Summary:

- Analysts expect Accenture to report $3.42 EPS on $17.14B in revenues, with potential for beating estimates due to recent upward revisions.

- I am cautious about starting a position due to uncertainties in AI investments and lackluster M&A-driven top-line growth, maintaining a hold rating.

- The company is aggressively expanding in AI, aiming for 80,000 AI-focused employees by FY26, but this exuberance may lead to future workforce cuts.

- Despite potential revenue catalysts from AI, current margin performance is weak, and the M&A strategy has not significantly boosted top-line growth, justifying my hold rating.

noel bennett

Introduction

Accenture plc (NYSE:ACN) is about to announce Q1 ’25 earnings on December 19 before the market opens, so I thought I’d go through what to expect in terms of numbers, what I am looking for to be announced, and how management is looking forward in 2025 in terms of M&A action and progress in all things AI. I don’t think it is a good time to start a position given the uncertainties of such aggressive efforts into AI, while its M&A efforts are not yielding good top-line growth. I am maintaining a hold rating.

What to Expect

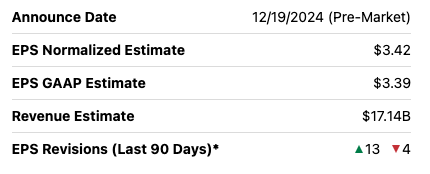

Analysts expect the company to do $3.42 of EPS (non-GAAP) on 17.14B in revenues. That is revenue growth of around +5% y/y and +4.5% sequentially. In terms of EPS, that will be growth of around +4.5% y/y and around +22% sequentially, which is rather impressive.

It seems that there have been quite a few upward EPS revisions in the last 90 days, which bodes well for the company.

Seeking Alpha

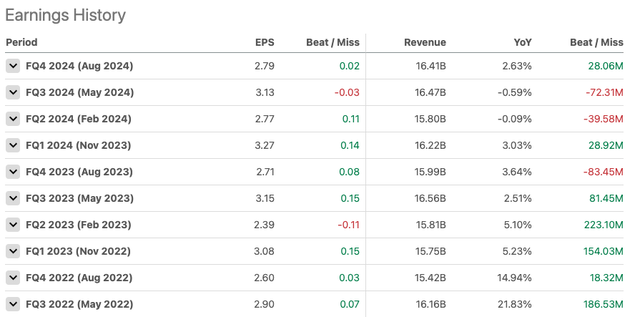

How likely is the company to beat these estimates? Well, over the last ten quarters, the company missed three revenue estimates and two EPS estimates. FQ3 ’24 was the last time it missed on both the top and bottom lines. I believe there’s a good chance the company will beat these estimates, given the many upward revisions.

Seeking Alpha

And how do these estimates stack up against what management has said?

For the upcoming quarter, management expects revenue in the range of $16.85B to $17.45B (17.15B at the midpoint), which is more or less in line with the above analysts’ estimates. There isn’t a lot of growth expected for the next quarter, around 1.5%, due to foreign exchange impact, while for the full year, the company expects revenues to grow in the range of 3% to 6%, which is also in line with analysts’ estimates. Management didn’t provide EPS guidance for the next quarter, but we can assume that it won’t be very different from what analysts are expecting. It seems that analysts have updated their outlook assumptions after the Q4 earnings release.

What I am Looking For

The company has been on a roll these past few years. It is one of those companies that constantly pops up in my feed as it acquires more and more companies on what seems like a monthly basis. This has been the company’s growth strategy for a while now, and I am expecting more acquisitions next year. ACN is a very tech-focused firm, and I expect the company to continue its growth efforts within the most advanced tech out there these days, which is artificial intelligence. The most recent announcement within the AI area has been the partnership between it and Stanford Online to offer the Gen AI Scholars program, designed to help business and tech leaders with the required knowledge to master everything AI. Last month, the company also launched a Center for Advanced AI in Japan to help clients “reinvent” with Gen AI. Now, the company has around 25 Gen AI studios around the world, which help advance AI further.

So, I am expecting to hear a lot more to do with AI in the upcoming year. For FY24, the company had around $3B in new GenAI bookings. $1B of it was in Q4, so it does look like there is a decent ramp occurring, and I expect it to continue well into 2025. I am going to be looking out for how well the company’s efforts in hiring an AI workforce have progressed. Management mentioned that it is looking to have around 80,000 working within its AI and data segment by the end of FY26. The number currently stands at around 57,000.

With such a large workforce solely focusing on AI and everything to do with AI, I am sure the company is going to be positioned well to help its clients scale AI initiatives within their organizations and make efficiencies across organizations.

However, I am a little worried about such exuberance within the AI space. Hiring is great for overall economies, but we know what happens when tech companies go on a hiring spree, thinking that the extra hands are justified due to the demand for the new tech. Management is often too optimistic, and while it does work out in the short run, it ultimately ends up cutting its workforce after a while because it wasn’t as lucrative as it was expected. I don’t think that is going to happen right now; however, it may not be too long from now.

I am looking for the company’s booking numbers for the next quarter to be substantially higher, like we saw in recent quarters. New bookings last quarter were $20B, an increase of 13%. I would like to see this growing even faster next quarter due to the immense potential of AI bookings that we saw accelerated in Q4. I wouldn’t be surprised to see over $1B in AI bookings for Q1’25.

In terms of margins, the company has been doing a decent job of improving them. However, it is still a little slow at becoming more efficient. Gross margins only saw a 10bps improvement in Q4 compared to Q4’23, so I would like to see what the company has in store to elevate this progress to the next level.

In short, I am expecting a lot of mentions of AI and related tech in the upcoming earnings announcement and how it will solve its clients’ problems. I am expecting a decent boost in Gen AI bookings once again, and I also wouldn’t be surprised to hear more about its M&A efforts, which seems the only way the company is seeing any top-line growth, most likely within the AI sector. The company’s efficiency efforts should also be its top priority, as I feel the current margin profile is a little weak.

Closing Comments

I do believe that the company is going to continue its aggressive M&A strategy in 2025 and beyond, with a big focus on AI and related companies. These may not be very large acquisitions, but over the year I expect these will add up significantly, which will help the company to maintain its edge in the latest technology like AI, boost its clients’ efficiency, train as many workers to the new tech as make sense and see how it all develops in the future. Big tech firms are continually investing in AI and data centers, so if ACN continues down this path of arming itself with the best consultants in the AI industry, I am expecting a decent revenue catalyst in the future.

This aggressiveness may lead to lackluster margin performance for now, and given the uncertainty of this strategy, I am inclined to maintain my hold rating for now. The company’s M&A strategy hardly yields good top-line growth, which is a bit disappointing, and if that doesn’t change, I think the company is still not worth the risk.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.