Summary:

- Taking lessons from their successful foray into cloud services, Accenture is making early investments in AI.

- Their dominant market position in IT services and strategic investments in AI set them up for success in the coming decade.

- Accenture’s stock price is undervalued, and I give Accenture a ‘Strong Buy’ rating.

We Are

I believe that the rapid rise of generative AI will accelerate the adoption of cloud, data, and security in the era of digitalization. Additionally, companies are prioritizing total enterprise reinvention as they aim to reduce costs and enhance their business’s resilience and agility. Accenture (NYSE:ACN) is well-positioned to address these strategic growth priorities, as they navigate the digital era with cloud, data, and generative AI.

Key Growth Strategies

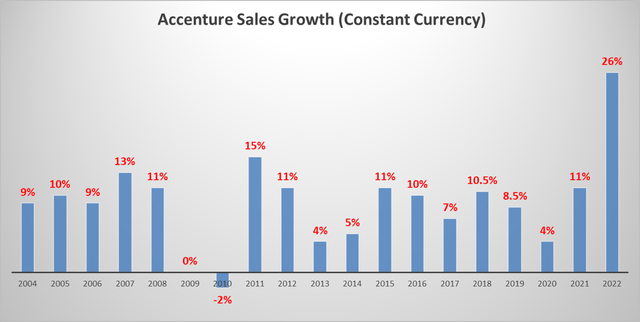

Accenture has achieved remarkable sales growth in the past, with constant currency revenue growth (including organic growth and M&A) ranging from high-single-digit to double digits.

Accenture 10K, Author’s Calculation

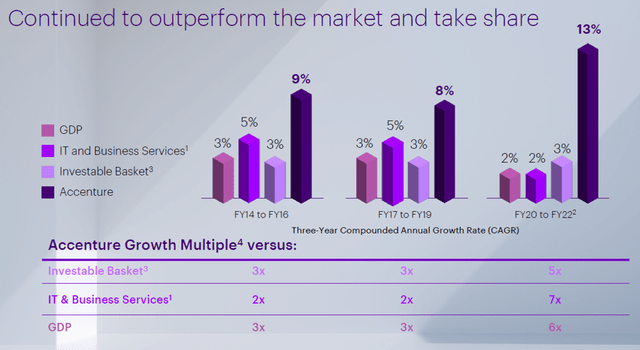

I believe they have consistently outperformed the market and gained market share from small and mid-sized IT services vendors.

Accenture 2022 Capital Market Day

I believe the key growth drivers for Accenture are as follows:

Cloud as a platform: Cloud business represents approximately 42% of the group’s sales. The business has achieved a sales compound annual growth rate of 35% during the period from 2019 to 2022. The momentum in the cloud business continues with strong double-digit growth as clients prioritize establishing a robust and secure foundation for reinvention. Accenture is a pioneer and clear leader in the cloud business. It is remarkable to note that they had only $1 billion in sales in 2012, but by 2022, their sales reached $26 billion.

Data as an enabler: Accenture has earned recognition as a leader in data and analytics. While modern platforms are a crucial part of transformation, companies need to leverage real-time data and analytics, along with adopting new ways of working, to unlock the true value of technology. This requires new digital skills that Accenture can provide.

AI as a differentiator: Accenture believes that generative AI has captured the attention of leaders and the public faster than any previous technology wave. I believe we are entering the age of AI, and companies will need to reinvent their operations with AI at the core. Although it is still early in the AI journey, similar to the cloud revolution a decade ago, foundational models and products are maturing, with many announced but fewer at the stage of general availability for wide deployment. To expand their AI capabilities, enterprises need to migrate their workflows to the cloud and store their data in the cloud. Consequently, the adoption of AI will further accelerate cloud migration, benefiting Accenture. Taking lessons from their successful foray into cloud services, Accenture is making investments to establish an early lead and position themselves for the opportunities that lie ahead. They have announced a $3 billion investment in AI, with plans to double their data and AI workforce from 40,000 to 80,000. This includes expanding their team of over 1,600 generative AI experts and developing new industry solutions powered by generative AI. I believe Accenture is well-positioned in the AI era, just as they were for cloud a decade ago.

Outlook and Headwinds

In Q3 2023, Accenture expects revenue growth in constant currency to be in the range of 8% to 9% over fiscal year 2022, assuming a 2% contribution from inorganic growth. They also anticipate an adjusted operating margin of 15.4% for fiscal year 2023, a 20-basis point expansion compared to fiscal year 2022 results. Additionally, they plan to return at least $7.1 billion through dividends and share repurchases, which is approximately 3.8% of the current market cap.

However, there are some key near-term headwinds to consider:

Weakness in small deals: Accenture indicates that small deals are currently weak due to the macroeconomic environment. Some small businesses are deferring IT projects, reducing staff, and tightening budgets. Accenture expects 2-6% sales growth in Q4, which already accounts for the weakness in small deals. If the small deals remain weak, Accenture forecasts 2% sales growth, which represents the lower range of their guidance. While I cannot predict the future, I anticipate continued headwinds for small deals in the near future, given the persistence of high inflation. The good news is that Accenture has already factored in this weakness in their guidance.

Strong FX headwinds: Accenture experienced 2.5% FX headwinds in the last quarter, and they now anticipate approximately negative 4% impact of FX on sales in USD compared to fiscal year 2022. FX headwinds will be one of the significant challenges for Accenture.

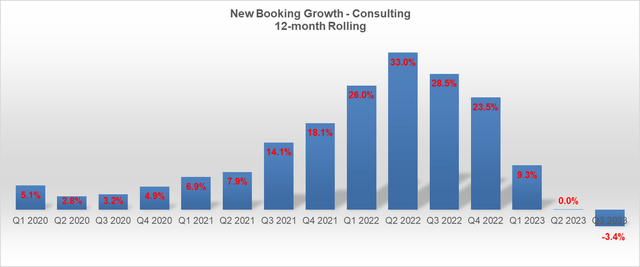

Weak Consulting Bookings: As new bookings tend to fluctuate from quarter to quarter, I use the 12-month rolling figure to calculate the new booking growth for Accenture’s consulting business.

Accenture’s Quarterly Results, Author’s Calculation

Accenture has experienced a slowdown in new bookings for their consulting services. Their consulting sales declined by 1% in constant currency in Q3, and they anticipate a similar decline in Q4. This decrease is partly attributed to the aforementioned weakness in small deals. Many small projects, especially new ones, are deferring their timelines. While I believe this trend will continue to pose a headwind for Accenture in the near term, large enterprises are expected to continue investing in transformative projects, particularly in areas such as cloud, data, cybersecurity, and AI.

Valuation

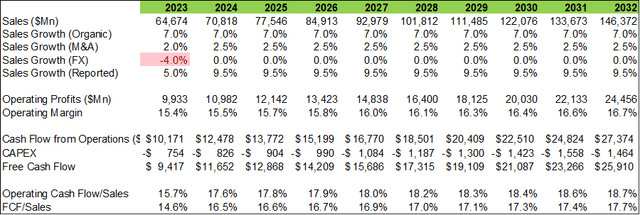

I have broken down the sales growth assumptions into organic growth, FX impact, and M&A contribution. For FY23, my assumptions are 7% organic sales growth, 2% growth from M&A, and a -4% impact from FX headwinds. These sales growth assumptions align closely with Accenture’s guidance. Regarding operating margin, I assume a 20 basis points improvement in FY23 and a gradual 10-20 basis points improvement annually going forward.

Accenture’s DCF Model-Author’s Calculation

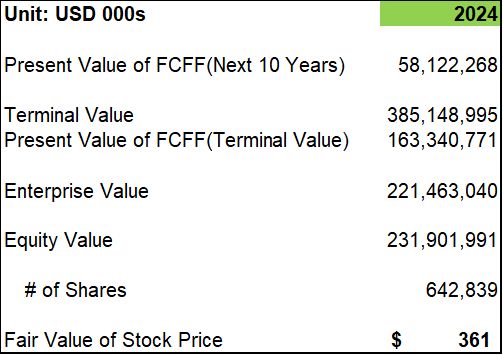

The DCF model uses 10% of WACC , 4% of terminal growth rate and 24% of tax rate. With these assumptions, the free cash flow conversion is estimated to reach 17.7% in 2032 in the model. The present values of free cash flow from firm over the next ten years and terminal value are $58 billion and $163 billion, respectively. Adjusting the debt and cash, the fair value of Accenture’s stock price is calculated at $361 in the model.

Accenture’s DCF Model-Author’s Calculation

In addition to the DCF model, Accenture is currently trading at around 18x of free cash flow. As I mentioned in my previous article for ON Semiconductor on Seeking Alpha, a 20x of free cash flow is quite reasonable for a steady growth company based on my past experience.

Conclusion

Accenture is in a strong position in the field of AI, much like they were with cloud services a decade ago. Their dominant market position in IT services and strategic investments in AI set them up for success in the coming decade, in my opinion. Currently, the stock price appears undervalued, leading me to give Accenture a ‘Strong Buy’ rating.

Since restarting my publication on Seeking Alpha this month, I have published several research articles in the technology sector, covering companies such as Snowflake (SNOW), ServiceNow (NOW), ON Semiconductor (ON), Arista Networks (ANET), Veeva Systems (VEEV), and Airbnb (ABNB). While the latter two are not classified under the GICS tech sector, I consider them technology companies. In the future, I plan to publish research on other technology names, including Roper Technologies (ROP), Amphenol (APH), Adobe (ADBE), ASML (ASML), Microsoft (MSFT), Amazon (AMZN). These companies encompass the entire tech sector within my growth portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ACN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.