Summary:

- Accenture, one of the world’s largest IT service providers, has seen consistent growth over the past decade. However, the company’s recent reports showed a slowdown in business activity.

- Despite these short-term challenges, long-term prospects remain intact and the development of Artificial Intelligence technology further strengthens them.

- Loyal to its long-term strategy, Accenture is investing $3 billion in developing Artificial Intelligence technology for building new competencies.

- We believe the risk/reward is skewed on the downside due to current valuations.

JHVEPhoto

Company overview

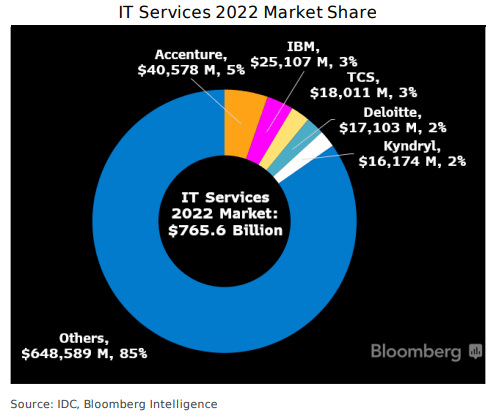

Accenture plc (NYSE:ACN) is the world’s largest provider of IT services and solutions. It employs >730k employees in >120 countries. The company offers a combination of consulting and IT services to the public sector and corporate. Revenue is distributed almost evenly between the consulting (55% of 2022 revenue) and outsourcing segments (45% of 2022 revenue). The latter has recently been renamed managed services.

(Source: IDC & Bloomberg Intelligence)

Accenture has implemented a successful strategy, consisting of leveraging its client relations with board members, CEOs, and senior executives in order to showcase Accenture’s solutions. Ideally, Accenture will propose consulting services for developing a new strategy. Then, consultants will connect with their colleagues working in technology services to deploy the technology required to implement the new strategy. Once the technology has been implemented, employees from ACN operations can be brought in to outsource those new solutions and lower customer costs. As a result, the company derives more than 50% of total revenues from 267 clients (called diamond clients) and 99 out of the top 100 clients have been with ACN for >10 years.

ACN stock key metrics

Accenture delivered 9% CAGR constant currency revenue growth (which includes inorganic growth) over the last decade. Per Bloomberg, the IT services industry grew about 3%/5% annually over the past five years, which compares to 12% CAGR in constant currency for Accenture.

At the same time, adjusted operating margin improved by≈ 25 bps per year in average while the share count declined by roughly 1% a year in average. As a result, EPS and FCF per share grew 10+% CAGR. Given the business model is asset-light (capex accounts for only 1% of sales and working capital is negative), the return on invested capital has been strong even though it has declined from 80+% in 2012 to 30+% nowadays.

Even though Accenture could be considered a cyclical company as it depends on company spending, the business proved to be very resilient. Since its IPO in 2001, constant currency revenue growth declined only twice, in 2003 and 2010, while EPS declined only in 2010. This decline was modest with a -0.4% fall in EPS. Besides, leverage remained very constrained with a net debt to FCF ratio comprised between 1x and 2x (0.9x currently) despite the company has been very acquisitive. Finally, Accenture gave back an average of >80% of its net income annually to shareholders through share buyback and dividends.

Accenture’s most recent results

Accenture reported $ 16.6B revenue in its third fiscal quarter (ending on 05/31), which represents a 2.5% year-over-year increase in a reported basis and a 5% yoy increase in local currency. Constant currency revenue growth keeps slowing down (9% in the second quarter and 15% in the first quarter). By segments, the managed services unit grew 13% yoy in local currency whereas the consulting business declined by 1% yoy. While clients continue to spend money on projects related to digital transformation, cloud transitions, security services and cost reductions, the macroeconomic environment has an impact on discretionary spending for advertising and marketing projects (which mainly hurts the strategy and consulting business) and some verticals such as the communications, media, and technology. Besides, the management noted a weakness in smaller deals (mainly short-term consulting and strategy works) while large deal activity ($ >100m) remained strong (often multi-year projects), suggesting that companies are still willing to spend money on strategic priorities and transformative projects.

The adjusted operating margin expanded by 20 basis points to 16.3% and non-GAAP EPS increased by 14% year-over-year to $ 3.19. New bookings amounted to $17.2B, a 4% increase in local currency, with consulting and managed services accounting for $ 8.9B (-2% yoy in USD) and $ 8.3B (+6% yoy in USD) bookings, respectively.

What is the outlook for ACN?

FY23 revenue guidance has been narrowed and lowered. It now calls for 8%/9% revenue growth in constant currency (including 2% of inorganic growth contribution). This compares to the previous guidance of 8%/10% and 8%/11% at the beginning of the fiscal year. FX headwinds are now expected to be around 400 bps (450 bps previously). FY23 guidance implies reported revenue of $ 64.37B at the midpoint, which does not change versus previous guidance as lower FX headwinds offset the weakness in the underlying business.

The adjusted operating margin is expected to improve by 20 bps to 15.4% (15.3%-15.5% previously). Reported EPS and adjusted EPS are expected to be around $ 10.94/11.05 ($ 10.84/11.06 previously) and $ 11.52/11.63 ($ 11.41/11.63 previously). At the midpoint, Adjusted EPS is now expected at $ 11.58 versus $ 11.52 previously.

The demand for IT is tied to corporate spending. As such, the demand for IT services could further weaken over the coming quarters. However, we believe that a weakness in demand would prove only temporary as clients will continue to invest in digital initiatives. Historically, IT spending were more related to cost reduction and back-office optimization (offshore, outsourcing…). Nowadays, the demand is more related to revenue maximization and strategic initiatives (building digital operations such as online marketing, e-commerce platform, cloud computing…). In addition, the demand for consulting services keeps increasing as consultants have specific industry expertise and can reuse solutions developed for previous clients, which may be cheaper and faster to implement than developing them from scratch.

Operating margin has improved by 25 bps annually in average over the last ten years. A significant part of the improvement was driven by labour offshoring. According to our understanding, the penetration rate of offshoring solutions varies greatly between regions. The US is the most penetrated (~80%) followed by the UK/North Europe (~65%) and South Europe (~30%). It seems that these discrepancies result from cultural reasons. Following the pandemic and the successful implementation of homeworking, clients could become less reluctant to select offshore solutions. However, all services cannot be executed offshore (not the skills, need for client proximity…). For instance, digital transformation projects are not prone to offshoring while some services such as software testing, ERP deployment, data center management… are more suitable for offshore solutions. Nowadays, client demand is more oriented towards higher value-added services (which are less prone to offshoring). Even though it may prevent the offshoring mix to improve, these services tend to offer better profitability as they are bigger and more complex.

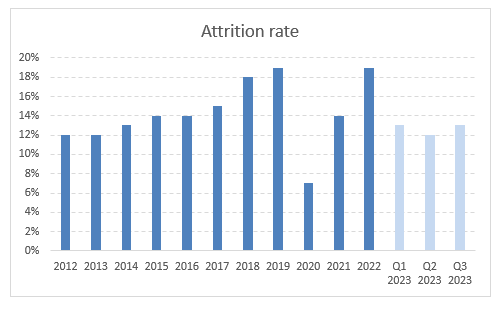

Accenture also announced that it will cut 19,000 jobs (~2.5% of the workforce) in response to weaker demand, which will support margins. Besides, as many other tech companies are doing the same, it would significantly ease the labour market within that sector, enabling companies to more easily find the workforce that they need while also easing the demand for higher compensation among staff. Indeed, the tech industry faced intense competition to attract and retain employees over the last few years. As a result, Accenture’s employee turnover fall to 13% in recent quarters while it was around 18%/19% over the last few years (2020/2021 was below because of the pandemic).

(Source: Annual reports)

To sum up, the penetration rate of offshoring solutions could increase in the ex-US regions, the increasing demand for premium services (digital transformation…) and easing workforce pressure should enable margins to slightly improve.

Why is Accenture investing in AI?

Accenture announced a three-year investment program of $3 billion to develop Artificial Intelligence technology. This program aims to develop new skills and capabilities across diagnostic, predictive, and generative AI. The company will double the number of AI specialists to 80,000 professionals through hiring, acquisitions, and training programs. In addition, Accenture has extended strategic partnerships with AWS, Azure and Google Cloud, the three largest public cloud providers, for giving clients access to the latest developments in AI.

Per management comments, generative AI is a very important focus for clients but is still at an early stage as about 50% of companies have not started on their data or AI journey. Even though generative AI is an exciting long-term opportunity, the main growth driver will come from helping clients to clean and manage datasets, migrate them to the cloud and provide data security.

Over the last two decades, Accenture proved itself by investing early on emerging technologies and ahead of the competition. Back in the early 2000s, it was one of the first players to expand into low-cost regions. The company also move ahead of the competition to take advantage of the cloud technology several years ago. These strategic initiatives have helped Accenture to maintain its competitive advantage with new capabilities and are most likely the reasons why Accenture has gained market share and grew faster than peers. The current AI program seems to be a continuation of this strategy and bodes well for future company prospects.

Valuation

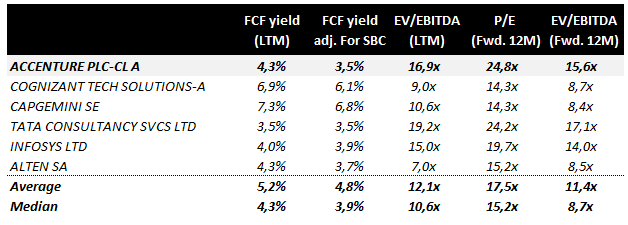

Accenture is trading at >25x earnings and 4.3% FCF yield (3.5% once adjusted for stock-based compensation). The P/E and FCF yield median and average used to be around 20x and 5% over the last 10 years, which suggests that the stock valuation may be a bit stretched, especially considering the business slowdown. Back in 2012/2013, while constant currency revenue growth decelerated from >10% to 4%/5%, the stock was trading at <15x earnings, which suggests that current valuation metrics could further contract if business activity continues to decelerate. While comparing to peers, Accenture’s valuations do not look attractive either.

(Source: Bloomberg & author)

We believe that Accenture is a high-quality company and enjoy many positive attributes. However, we are not comfortable with current valuations and prefer Capgemini (OTCPK:CAPMF) (investment thesis available here).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.