Summary:

- Accenture’s stock shows modest growth, facing challenges from reduced discretionary spending in consulting projects.

- Recent acquisitions, especially in AI, position the company for mid-digit growth, reflected in Q1 FY24 upbeat bookings.

- Ongoing business spending slowdown and potential dollar impact pose risks, but I expect a rebound with GenAI momentum.

DNY59

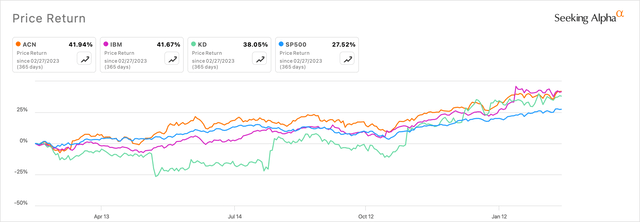

Accenture (NYSE:ACN) has seen modest growth in their stock’s performance, beating the broader market indices. Over the past year, the company’s market cap rose ~41%, higher than the S&P 500 at ~27% and beating some of its peers such as IBM (IBM) and Kyndryl (KD).

sa

Still the technology consulting company’s market performance is dwarfed by larger technology companies such as Microsoft (MSFT) and Salesforce (CRM). Optimism in the company’s outlook appears to have waned since the company is seeing its growth rates stall as businesses reduce their discretionary spending while allocating their budgets towards larger growth areas such as GenAI.

Accenture has made it mission-critical to also pivot in this area. Over the past couple years, the company has taken advantage of its strong cash position to acquire companies. I believe these acquisitions position Accenture towards a path of profitable growth again, and I see room for the stock to run given these initiatives turning me bullish on the stock.

About Accenture

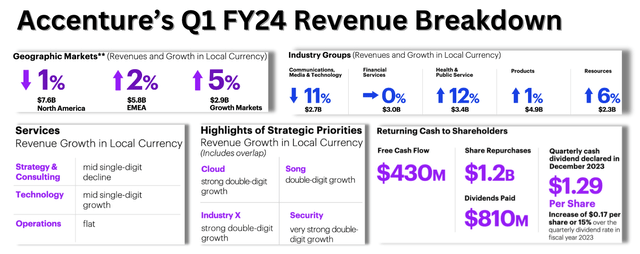

Accenture is a professional and managed services company with the aim of providing consulting services to clients and enterprises, helping them digitize their businesses and optimize their operations. This global consulting heavyweight offers consulting services as well as managed services or outsourcing services. As of its FY23 10K report, slightly over 50% of its revenues come from Consulting, whereas the rest come from its Managed Services business. I have compiled a snapshot below from its Q1 FY24 presentation.

Author’s compilation from Accenture’s FY24 Q1 quarterly presentation

The company also has a history of working with companies across industry types. Consumer product clients account for around 30% of Accenture’s revenue share. Clients in the Financial Services, Healthcare, and Communications & Media domains each account for 18%–20% of Accenture’s revenues. Around 47% of its clients are North American companies, with 33% being in Europe and the rest in emerging market regions.

Since the company operates within the business consulting and managed services domains, it typically enters into multi-year contracts with its clients and records the volume of these contracts as Bookings. I view Accenture’s new bookings metric as an approximate forward indicator that signals the growth of its business, since more bookings mean more contracts signed, with the potential for more revenues per contract signed.

Acquisitions may reverse the slowing trends in Accenture’s business.

In general, the consulting space has been hit by slowdowns in project budgets. These trends were especially visible in Accenture’s results, which were more pronounced in some of their stronger revenue segments, which I will discuss later. But the key takeaway from Accenture’s Q1 FY24 earnings call last month was that businesses are continuing to decrease their discretionary budgets for projects, as noted by Accenture’s management on the call.

As expected, we continue to see lower discretionary spend, which particularly impacts our consulting type of work as well as slower decision making and our CMT (Communications, Media, & Technology) industry group continues to be challenged. We remain on track with the business optimization actions we announced in March to reduce structural costs to create greater resilience.

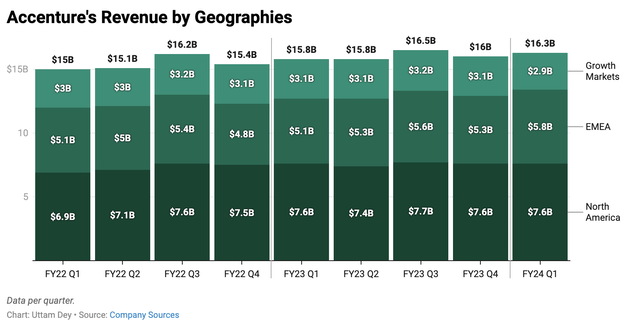

As can be seen in the chart below, revenue growth rates have been stalling since mid-2022.

Accenture’s revenue by Geographies, Author’s compilation from company sources

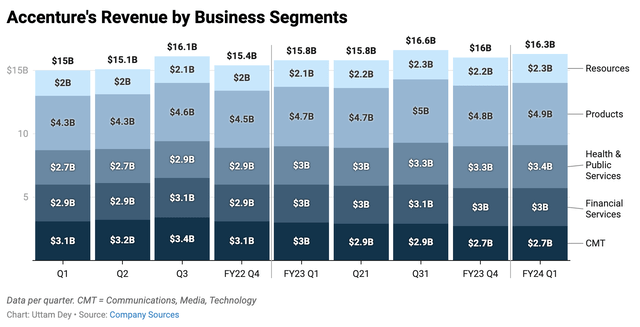

Most of the slowdown was attributed to their business in North America, which, as I noted earlier, usually accounts for 47% of their revenue. In terms of revenue segments, the slowdowns have been more pronounced within their clients that are part of the Products business group and the CMT group, as these businesses were particularly hit hard by the rapid rise in interest rates. This was also pointed out by Accenture’s management in the commentary I attached earlier. In the chart below, I see how quarterly y/y trends in revenue within business segments and geographical segments show slowdowns.

Accenture’s revenue by Revenue Segments, Author’s compilation from company sources

However, in the Q1 FY24 quarter, Accenture issued some upbeat numbers in their bookings, which may point to a trough in their earnings moving forward. In the Q1 quarter, Accenture noted that its bookings were up 14% y/y to $18.4 billion. Accenture noted that its consulting projects related to digital transformations, such as Cloud and Security saw strong double-digit growth. Moreover, Accenture has been very busy in the past couple of years, acquiring close to 14 companies since 2022. Four of those acquisitions have been made in the last two months alone, and most of the recent acquisitions are tied to AI. On the Q1 call, management noted that it had completed $450 million of sales in Q1 alone due to GenAI projects, which easily overshadowed the $300 million it achieved due to sales from GenAI projects through FY23.

With respect to the acquisition strategy, I have attached an excerpt from management’s Q1 FY24 call that I think would appropriately add color to Accenture’s acquisition-led strategy. I have also bolded one sentence in particular in the commentary below, which shows how management draws from its history of leaning on its investment capacity.

We’re still investing to either scale in hot areas or add new types of skills. You see that we’re executing in capital projects like we described. I would reiterate that it is really a huge competitive advantage for us that we can invest across the cycles. You saw that we did that in the first year after the pandemic, where we significantly increased, and again, always to drive organic growth and position ourselves for those next waves. So, you’re going to see the AI acquisitions. You saw health in the UK, another great area of growth, capital projects. So, think about our strengths here is how we accelerate pivoting to growth.

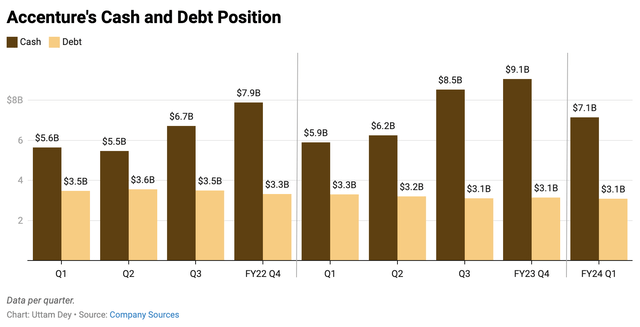

Although the company’s cash levels have declined, the company still looks healthy and is able to service its net debt position. I suspect management is using the company’s strong cash position to invest it in emerging areas of growth and fund its next chapter using acquisitions that I mentioned in the earlier paragraph.

Accenture’s cash and debt positions, Author’s compilation from company sources

Furthermore, management also revealed in the Q1 FY24 call that they are sticking to their long-term objective of returning cash to shareholders, having executed 22% of their share buyback program in the last quarter and repurchased $1.2 billion worth of shares at an average price of $311.90 per share. Observing how management is diligently managing the company’s debt levels in the chart above while investing its cash for future growth, I sense that management saw value at the ~$315 price range and bought back shares. By doing so, I see that Accenture’s is consistently managing the dilution in its shares, as its outstanding share volume has fallen by just under a percent on a compounded basis over a five-year trailing period.

Outlook for Accenture

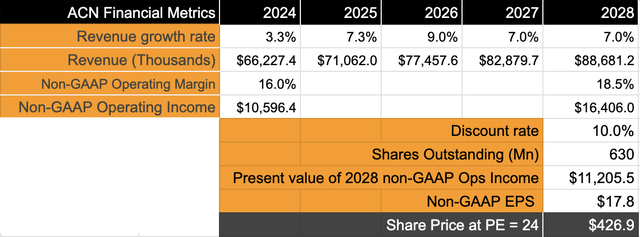

Accenture has demonstrated its acuity in moving swiftly to gain market share in the consulting and managed services space for GenAI. The acquisitions that I reflected upon earlier manifest Accenture’s ambitions to benefit from GenAI. I believe these acquisitions in the past few years will pivot the professional services company towards higher mid-digit growth from now on, as the company has already seen some of that benefit in the last few quarters. At the same time, management has also prioritized delivering moderate margin expansion per their Investor Day presentation. Taking these assumptions into account, I expect their adjusted operating income to grow at ~12% CAGR, outpacing its ~7.5% compounded growth over a five-year period.

Author

At this pace of compounded growth, I think a forward PE of 24 is justified, which means the stock is currently undervalued with at least 12% upside.

Risks & Other Factors to consider

If the business spending slowdown continues as the company had previously seen in the last few quarters, the outlook of Accenture will deteriorate, forcing me to reconsider the optimistic outlook that I currently have for the company. As mentioned earlier, I had noted how Accenture management still sees business discretionary spending decelerating, but they expect spend cycles to reverse higher, and the momentum in its GenAI bookings is expected to aid higher revenue growth, in my opinion.

The dollar also plays an important role in impacting Accenture’s growth. With the surge in the U.S. dollar in FY22, Accenture was impacted as businesses pushed out their projects due to higher exchange rates and interest rates. So far, Accenture continues to see no impact from the dollar if it remains flat on a y/y basis. But were the dollar to move higher again, it would add headwinds to Accenture’s revenue growth rates.

Takeaways

I believe Accenture is setting itself up to be a secular beneficiary of the shift towards GenAI by consolidating its position in Consulting and Managed services. Management has reinvested cash towards acquiring companies that will help it re-accelerate its growth trajectory while prioritizing margin expansion at the same time, aiding the long-term bullish view I hold for Accenture. I rate Accenture as a Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ACN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.