings.

Peer Valuation Comparison (compiled by author from Seeking Alpha and market data)

Peer Valuation Comparison (compiled by author from Seeking Alpha and market data)

Takeaway for Investors

Accenture is a global consulting behemoth that works with many of my companies worldwide but their valuation is starting to look expensive at a forward P/E of 27.5x. Revenue growth has slowed in recent years from 2020 and 2021 highs of 14.0% and 21.9%, respectively, to only 4% last year with similar guidance for fiscal year 2024. While Accenture’s services are essential and sticky, their business is still cyclical with the global economy. I expect the company to continue being nicely profitable in the coming years but the valuation is looking hard to justify given forward guidance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: While the information and data presented in my articles are obtained from company documents and/or sources believed to be reliable, they have not been independently verified. The material is intended only as general information for your convenience, and should not in any way be construed as investment advice. I advise readers to conduct their own independent research to build their own independent opinions and/or consult a qualified investment advisor before making any investment decisions. I explicitly disclaim any liability that may arise from investment decisions you make based on my articles.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.