Summary:

- Activision Blizzard stock is currently trading at a discount from Microsoft’s target acquisition price, with an 18.72% upside from current prices if the Microsoft deal were to go through.

- The market isn’t pricing in a particularly high probability for the acquisition, and it also doesn’t seem to be pricing in this quarter’s Diablo release.

- Looking at the full picture, ATVI appears better positioned for upside rather than downside overall. While the acquisition process is driving volatility in both directions, Diablo represents upside.

- While a risky trade to make, ATVI ends up being a good buy for this quarter. I am expecting Diablo sales to let ATVI beat against consensus, upping share prices.

Mario Tama/Getty Images News

Overview

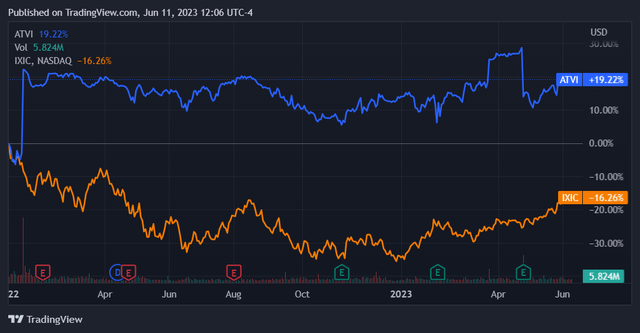

Activision Blizzard (NASDAQ:ATVI) stock has been trading choppily since Microsoft (MSFT) first announced its intent to acquire the company in January 2022. The news initially sent ATVI shares soaring and began a new narrative for the stock that centers around the acquisition. Since then Microsoft has been working with antitrust regulators around the globe to get the deal done, a process that has yet to conclude. Nevertheless Activision shares have handily outperformed the NASDAQ Composite throughout this period.

Seeking Alpha

Apart from the ongoing process in the US, the United Kingdom is the final jurisdiction that Microsoft needed to seal in order to complete this deal. Prior to today’s FTC announcement, the most recent news item around the acquisition was that Microsoft got sign-off from China back in May. Since then Activision stock has ticked up somewhat yet still underperformed the NASDAQ Composite.

Seeking Alpha

The latest news from the FTC is of course an unwelcome turn of events. Nonetheless I think it is important to remember that it does not necessarily spell the end. We must note that the FTC had already sued to stop the acquisition back in December 2022. This latest action is an injunction, not a new lawsuit. It’s going to ensure the acquisition can’t go through until things are resolved, but it does not change the legal territory itself.

This will be a drawn out legal process that could go either way. Additionally, the upcoming 2024 Presidential Election could see a new administration that sets the FTC on a new course. Overall this news item adds further uncertainty and extends the timeframe to resolution, but the jury is still out on this matter – perhaps literally.

Spread Between Price and Acquisition Price

Activision’s current share price of $80.36 gives it a market cap of $63.19B, which is $11.81B less than Microsoft’s targeted acquisition price of $75B at around $95.40 per share. There is a still a significant spread between Activision’s share price and its acquisition price.

Of course, there is always a spread between a stock’s market price and its stated acquisition price. This occurs with every acquisition of a public company. In fact, this disparity is the basis for multiple types of trading strategies, including merger arbitrage and many event-driven trading strategies in general.

Trading this spread can work because a stock’s share price and its acquisition price are guaranteed to become identical if and when an acquisition does actually go through. This price parity effect is highly reliable because of the guaranteed profit that one can make by getting shares cheaper than what they’re worth at a confirmed acquisition price. This effect is then highly effective for making the stock’s price efficient at deal close. Once a given acquisition becomes conclusive, what remains of the spread between share price and acquisition price becomes an opportunity for arbitrage.

Up until the acquisition closes, however, the stock’s share price will fluctuate, reflecting dynamic market perceptions of the acquisition’s likelihood. The clear profit incentive and reliable payoff structure will ensure that optimism gets priced in. The stock’s price in an acquisition process then becomes similar to a probability estimate for the acquisition itself. At its current price of $80.36, Activision shares are discounted from its acquisition price by 15.8% and imply an 18.72% upside if it were to go through.

Based on Activision’s trading range since Microsoft’s announcement today’s price looks to be roughly in the middle. This price tells us that the market’s conviction around the deal isn’t hovering particularly high or particularly low right now. Indeed, Activision shares are still cheaper than their recent peak of roughly $85.60. Previous peaks were also marginally higher at around $82 per share.

This price behavior indicates a negative read on the acquisition. However, I think that there is still an element of momentum as to Microsoft’s progress through the approval process. Getting approval in China was a major stepping stone. Microsoft has also continued to up the stakes in the United Kingdom, sending the company’s President to meet the Chancellor of the UK to see if they can work things out in that jurisdiction.

Overall Activision stock is not priced overly optimistically and is sitting at a price point somewhere between its bull and bear case. The good thing here is that there is a significant upside scenario if the deal does go through. The bad thing is that the deal petering out and/or being called off will have the opposite effect on the stock.

Since the stock first jumped in response to the announcement and has remained within a higher trading range since then, the acquisition failing could see it return to pre-acquisition prices. This means that the bear scenario has become more quantitatively significant along with the bull scenario. Essentially, Activision’s stock in the here and now is locked into a volatile move in the future in one way or another. Unfortunately this isn’t any more tradeable than what we would have without the acquisition in play.

The good thing is that Activision Blizzard has another upside catalyst that is wholly unrelated to the acquisition: Diablo IV.

The Diablo Launch This Quarter

Diablo IV is a major launch of an esteemed and best-selling game franchise. While not as high profile as some other Blizzard franchises, the Diablo series has put up good sales figures throughout its time. Initial indicators also show that sales are off to a good start. The game broke the record to become the fastest-selling Blizzard game ever at launch. Furthermore, players played for 93 million hours – equal to 10,000 years – during the first 100 hours after release.

The game is also priced at a premium. The standard copy sells for $70 and the early access/deluxe editions go for either $100 or $90. It looks like Blizzard should get massive sales figures at premium unit costs for this game, which will be good for revenues. This is also before the future monetization prospects of this game, which shouldn’t be discounted. I had thought before that Blizzard should have a winner on their hands, and initial indicators have increased my conviction that this will be the case.

This means that ATVI could be a buy after all. Both factors – the acquisition and the Diablo release – will remain in play for this quarter and quite likely for the next. Together it seems that they set out to a good bet over this time interval.

Risks

There are multiple risks here because of the two distinct forces at play for ATVI stock. The first is of course the acquisition failing, already outlined earlier in this article. The second would be Diablo IV underperforming in terms of sales. This is a game that has entered the market with high expectations. If current buying strength doesn’t persist analysts could end up disappointed and then investors could sell off the stock. Both of these downside events could occur at the same time, which would be the worst-case scenario for the stock near-term.

Conclusion

Based on the full picture here, I am ultimately still optimistic about Activision Blizzard. I personally believe that both upside catalysts will materialize for this stock. I think that the acquisition will eventually close and I also believe that Diablo IV will be a smashing success that boosts earnings. These may not happen at the same time, but they will both end up being beneficial for its share price. At current prices I don’t think the stock is reflecting much optimism. As a result Activision Blizzard stock looks like a good buy for the upcoming quarter.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ATVI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.