Summary:

- ACN shares have fallen roughly 33% from their 2021 highs north of $400/share.

- Today, ACN trades for roughly $275.00/share, which is in-line with my fair value estimate.

- I expect to see continued double digit dividend growth from ACN moving forward.

VasukiRao

As I said in my last article, due to several ominous storm clouds on the horizon, my desire is to accumulate shares of the highest quality companies on Earth.

Ideally, I’m looking for low beta blue chip dividend growth stocks that benefit from secular tailwinds which are also trading with attractive cash flow multiples attached to them.

In other words, I want to own stocks that have the potential to protect capital during bear markets, compound my wealth during bull market periods, and provide me with predictable shareholder returns over the long-term.

Oh, and I don’t want to overpay for them.

That’s not too much to ask… right?

I mean, it’s cool to have your cake and eat it too… isn’t it?

You might be thinking that all sounds too good to be true.

Admittedly, there aren’t a lot of stocks that meet those criteria.

But, after a recent sell-off, one of my favorite low beta tech stocks checks all of those boxes…

Accenture (NYSE:ACN) shares are down by roughly 15% from their 52-week highs.

What’s more, they’re down by approximately 33% from the all-time mark that they set in late 2021.

These last couple of years have been tough for Accenture from a share price perspective; however, the company’s underlying fundamental growth trajectory remains intact.

With that in mind, I believe that the stock’s recent weakness has presented investors with another Buffett-esque opportunity to buy shares of a wonderful company at a fair price.

Those are the types of situations that I’m looking to capitalize on these days.

Quality remains my priority and I feel much more comfortable paying a fair price for a best-in-breed stock with reliable growth prospects moving forward like Accenture in today’s market environment than I do attempting to bottom fish for lower quality stocks, even if they appear to offer deep value.

Sticking with secular growth is the easiest way to avoid value traps and with that in mind, please enjoy this analysis of one of the strongest compounders in the entire market: Accenture.

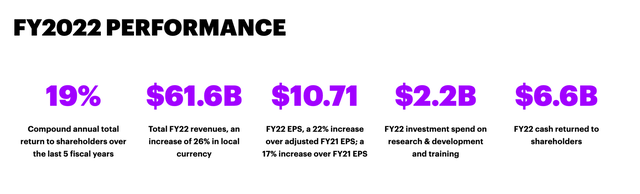

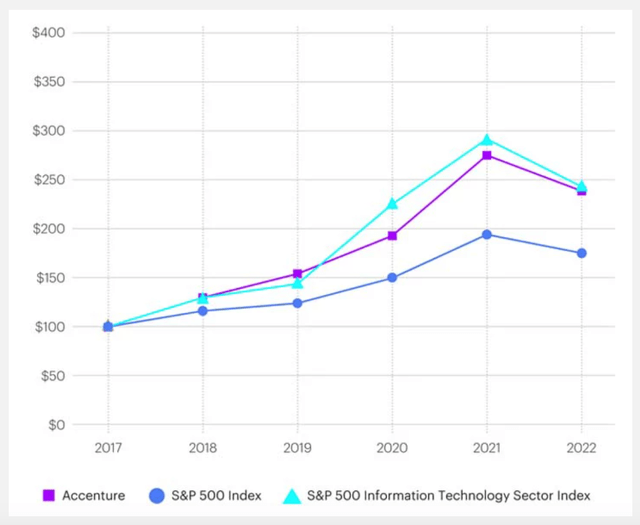

Historical Returns (Accenture Investor Relations )

Company Overview

In short, Accenture is a technological consulting firm which helps clients with enterprise software solutions.

This company casts a wide net in this regard, having developed a wide range of expertise, allowing it to garner business from approximately 75% of the S&P 500 firms in some way, shape, or form.

Admittedly, the phrase “enterprise software solutions” is a bit abstract. But, this is how I think about it (at a high level): Accenture’s products/services help businesses across a wide variety of industries to operate more efficiently as we forge further and further into the digital age.

This company uses its expertise to help its clients identify operational inefficiencies and technological growth opportunities/trends that have the potential to increase top and bottom-line results.

Accenture helps its clients with things like cloud migration, artificial intelligent adoption, and the integration/improvement of digital security systems across their enterprise platforms.

This company uses big data to help its customers to improve supply chain operations/ limit supply chain risk and to adapt to changing technological environments (regarding trends such as advanced manufacturing and automation).

The company is also a leader in the outsourcing business, helping its clients find partners that can more efficiently meet their needs.

Lastly, I should note that Accenture has invested in digital advertising services and continues to climb the ladder, so to speak, in terms of its business as a digital ad agency.

All in all, ACN has taken steps to become a one-stop-shop for enterprise clients looking to quickly expand and grow in today’s digital world.

According to CFRA report, the IDC (International Data Corporation) said that approximately 65% of global GDP would be digitalized by the end of 2022.

Overall, the organization expects that nearly $7 trillion has been spent on this trend thus far and these secular tailwinds remain in place moving forward.

Yes, in recent years, slowing economic growth across the world has caused enterprise software spending to decline; however, the digitalization of the modern world (and business) isn’t going to stop.

Sure, capex being directed towards consulting/software solutions has dipped in recent years, but ultimately, if companies want to stay alive long-term, they can’t ignore disruptive digital forces forever.

And, even with a spending slowdown in the enterprise software space over the last 12-18 months, you’ll see that ACN’s results were very strong during its most recent fiscal year.

Accenture Data (Accenture Investor Relations )

Ongoing technological disruption creates long lasting opportunities for companies like ACN as its clients continue to manage data, adapt, and evolve in an ever-changing operating environment.

No other consulting firm on Earth can compete with ACN in terms of its size/scale; Morningstar reports that ACN has an IT work-force of roughly half a million people.

Morningstar also notes that ACN has “an industry leading number of diamond accounts” (meaning clients that represent $100 million+ annually), that this figure has risen from 140 to 200 since fiscal 2014, and most importantly, that 98 out of Accenture’s 100 largest clients have now been with the company for 10+ years.

This speaks to the sticky ecosystem/wide moat that Accenture has developed over the years.

This company has established a reputation of unparalleled success which has enabled it to take market share and grow into a force that is difficult to compete with (especially for smaller firms without the resources to keep up with every new technological trend).

There also appears to be relatively high switching costs in place to leave ACN’s ecosystem, further widening the company’s defensive moat.

The tech sector is ever changing/morphing and therefore, there are endless problems that Accenture’s clients need to solve.

The rapidly changing landscape in the tech sector is what scares off many investors; however, ACN is a great way to capitalize on those fears.

The combination of limitless long-term demand and a strong competitive moat makes Accenture one of my favorite long-term investment ideas.

Innovation and volatility drive demand for Accenture’s services and with that in mind, investors shouldn’t be surprised to see how well this company has performed over the last 20 years or so coming out of the dot-com boom/bust cycle.

Valuation

To me, the easiest way to identify a very high quality company is to analyze its bottom-line.

Obviously there are many more variables at play here, but in general, a company that has proven its ability to consistently compound its earnings-per-share at a high rate over the long-term ends up checking the other boxes that I’m looking for.

No, that isn’t always the case.

There are no hard and fast rules when it comes to picking winners in the stock market.

But, as I like to say, excellence never happens by accident.

Over time corporations develop cultures of success, which, in turn, breeds future success.

Success leads to the accumulation of talent and assets which tend to allow companies to build competitive moats.

As a long-term investor, I want to partner with these wide moat businesses and benefit from their success.

That is why I look for proven compounders when putting new cash to work.

And when it comes to growing its earnings-per-share over the years, few companies can compete with Accenture’s results.

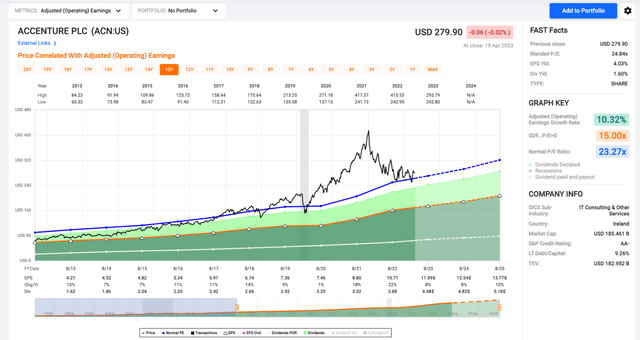

Accenture Fundamentals (FAST Graphs )

As you can see, over the last 20 years, Accenture has posted negative y/y EPS growth twice.

What’s even more impressive is that the company’s down years have been -1% performances.

Obviously the past doesn’t predict the future, but the fact is, historically this company has done a wonderful job of maintaining profitability throughout even the worst economic environments and this allows it to come out the other side of bear markets stronger than its peers.

That statement is the perfect segue to ACN’s forward looking growth prospects.

This isn’t just a backwards looking growth story.

Looking at the chart above you’ll notice that the consensus analyst estimate for ACN’s EPS growth is 8% in fiscal 2023, 8% in fiscal 2024, and 10% in fiscal 2025.

In short, this compounding story is far from over.

What’s more, not only does this company have a long history of producing annual EPS growth… but also, exceeding Wall Street’s expectations.

You’d think that after decades of reliable growth Wall Street analysts would be a bit more bullish on ACN; however, this company has beaten consensus estimates during 18 out of the last 20 quarters on the bottom-line.

Accenture’s quarterly revenue totals have come in above Wall Street’s estimates during 17 out of the company’s last 20 earnings reports.

And therefore, I wouldn’t be surprised to see the company outperform again in fiscal 2023/2024, ultimately clearing the high single digit EPS growth hurdles that Wall Street has set out before it and producing double digit growth (after all, ACN’s annual EPS growth rate has been 10%+ during 12 out of the last 20 years).

During the company’s most recent quarter, ACN management provided an update for full-year fiscal 2023 earnings.

The company stated that it expects to see:

Full-year revenue growth of 8% to 10% in local currency and foreign-exchange impact of negative 4.5%.

ACN guided towards GAAP EPS of $10.84 to $11.06 and adjusted EPS of $11.41 to $11.63. In fiscal 2022, ACN produced adjusted EPS of $10.71, so the mid-point of this guidance represents a y/y growth rate of 7.56%.

The company also increased its guidance for operating cash flow, signaling a range of $8.7 billion to $9.2 billion (up from prior guidance of $8.5 billion to $9.0 billion).

Lastly, ACN increased its free cash flow guidance to a range of $8.0 billion to $8.5 billion (up from $7.7 billion to $8.2 billion).

The growth called for here is nearly in-line with ACN’s longer term averages

Over the last 20 years, ACN’s EPS CAGR is 13.2%.

During the last decade, ACN’s EPS CAGR is 10.80%.

I expect to see this company produce an EPS CAGR of ~10% over the next 3-5 years.

With that in mind, I think it’s fair to place a slightly discounted multiple on ACN’s earnings expectations when trying to arrive at a fair value estimate.

Over the last 10-year period, ACN’s average P/E ratio has been 23.3x.

I usually use forward estimates when attempting to determine fair value (to me, evaluating stocks is all about figuring out what multiple is fair to pay for future cash flows).

Because of the inherent uncertainties associated with future estimates, I start with a slight discount in place, in the first place.

Looking ahead, I expect to see this company produce earnings in the $12.75-$13.00/share range in fiscal 2024.

The multiple that I feel comfortable paying for ACN (with current growth expectations in mind) is 21.5x.

21.5x the mid-point of my 2024 EPS estimate range is $276.70.

I’m content to round that down to $275 since it’s a nice round number.

So, when looking at this company, its balance sheet (I should have mentioned, ACN is a AA- rated company), its growth prospects, and its ongoing shareholder returns, that’s my current fair value estimate: $275.00/share.

Shareholder Returns

I feel comfortable paying fair value here because there is little doubt in my mind that ACN’s fundamental growth will support strong share price appreciation over the long-term, even at a 20x+ multiple.

If I’m wrong and the market decides that ACN shares are only worth 20x… it won’t take long for ACN’s expected EPS growth to result in strong profits, even if multiples compress (which, I should add, would be a historical anomaly here).

The best part about paying fair value here (as opposed to waiting for an even wider margin of safety) is that I lock in exposure to this company’s rapidly growing dividend.

Accenture currently yields 1.60%.

The company is on an 18-year annual dividend increase streak.

ACN’s 5-year dividend growth rate is 11.26%. Its most recent dividend raise came in at 15.5%.

Currently, Accenture’s forward dividend payout ratio is just 38.6%.

Historically, ACN’s payout ratio has hovered in the 35%-40% range.

Therefore, the potential for a payout percentage boost combined with ACN’s high single digit EPS growth expectations in fiscal 2023 lead me to believe that when this company announces its next raise (which should happen in September) investors are going to be given another 10%+ dividend raise.

1.60% might not seem exciting to some, but even sub-2% yields can snowball into very significant passive income forces when they’re compounding at a 10%+ clip.

For instance, someone who bought ACN shares 15 years ago currently has a yield on cost of 14.97%.

An investor who bought ACN 10 years ago is currently sitting on a yield on cost of 7.3% yield on cost.

Heck, someone who bought 5 years ago already has a 3.5% yield on cost.

It’s incredibly hard to find a 3.5% yield with reliable double digit growth potential… and it’s essentially impossible to find a company with a 7.3% yield (and don’t even get me started with that 15% yield level) that offers 10%+ dividend growth.

This is the beauty of the dividend growth strategy.

Combining blue chip compounders that have generous shareholder return policies with a little bit of patience provides investors with passive income opportunities that they can’t find anywhere else in the market.

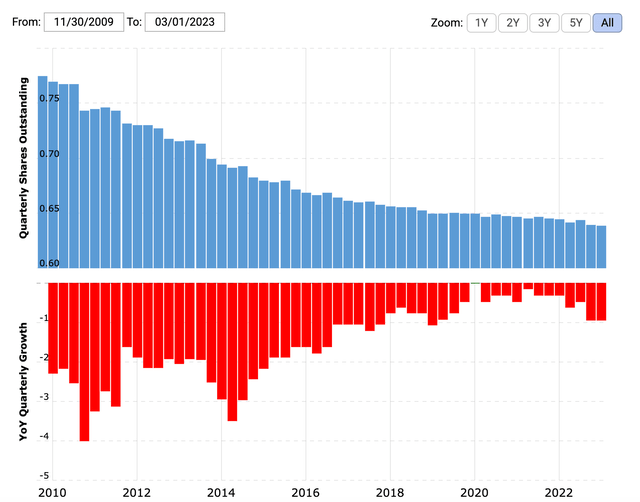

Oh, and with regard to shareholder returns, I should also note that ACN has used its buyback to successfully reduce its outstanding share count over time.

ACN bought back roughly $4.1 billion of shares during fiscal 2022 and when it announced its most recent dividend raise last September, its board also approved another $3 billion share repurchase authority, which brought its buyback power up to $6.1 billion.

During Q1 of 2023 ACN repurchased $1.4 billion of shares. In Q2, ACN bought back another $1.1 billion of shares.

For the full-year, I expect to see buybacks total $4-$5 billion (in-line with 2022’s total) and this bodes well for shareholders over the long-term (especially dividend growth investors; remember, every single share retired is one less $4.48/share annual dividend that is weighing on Accenture’s cash flows).

Accenture Outstanding Share Count

ACN Outstanding Share Count (Macrotrends)

Overall, the practice of reducing the share count with regular buybacks bolsters EPS and being that these buybacks haven’t damaged ACN’s balance sheet, this is the type of financial engineering that I’m a big fan of.

Conclusion

In general, stocks with strong secular growth tend to trade with high premiums because of their ability to reliably compound their fundamentals over time.

These reliably compounding fundamentals (sales, earnings, cash flows, etc) allow companies to generously reward their shareholders with sustainably increasing dividends (and consistently falling outstanding share counts due to consistent share buybacks, if we’re lucky).

Strong shareholder returns also tend to bolster valuation premiums and set floors under share prices.

Historically, that’s what has happened with ACN.

This stock hasn’t dipped meaningfully below the 20x threshold since 2014.

Since 2015, the stock has spent the vast majority of its time trading above 22x (oftentimes, well about that threshold with quite a bit of time being spent trading above 25x).

In other words, you generally have to pay an above market premium if you want to accumulate ACN shares; however, even with that being said, long-term shareholders have been rewarded in a big way.

As you can see here, ACN shares have outperformed the broader market by a wide margin over the last 5 years or so.

Accenture Data (Accenture Investor Relations )

Over the last decade, ACN shares are up by 252.6% which compares favorably to the S&P 500’s 160.9% gains.

Looking back to 2001 on Seeking Alpha’s ticker tracker, we see that ACN shares have risen by more than 1730%. And that doesn’t even factor in dividends, which are a significant factor in this company’s long-term total returns.

So, when a stock like this experiences short-term headwinds and dips down to my fair value estimate, I’m always willing to pounce.

Accenture was caught up in the irrational boom/bust cycle associated with software firms coming out of the COVID-19 crisis.

Exuberance surrounded shares in 2020/2021, pushing ACN’s valuation up to irrationally high levels.

That wasn’t the time to buy (although, everyone else was apparently doing it).

Since then, ACN has crashed alongside the other SaaS (software as a service) stocks. These days, the stock is out of favor (down 33% from recent highs). And to me, now’s the time to start thinking about building an Accenture stake.

Late last year, I initiated my personal ACN position at $281.77, followed up by a purchase at $257.76, both in September of 2022.

Currently, my cost basis is $271.18.

I’d love to continue to average down from here. However, with shares hovering around my fair value estimate in the $275.00 area, don’t be surprised if you hear about me buying more ACN shares in the near-term.

I’d love to grab more shares in that $255 area, but I am content to add here in the $275.00 area and I may not be willing to wait for lower prices that may never materialize.

Either way, Accenture sits near the top of my personal watch list at the moment. I haven’t put any of my April savings to work yet and therefore, expect to see several purchases from me in the coming days (these will be discussed in real-time with Dividend Kings members). Ideally, ACN below my $275.00 target will be one of them.

Moving forward, I can’t predict that ACN will be another 10-bagger+ over the next 20 years. But, I wouldn’t be surprised if that turns out to be the case.

Overall, I believe that this company maintains market beating potential and that long-term outperformance trends are likely to remain intact. Therefore, investors buying shares at (or better yet, below) fair value are potentially setting themselves up for very nice success over the long-term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ACN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

- Access to our model portfolios

- real-time chatroom support

- Our “Learn How To Invest Better” Library

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.