Summary:

- Acuity Brands, Inc. is expected to grow revenue due to a healthy backlog, expansion into new verticals, and product innovation.

- Margins to benefit from operating leverage, product vitality, and margin-accretive acquisitions, with full integration of Optotronics business contributing.

- The company’s revenue and margin growth prospects are positive, but the current valuation is in line with historical averages, leading to a neutral rating.

asbe/E+ via Getty Images

Investment Thesis

Acuity Brands, Inc. (NYSE:AYI) should deliver good revenue growth in the coming quarters thanks to its healthy backlog and improved order pipeline in the infrastructure business. Further, the company’s revenue growth should benefit from its expansion into new verticals like refueling stations and horticulture. In addition, the company’s focus on product vitality and innovation should contribute to volume growth and improve pricing/mix.

On the margin front, the company’s margins should benefit from operating leverage on higher sales, product vitality initiatives, and margin-accretive acquisitions. Further, the full integration of the Optotronics business should also contribute to margin growth. While I like the company’s growth prospects, I can’t say the same for its valuation. The stock has seen a ~50% increase since my previous bullish article and is trading in line with its historical averages on consensus FY25 P/E. I believe the company’s growth prospects are already reflected in the stock. So, I am moving to the sidelines and rating AYI neutral.

Revenue Analysis and Outlook

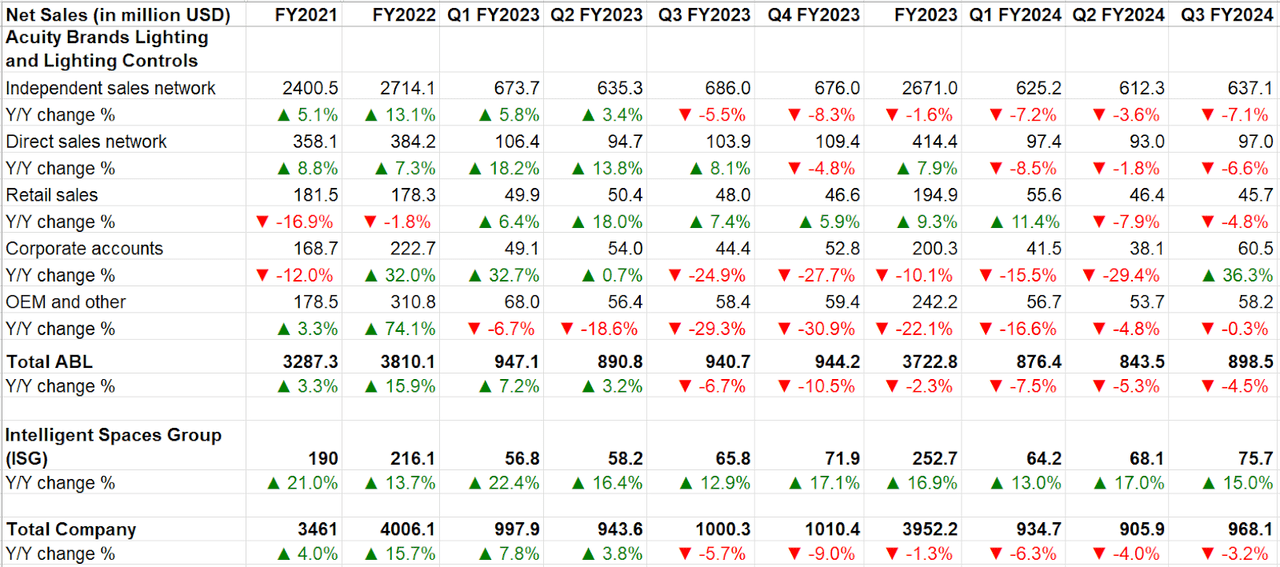

Over the last few quarters, the company has been seeing downbeat revenue trends due to macroeconomic headwinds and challenges from difficult Y/Y comparisons in its Acuity Brands Lighting and Lighting Controls (ABL) segment.

In the third quarter of 2024, the ABL segment also faced some labor shortage-related issues that impacted the company’s ability to meet production targets. As a result, the segment saw a Y/Y decline in sales across its independent sales network, direct sales network, retail sales, and OEM and other channels. This decline more than offset sales growth in its corporate accounts, which benefitted from a large retail relight project and much easier comparisons as it lapped last year’s 24.9% decline.

On the other hand, the Intelligent Spaces Group (ISG) segment’s sales grew by 15% Y/Y driven by higher sales of Distech products and contribution from the acquisition of KE2 Therm.

On a consolidated basis, the company’s net sales declined by 3.2% Y/Y to $968.1 million as sales decline in the ABL segment more than offset higher sales in the ISG segment.

AYI’s Historical Revenue Growth (Company Data, GS Analytics Research)

Looking forward, I am optimistic about the company’s revenue growth outlook.

On its last earnings call, management noted that the company’s order rates consistently exceeded shipments last quarter, resulting in a healthy backlog growth. Further, the company also noted increased quoting activity, particularly in the infrastructure sector, which indicates a healthy order pipeline. This backlog growth and improved order pipeline should translate into good sales growth in the coming quarters as management addresses labor shortages and related production issues.

The company is also expanding into new verticals such as refueling stations and horticulture, where there is a good demand for sustainable and efficient lighting solutions. Further, the company continues to expand its solutions from Intelligent Spaces business across geographies. Last quarter, the company continued to add system integrator capability in the UK, Australia, and Asia as a part of geographic expansion.

In my last article, I mentioned Acuity’s focus on product vitality and innovation to be a key revenue driver in the medium to long run. The company has continued to introduce new and improved products such as Lithonia FRAME and advanced lighting solutions from A-Light, Luminis, and Eureka. The company’s acquisition of Optotronics a few years ago also has given it more control of technology in its luminaries and provided significant flexibility both in design and operations, driving innovation. In addition to helping volumes, the company’s focus on innovation should also help the company in terms of pricing/mix.

Margin Analysis and Outlook

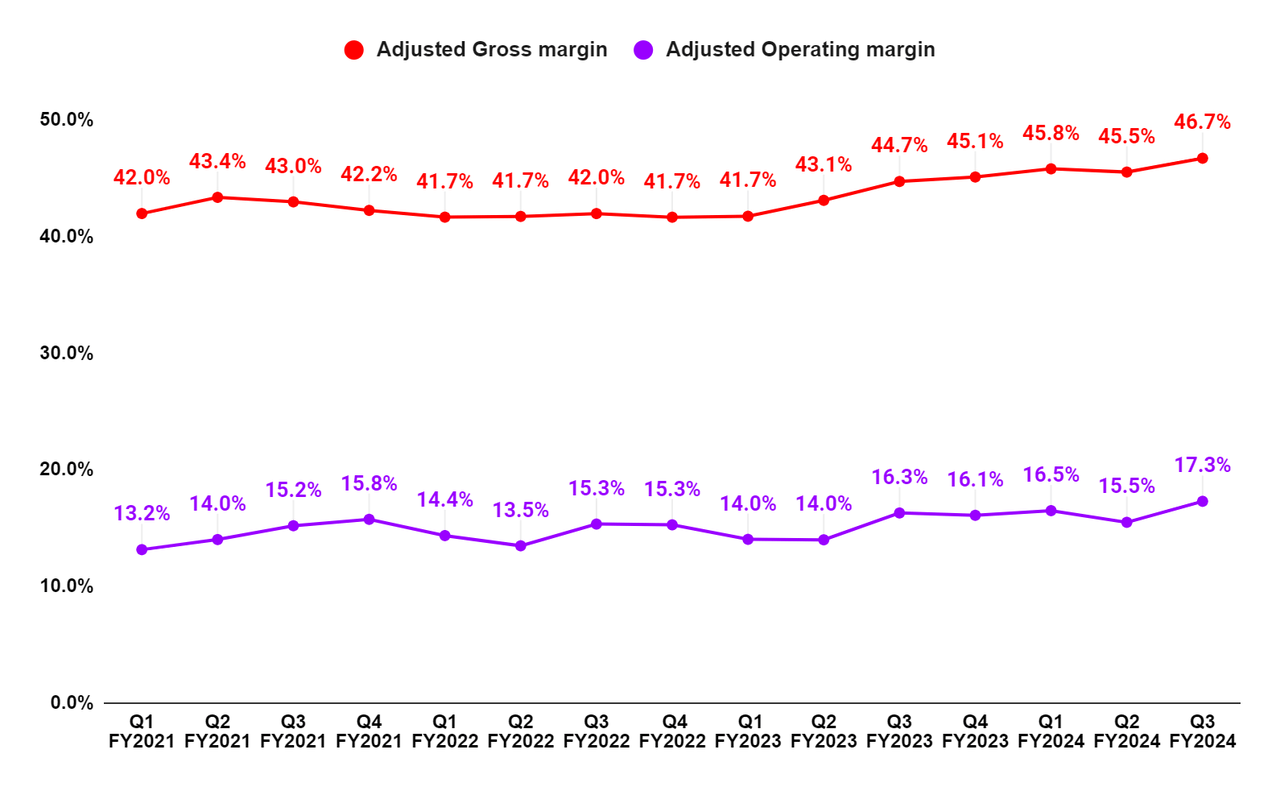

In Q3 2024, despite a 3.2% Y/Y net sales decline, the company saw a 200 bps Y/Y increase in gross margin to 46.7% and a 100 bps Y/Y increase in adjusted operating margin to 17.3%. This increase was attributed to product vitality initiatives, effective price/cost management, and productivity gains, which more than offset the impact of lower net sales and higher production costs.

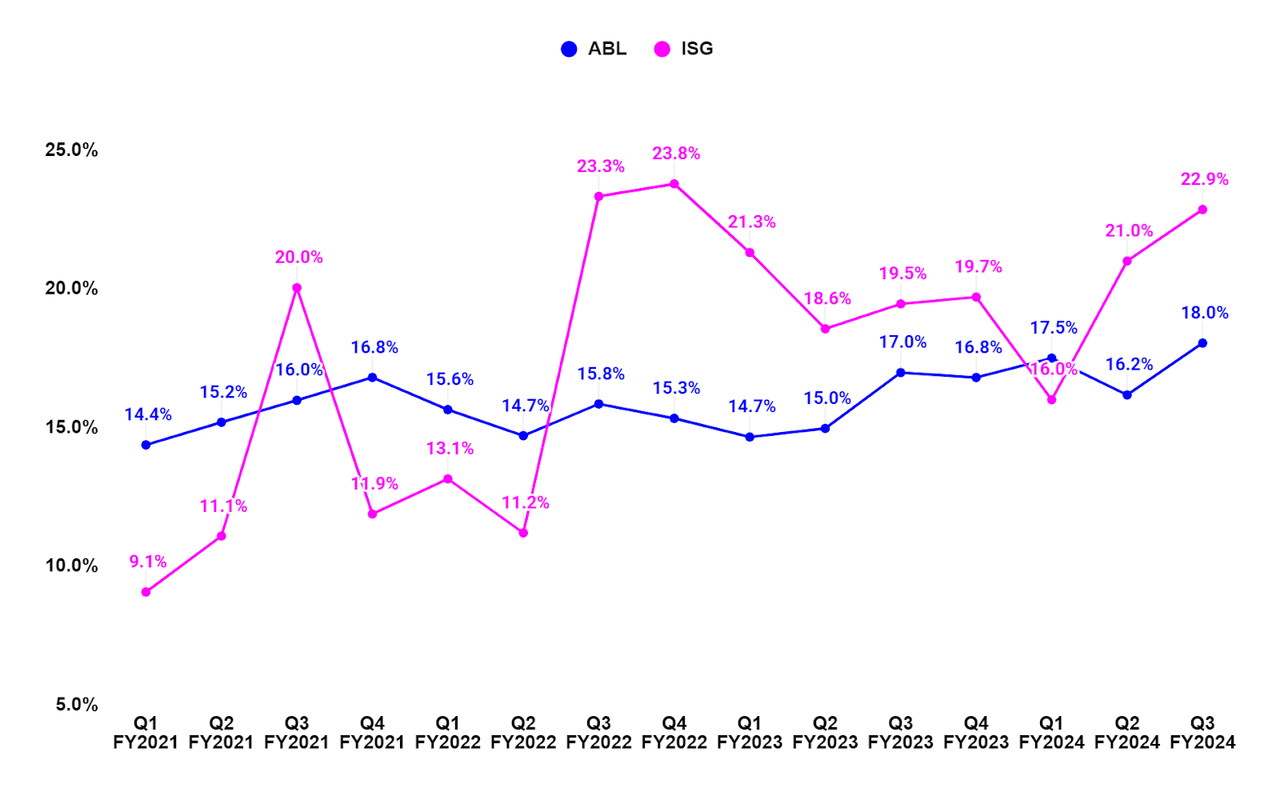

On a segment basis, the ABL and ISG segments grew adjusted operating margin by 100 bps Y/Y and 340 bps Y/Y, respectively.

AYI’s Adjusted Gross Margin and Adjusted Operating Margin (Company Data, GS Analytics Research)

AYI’s Segment-Wise Adjusted Operating Margin (Company Data, GS Analytics Research)

Looking forward, I am optimistic about the company’s margin improvement prospects. The company’s revenue outlook is positive and the company’s margins should benefit from operating leverage due to increasing sales. The company’s margins should also benefit from the product vitality initiatives, as the new/improved products usually command better pricing and margins. Further, the company has fully integrated the Optotronics business acquired a few years back, which should enable it to have more flexibility both in design and operation. This vertical integration should also improve margins.

The company has also been implementing a bolt-on acquisition strategy and acquiring a high-margin business (KE2 Therm is a good example). I expect management to continue implementing this strategy, which should help improve the margin mix in the long run.

Valuation and Rating

AYI stock is trading at 15.41x FY24 consensus EPS estimate of $15.52 and 14.54x FY25 EPS estimate of $16.45. Over the last 5 years, the stock has traded at an average forward P/E of 14.47x.

AYI Consensus EPS estimates (Seeking Alpha)

While the company’s FY24 P/E is at a premium to its historical valuations, its FY25 P/E is almost in line.

Many of the electrical components and equipment companies like Eaton (ETN) and Hubbell (HUBB) are trading at a premium to their historical valuations these days. One reason behind this premium is they supply components related to data centers or grid resiliency, and their end-market demand is benefiting from secular megatrends. However, Acuity Brands is primarily into lighting products and is not as exposed to some of those secular themes. So, I don’t think its P/E multiple can re-rate meaningfully above historical levels.

Further, the company imports ~15% of its finished products and some of the raw components to manufacture its products from Asia. With elections approaching, there is a good chance of debate around import tariffs re-igniting, which might keep some pressure on AYI’s valuation multiple. This is another reason why I don’t see much probability of P/E multiple re-rating from these levels.

With the company’s EPS expected to grow around 6-7% over the next couple of years (consensus estimates), I believe the stock can give mid-single-digit CAGR assuming P/E remains constant. This is not enough for me to give a buy rating. Last year, when I covered the stock with a buy rating, it was trading at a meaningful discount to its historical levels. However, the stock has given over 50% upside since then. After this meaningful price appreciation, I believe that the current valuations appropriately reflect the company’s prospects. Hence, I am downgrading my rating to neutral.

Takeaway

I am optimistic about the company’s revenue and margin growth prospects in the coming quarters. The revenue growth should benefit from a healthy backlog, improved order pipeline, expansion into new verticals, geographic expansion in the ISG segment, and product vitality initiatives. The margins should see gains from operating leverage, product vitality initiatives, accretive M&As, and full integration of Optotronics business. While I like the company’s growth prospects, I am not a fan of its current valuation, which is trading in line with its historical averages. So, I am moving to the sidelines and downgrading my rating to neutral.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Gayatri S.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.