Summary:

- Companies that are digital technology leaders have achieved up to five times the revenue growth compared to those that under invest in technology.

- As companies around the world ramp up spending on technology to widen their lead over or play catch up to competitors, demand for consulting and outsourcing services will inevitably grow.

- Accenture is a leader in this space, and enjoys advantages in marketing, hiring, returns on its investments in R&D and acquisitions, and operating leverage due to its brand, reputation, and scale.

- Accenture’s growth and stock price have significantly outpaced its large competitors over the last 7 years, but the recent pullback creates a buying opportunity for long-term investors.

JHVEPhoto

“[W]hy we are here? To create value for our clients by delivering on the promise of technology and human ingenuity.”

– Julie Sweet, Accenture (NYSE:ACN) CEO, 2022 Investor Day

Overview

In 2006, Clive Humby, a British mathematician, coined the phrase, “Data is the new oil”, a quote that was popularized in 2017 by the Economist report titled, “The world’s most valuable resource is no longer oil, but data”.

Like the general stores during the gold rush that provided picks and shovels to the miners and Schlumberger Limited (SLB), which provides equipment and technology to the oil and gas drillers and producers, Accenture provides the know-how and technology for digital transformation that enable companies to identify, access, and unlock the value of the rich trove of data buried deep within their organizations.

Since Accenture’s 2001 split from accounting firm Arthur Andersen, the company has become a trusted technology partner to many of the leading companies in the world–it currently employs over 700,000 people globally and counts 89 of the Fortune Global 100 among its clients.

Demand for and returns from digital technology

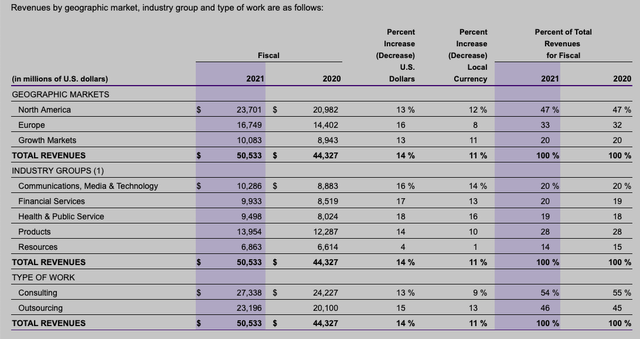

According to a 2019 Accenture study, digital technology leaders achieve 2-3 times the revenue growth compared to those who under-invest in technology (figure 1). In a follow-up study conducted after the COVID-19 outbreak, Accenture found that the difference had widened to up to 5 times.

Figure 1: Growth of digital leaders vs followers

Accenture study

Digital picks and shovels providers like Accenture help clients deploy technology to mine for more value from their data to reduce costs, improve efficiency, and drive value to customers. They enable clients who are digital leaders to advance to the next level and those who have fallen behind to play catch-up and potentially leapfrog their competitors.

Like the Red Queen’s race in Lewis Carroll’s Through the Looking Glass, the clients are constantly running (and spending IT dollars) just to stay in the same spot:

“Well, in our country,” said Alice, still panting a little, “you’d generally get to somewhere else-if you run very fast for a long time, as we’ve been doing.

“A slow sort of country!” said the Queen. “Now, here, you see, it takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!”

– Lewis Carroll, Through the Looking Glass, Chapter 2

Clients cannot afford to slow down their digital technology spending as they run the risk of falling behind, but the main beneficiaries of this race are the clients’ customers and the picks and shovels providers like Accenture.

Helping clients lead with technology

Accenture helps its client firms implement a cloud-based technological platform for the future. Its teams work with employees throughout its clients’ organizations to imagine and identify ways to break down intra-enterprise silos, connect the data across all parts of the organizations, and reinvent and transform the client’s processes. Accenture brings its experience and knowhow to help the client migrate to a cloud-based platform, and it integrates and implements the software and hardware necessary to deploy advanced data analytic and artificial intelligence algorithms for clients to derive real-time insights that improve the efficiency of their operations.

In addition to delivering better outcomes and experiences for Accenture’s clients and their customers more quickly and for less cost, the systems can also improve clients’ agility and resilience by enabling managers to pose “what-if” questions about different future scenarios and quickly course-correct when faced with unexpected disruptions.

Accenture is more technology agnostic compared to some of its large competitors such as IBM (IBM) or Oracle (ORCL), which have large libraries of proprietary software to sell. Although Accenture has its own platform and software libraries, it partners and work closely with a large number of systems, software, and hardware providers to give clients better solutions (figure 2). For example, it builds on critical infrastructure from leaders such Amazon Web Services (AMZN), IBM, and Oracle, implements ServiceNow (NOW) software to give clients the ability to implement low- or no-code software, partners with Palantir’s (PLTR) Foundry to give clients like Airbus (OTCPK:EADSF) full visibility into their supply chain through the use of digital twins, and incorporates robotics from Rockwell Automation (ROK) into manufacturing plants.

Figure 3: A partial list of Accenture partners

Accenture provides its services under two types of arrangements: consulting and outsourcing. Consulting, which includes strategy, management and technology consulting and technology integration consulting, reflect a finite, distinct project or set of projects with a defined outcome and a defined set of specific deliverables, and are typically completed within 12 months. Conversely, outsourcing revenues are ongoing, repeatable services or capabilities provided to run, manage, or transition operations of client systems or business functions and generate longer term recurring revenues. Accenture’s mix of consulting to outsourcing revenue is roughly 55% to 45%.

Looking ahead

The cloud was initially about IT efficiency and modernization, but now drives growth and innovation and is a significant driver of competitive advantage to clients. In 2013, Accenture declared that “every business is a digital business” – a phenomenon which not only continues to hold true today but is also accelerating. In its Technology Vision 2022, it asserted that businesses need to have a presence in the metaverse to bridge the physical and the digital virtual worlds – a strategy that is beginning to gain momentum.

The digital transformation has just begun and there still much that companies can do to improve their competitive positions. This creates a very large opportunity that will drive Accenture’s growth and shareholder value over the long term.

Investment thesis

Accenture is the leading industry provider and market share leader in technology consulting and outsourcing – an industry that I expect will continue growing over the long term. By continuously growing and enhancing its talent and intellectual property base, the company has been able to gain share and capitalize on the industry’s inherent economies of scale.

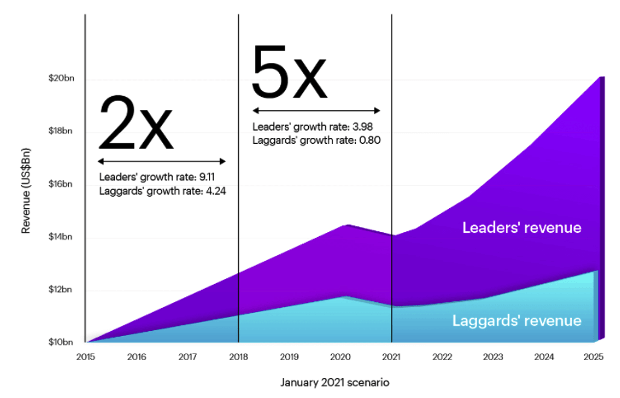

Accenture is a leading provider and market share leader

Accenture is a trusted leading provider that has built a strong reputation for consistently delivering on its digital transformation solutions. It was named a “Magic Quadrant” provider in the Data Analytics Service Providers category by Gartner (figure 4) and an industry leader amongst Data Management Service Providers and Innovation Consulting Services by Forrester Research (figure 5).

Figure 4: Gartner Data Analytics Service Provider “Magic Quadrant” leaders

Gartner

Figure 5: Forrester Research Data Management Service and Innovation Consulting Services leaders

Forrester Research

According to Accenture, it has the #1 in global market share in each of North America, Europe, and growth markets, is the #1 systems integrator and twice the size of the next player, the #1 application management services provider and 50% larger than the next provider, and its Accenture Operations offering is double the size of its next largest competitor offering similar services.

The company’s strong reputation, market leadership, and proven track record of successful implementations poses lower risks for clients as well as career risk for CIOs and CTOs who choose to hire Accenture. This has yielded tangible benefits: in 2021, 70% of new bookings were single sourced, and the number clients with bookings of over $100 million in a quarter jumped to 156, up 50% from 2 years ago.

Continued long-term industry growth

The era of the fast follower is over.

– 2021 Tech Vision Report by Accenture

As companies around the world accelerate the digital transformations of all aspects of their operations to drive growth, improve customer satisfaction, reduce costs, and improve resilience, Accenture’s clients face intense pressure to keep up their technology spending to stay competitive. The digital transformation journey is still in its early innings, even for industry leading clients, and there is much that can be done to widen their lead over competitors. Conversely, the players who have underinvested in technology will need to play catch up to avoid falling further behind and risking extinction.

Technological innovation will continue to accelerate, which drives the race amongst clients to implement technology to stay ahead of the competition. As such, Accenture’s market opportunity will only get larger and its growth continue for a long time.

To cite some statistics from Accenture demonstrating the low penetration and vast opportunity ahead:

- 83% of executives agree that their organization’s business and technology strategies are inseparable and even indistinguishable, and 93% believe their functional silos are a hindrance to their ability to transform their business processes;

- Even though CFOs surveyed indicated that 60% of traditional finance tasks are automated, 83% identified the need to capture new metrics; and

- Only 30% of workloads have moved to the cloud, which is necessary to implement state of the art digital technologies.

The COVID-19 outbreak has accelerated the demand in several respects – it has forced companies to very quickly roll out the tools for employees to work remotely and created an urgent need to create more resilience and the ability to adapt to unexpected exogenous events and disruptions.

Accenture’s 2021 Tech Vision Report discussed the technology that Starbucks (SBUX) implemented to reinvent its customer experience, which also enabled it to emerge stronger following the COVID-19 pandemic:

Starbucks had a digital transformation well underway by 2020, and when the pandemic hit, that transformation evolved from a strategic initiative to a vital airbag. The company’s mobile app, which allows users to customize orders and pay for drinks with their phones, proved invaluable as contactless transactions rapidly became the norm. By August, three million new users had downloaded the app, and mobile ordering and drive-thru pick up combined accounted for 90 percent of sales.

When demand surged, it doubled down. The company pushed out a new integrated ticket management system to combine orders from Uber Eats, the Starbucks app, and drive- thru customers into a single workflow for baristas, and introduced a new espresso machine laden with sensors to help staff track how much coffee was being poured and predict necessary maintenance.

These decisions enabled Starbucks to extend its lead over competitors such as JDE Peet’s (JDPE.AS) (OTC:JDEPY). But there is still much to do – on Starbucks’ Q3 2022 earnings call, interim CEO Howard Schultz lamented that much more needs to be done to enable the company to both meet the surging demand and accommodate its customers’ changing purchase habits. Schultz also identified the need to leverage technology to improve the experience for its employees, and announced its plan to boost customer loyalty through a metaverse-centered app – a project that it will demo in its September 2022 Investor Day.

Accenture summed it up well in the 2021 Tech Vision Report:

On one hand, we have widespread and accelerated digital transformation coupled with the digital building blocks to create almost anything. On the other, we have blank slates in every industry waiting for the next vision of the future to be defined. Combined, it’s an opportunity we may never see again in this generation: to actively shape our future almost from the ground up.

I am bullish on the long-term prospect for digital transformation services.

Competence in people and software integration

In a previous article discussing the clear advantages that outsourced business process providers have over in-house IT teams, I noted that except for the deepest-pocketed organizations, firms going through digital transformation generally cannot justify the expense of bringing top specialists in-house to build best-in-class systems, nor are they likely to be able to provide its employees with the highly specialized training, opportunity to sharpen their skills working on multiple implementations, or environment to stay on top of the latest trends, technological developments, and best practices within the industry.

In contrast, outsourced providers can afford to spend money to hire the best teams, build deep IP (intellectual property), on R&D, and to buy knowhow through acquisitions as they can spread these costs over as many clients as they can sell to. Given that the incremental cost of selling existing intellectual knowhow to each additional client (beyond implementation labor, which can be billed to clients) is essentially zero, outsourced firms can achieve highly attractive returns on their investments in IP and software. Apart from truly proprietary systems (e.g., trading algorithms for commodity trading firms), it is difficult for organizations to justify the cost of developing in-house IP that they are unable to share with others.

Talent acquisition, training, development, and coordination

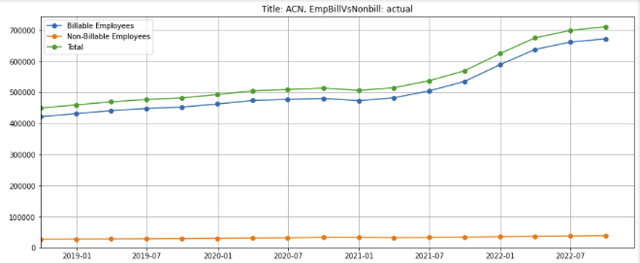

Over the last 6-7 years, Accenture has doubled its total employee count to over 700,000 (figure 6, green line). The employee count accelerated in 2021 – a 23% increase over 2020 and a 27% year-over-two-year increase.

Figure 6: Accenture employee count

Author, using publicly available financial data

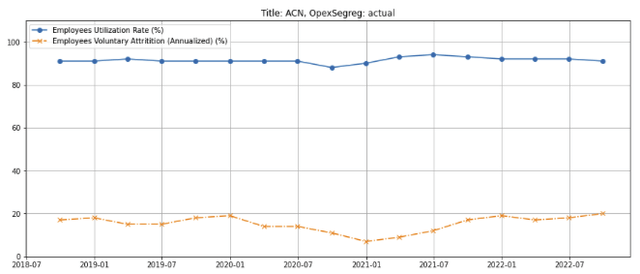

Even though the number of employees has grown significantly, the utilization rate has held steady at 92%, indicating that work volume remains strong (figure 7, blue line). The voluntary attribution rate dipped following the COVID-19 outbreak but has returned to the historical ~18-20% range (orange dashed line).

Figure 7: Accenture employee utilization

Author, using publicly available financial data

To keep employee skills current, Accenture spent $900 million on training and professional development, and has created a metaverse application to onboard the 150,000 annual new employees it hired in 2021. The metaverse application also serves as an environment for employees to meet and collaborate, which enables Accenture to staff the most appropriate team members on a project regardless of their physical location and for team members to work together effectively from multiple remote locations.

Software and IP acquisition

Technology democratizes consumption but consolidates production. The best person in the world at anything gets to do it for everyone.

– Naval Ravikant, co-founder/Chairman of AngelList

This is also the case for software. In 2021, Accenture spent $1.1 billion in R&D and invested $4.2 billion across 46 acquisition to deepen its industry and functional expertise. The company was granted 299 patents, placing it 141st on the list of Top 300 Organizations Granted US Patents for the year, and has 8,200 patents and pending patent applications worldwide. In the 5 weeks since the beginning of Q3 2022, it has announced 9 acquisitions and investments in companies in the US, Canada, Europe, Asia, and Latin American which specialize in digital transformation, cloud, infrastructure engineering manufacturing automation and robotics, omnichannel marketing, and ESG.

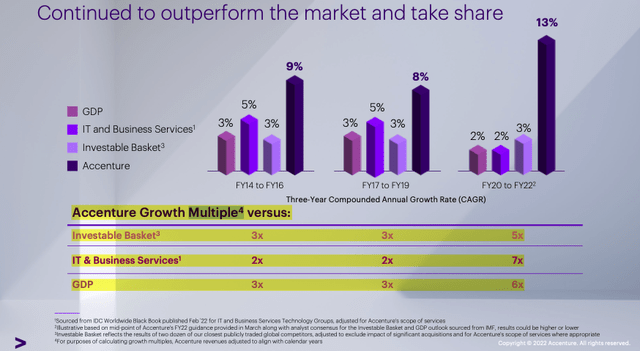

Market share gains

Accenture has consistently gained market share over the last eight years. Its growth rate between 2014 – 2019 was about three times that of its publicly listed competitors. From 2020 – 2022, the growth rate has accelerated to five times that of its publicly listed competitors (figure 8).

Figure 8: Accenture has continued to gain market share

Accenture 2022 Investor Day CFO presentation

I believe this is due both its reputation, industry leadership, as well as its long-term and sticky relationships with clients. Accenture notes in its 2021 10-K filing that 98 of its top 100 clients in 2021 have partnered with the company for over 10 years.

Client relationships are sticky because even though clients are free to work with Accenture’s competitors, the cost and risks of switching IT providers are significant as institutional knowledge is not easily transferred. In addition, working with a “one stop shop”, as opposed to multiple vendors, reduces blame shifting and finger pointing when things go wrong.

Consequently, Accenture has an incumbent advantage with existing clients as long as it delivers on project performance and prices its new contracts reasonably. This appears to be the case as 70% of the company’s new contracts are single-sourced. (As a side note, it is interesting to read about some of the tactics that large consulting firms employ to keep competing consultants out.)

Operating leverage and advantages of scale

Size and scale matters. As Accenture’s client base grows, its overhead, R&D, and acquisition amortization costs are spread over an increasingly revenue base, so we can expect its operating margin to gradually expand over time.

Furthermore, a large IT outsourced service provider like Accenture not only has deeper pockets and more resources with which to develop or acquire best-in-class technology available, but it also has a larger client base to distribute its IP and technology. This should lead to a higher return on its investment in IP compared to smaller competitors, which can in turn be re-invested to build more and better IP, propagating a virtuous cycle that leads to a sustainable long-term advantage.

Financial analysis

Key financials

Revenue

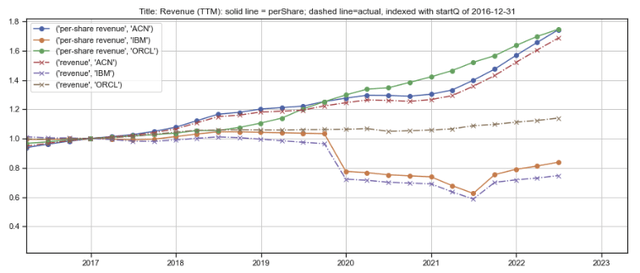

Since Q4 2017, Accenture’s revenue has grown 1.7x, for a compounded annual growth rate of ~10.1% (figure 9, red dashed line), outgrowing both Oracle’s 1.15x (grey dashed line) and IBM (purple dashed line), which shrunk after it sold some of its less profitable business under former CEO Ginni Rometty.

In spite of its lower revenue growth, Oracle delivered similar per-share revenue growth to Accenture (green solid line vs blue solid line) over the same period because its aggressive share buyback program significantly reduced the number of shares outstanding.

Figure 9: Accenture actual and per-share revenues vs comparables (indexed)

Author, using publicly available financial data

EBITDA margin

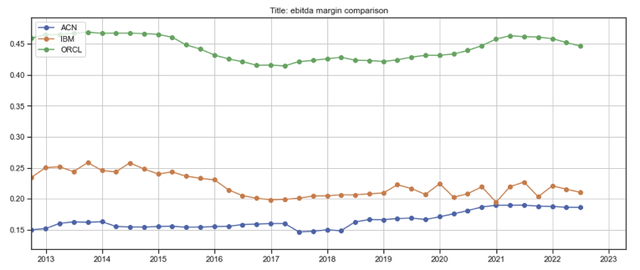

Over the last decade, Accenture’s EBITDA margin (figure 10, blue line) has gradually trended up more than Oracle or IBM (green and orange lines), which I expect will continue over the long term due to operating leverage.

Figure 10: Accenture EBITDA margins vs comparables

Author, using publicly available financial data

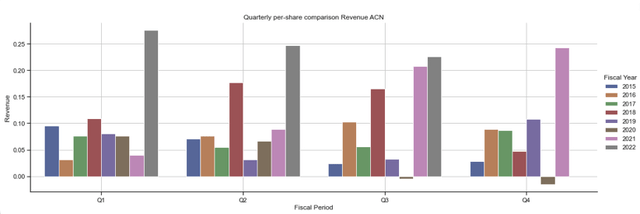

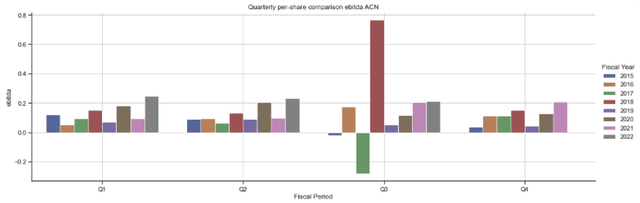

Quarterly per-share revenues and EBITDA

With the exception of a slowdown in fiscal Q3 and Q4 2020 due to the COVID-19 outbreak (figure 11, purple bars), Accenture’s quarterly per-share revenue has grown consistently every year over the last eight years, but accelerated in the last five quarters (pink and grey bars) due to: (1) clients stepping up their spending to increase their resilience to unforeseen future disruptions, widen their lead over competitors, or play catch-up to competitors who have continued to invest in technology through the pandemic, and (2) price inflation, which should subside with time.

It would be fantastical to expect continued year-over-year per-share revenue growth of greater than 20%. However, I believe that a continued low-teens per-share EBITDA growth rate is a reasonable base case forward projection (figure 12).

Figure 11: Accenture per-share quarterly revenues, year-over-year change

Author, using publicly available financial data

Figure 12: Accenture per-share quarterly EBITDA, year-over-year change

Author, using publicly available financial data

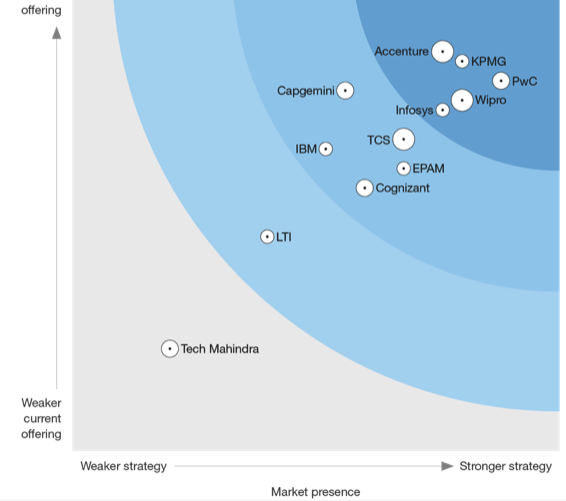

Segment revenues and operating KPI

Composition of revenues

Accenture’s revenues are well diversified across industry groups, evenly split between its North America and international markets, and between consulting and outsourcing work. (figure 13, second from right column).

Figure 13: Accenture revenues by geography, industry groups, and type of work

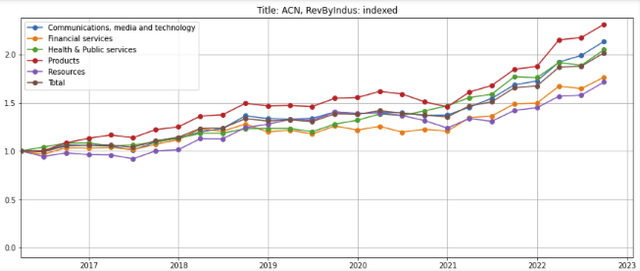

Growth of industry groups

All of Accenture’s industry groups are growing (figure 14), with products (consisting of consumer goods, industrials, and life sciences) (red line) and communications, media, and technology (blue line) outgrowing the financial services and resources (orange and purple lines) groups.

Figure 14: Accenture revenue growth, by industry group

Author, using publicly available financial data

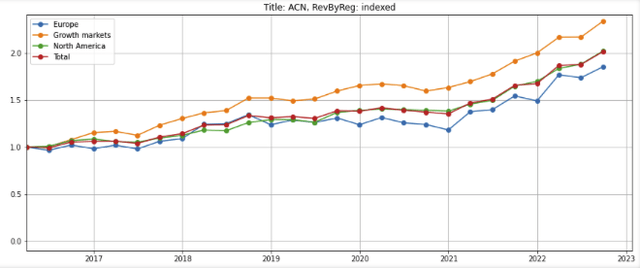

Growth by regions

Similarly, all of Accenture’s regions are growing (figure 15), with growth markets (orange line) leading and Europe (blue line) lagging.

Figure 15: Accenture revenue growth, by region

Author, using publicly available financial data

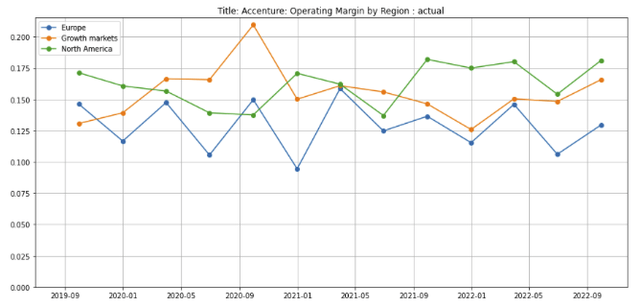

Operating margins for North American have trended up (figure 16, green line), but Europe and growth markets have been weaker partly due to the recent strength of the US dollar (blue and orange lines).

Figure 16: Accenture operating margin growth, by region

Author, using publicly available financial data

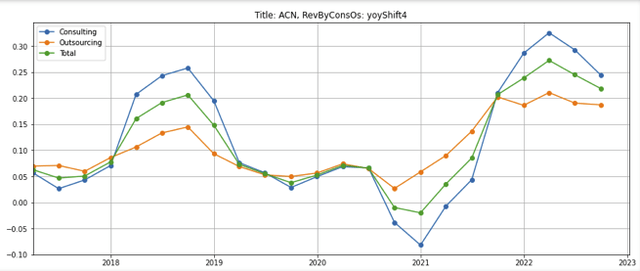

Outsourcing vs consulting revenues

About 45% of Accenture’s revenues come from outsourcing contracts, which are by nature recurring and less volatile (figure 17, orange line) compared to consulting revenues that are non-recurring and require ongoing selling (blue line). Nonetheless, I believe both will keep growing as clients face ongoing pressure to leverage technology to stay ahead of or catch up to their competitors.

Figure 17: Accenture revenues: consulting vs outsourcing year-over-year change

Author, using publicly available financial data

Leading indicators

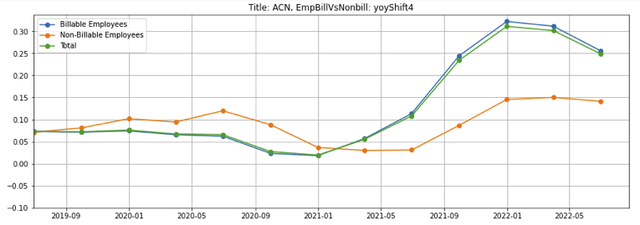

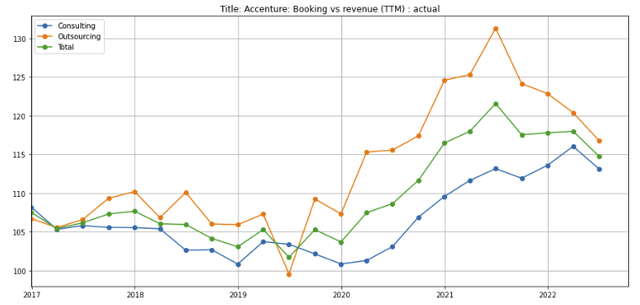

Employee growth and booking to revenue ratio

Accenture hired aggressively over the last four quarters, increasing the number of employees by as much at a 30% year-over-year (figure 18) to keep up with the surge in its bookings to revenue ratio (figure 19). The pace peaked in Q2 2021 is moderating.

I conjecture that the jump in the bookings to revenue ratio in late 2021 to early 2022 is partly due to the fact that inflation is priced into the numerator (forward bookings) while the denominator (trailing revenue) is based on pricing levels before inflation surged. The bookings to revenue ratio should also tick down over time to a more sustainable level in the high single-digits or low-teens.

Figure 18: Accenture employee count: year-over-year change

Author, using publicly available financial data

Figure 19: Accenture bookings to revenues

Author, using publicly available financial data

Financial summary

|

Historical performance |

Hypothetical outlook |

|

|

Bookings to revenue |

2017-19: high-single digits 2020-22: surged from 1.15 to 1.3 before moderating in most recent quarter (see figure 19 above) |

Unlikely to stay at above 1.15 over the long term Growth likely to be in the high-single digit to low-teens at best |

|

Revenue |

Prior to 2020: hit-single digit year-over-year growth Q3 2021 onwards: year-over-year growth rate surged into the 20% range (see figure 11 above) |

Growth rate unlikely to remain at 2021-22 levels over the long term Growth likely to be in the high-single digit to low-teens |

|

EBITDA margin |

Expanded from 15% in 2013 to 19% in 2022 (see figure 10 above) |

Expect slow but steady EBITDA margin expansion over the long term. As such, a longer-term low-teens EBITDA growth rate seems reasonable |

Valuation

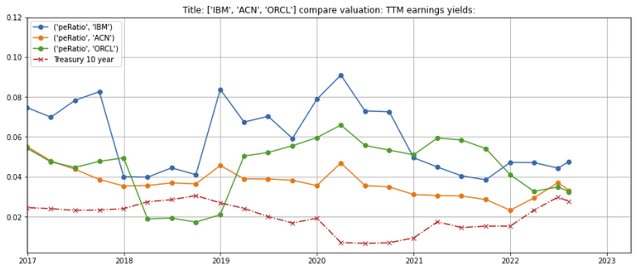

Accenture’s earnings yield (the reciprocal of the price earnings ratio) (figure 20, orange line) is regressing towards its 5-year average and Oracle’s earnings yield (green line). IBM’s earnings yield is higher due to its lower growth rate (blue line).

The company is not on sale but may be attractive for investors who wish to accumulate Accenture stock for the long term.

Figure 20: Accenture valuation: earnings yield

Author, using publicly available financial and stock price data

Stock price appreciation

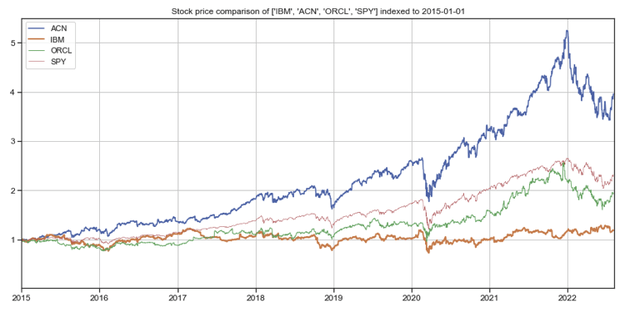

Over the last seven years, Accenture’s stock price has appreciated by 4x even after the sharp pullback in 1H 2022 (figure 21, blue line), well ahead of the S&P 500 (red line), Oracle (green line), and IBM (orange line).

Figure 21: Accenture stock price performance vs comparables

Author, using publicly available stock price data

Key concerns

1. Inflation will drive up costs and can potentially squeeze margins

Mitigation: In periods of high inflation, there is a greater need amongst clients to implement and leverage digital technology to lower costs that cannot be passed through to their customers. Even though labor costs rise in inflationary times, Accenture will likely be able to raise prices on its existing intellectual property (e.g., software libraries) to partly offset wage inflation.

2. Reputation harm and lawsuits from high profile botched client implementations

Client implementations can go wrong. For example, Accenture was sued for $32 million by Hertz (HTZ) in 2019 for “defects” in its code and failure to perform proper testing. In its 2021 SEC Form 10-K filing, Accenture disclosed that it was named in a class action lawsuit file by customers of Marriott International (MAR) alleging negligence related to a data security incident involving the unauthorized access to the reservations database of Starwood Worldwide Resorts, which Marriott acquired.

While there is no doubt that the vast majority of Accenture’s implementations have been successful, this is a risk that investors must be aware of and willing to take.

3. Recessions

Accenture’s earnings and stock price will most likely decline in a recession, but I would view such a pullback as a buying opportunity.

Summary

-

Companies that are digital technology leaders achieve up to five times the revenue growth compared to those that under invest in technology.

-

As companies around the world step up and continue to spend on technology to widen their lead over or play catch up to competitors, the demand for consulting and outsourcing services will inevitably grow.

-

Accenture is a leading provider and market share leader in this space, and enjoys advantages in marketing, hiring, returns on its investments in R&D and acquisitions, and operating leverage due to its brand, reputation, and scale.

-

Accenture’s growth and stock price have significantly outpaced its large competitors over the last 7 years, but the recent pullback creates a buying opportunity for long-term oriented investors.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ACN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.