Summary:

- Accenture is a top-tier IT services firm with strong diversification across regions, industries, and service offerings.

- The company’s Q4FY23 growth was slightly lower than expected due to reduced discretionary spending and challenges in the Communications, Media & Tech sector.

- The stock is already trading in line with peers; therefore, I stay cautious for now and assign a hold rating to the stock.

Laurence Dutton

Investment Thesis

Accenture plc (NYSE:ACN) is a top-tier IT services firm with an appealing Free Cash Flow yield. ACN stands out in the IT services industry due to its exceptional diversification across regions, industries, and service offerings. Approximately 70% of its workforce is located in cost-effective locations, a high percentage compared to traditional IT services firms. The company derives significant revenue from approximately 190 clients, contributing over $100 million annually. ACN’s consistent investments in training and acquisitions are likely to maintain its leading position in high-growth areas of the IT services sector. However, a decrease in spending on discretionary IT services is having a negative impact on the growth of consulting sales, and I expect the pressure to continue in the near term. The stock is already trading in line with peers; therefore, I stay cautious for now and assign a hold rating to the stock.

Q4FY23 Review and Outlook

Accenture’s fiscal year 2023 closed reporting a 3.64% YoY growth slightly lower than market expectations mainly due to industry-wide reduced discretionary spending, which impacted its consulting business, and challenges in the Communications, Media & Tech (CMT) vertical that dragged down overall growth. Considering the macroeconomic challenges affecting the IT services sector throughout the year, this performance can be seen as a success, as it aligns with the lower end of the original 8-11% growth guidance set a year ago (following an exceptional 26% growth in FY22).

For fiscal year 2024, Accenture’s revenue growth guidance of 2-5% in local currency was slightly below the 3-6% anticipated, mainly due to a slower start to the year and the need to build up its book of business. Nevertheless, with a substantial backlog, an increase in the number of Diamond clients (up 33 from the previous year), and investments in strategic areas like artificial intelligence (AI) sales, I am optimistic that Accenture can achieve mid-single-digit, high-quality growth or better by the end of FY24, consistent with its historical five-year average, and deliver double-digit total returns.

Despite the challenges in consultancy and slower spending in the CMT sector, Accenture does not plan significant changes to its growth strategy. The company expects enterprises to continue their digital transformation efforts to reduce costs and drive growth. Accenture is well-positioned to capture this demand, having established a strong presence in cloud, data, AI, and security services through staff training and strategic acquisitions. With a healthy balance sheet and an expected free cash flow of $8.7 billion to $9.3 billion for the fiscal year 2024, I believe the company has the resources to execute its growth strategy.

Positioned to Drive Market Share Gains

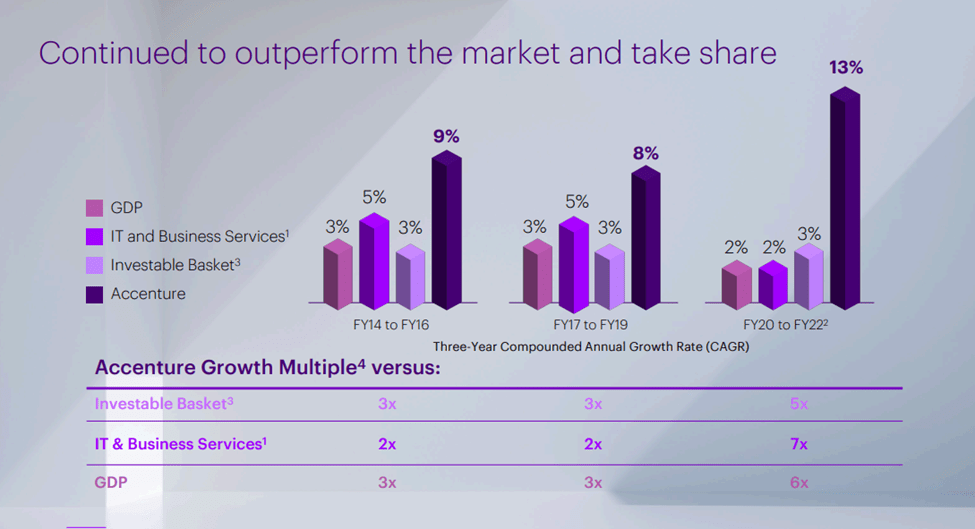

Accenture currently holds the top position in the $1 trillion technology services market and has consistently outpaced industry growth for more than a decade. Remarkably, even with this impressive performance, Accenture’s market share remains below 5%, indicating significant room for expansion if the company continues to invest aggressively in emerging technologies and captures a larger portion of its IT budget. Over the last five years, the industry has achieved growth of approximately 5%, slightly above the global GDP, while Accenture has achieved an impressive 11% expansion.

Accenture’s success in gaining market share, despite its size, can be attributed to its proactive approach of investing in emerging technologies ahead of the curve. This commitment to continuous innovation sets it apart in the IT services sector and enables the company to adapt its operating strategy as needed. I anticipate that Accenture is well-positioned to maintain this trajectory in the coming decade, particularly as technology spending continues to increase as a proportion of the global GDP. Notably, Accenture’s workforce is substantial, with over 700,000 employees, surpassing other major players like TCS (over 600,000), Infosys (over 330,000), and IBM (around 300,000).

Company Presentation

Continues Innovation Provides Edge

Accenture possesses several distinct advantages that set it apart from its competitors. These include its strong brand, a culture of staying ahead in technology investments, a robust consulting division, and close and enduring client relationships. Accenture’s longstanding collaborations with leading global corporations, spanning several decades, enable it to secure business without the need for competitive bids. Approximately 70% of Accenture’s new bookings come from sole-source agreements, indicating that other competitors are not even considered for these projects. Remarkably, 99 out of its top 100 clients have maintained partnerships with Accenture for more than ten years. The company’s unique culture of continuous reinvention and substantial investments in emerging technologies contribute significantly to its ability to achieve sales growth that surpasses industry averages. Additionally, Accenture’s strategy of targeting smaller acquisitions and then scaling these businesses is a key differentiator.

Financial Outlook & Valuation

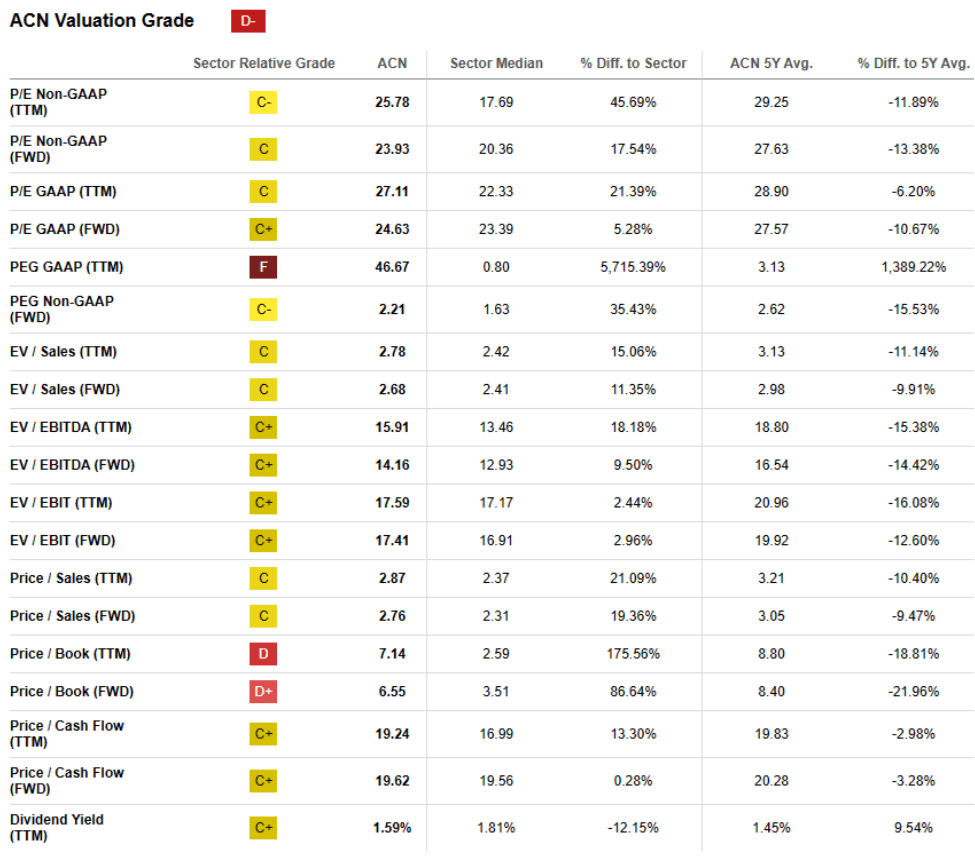

I believe Accenture’s margins could show slight improvement over the next 12 months, aided by falling employee attrition, muted subcontractor costs, and the possibility of lower wage increases. I anticipate the company to continue to reinvest its excess profit, given the company’s history of reinvesting in growth. The recent announcement to invest $3 billion in data and AI is one such area for new outlays. I believe Accenture is better positioned than other consulting-focused service providers to gain from an acceleration in AI-related projects in the next 3-5 years, which, along with a potential rebound in cloud spending, could push its annual sales growth rate back to double digits. ACN is currently trading at 24x forward PE, roughly around the sector median of 23x. Over the past year, ACN has typically traded at a premium compared to its peers when looking at the next twelve months price-to-earnings ratio. ACN’s current premium of 32% compared to the S&P 500 index is consistent with its historical trading patterns. ACN’s strong positions in both Managed Services and Consulting justify a valuation similar to leading Business Process Outsourcing (BPO) companies like ExlService Holdings, Inc. (EXLS), which trade at multiples of 23x. Additionally, ACN’s valuation aligns with that of top Digital companies like EPAM Systems, Inc. (EPAM), despite ACN having a lower growth rate due to its significantly larger revenue base. Therefore, I remain cautious for now and assign a hold rating to the stock.

Seeking Alpha

Investment Risks

A decrease in IT spending could result in lower demand for Accenture’s services, making the effective execution of mergers and acquisitions critical since any unforeseen issues might hinder the company’s ability to gain recognition for future M&A activities. There is also a potential risk of price competition, especially given the ongoing offshore outsourcing trend, which could affect profit margins. Moreover, if major outsourcing contracts underperform relative to expectations, it could have adverse effects on both financial performance and market perception.

Conclusion

Accenture holds a prominent position in the $1 trillion technology-services market, consistently exceeding industry growth for over a decade despite a market share. With a remarkable 11% expansion in the last five years, Accenture’s success in gaining market share is attributed to its proactive approach to adopting emerging technologies, enabling flexible strategy adaptation. Nonetheless, the reduction in discretionary IT service spending is adversely affecting the expansion of consulting sales, and I expect this pressure to persist in the short term. Given that the stock is currently trading in line with peer companies, I remain cautious for now and assign a hold rating to the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.