Summary:

- Accenture’s strong cloud investments over the past few years could support high-single to low-double-digit sales growth in 2023.

- The need for greater insights as well as emerging technologies like Internet of Things, blockchain, and metaverse could be longer-term drivers for IT services.

- ACN stock is trading at a discount compared to its historical multiple.

Khanchit Khirisutchalual

Thesis

Accenture’s (NYSE:ACN) emphasis on investing ahead of the curve in emerging technologies is the primary reason it’s gaining market share from rivals — despite its size — and I believe this should continue. The company’s culture of continuous innovation is unique in the IT-services industry and has helped the company reinvent its operating strategy when needed. Recent bookings data suggest that demand is softening, and sales growth in fiscal 2024 will be lower than in the past three years. However, ACN stock is currently trading at a discounted multiple to its historical EV/EBITDA at 13.5x. I keep an end of December’24 price target of $322 based on assumed 15x multiple to CY24E EBITDA.

Growth in Sales and Earnings Supported by Projects in Attractive Segments

Against the backdrop of a more challenging macroeconomic environment, Accenture delivered a strong performance in the previous quarter. The market conditions are not similar to 12 months ago, with an increased level of uncertainty. Clients are slowing their investment decisions and reducing budgets on lower-priority projects or those with a longer return on investment. However, the full-year outlook reflects resilient competitiveness and indicates that the growth strategy still works. ACN continues to see an acceleration in cloud adoption and is working with many clients on cloud management, cloud migration, and other cloud-related deals. The same applies to security services and digital platforms. Both activities continued to show double-digit sales growth in the previous quarter.

The consulting business has been a key driver of growth in the past few quarters. The slowdown was anticipated as the consulting activities are quite sensitive to broader economic development. Still, consulting remains an important part of Accenture’s business model as it allows the firm to establish deep and long-lasting relations with its clients and to foresee future trends in IT. Traditional players in IT service and consulting are trying to build similar business models. Wipro spent $1.5 billion to acquire Capco, a technology consultancy firm, and this has helped the firm to win deals that it would not have gained without Capco. However, Wipro still lacks the expertise and scale to challenge Accenture’s position.

Accenture’s consultancy activities are sensitive to broader economic development but remain an important pillar in the firm’s growth strategy. The combination of consultancy capabilities and IT services presents an important competitive advantage that cannot be easily replicated, even as other large IT service providers try to also develop consultancy activities. In the past few years, the company has strengthened its business model by shifting to attractive growth segments in the IT services industry through training and acquisitions. By focusing on attractive areas, Accenture can benefit from structural growth and relatively favorable pricing.

Accenture’s Cloud Investments to Support Steady Growth in 2023

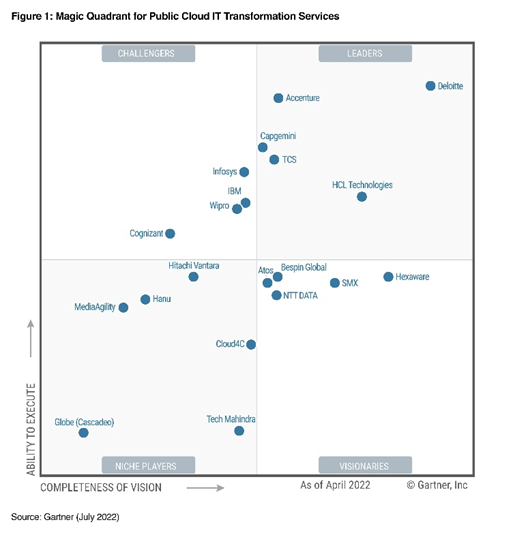

Accenture’s strong cloud investments over the past few years could support high-single to low-double-digit sales growth in constant currency in 2023, which I view as impressive given that tech spending will likely be flat to down overall. I anticipate sales growth will likely be better than most of its rivals, driven by both cloud and Accenture’s deep relationship with its top clients. With its investment, Accenture could see its leadership position in managed public-cloud services improve vs. rivals Tata Consultancy Services, Infosys, and Cognizant in the next couple of years. The business involves IT services companies managing a client’s infrastructure, which is hosted on one of the public-cloud providers such as Amazon.com (AMZN), Microsoft (MSFT) or Google (GOOG). As legacy IT-infrastructure outsourcing business declines due to enterprises shutting down their data centers, managed services are becoming the preferred model. That digital shift gives Accenture optimal exposure to industry leaders and innovators.

Magic Quadrant for Public Cloud IT Transformation Services (Gartner)

Cloud-First Program Right Step at Right Time

Accenture’s decision to double down on its cloud strategy is on track, given the potential for new projects as only 13% of enterprises that access the cloud are using it to the full extent as of the company’s April analyst day. In September 2020, the company designated $3 billion to be spent over three years to expand its expertise, creating Accenture Cloud First with a staff of about 70,000. The capital is being spent on acquisitions, training talent, and creating tools that help migrate workloads and applications to the cloud. During the fiscal year of 2022, ACN allocated $3.4 billion towards 38 important acquisitions, $1.1 billion towards research and development, and another $1.1 billion towards education and training.

Data and Analytics, IoT Drive Long-Term Growth

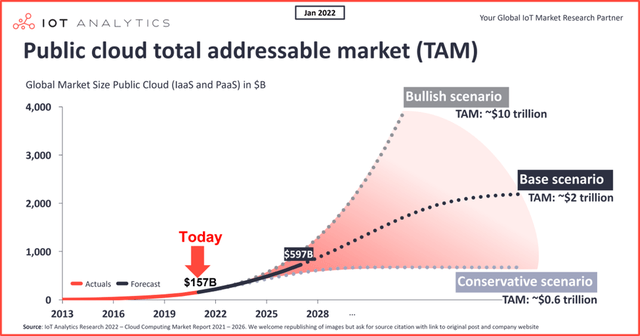

The need for greater insights as well as emerging technologies like Internet of Things (IoT), blockchain, and metaverse could be longer-term drivers for IT services. Data-related projects undertaken by IT services companies integrate information from various sources, both within and outside of an organization, to create a common platform that anyone can use. Once the information is normalized, IT services companies help clients create analytics dashboards to gain better insights into their operations and customers. While IoT has a fair degree of hardware and associated software spending, blockchain-related work depends mostly on services. Worsening economic conditions could stall the growth rates of these technologies, as they aren’t critical to an enterprise, compared with cloud and security.

TAM forecast for Public Cloud Market (IOT Analytics)

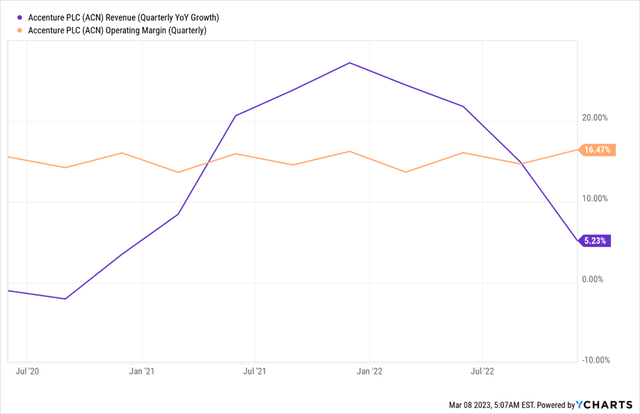

Sales and Margin Outlook

Accenture’s organic top-line growth could return to pre-pandemic levels of 6-8% in constant currency over the next 12-18 months, as enterprises hold back on new IT projects. Acquisitions may add another 2% to this rate, which would allow Accenture to increase sales 8-10% in constant currency even in a downturn. In comparison, revenue gains in constant currency have averaged 23% over the past 12 months. Meanwhile, I expect a modest expansion in operating margin of about 30-50 bps each year, with employee attrition easing and management maintaining a healthy pace of investments in emerging technologies.

ACN’s historical operating margins and revenue growth (YCharts)

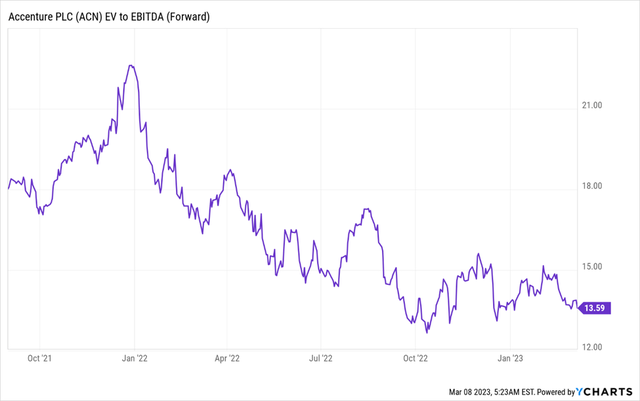

Valuation

ACN is currently trading at a discounted multiple to its historical EV/EBITDA at 13.5x. I keep an end of December’24 price target of $322 based on assumed 15x multiple to CY24E EBITDA. The company trades at a premium valuation compared to peers which I think is justified, given the companies above average revenue growth, a leading position in the digital industry, consistent expansion of profit margins, and strong free cash flow. However, there are also risks associated with the company’s business, such as a potential decrease in demand for IT services, challenges specific to certain industries or regions, increased pricing pressures in older, more standardized services, and the complexity of integrating acquisitions.

ACN’s historical forward EV/Ebidta (YCharts)

Final Thoughts

Accenture’s growth strategy remains resilient despite the challenging macroeconomic environment. The company’s strong investments in cloud, security services, and digital platforms, as well as its deep and long-lasting relationships with top clients, could support high-single to low-double-digit sales growth in 2023. The company’s cloud-first program is on track, and data and analytics, as well as IoT, could drive long-term growth. The stock is trading at a discount compared to its historical multiple, which is why I keep a Buy rating with an end-of Dec’24 price target of $322 based on assumed 15x multiple to CY24E EBITDA.

Disclosure: I/we have a beneficial long position in the shares of ACN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.