Summary:

- With the CMA giving a negative assessment of the ATVI/ MSFT merger, the likelihood of a deal closing dropped to single-digit probabilities.

- Referencing the AI hype, Microsoft will likely push for other priorities; and the CMC has historically rarely changed its mind on review.

- Activision Blizzard’s standalone fundamentals, which although stellar do likely not justify a $75 billion valuation.

- Anchored on my estimates for ATVI’s EPS through 2025, I calculate a fair implied share price of $65.11.

Rich Polk

Activision Blizzard Entertainment stock (NASDAQ:ATVI) crashed more than 10% after the UK Competition and Markets Authority’s (CMA) decision to block the merger with Microsoft (MSFT) caught investors by surprise. Now, while both Microsoft and Activision management have said to appeal the decision, the likelihood of the $75 billion deal closing has dropped to single digit probabilities, in my opinion. Investors should be aware that with the hype surrounding AI, Microsoft will likely push for other priorities; and the CMC has historically rarely changed its mind on review.

Accordingly, the ATVI equity story has now contracted back to the company’s own fundamentals, which although stellar do likely not justify a >x5 EV/ Sales. Anchored on my estimates for ATVI’s EPS through 2025, I calculate a fair implied share price of $65.11, and thus argue that the blocked merger was likely a catalyst for ATVI to lower.

The Merger ATVI/ MSFT Is Highly Likely Blocked For Good

On April 26th, the UK CMA unexpectedly blocked the ATVI/ MSFT merger, citing evidence that Microsoft’s takeover of Activision Blizzard could likely result in the combined entity operating a monopoly-like market share in cloud gaming, which could:

…replace market forces in a growing and dynamic market with mandated regulatory obligations ultimately overseen, and enforced by, the CMA – in this case at a global level.

Although Microsoft has tried to address regulatory concerns through various promises, the CMA argued that Microsoft’s commitments would only apply to a limited subset of Activision Blizzard’s gaming portfolio, as well as a certain subset of cloud services. Accordingly, the CMA feared that:

Microsoft would find it commercially beneficial to make Activision’s games exclusive to its own cloud gaming service

The reason why the CMA decision was such a surprise is anchored on the regulator’s previous statement that the ATVI/ MSFT merger:

will [likely] not result in a substantial lessening of competition in relation to console gaming in the UK…

adding also that:

…[it] would not be commercially beneficial to Microsoft to make CoD exclusive to Xbox following the deal

Now, while both Activision and Microsoft management have already announced to appeal the CMA’s decision, the success probability of the deal closing has become super unlikely, in my opinion. And accordingly, going forwards, ATVI investors are advised to value the gaming company based on its stand-alone fundamentals.

ATVI’s Fundamentals Solid

Of course, even without the Microsoft deal Activision Blizzard is a strong company: the gaming giant owns and publishes some of the most iconic and engaging franchises, including Call of Duty, World of Warcraft, and Diablo, as well as Candy Crush (mobile). However, without the Microsoft deal, which also prices synergy benefits from combining ATVI’s content with MSFT’s Xbox ecosystem, ATVI equity is likely not worth $75 billion.

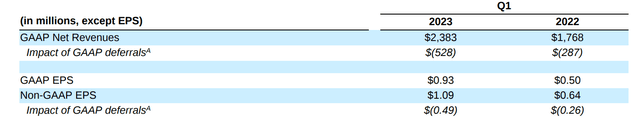

On April 26th, ATVI also reported Q1 2023 results, beating analyst estimates with regards to both topline and earnings. During the period from January to end of March, Activision Blizzard’s net revenues amounted to $2.38 billion, up from $1.77 billion in the same period in 2022. The company’s GAAP operating margin was 34%, while GAAP earnings came in at $0.93, an increase from $0.50 in Q1 2022.

Activision’s strong Q1 2023 performance was driven by favorable momentum across franchises, anchored on content updates for Call of Duty, Candy Crush, World of Warcraft, and Overwatch. One thing to watch out for, however, is the latest success from Ubisoft’s (OTCPK:UBSFY) XDefiant Beta testing, which may imply a potential CoD competitor. Looking ahead, Activision’s Q2 guidance predicts 30% YoY net bookings growth, which I believe is a reasonable projection in context of the upcoming release of Diablo IV.

But reflecting on ATVI’s fundamentals, what could ATVI be worth on a standalone basis, ex MSFT merger?

Residual Earnings Model

To derive a more precise estimate of a company’s fair implied valuation (without the Microsoft deal), I am a great fan of applying the residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

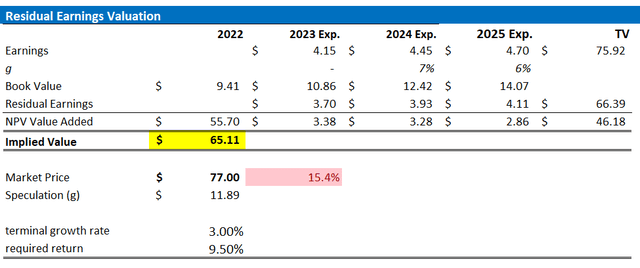

With regard to my Activision stock valuation model, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, the analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on ATVI’s cost of equity at 9.5%.

- For the terminal growth rate after 2025, I apply 3.25%, which I believe is a reasonable estimate post-2025 (approximately 0.5 – 1 percentage points above nominal GDP growth).

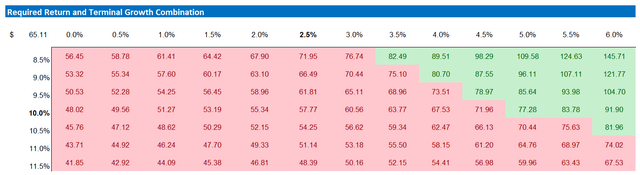

- Investors with different assumptions regarding ATVI’s cost of capital and terminal growth may take reference from the sensitivity table enclosed.

Given the above assumptions, I calculate a base-case target price for Activision of about $65.11/share.

Company Financials; Author’s EPS Estimates; Author’s Calculation

My base case projection for ATVI’s target price implies downside. However, it is crucial for investors to evaluate the risk and reward ratio of investing in a company based on a ‘scenario’ view. To assess different scenarios based on various assumptions, I have created a sensitivity table that analyzes ATVI’s cost of equity and terminal growth rate. See below.

Company Financials; Author’s EPS Estimates; Author’s Calculation

Conclusion

After the CMA provided a negative assessment on the ATVI/ MSFT merger, the likelihood of a deal closing dropped to single digit probabilities, in my opinion. This prompts investors to review their ATVI investment based on Activision Blizzard’s standalone fundamentals, which although stellar do likely not justify a $75 billion dollar valuation.

Anchored on my estimates for ATVI’s EPS through 2025, I calculate a fair implied share price of $65.11, and thus I see about 15% downside for ATVI stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice; this is market commentary only.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.