Summary:

- Accenture delivers growth through the economic cycle.

- The company is active in fast-growing areas like the metaverse, technological transformation, and outsourcing.

- The stock became more reasonably valued over the past year. The current price gives it a strong upside potential.

- ACN rewards shareholders with a growing dividend and regular buybacks. Over FY2023, it plans to return $7.1B in cash or ~4% of its market cap.

noel bennett/iStock Editorial via Getty Images

Accenture (NYSE:ACN) is a growth machine with high free cash flow generation. It’s reasonably valued and regularly returns cash to shareholders. Accenture’s current price is an opportunity for long-term investors.

My recent articles have focused on ‘buy and hold’ stocks for the long run. I started with ten stocks to buy and hold forever. Later came a list with three hidden gems, and during the post-summer sell-off, I wrote about four more possibilities.

Accenture also fits this strategy of being a long-term buy-and-hold.

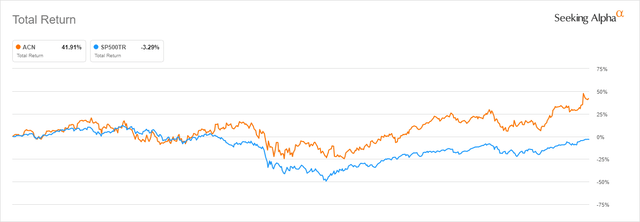

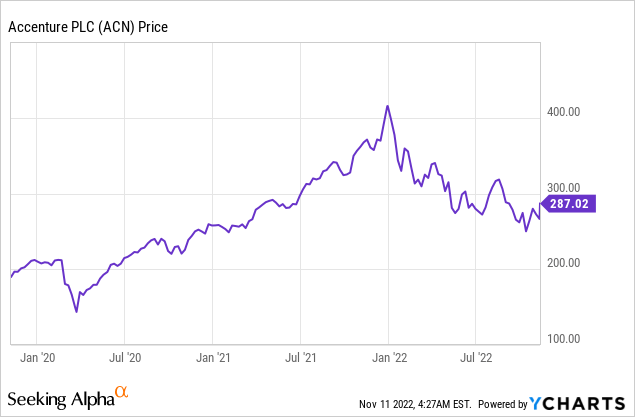

Recent Share Price Evolutions

Accenture profited from a post-pandemic boost like many other tech stocks. Signs of a slowdown in growth brought the share price back to more reasonable levels.

About Accenture

Accenture is a leading provider of professional IT services. It helps businesses build their digital core, optimize their operations, and accelerate revenue growth. Accenture identifies five key forces to evolve companies:

- Total enterprise reinvention

- Talent

- Sustainability

- The metaverse continuum

- The ongoing technology revolution

These forces make sense as they provide vast possibilities for many companies. Accenture can help develop these opportunities with its services and profits from outsourcing demand for professionals in these areas.

Accenture aims to grow with respect for all stakeholders:

“Our goal is to create 360° Value for all our stakeholders-our clients, people, shareholders, partners and communities. This goal reflects our growth strategy, our purpose, our core values and our culture of shared success.”

-Julie Sweet Accenture Chair & CEO

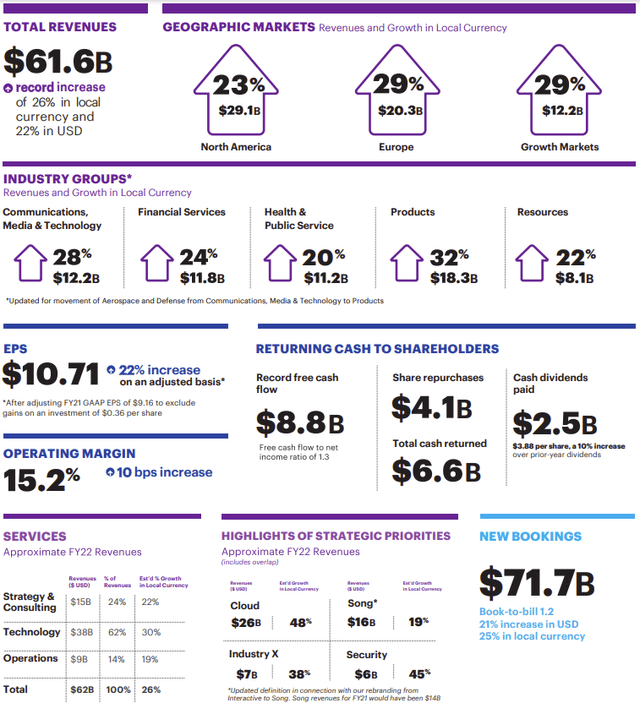

Its latest 2022 FY results (ending August 31) showed fast and profitable growth in all areas with strong new bookings.

The one-pager of Accenture immediately shows many of my reasons to invest in Accenture: strong growth and outlook, high free cash flow, and regular shareholder returns.

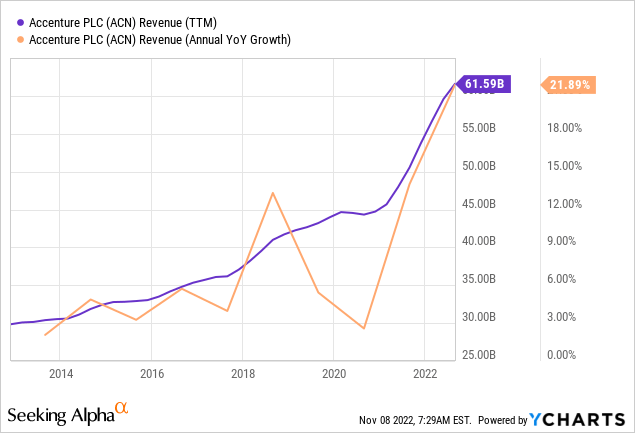

Solid Growth

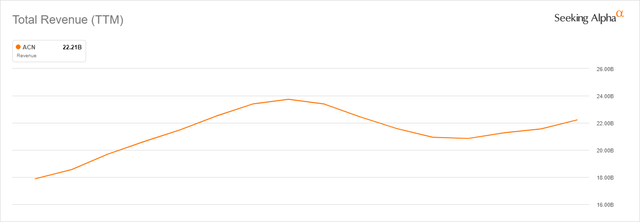

Accenture’s past growth is undeniably strong. It profited from the post-pandemic demand like most IT service companies and saw the growth extend into 2022. The currency headwinds didn’t even dent the results.

Accenture’s revenue grew faster than its workforce, which increased by 15.5% in 2022. The strategy clearly paid off over the past few years with solid growth.

Future Growth

The near-term future is still solid for Accenture. 2022 bookings increased by 20.9% in USD. It also posted a strong outlook of 8% to 11% local currency growth in fiscal 2023.

Accenture operates in a growth market. The IT Services market is expected to increase by 7.1% CAGR until 2027. In the past, it strongly outperformed the total market and intends to keep doing so in the future. Both factors combined lead to possible double-digit growth for the foreseeable future. Margin expansion puts a flywheel on EPS growth.

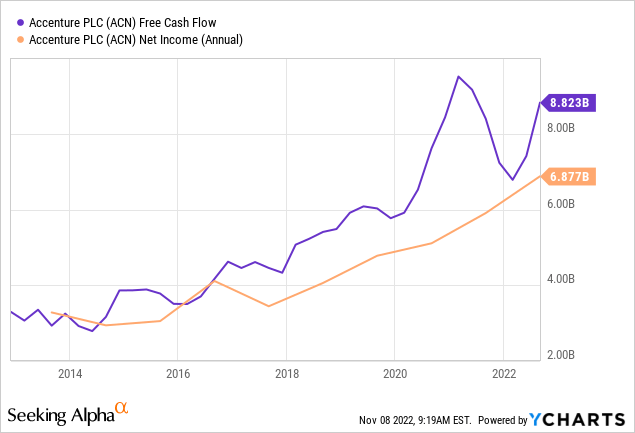

Free Cash Flow And Usage

Free cash flow is vital as this is what a company could use for shareholder returns. Potential buybacks or dividends are only possible if the company produces enough cash.

Accenture consequently generates free cash flow above its net income. It had substantial share-based compensation of $1.68B in 2022 but repurchased shares at a faster rate.

Investments

Accenture spent $3.4B across 38 strategic investments in 2022. It acquires small consulting firms to expand its expertise in business areas, grow its business, and add talent.

An overview of recent acquisitions, I’ve highlighted why they add value to Accenture:

- Blackcomb Consultants is a leading independent Guidewire partner in North America. It helps insurers to become cloud-first businesses.

- The Beacon Group is a growth strategy consultancy firm with Fortune 500 clients.

- Inspirage is an integrated supply chain specialist firm focused on Oracle Cloud technology.

- Sentia provides cloud advisory and delivery services spanning hybrid and multi-cloud strategy, cloud transformation, and migration.

It expects 2.5% inorganic growth in FY2023 from such investments.

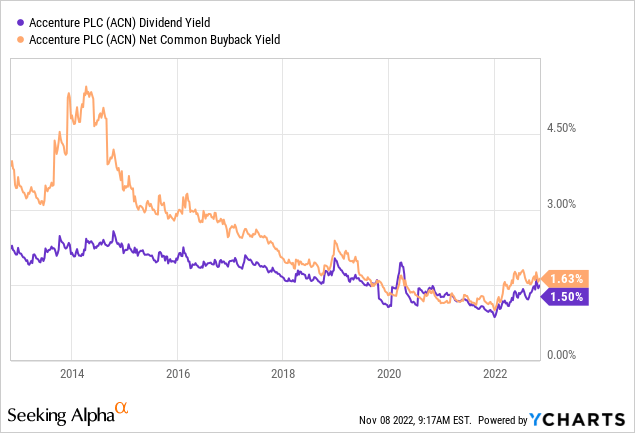

Shareholder Returns

The easiest way to spot shareholder-friendly management is the cash returns to shareholders through buybacks and dividends. Accenture has a remarkable history in both.

Accenture pays a steadily increasing quarterly dividend. It just hiked the dividend by 15%, above the 5-year average of 10%. Its 35% payout ratio of net income leaves room for further increases.

Excess cash goes to share repurchase programs. It announced an extra $3B buyback program and has $6.1B in total available for buybacks.

It expects to return at least $7.1B in cash through share repurchases and dividends in FY2023. This target implies a 4% forward shareholder yield.

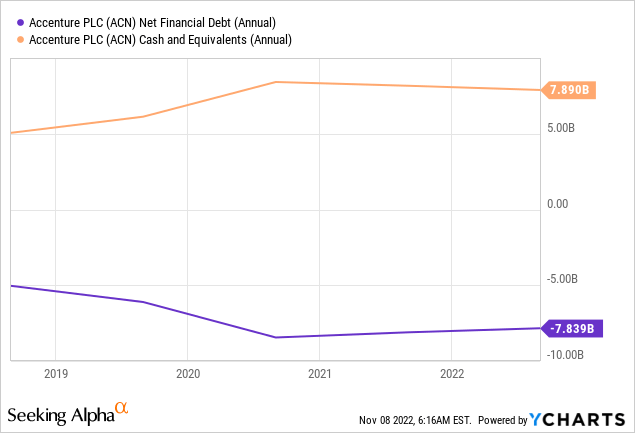

Balance Sheet

Accenture is a serial acquirer with a conservative approach. It doesn’t use considerable leverage but makes small acquisitions with available free cash flow.

Accenture’s balance sheet is rock solid. It doesn’t have significant debt and bolsters a large net cash position.

Valuation

Accenture’s valuation is reasonable. It posted strong growth in the past couple of years, and the expected slowdown in growth reduced the share price heavily.

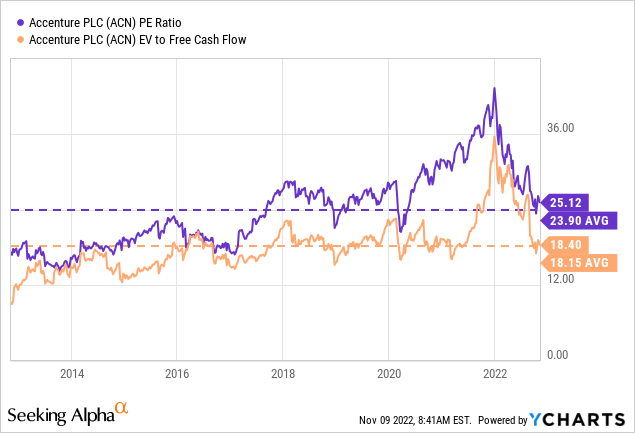

PE and EV/FCF metrics align with their 10-year average. It could always get cheaper, but it looks like a good entry point for a long-term position. It only trades slightly above the pandemic low in terms of valuation.

The lower valuation period between 2012-2016 also had slower growth rates of 0-5%. Accenture can maintain a growth rate above 7% for the next couple of years based on the industry outlook and past outperformance.

Risks

Accenture uses a buy-and-build strategy that requires a constant stream of acquisitions. A lack of targets is unlikely in the current market. Every addition does come with integration risks. I believe Accenture should easily handle this risk.

The economy could slow worse than currently expected. Outsourcing could get affected more harshly than the general market. I believe this could both provide opportunities and risks for Accenture.

In the financial crisis of 2008, Accenture fared pretty well compared to the stock market. It did experience lower revenues but wasn’t punished harshly on the stock market:

Conclusion

Accenture’s long-term outlook is bright. It outgrew sector growth in the past, both organically and with acquisitions. It’s active in many fast-growing sectors like the metaverse, technological evolution, and talent development. The company will continue this outperformance with a strong strategy executed by stable management.

The valuation is cheap compared to the past five years. It provides an excellent entry point for a quality investment.

Disclosure: I/we have a beneficial long position in the shares of ACN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Any investments you would take after a piece or discussions with me are your responsibility. Please do your own due diligence before an investment.