Summary:

- It’s now official – JPMorgan Chase has agreed to take over First Republic Bank in a government-led deal.

- In this article I provide the key conditions of the deal.

- I see JPM as the industry leader with the largest moat possible. Also, I see reasons why the deal makes JPM a great Buy at its current price levels.

It’s now official – JPMorgan Chase & Co. (NYSE:JPM) has taken over First Republic Bank (NYSE:FRC) in a government-led deal after it was seized by regulators, making the largest U.S. bank even bigger. The acquisition was agreed upon after private bailout attempts failed to fill the hole in First Republic Bank’s balance sheet and customers pulled their deposits. The acquisition will close one of the largest troubled banks left after the industry turmoil in March and minimize the damage to the FDIC guarantee fund, Bloomberg reports. The collapse of FRC was the second-largest bank failure in U.S. history.

Drew Angerer

If you look at the market reaction, you can see the $400 billion giant adding more than 2.6% at the time of this writing:

Seeking Alpha, JPM stock

Why the reaction is so positive? Let’s figure it out.

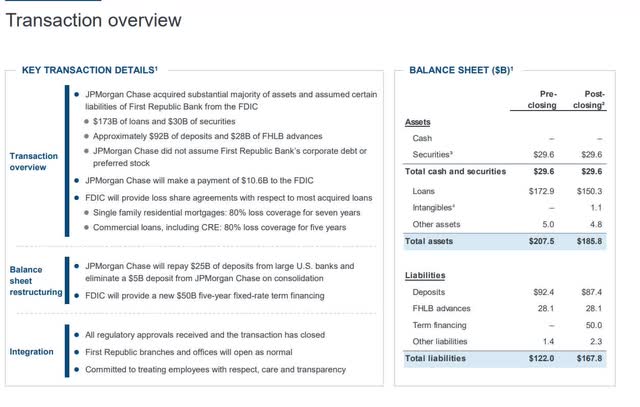

The JPMorgan and First Republic Deal

As the Seeking Alpha News team reported, JPMorgan’s CEO – Jamie Dimon – stated that the government invited them to step up and their financial strength and business model allowed them to minimize costs to the deposit insurance fund in executing the transaction. JPMorgan acquired approximately $173 billion in loans from First Republic, $30 billion in securities, and $92 billion in deposits. The FDIC will enter into a loss-sharing agreement with JPMorgan for single-family, residential, and commercial loans, and provide $50 billion in financing to the bank. JPMorgan expects to realize a one-time gain of $2.6B from the deal but spend $2B on restructuring costs over the next 18 months. First Republic Bank’s business model, which funded cheap mortgages to wealthy clients from little or no-interest deposits, collapsed when rates rose rapidly, causing panic and significant losses. Deposit outflows totaled $70B in Q1, putting the spotlight on Wall Street institutions that deposited $30B at the bank on March 16 to stave off additional fallout.

JPMorgan’s report

The deal with First Republic Bank will, of course, grow JPMorgan, an outcome that government officials have so far tried to prevent because of regulatory restrictions. These restrictions limit JPMorgan from growing its deposit base through acquisitions because it already has a large share of the U.S. deposit base. Normally, JPMorgan would not be able to grow its deposit base further because of these regulations. Consolidation in the financial industry and other sectors is also a concern of prominent Democratic lawmakers and the Biden administration.

JPMorgan CEO, Jamie Dimon, stated that the acquisition of First Republic Bank will help stabilize the bank system and that it’s a good outcome for everyone. The estimate that the acquisition will add more than $500M to JPMorgan’s net income may be conservative due to open questions about deposit retention, JPM Chief Financial Officer Jeremy Barnum added. JPMorgan will not be keeping the First Republic name, and Dimon is not a fan of putting mortgages on the balance sheet. Overall, the acquisition should have a positive impact on JPMorgan, in my view.

First, the most obvious result is that the bank grows larger under conditions that are quite comfortable for itself (with regulatory protection and loss sharing). In difficult times, different industries go through phases of consolidation – some players get bigger, and others get eaten up. This is a capitalist race, with JPM currently winning the rest by a wide margin.

Second, JPM is becoming “even bigger to fall” than it has been. The regulator has not only tried to artificially limit the size of the largest banks – its excessive consolidation threatens the entire banking system. JPMorgan has further increased its safety and stability as by becoming this big it has achieved the highest possible probability for a commercial company to be saved.

Third, if the First Republic suddenly becomes the last big victim and the crisis of regional banks suddenly stops with it, then this is definitely a positive sign for JPM because it has managed to stop being independent and thus violate the rules of the new game. If the regional bank crisis continues, JPM could be approached again – consolidation may continue. For JPM’s shareholders, I think it’s a win-win situation.

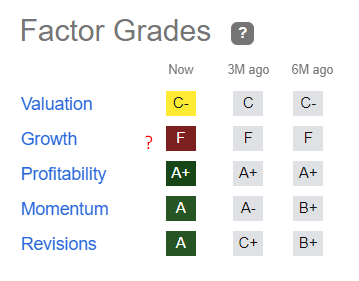

Fourth, JPM is finally able to improve its growth profile with the one-time increase in operating profit and possibly EPS. It was JPM’s growth factor that could not match the rest of its peers according to Seeking Alpha’s Quant Ranking System:

Seeking Alpha, JPM, author’s notes

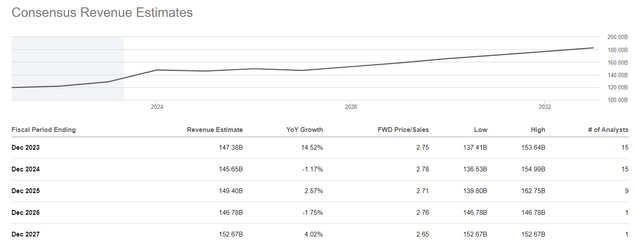

Fifth, I logically expect a positive revision to the currently available sales and EPS estimates of Wall Street analysts. Seeking Alpha shows consensus revenue of only $145.65 billion in FY2024 (-1.17% YoY), which appears to be completely off. The upward revision should allow JPM to come out of its premium valuation overnight and provide a tailwind for the stock.

Seeking Alpha, JPM

The Bottom Line

It’s too early to assess exactly how this acquisition will affect JPM stock over the medium term. Right now, we see a positive market reaction, which may turn out to be absolutely wrong in the foreseeable future – perhaps new details of the deal will become known, or we will see a negative picture of the actual financial results, and all my conclusions will lose absolutely any meaning. Moreover, JPM already is trading quite expensively (to its peers) – perhaps its growth upside is limited for FY2024 and possibly even for FY2025. Who knows, maybe JPM stock will have the same relatively poor performance over the next five years as it has over the past five years (+30.3%) due to the valuation premium and too large a basis for comparison.

Be that as it may, I see more pluses for JPM today than minuses – consolidation in the banking sector at such a high level seems an obvious win for the bank, especially on the terms this deal was done. Today, I see JPM as the industry leader with the largest moat possible, which got even bigger after the FRC purchase. I rate JPM as a “Buy” and look forward to seeing how the acquisition is reflected in the official financial reports.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in JPM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to navigate the stock market environment?

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% – hurry up!