Summary:

- Acuity Brands, Inc. is facing short-term revenue challenges due to macroeconomic headwinds and slow corporate and OEM segments.

- Despite the near-term challenges, the company’s strategic initiatives, including product innovation and market expansion, position it for future growth.

- The company was able to improve margins last quarter despite revenue headwinds and, looking forward, the margin outlook is positive.

- Valuation is attractive.

peterschreiber.media

Investment Thesis

Acuity Brands, Inc. (NYSE:AYI) faces short-term revenue challenges due to macroeconomic headwinds and slow corporate and OEM segments. However, the company’s strategic initiatives, including product innovation and market expansion, as well as margin resilience, position it well for future growth. AYI is currently trading below its historical average P/E. I like the company’s execution and medium to long-term growth prospects, and believe that the near-term revenue concerns are already getting priced in at current levels. As revenue comparisons become easier in the back half of FY24 and AYI returns to revenue growth, the company’s valuation multiple can see a re-rating. Hence, I have a buy rating on the stock.

Revenue Analysis and Outlook

The company has seen good growth over the last couple of years, helped by strong demand and higher than usual backlog. However, of late, the company has started seeing some impact of slowing demand and backlog normalization.

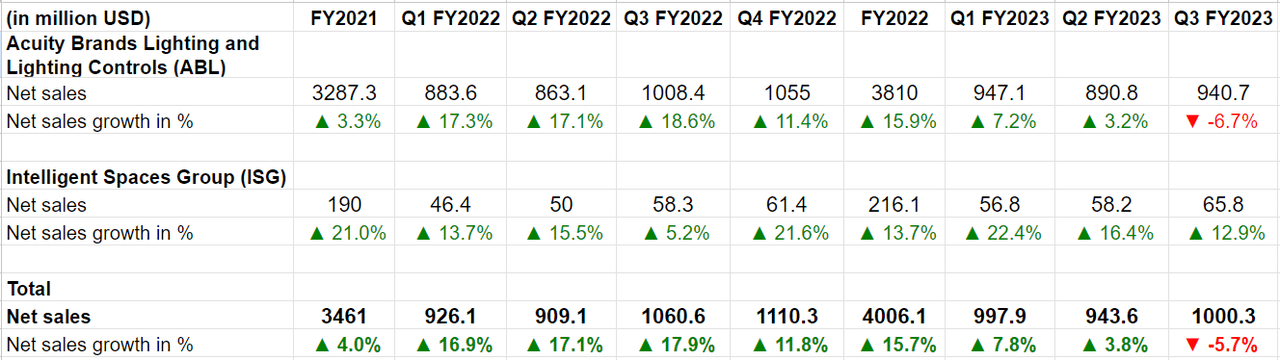

In the third quarter of 2023, AYI encountered challenges stemming from ongoing lead-time normalization trends and the tough broader macroeconomic landscape, resulting in a 5.7% year-over-year decline in sales to $1 billion. Within the Acuity Brands Lighting and Lighting Controls (ABL) segment, sales decreased by 6.7% year-over-year to $940.7 million. This decline was primarily driven by reduced net sales in independent sales networks, OEM, and other corporate account channels, which more than offset the increased sales from good demand for infrastructure projects in the direct sales network and the robust performance in the retail channel. Conversely, the Intelligent Spaces Group (ISG) witnessed a 12.9% year-over-year increase in sales, reaching $65.8 million. This growth was propelled by the strength of the Distech and Atrius businesses, along with the advantages of price increases and a favorable product mix.

AYI’s Historical Sales Growth (Company Data, GS Analytics Research)

Looking forward, the company’s revenue outlook is mixed. After remaining elevated for the last couple of years, the company’s backlog has returned to normal levels and the company’s sales are much more aligned to end customer demand. The company is seeing some weakness on the large corporate account customer side as there is uncertainty about the timing of renovation projects at big clients. With the economy reopening, there was a good deal of expectation about employees returning to offices and related renovation spending, but the actual return-to-office has been slow with many large corporates still working in hybrid mode. The broader macroeconomic concerns have also impacted the sentiment. Similar weakness is being witnessed on the OEM side too where clients are destocking inventory as supply chain constraints have normalized, and lead times are not that high.

On the other hand, the company’s direct sales network is witnessing relatively stable order rates and I expect this business to benefit from IIJA (Infrastructure Investment and Jobs Act) funded projects as the company has been investing in its direct sales force for targeting work related to IIJA projects. The company’s retail business is expected to continue doing well and is benefitting from a good response to the company’s “Contractor Select” offering.

Overall, with the weakness in corporate and OEM business. While the rest of the business is stable, it should lead to a slight decline in sales in the coming quarters. So, for the near term, I am expecting downbeat commentary from management, at least for the first half of FY24.

However, most of this weakness is due to the current macroeconomic conditions and factors outside the company’s control. The company is executing well on things it can control. One such initiative is launching new products and offerings to address market needs. After the success of the Contractor Select portfolio, which consists of 300 SKUs of everyday lighting and lighting control products and is made-to-stock for retailers and electrical distributors, the company launched the “Design Select” Portfolio of 3000 configurable products that meet the key choices of lighting specifiers. So, now the company’s portfolio is clearly delineated among made-to-stock, semi-custom configurable, and made-to-order offerings, servicing different types of customers. The company can launch new products and improve service levels according to the portfolio type and the corresponding customer base. This should help drive long-term growth.

In addition to innovating existing product offerings, the company is also doing a good job in terms of increasing its addressable markets by entering new geographies and launching new complementary offerings, either organically or through acquisitions. A good recent example is the company’s acquisition of KE2 Therm in Q3. This acquisition allows the company to enter the commercial refrigeration control space and more effectively sell its Distech portfolio (of its Intelligent Spaces Group Segment) in verticals like retail and restaurants.

Overall, while there are near-term headwinds, once the macroeconomic cycle turns I believe the company can post above-market growth thanks to its good execution, product vitality initiatives, and efforts to increase the addressable market.

Margin Analysis and Outlook

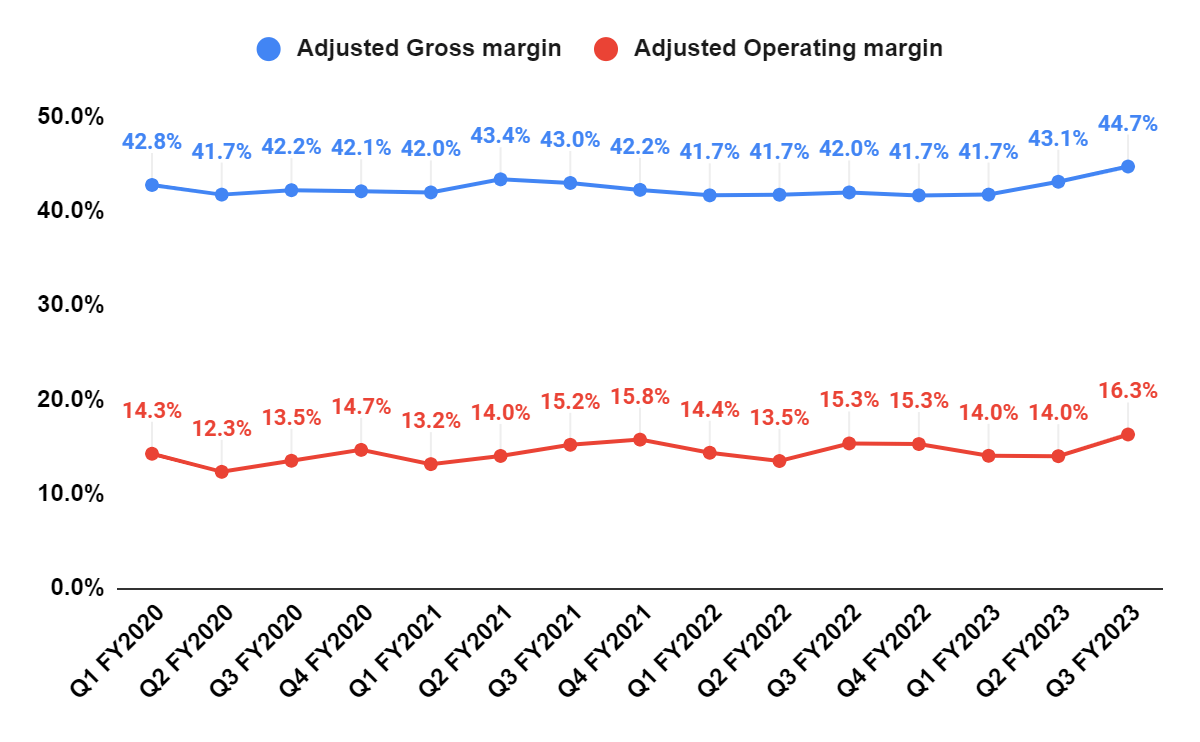

During 3Q23, the company’s focus on strategic pricing, continued productivity improvements, and managing material costs resulted in margin expansion despite the decline in sales. The adjusted gross margin increased 270 bps Y/Y to 44.7%, driven by price increases and lower material input costs, particularly steel and inbound freight costs, which outweighed labor and other cost escalations. The improvement in gross margin resulted in a 100 bps Y/Y improvement in adjusted operating margin to 16.3%.

AYI’s Adjusted Gross margin and Adjusted Operating margin (Company Data, GS Analytics Research)

Looking forward, I am optimistic about the company’s margin growth prospects. The company has done a good job in terms of strategically increasing prices and managing material costs to offset inflationary headwinds, and I expect this to continue in the future. The company’s product vitality initiative also helps it increase prices by introducing new innovative products, which should help margins. In addition, the company’s ISG segment, which has higher margins, is growing at a faster pace compared to ABL business and this should help the overall margin mix. So, I am optimistic about the company’s margin growth prospects.

Valuation and Conclusion

AYI is currently trading at 12.13x FY24 (ending August) consensus EPS estimate of $13.13 which is a discount to its 5-year average forward P/E of 14.21x.

While the company’s revenue outlook presents a mixed picture, it appears to be already factored into its valuations, which are currently lower than historical levels. I like the company’s excellent execution in terms of product vitality and its efforts to broaden its addressable markets. I believe that as the broader market conditions improve, the stock’s valuation multiple should undergo a positive re-rating driven by its strong execution.

Furthermore, the company has demonstrated exceptional margin performance, effectively enhancing margins despite facing volume-related challenges. Considering these factors, I find it prudent to take a contrarian stance on this stock and buy it despite short-term revenue headwinds, given its compelling execution story and current appealing valuations. As we progress into the latter half of FY24 and comparisons ease, there is potential for revenue growth to turn positive, serving as a catalyst for the stock. Hence, the stock appears to be a good buy for medium to long-term investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Ashish S.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.