Summary:

- As technology and technological services become increasingly complex, ACN’s wallet share, market, and margins stand to improve.

- ACN technology niche and expertise lead to growth potential that outclasses its main competitors.

- Its risk is low for a technology-related company due to a sticky clientele and high barriers to entry; steep declines are unlikely even if growth prospects are not fully realized.

- ACN offers a sizable, sustainable dividend with room for growth and has a history of buybacks, which present it as an excellent long-term hold.

VasukiRao

Editor’s note: Seeking Alpha is proud to welcome Marcos Rodriguez as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Down from its TTM high of $392.19 to $269.21, Accenture (NYSE:ACN) still possesses solid fundamentals, growth prospects, and other benefits that make it a worthy consideration for a buy and hold long position. I recommend ACN as a buy for a number of reasons.

Moat and Competitive Advantage

Accenture occupies a unique intersection of the consulting and tech/IT industries, a position it has exploited to carve out a niche – but significant – market with limited competition (mostly IBM (IBM), Deloitte, and McKinsey & Co.). Accenture’s moat has several aspects.

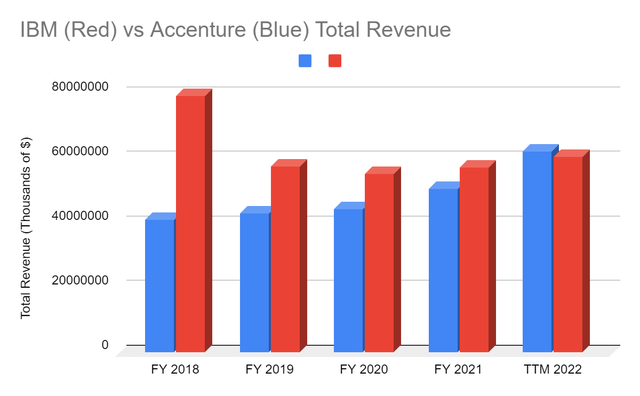

In the consulting space, reputation is of the utmost importance. In this area, Accenture shines. Though reputation is a largely intangible asset, Accenture has become known for its reliability and expertise in technology and thus has become a top name when it comes to tech consulting. This can be seen through comps analysis, as Accenture is the sector leader in TTM revenue (at least among publicly traded companies; the closest in revenue is IBM). Morningstar also cites Accenture as the industry leader in diamond contracts, generally defined as $100 million per year or more.

Since technology is likely to grow increasingly complex with the advancement of fields such as the cloud or quantum computing (Accenture offers cloud and quantum services), the company’s tech-heavy business model should benefit its wallet share among its largest clients. This is because Accenture will be able to offer more services to its existing enterprise customers, which I anticipate will boost their net dollar expansion rate and improve margins. I predict the same technological growth might also attract established, aging enterprises wishing to modernize or optimize their operations as potential clients.

Furthermore, as with many consulting/technological service firms, Accenture benefits from sticky clients. High switching costs mean that Accenture’s clients, especially those with larger contracts, are very unlikely to switch providers. This contributes to Accenture’s moat specifically because of the aforementioned leading number of diamond contracts, which means that Accenture, more than other firms, has loyal clientele who are loathed to make such an enormous buyout and restructure their technological services. This secures their revenue base.

Other elements of Accenture’s moat include their scale, including an extensive collection of patents (nearly 7,000 active) and one of the largest workforces in the industry, numbering around 730,000. This is relevant because there are returns to scale in terms of intellectual property and workforce to provide necessary services. In other words, there are services that Accenture can perform easily due to superior software, IP, and intellectual capital that other companies struggle to provide due to a lack of IP or a qualified workforce. These factors enable them to upgrade and service enterprise technology more effectively than other consulting firms, implying a sustainable competitive advantage.

This provides high barriers to entry for small firms and a competitive advantage over established firms that do not focus as heavily on technological services. The notable exception to this is IBM, which is rich in IP, but their specialties are more diverse and recent financial performance is much poorer, as discussed below. I find Accenture’s moat to provide a high level of security to their margins and revenue base, subsequently limiting risk. This is a major factor in my long-term buy suggestion, as Accenture’s downside is severely limited, while its growth potential is promising.

Key Metric Examination and Implied Growth

While Accenture’s moat is a major contributor to its low risk, Accenture’s financial performance (especially when compared to its publicly traded competitors) offers even more security. Total revenue has increased at an incredible rate, leaping from ~$35 billion in 2017 to ~$62 billion in 2022. This has been accompanied by a concurrent increase in operating profit, improving from $4.6 billion in 2017 to nearly $9.4 billion in 2022, implying that the additional revenue generation is not at the cost of margins. Accenture also boasts a diluted EPS of 10.87, compared to 5.44 in 2017. Accenture’s P/B and P/E ratios are promising, at 7.31 and 23.89, respectively. Although these values may seem high at first glance, they are justified by Accenture’s rising EPS and the high industry average P/B and P/E. While these metrics are not perfect, they do imply that Accenture is trading at price at least close to fair for its industry.

Accenture’s D/E ratio hovers around .11, very healthy for their level of recent revenue growth, and their balance sheet also shows fair management of assets/liabilities and cash on hand. Future revenue growth is projected at 7.7% YoY through FY 2024, and gross profit (7.2%), as well as diluted EPS (9.64%), also have healthy growth projections (estimates via FactSet composites). This suggests Accenture’s financial health is stable, and growth is likely despite their low risk. IBM is compared below in several metrics, putting Accenture’s financial prospects into perspective to a competitor of comparable market size.

|

Metric |

ACN Value (IBM Value) |

|

P/E |

23.89 (95.24) |

|

P/B |

7.31 (6.47) |

|

EPS (Diluted) |

11.01 (8.87) |

|

D/E |

.11 (2.34 |

|

Net Profit Margin |

11.49% (2.27%) |

Note: All data has been sourced or calculated based on data sourced from IBM’s and Accenture’s 10-K and 10-Q forms.

I would also note that Accenture’s P/E has not yet returned to its 2021/2022 peaks, despite a strong first-quarter showing. This implies to me, once again, that the current price is fair for a long-term buy. I do not wish to imply that Accenture is necessarily undervalued, as FactSet composites suggest analyst opinions are split (leaning buy-heavy). Rather, its current price is fair enough to justify a buy due to its long-term growth prospects and beneficial shareholder treatment.

Shareholder Benefits

The icing on top of the ACN cake is Accenture’s treatment of investors. Accenture’s dividend per share is $1.12 per quarter as of FY 2023, a healthy enough dividend yield of nearly 1.7%. Promisingly, this payout is only 37% of earnings (29% of FCF), implying sustainability. Even better is the room for dividend growth implied by impressive EPS and earnings retention. Accenture has improved its dividend by ~13% per year on average for the last 10 years, which again implies that there is substantial potential for later dividend growth. This, combined with the stability and low risk of the stock, provides another argument for going long ACN.

Coupled with its dividends, Accenture continued a healthy trend of buybacks last quarter, purchasing nearly $1 billion in shares outstanding. Accenture has historically bought back at least $1-2 billion per full year since 2010, implying healthy earnings and limiting any potential dilution. Accenture thus appears as a low-risk stock with growth potential that is somewhat reasonably valued, sweetened by a healthy dividend and habitual share buybacks – very enticing for a long position.

Risks and Other Considerations

As I’ve mentioned several times, a major factor in my buy recommendation is Accenture’s low risk. Despite this, potential risks still exist.

As with any company, a negative event of any kind (e.g., a data breach or executive scandal) could damage Accenture’s reputation and prompt the flight of existing clients while precluding Accenture from acquiring new ones, which would be catastrophic for the company’s growth. I find this risk limited, given that it is nearly impossible to predict or avoid (though, should such an event occur, it would affect Accenture significantly more negatively than it would another corporation).

Other risks could include reverse growth in extended periods of economic downturn should companies slash consulting expenses, though, with a long position, this risk is somewhat negligible. I don’t anticipate any potential 2023 recession to be extensive enough to significantly threaten Accenture. It should also be noted that if projected growth fails to be realized, Accenture might underperform the broader index, even though realized losses are unlikely. However, given the security of their revenue base and growing industry, I do not anticipate this to be the case.

In my view, Accenture’s sustainable competitive advantage secures their market share and limits risk within the industry, limiting their risk exposure to broader economic conditions.

Conclusion

I find the current share price to be reasonable given Accenture’s financial performance and analyst estimates/price projections. Furthermore, I am impressed with Accenture’s competitive advantage, recent and projected growth, and industry tailwind. The combination of these factors and a healthy dividend/minimal share dilution inform my buy and hold suggestion for Accenture.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ACN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.