Summary:

- The Microsoft/Activision Blizzard deal spread is narrowing as the anti-competition reviews continue.

- Microsoft is proactively striking deals to convince regulators the deal is fine.

- Sony is actively opposed to the deal and argues Microsoft needs to do a lot more.

- The deal is getting closer to the end stages of agency decisions and court dates.

Jon Kopaloff

Microsoft Corporation (MSFT) has offered $95 per share of Activision Blizzard, Inc. (NASDAQ:ATVI). Because there are antitrust concerns, ATVI trades at $79.26. My most recent article about this name was called; Why I Still Like The Microsoft Activision Blizzard Deal (ATVI).

I still do, and from the beginning, my argument is:1) the spread is wide, 2) the downside may not be all that bad, and 3) it is a vertical merger. It is a simple argument, but that doesn’t mean it can’t hold up.

The stock has closed part of the spread since my earlier articles, but there is still 19.85% upside to the deal closing. The current outside date is July 18 2023.

Several things happened since my earlier write-ups that can be used to explain the spread narrowing. Reuters reported the deal is likely to win over the European Commission. No divestments are required, but some behavioral remedies are likely. Microsoft is cementing behavioral remedies ahead of the deal by making deals left and right with gaming platforms to pro-actively convince regulators it will allow broad access to its gaming content. The latest example came today, with Microsoft announcing a deal with a Japanese platform.

This time I wanted to offer some option ideas to use based on different timelines around the various regulatory processes and incorporating my views of the downside and/or likelihood of closing.

One idea is to have a call calendar spread for January 24′ long the $90 strike, while selling the $95 strike. This position profits if the merger completes at $95 anywhere before the expiry date. It is not the most significant profit because the merger will likely be completed in that timeframe. The position doesn’t work if a deal is cut below $87.20. Usually, it won’t work in a deal break, either. However, it could still work if the deal breaks soon. The spread then still gives much time for the share price to recover as an independent company. I don’t think that’s likely, but the volatility of ATVI as an independent company would be a bit higher. That combination would work in your favor. The spread could still be valuable if ATVI does better than expected as a stand-alone company without the overhang of the bid. My expectation is the position will do terribly if the merger takes a long time to fall apart slowly.

bull call spread payoff structure (optionstrat.com)

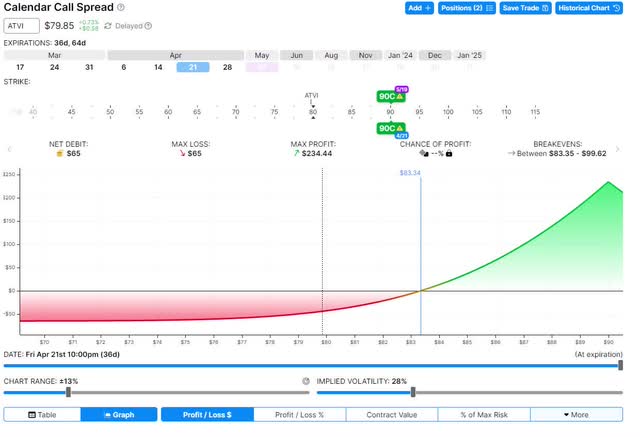

Another example of a position that I think may be interesting is to go long the May 19 $90 contract and short the April 21 $90 contract.

calendar call spread payoff structure (optionstrat.com)

This position breaks even with ATVI at $83.34 or higher at expiration. It doesn’t work if the stock trades up quickly before the first leg expires (which seems unlikely) or if it falls apart and stays down until the second leg expires.

However, the CMA will publish its final decision on April 26. The CMA is currently regarded as the point regulator on this deal. The CMA and EC also publish a bit more throughout the process. For example, Sony has been trying to prevent the merger and offered these observations on the CMA’s remedies notice. From its conclusion:

In conclusion, to address the competitive harm caused to consoles and cloud gaming, the Transaction should be prohibited or subject to a structural remedy. SIE is extremely skeptical that an agreement with Microsoft could be reached, much less monitored and enforced effectively. As a result, a behavioural commitment that was designed to form the basis of an agreement between Microsoft and SIE should not be accepted by the CMA because there is no realistic prospect of such an agreement being reached that would maintain effective competition

I understand that Sony (SONY) is pushing for Microsoft to divest Activision or Blizzard to get the deal done. But in my opinion, these are the assets Microsoft wants to have. I don’t think Microsoft would go through with it if it had to divest the entire Activision or Blizzard segment of games. In any case, it does look like the CMA is the body most sympathetic to Sony’s highly vocal and public opposition.

The EU is set to decide just before, but expectations are that it will allow the deal. When the first leg expires, neither decision is likely out. The stock is very unlikely to have spiked at that point. After the 26th, it could go on a good run because a significant hurdle will have cleared. It is also much more likely the FTC issues will clear up if two regulators give it a pass. Microsoft has told the FTC it won’t close before early May. It could close later in May or June if the agency can be satisfied. If not, they are set to go to court in early August.

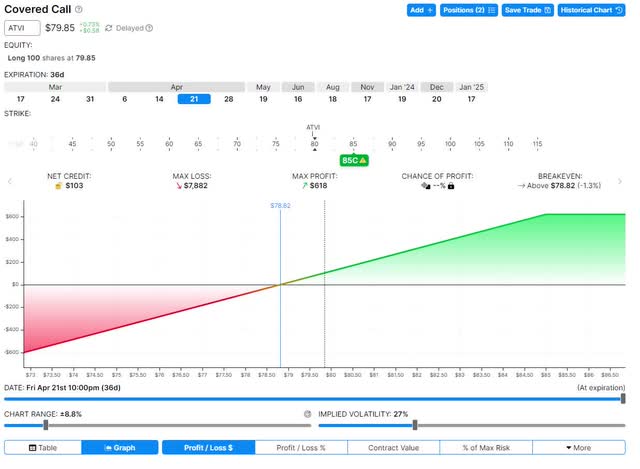

A position I like that’s a bit more straightforward is a simple covered call. One version I like is to sell the April 21′ $85 calls for $1.03. While owning enough stock. This also benefits from the calls expiring before the April 26th CMA date.

covered call payoff structure (optionstrat)

After the 26th, it would be possible to reload on covered calls if they offer a decent yield. For example, $95 August calls. If the deal breaks, this position is in the short term, still excruciating. But it is slightly less painful because of the sold call. I don’t mind the downside as much as on some other deals. Activision is a quality company with valuable assets that will likely produce positive cash flow for many years. Nadella snapped it up just as the stock bottomed. This followed persistent headlines about how Activision management allegedly engaged in sexual misconduct, and CEO Kotick covered it up. By the time the deal breaks, this negative overhang is a bit further in the rearview mirror and hopefully dealt with adequately.

Disclosure: I/we have a beneficial long position in the shares of ATVI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.