Summary:

- The FTC recently filed suit to block Microsoft from acquiring Activision Blizzard.

- ATVI is continuing to deal with the fallout from a dysfunctional corporate culture.

- ATVI is trading at a substantial discount to the proposed acquisition price.

- The Wall Street analyst consensus favors the completion of the deal.

- The market-implied outlook (calculated from options prices) indicates a high probability that the deal will close.

Rich Polk

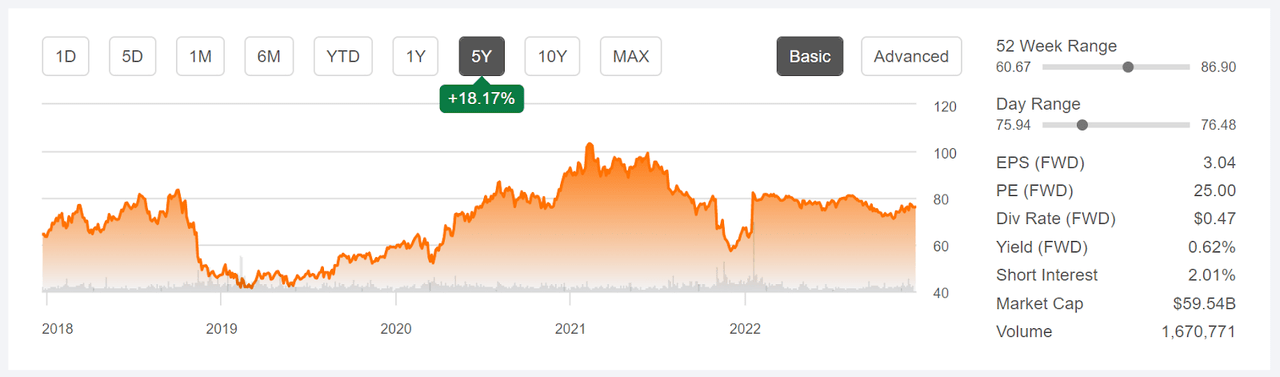

Activision Blizzard (NASDAQ:ATVI) is in something of a state of limbo as regulators continue to work through concerns about the company’s pending acquisition by Microsoft (MSFT). ATVI shareholders overwhelmingly approved the terms of the deal back in April, but the Federal Trade Commission (FTC) recently filed suit to prevent the purchase because of concerns that the consolidation of the two companies would be anti-competitive. If the deal is approved, Microsoft has agreed to purchase ATVI for $95 a share, 25% above the current share price of $76.08. ATVI spiked upwards following the acquisition announcement on January 19, 2022, maxed out at around $80, and have been trading consistently below $80 since mid August. The shares are currently trading slightly above the level just prior to the FTC lawsuit announcement on December 8th.

Seeking Alpha

5-Year price history and basic statistics for ATVI (Source: Seeking Alpha)

The company is in the midst of dealing with notable legal challenges, primarily involving serious sexual harassment and discrimination issues. The firm culture, simply put, looks dysfunctional. An acquisition by Microsoft should help to catalyze radical change in the organization.

Interestingly, Berkshire Hathaway has built up its holdings in ATVI since the proposed acquisition was announced. Berkshire owned $4.47 Billion in ATVI shares as of September 30th, according to the most recent Form 13F.

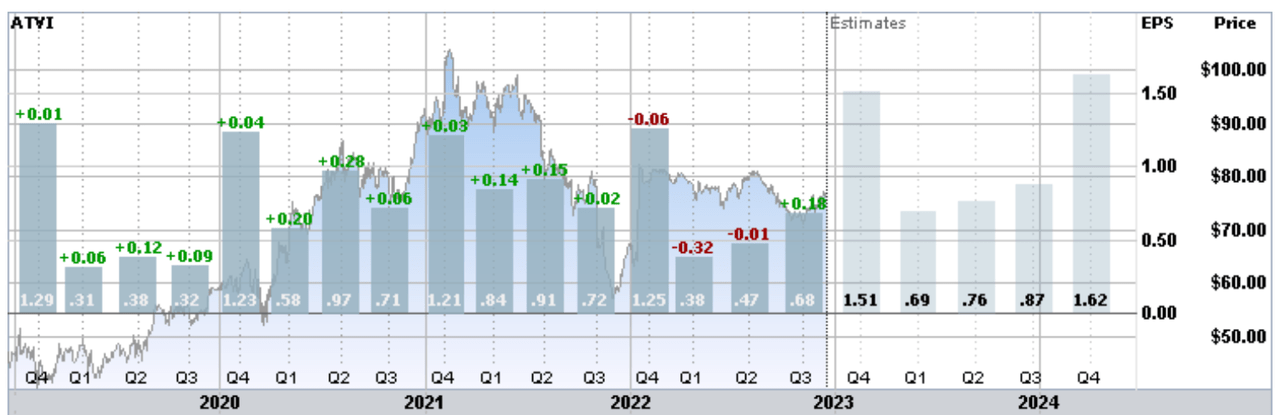

Since enjoying a substantial surge in earnings during COVID, as video game sales soared among people with few entertainment options outside of their homes, this increase was not sustainable. EPS for Q1 and Q2 of 2022 were substantially lower than for the same quarters in 2020 and 2021. The consensus outlook is for an earnings recovery over the next year, with a consensus expected EPS growth rate of 7.4% per year over the next 3 to 5 years. The relevance of these projections depends on the probability of the acquisition closing, of course.

ETrade

Trailing (4 years) and estimated future quarterly EPS for ATVI. Green (red) values are amounts by which EPS beat (missed) the consensus estimate for a quarter (Source: ETrade)

I last wrote about ATVI on May 30, 2022, about 6 ½ months ago, at which time I upgraded the stock from a hold to a buy. At that time, the shares were trading at $78.20, as compared to $76.08 today. Since this post, ATVI has reported one quarterly earnings miss (Q2) and one earnings beat (Q3). My upgrade on ATVI was primarily due to the pending acquisition by Microsoft for $95 per share. I formed my view on the likelihood of the deal closing from two sources. The first was the Wall Street analyst consensus outlook and the second was the market-implied outlook, a probabilistic price forecast that reflects the consensus view from the options market. The Wall Street consensus clearly favored the deal going through, with a consensus 12-month price target of $95.56. The highest and lowest analyst price targets were $95 and $100, an incredibly tight range. The market-implied outlook indicated that the buyers and sellers of options were, in aggregate, assigning a substantially higher probability to the deal closing than the alternative.

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock is largely determined by the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper explanation and background, I recommend this monograph published by the CFA Institute.

With more than 6 months since my last analysis and the recently-announced FTC suit, I wanted to revisit my rating. I have calculated updated market-implied outlooks for ATVI and compared these with the Wall Street consensus, as in my previous post.

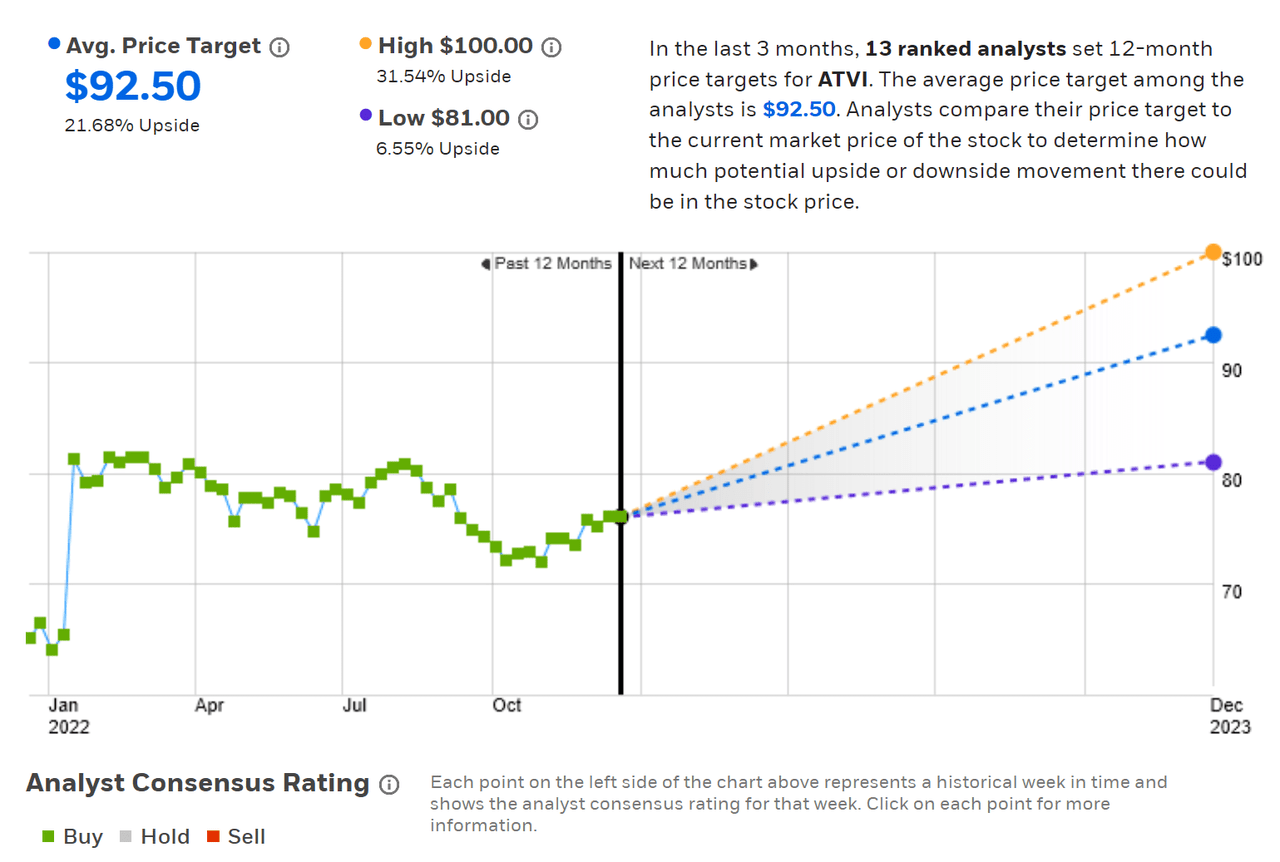

Wall Street Consensus Outlook for ATVI

ETrade calculates the Wall Street consensus outlook by aggregating the views of 13 ranked analysts who have published price targets and ratings in the past 3 months. The consensus rating is a buy, as it has been for all of the past 12 months and the consensus 12-month price target is $92.50, 21.7% above the current share price but just slightly below the planned acquisition price. The range of the analyst price targets is considerably wider than it was in my previous post, but is low compared to most stocks that I have analyzed. The increased spread reflects a reduced level of confidence that the deal will close.

ETrade

Wall Street analyst consensus rating and 12-month price target for ATVI (Source: ETrade)

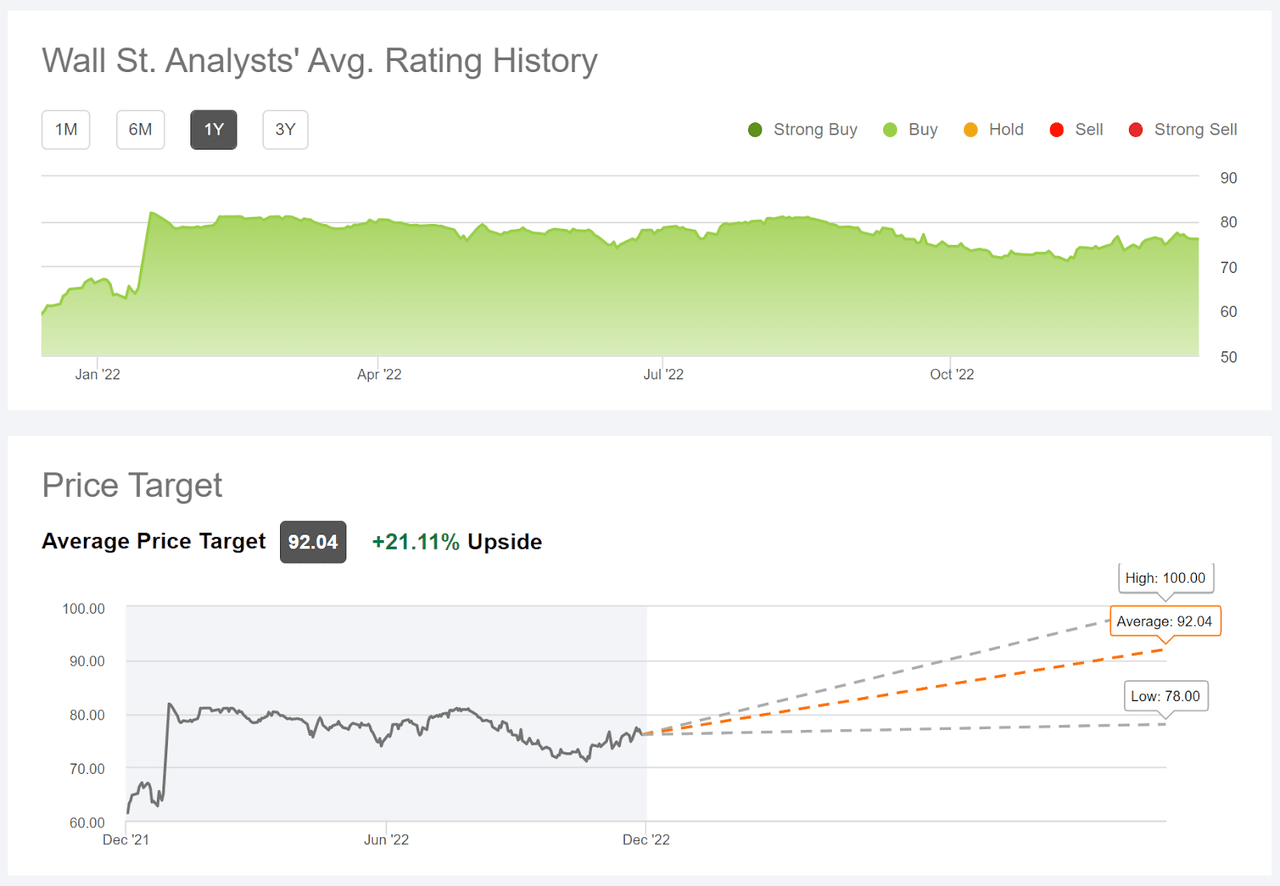

Seeking Alpha’s version of the Wall Street consensus outlook for ATVI is based on price targets and ratings from 24 analysts who have published opinions in the past 90 days. The consensus rating is a buy and the consensus 12-month price target is $92.04, 21.1% above the current share price.

Seeking Alpha

Wall Street analyst consensus rating and 12-month price target for ATVI (Source: Seeking Alpha)

The prevailing view from Wall Street is a buy, with a 12-month price target that is very close to Microsoft’s acquisition price. The spread among the individual analyst price targets has increased since my previous post, indicating that some analysts now assign a lower probability to the deal coming to fruition. A secondary issue, of course, is whether an expectation of a 21% – 22% gain justifies the risks, given the firm’s embattled management and culture and the uncertainties with regard to the acquisition.

Market-Implied Outlook for ATVI

I have calculated the market-implied outlook for ATVI for the 5.9-month period from now until June 16, 2023 and for the 13-month period from now until January 19, 2024, using the prices of call and put options that expire on each of these dates. I selected these expiration dates to provide a view to the middle of 2023 and for the full year.

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

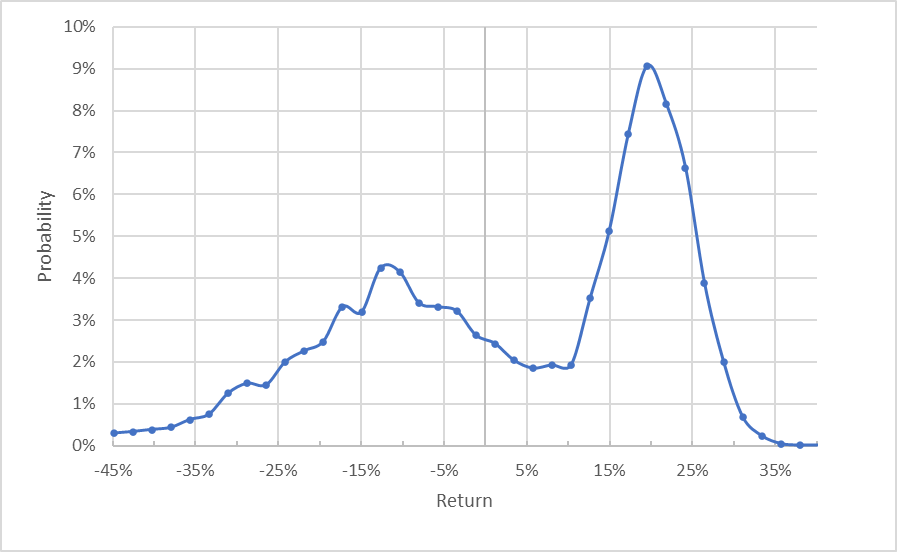

Geoff Considine

Market-implied price return probabilities for ATVI for the 5.9-month period from now until June 16, 2023 (Source: Author’s calculations using options quotes from ETrade)

The market-implied outlook to the middle of 2023 is qualitatively similar to the results that I calculated in May in that there are 2 distinct peaks in the probability distribution. I interpret this as representing 2 distinct possible outcomes: one in which the acquisition closes and one in which it does not. The higher-probability peak corresponds to a return that takes the share price to $91.50, slightly below the $95 acquisition price. The secondary peak corresponds to a price return of -12.5%. The options prices suggest that ATVI will fall by something in the vicinity of this amount if the deal appears to be in jeopardy or is blocked. This outlook indicates that the overall probabilities favor the deal going through, such that the shares are likely to rise substantially from the current level. I interpret this as a bullish outlook. The expected volatility calculated from this distribution is 29% (annualized), which is quite moderate–especially for a stock facing this level of uncertainty.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. Considering the higher probabilities of small-magnitude (but high-probability) negative return vs. positive return, the expectation of a negative bias reinforces the bullish interpretation of this outlook.

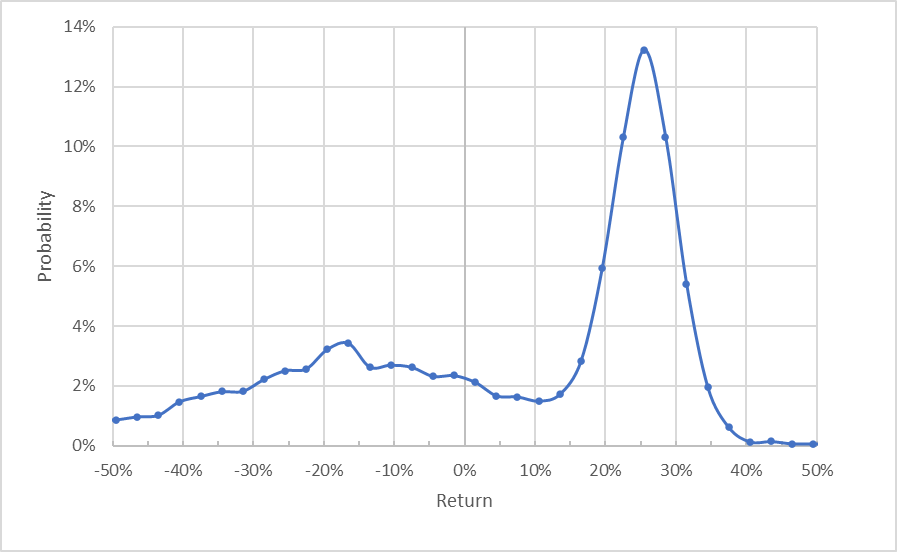

The market-implied outlook for the next 13 months, from now until January 19, 2023, also shows the bi-modal probability distribution, but the higher probability of the deal closing is even more elevated. The peak probability corresponds to a price return of 25.5%, which would bring the share price to $95.87. This outlook indicates that the consensus view from the options market strongly favors the acquisition being closed at $95 per share at some point in the next year. The secondary much-lower peak in probability corresponds to a price decline of 17.5%. This is a bullish outlook, based on a high probability that the deal goes through. If it does not, the shares are likely to drop by something in the vicinity of 20%. The expected volatility calculated from this distribution is 26% (annualized).

Geoff Considine

Market-implied price return probabilities for ATVI for the 13-month period from now until January 19, 2024 (Source: Author’s calculations using options quotes from ETrade)

The market-implied outlooks are tilted to favor the ATVI being purchased by Microsoft within the next 13 months and that the shares are likely to rise substantially in the next 6 months. The expected volatility is quite moderate, suggesting that ATVI will not drop too precipitously even if the deal fails.

Summary

Owning ATVI is a bet that Microsoft’s acquisition will go through. The Wall Street analyst consensus is in line with the deal closing, with a buy rating and a consensus 12-month price target that is $2 to $3 below the $95 acquisition price. The spread in the individual analyst price targets has gotten a bit wider in the past 6 months, suggesting that some analysts are assigning a lower probability to the purchase. The market-implied outlooks, by contrast, are assigning a higher relative probability to the deal going through than in my previous analysis. Aside from the acquisition, the good news is that the consensus outlook is for a modest recovery in earnings in the coming year or so. Even with the recent news that the FTC is seeking to block ATVI’s acquisition by Microsoft, the consensus views from the Wall Street analysts and the options market favors the deal. As a rule of thumb for a buy rating, I want to see an expected return that is at least ½ the expected volatility. The 20%+ gains expected by the analysts that would bring the share price up to $95 are well above half of the 26%-28% expected volatility. I am maintaining a buy rating on ATVI.

Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.