Summary:

- ATVI’s takeover by MSFT is still pending. UK regulators have recently offered their statements about this deal.

- It is not certain that this deal will get approved.

- Even without MSFT, ATVI could do well in the longer term.

Mario Tama

Article Thesis

Activision Blizzard (NASDAQ:ATVI) continues to see its shares rise and fall depending on news related to the pending takeover by Microsoft (MSFT). Meanwhile, the company’s underlying performance has been compelling, and the outlook suggests that Activision Blizzard could do well in the long run even if the Microsoft takeover falls through — although that would still result in short-term share price pressure.

The Ongoing Microsoft Takeover Saga

Microsoft’s takeover of Activision Blizzard was proposed more than a year ago, and we still don’t know whether the acquisition will actually go through or not. While Microsoft is not a gaming-focused company, it has some gaming exposure, mainly via its Xbox hardware system. Some regulators, politicians, and media workers fear that a takeover could harm gamers, e.g. due to Activision Blizzard titles coming to the Xbox system only, and not to competing products such as Sony’s (SONY) PlayStation. On top of that, a general anti-big-tech sentiment exists among some regulators, politicians, and so on, which is why some are in favor of shooting down any major deals proposed by Microsoft and its big tech peers, no matter what company they want to acquire.

Thus it is far from guaranteed that Microsoft’s takeover of Activision Blizzard will be consummated, and that is priced into Activision Blizzard’s stock: Right here, shares trade for $73, which is around 23% below the proposed takeover price of $95 per share. In other words, ATVI currently has an upside potential of around 30% versus the takeover price — if the acquisition were to happen, current shareholders would see a hefty return.

Most recently, new concerns about the takeover emerged, as regulators in the United Kingdom made some comments that suggest that there could be problems with the acquisition. Seeking Alpha reports that the regulator (‘CMA’) stated:

The evidence suggests that, after the Merger, Microsoft would find it commercially beneficial to make [Call of Duty] exclusive to Xbox or available on Xbox on materially better terms than on PlayStation. We provisionally found that this would substantially reduce competition in gaming consoles to the detriment of gamers—Xbox and PlayStation gamers alike—which could result in higher prices, reduced range, lower quality, worse service, and/or reduced innovation.

While the picture that the regulator paints may be overly bleak, there’s some truth to it. If Call of Duty, one of ATVI’s biggest franchises, were to become an Xbox-exclusive title, then that could be seen as an issue. There are, however, ways around that — Microsoft could agree to have Call of Duty available on the PlayStation system for a set number of years following the takeover, for example.

Similar remarks by the UK regulator were made about Microsoft’s cloud gaming service and some of ATVI’s current offerings. But I believe that here, too, a deal could be made that works for all sides — if MSFT agrees to avoid exclusiveness of its own platforms for a while, at least for major titles and franchises, regulators might be happy with that. Thus it does not look like a deal is impossible, although these statements by the UK regulator aren’t really positive, either, which is why ATVI’s share price reacted negatively to these statements, as the market saw a takeover deal as somewhat less likely following these remarks.

On the other hand, Activision Blizzard’s CEO Bobby Kotick stated that the UK tech industry could be harmed if the deal gets blocked by UK regulators, stating that this could make the UK “Death Valley” instead of a new Silicon Valley. It’s good that ATVI is fighting back, I think, and the comments by ATVI’s CEO might help persuade regulators in approving the deal, although possibly with some concessions (e.g. Call of Duty does not become an Xbox-exclusive title).

Investors will have to wait for some time until a decision about the deal has been made. For now, there are no certainties, but it is pretty clear that the market is not seeing this as a done deal — the spread between the current share price and the takeover price suggests that there are major uncertainties in place. The good thing is that Activision Blizzard looks like it is doing well on an operational basis — even if the deal does not happen, ATVI could thus do well in the long run. Of course, if the deal gets blocked, the short-term market reaction would likely still be negative, e.g. due to arbitrageurs exiting their positions. The two companies plan to close the deal before June 30, when Microsoft’s current fiscal year ends. There is no guarantee that that will happen, of course.

ATVI: Solid Underlying Performance

The initial phase of the pandemic was a good time for gaming companies. Many consumers were locked up or stayed home voluntarily. At the same time, massive fiscal and monetary stimulus resulted in an environment where consumers were flush with cash. With not many things to do outside of their homes, and with ample cash, many consumers spent more on at-home hobbies such as gaming, which is why companies in this industry, including ATVI, did quite well at the time.

But as the pandemic started to wane, consumers wanted to spend more time doing things outside of their homes, which resulted in an environment that wasn’t as beneficial for ATVI and other gaming companies. On top of that, some product delays resulted in weaker ATVI sales, which was one of the reasons for ATVI’s shares to pull back before the takeover proposal from Microsoft.

Activision Blizzard’s most recent results were pretty compelling, however, and so is the company’s outlook. For the fourth quarter — results were reported on February 6 — the company announced net bookings, its revenue equivalent, of $3.6 billion. That was up by an impressive 43% year over year, which easily beat estimates by more than 10%. Activision Blizzard’s net bookings during the quarter were also the highest on record, suggesting that the company has gotten quite strong again on an operational basis, following the somewhat weaker period following the initial pandemic phase when consumers preferred to go out once lockdowns had ended.

This strong sales performance was driven by several factors. First, Activision’s Call of Duty title Modern Warfare II generated very strong results, as it was the best-performing title in the series in terms of sales during the first quarter since release. Likewise, other franchises performed well, too. Blizzard benefitted from strong bookings at Warcraft (where a new title dropped as well) and Overwatch, and ATVI’s mobile gaming business, King, saw sales expand by a mid-teens rate as well. ATVI’s in-game sales rose by more than 40%, which is a surprisingly strong showing and which suggests that the company is making progress in monetizing its existing user base. Overall, the strong demand for ATVI’s products suggests that inflation, which hurts consumer demand in some industries, is not a major issue for ATVI — otherwise gamers wouldn’t spend as much money on discretionary items.

ATVI’s outlook for the current year is positive as well, mainly due to the strong performance of recent title launches in Q4 of 2022 that should drag on into H1, while new title launches will help as well. One of the largest launches will be Diable 4, which will come to the market in June, and which will drive strong growth for Blizzard in the current year according to ATVI’s management.

Free cash flow totaled $2.1 billion over the last year. Considering the fact that some revenues are already locked in but not yet accounted for, cash flows should improve in the coming quarters, especially since management is forecasting healthy underlying business growth thanks to the expected impact of new titles such as Diablo. ATVI also has a net cash position of $8.4 billion, which is why its net cash-adjusted market capitalization, or enterprise value, is around $50 billion today. Based on that, its current valuation seems rather low:

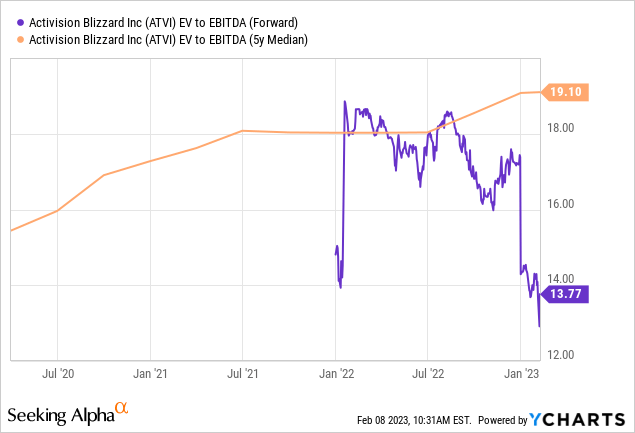

ATVI trades with a sub-14x EV/EBITDA multiple today, while the 5-year median EBITDA multiple stands at 19. This suggests that shares are pretty inexpensive today. If the takeover by MSFT falls through, ATVI would receive around $3 billion in cash as compensation, which would make its net cash position grow even larger and which would lead to an even lower EV/EBITDA multiple, all else equal.

Final Thoughts

While we don’t know whether the takeover by MSFT will happen, ATVI does not look bad at current prices. If the deal happens, ATVI shareholders will see a return of around 30% in less than a year.

If the deal falls through, the immediate market reaction would most likely be negative. But ATVI could still do well in the longer term, as it is rather inexpensive today and since growth has picked up again.

Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!