Summary:

- Macro challenges and foreign currency headwinds are impacting Accenture which is seeing signs of deceleration.

- Accenture is well placed to benefit from long-term opportunities in digital transformation.

- Ample balance sheet flexibility to maintain inorganic growth efforts.

JHVEPhoto

Global consulting firm Accenture (NYSE:ACN) may face some near-term headwinds from curtailing advertising and marketing activity as a result of macro challenges. The company’s long-term prospects however are solid.

Business Overview

Accenture is one of the world’s largest consulting firms. The company is widely diversified with operations in all continents around the world (the company classifies their operations into three geographic markets (i) North America (ii) Europe and (iii) “Growth Markets” namely Asia Pacific, Latin America, Africa and Middle East) and serves clients across a broad range of industries including technology, health, financial services and products.

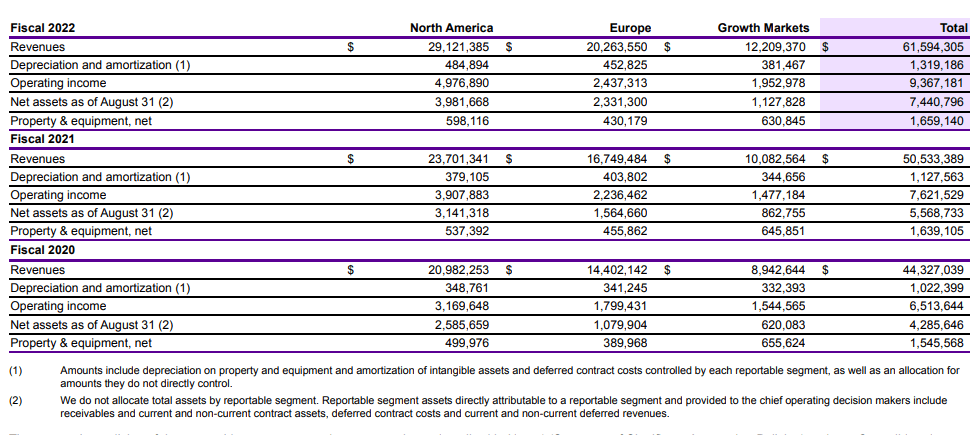

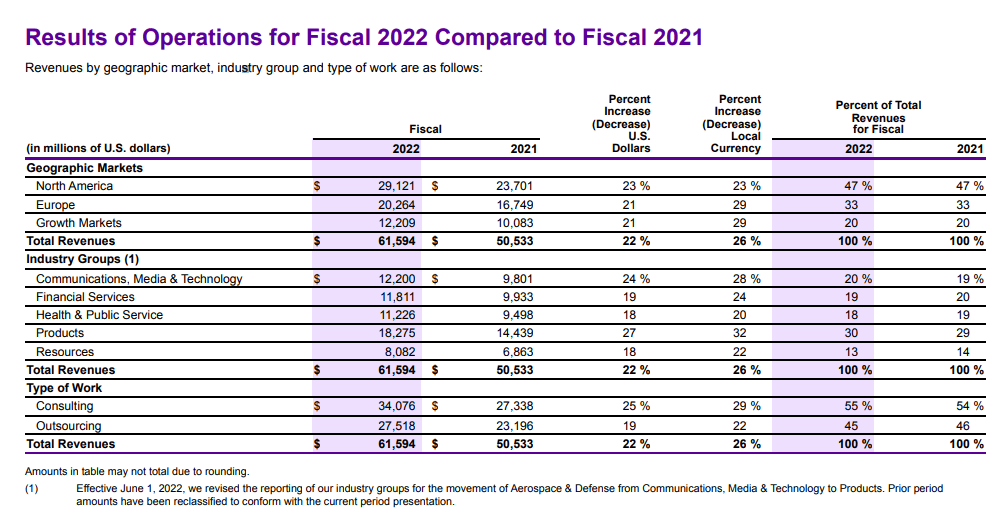

For FY 2022 (year ended August 2022), Accenture reported revenues of USD 61.6 billion, a record increase of 22% YoY. All geographic segments reported growth.

-

North America, Accenture’s biggest market accounting for 45% of revenues, saw revenues increase 23% YoY to USD 29.1 billion, accelerating from last year’s 13% YoY revenue growth.

-

Europe, Accenture’s second biggest market accounting for about a third of revenues, saw revenues rise 21% YoY to USD 20.3 billion, again accelerating from the previous year when revenues rose 16% YoY.

-

Growth Markets, the smallest market accounting for around a fifth of revenues, saw revenues increase 21% YoY to USD 12.2 billion, again accelerating from the previous year when revenues were up 13% YoY.

Accenture FY 2022 Annual Report

Consulting, Accenture’s biggest business segment by work type, saw revenues grow to USD 34 billion, up 25% YoY, an acceleration from the previous year when revenues rose 13% YoY. Outsourcing, saw revenues rise to USD 27.5 billion, up 19% YoY, again accelerating from the previous year when outsourcing segment revenues rose 15% YoY.

By industry group, Products, led growth with revenues up 27% YoY to USD 18.3 billion while Communications, Media & Technology led growth with revenues up 24% YoY to USD 12.2 billion.

Accenture FY 2022 Annual Report

Operating income rose 22.9% YoY to USD 9.37 billion, while operating margins at 15.1% was almost the same as the previous year’s 15.2%.

Near-term challenges amid slowing global economy but long-term demand trends intact

For Q1 FY 2023 (quarter ended November 2022), Accenture’s results showed a noticeable deceleration; revenues were up just 5% YoY to USD 15.7 billion, the slowest quarterly YoY growth rate since the quarter ended November 2020. Net income however rose 9.7% as the company proactively cut costs, helping net margins rise to 12.5%, the highest since the quarter ended November 2020.

Part of the slowdown was driven by softness in strategy and consulting segment revenues which were hit by clients revisiting spending related to marketing strategy and campaigns, as macro headwinds impacted advertising and marketing activity, resulting in weakening ad spend for the sector in general; Meta Platforms (META) reported a 4% drop in advertising revenue in Q4 2022, and Google (GOOG) (GOOGL) reported a 7.8% drop in YouTube ad revenues and a 3% YoY drop in overall ad revenue in Q4 2022.

Near term a slowing economy (or a possible recession) along with continued interest rate hikes (the Fed raised rates by 0.25% in February and expects ‘ongoing’ increases) could cause clients to further tighten their ad budgets which suggests continued weakness in this segment of Accenture’s business. Rate hikes could also lead to a stronger dollar and thereby contribute to foreign currency headwinds.

Longer term however the company’s prospects appear brighter. Accenture’s consulting division is benefiting from ongoing demand for consulting services in the areas of digital transformation (including cloud adoption, and cybersecurity among others) while the company’s outsourcing business (also known as their managed services business) continues to benefit from client efforts to transform their businesses through initiatives including automation, data analytics, and artificial intelligence.

These structural demand drivers have room for further growth. The pandemic has hit home the importance of digitization to improve business resilience and digital transformation is no longer viewed as a “nice to have”. According to a 2021 survey 91% of respondents had stepped up investments in digital transformation but a separate 2022 survey revealed that while 18% of manufacturers were forced to speed up their digital transformation process as a result of the pandemic, about 42% of respondents hadn’t even begun the transformation yet. IDC expects global spending on digital transformation to reach USD 3.4 trillion in 2026, with a five-year CAGR (compound annual growth rate) of 16.3%.

As these companies make necessary investments to keep pace with competitors, consulting firms are well placed to capture a share of that spend. In terms of digital transformation expertise and capabilities, Accenture has been named as a leader by various advisory service providers including NASDAQ-listed technology advisory firm Information Services Group, Gartner, and IDC. Accenture’s capabilities and service offering is not easy to replicate and the company repeatedly emphasizes that 99 of their top 100 clients have been with Accenture for over 10 years indicating a high level of loyalty which suggests Accenture’s share of the market may be challenging for competitors to capture.

Continued acquisitions to support growth ambitions

Supplementing organic growth efforts with inorganic growth tactics, Accenture has long been quite acquisitive and the company’s latest acquisitions are strategically meaningful and positions the company to benefit from emerging consulting demand trends. Accenture’s acquisition of strategy and consulting firm Bionest (which is expected to bolster Accenture’s consulting capabilities in life sciences) in February 2022, better positions Accenture to better capitalize on opportunities in the life sciences professional services space and keeps pace with competitors who have also been snapping up consulting firms with capabilities in this area. Last year, rivals Bain & Company acquired a minority stake in Trinity Life Sciences, while French consulting firm Sia Partners acquired Latham Biopharm Group. In 2021, Oliver Wyman scooped up Huron’s life sciences practice in the U.S. Accenture, who was named as a leader in healthcare provider digital services by advisory firm Everest this year (in a report that assessed the firm’s ability to drive digital transformation across the healthcare provider value chain), could see their leadership position further strengthened.

Covid-induced supply chain disruptions have compelled companies to revisit their supply chains triggering an opportunity for consultants who have been busy making acquisitions to boost their competency and offerings in this growing sector. Accenture’s acquisition of supply-chain focused consulting firm Inspirage (which is expected to enhance Accenture’s ability to assist clients in their efforts to transform their supply chains through technologies such as digital twins) should help Accenture capitalize on major demand trends related to supply chain optimization and keep pace with rivals who have also been circling opportunities in this space; a few months ago McKinsey acquired supply chain consulting firm SCM Connections, Bain & Company acquired procurement consulting firm Proxima, PwC acquired supply chain expert Olivehouse.

German-based SKS Group (which would expand Accenture’s ability to serve specialized banks), should help Accenture capitalize on consulting opportunities related to helping banking industry clients modernize their business. Digital transformation is accelerating in the banking sector, putting pressure on banks who concurrently have to juggle risks related to cybersecurity as well as heightened regulatory demands.

With a debt to equity of just around 14%, Accenture has ample balance sheet flexibility to make further acquisitions going forward.

Conclusion

Accenture’s stock has declined 16% over the past year and the stock currently trades at a forward P/E of 25.2 and a P/BV of 7.92. This is quite pricey although some may view it as fair for a market leading player positioned to benefit from long term growth opportunities.

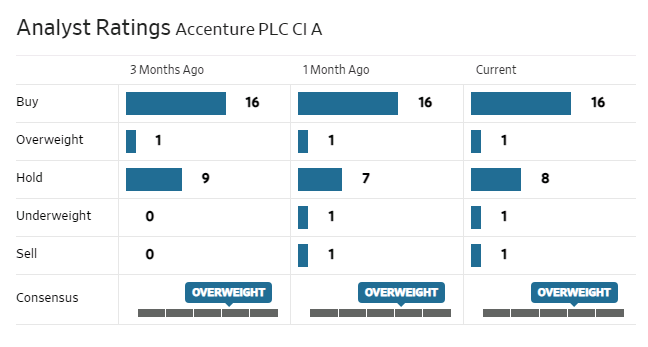

Analysts are mostly bullish on the stock.

WSJ

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not a recommendation to buy or sell any stock mentioned. Please consult with a professional investment advisor prior to making any decisions.